A 1 000 loan bad credit makes you always ready for a sudden expense you haven’t planned. Many people in the United States struggle with covering unforeseen costs, poor credit score requirements, and temporary monetary disruptions as they live paycheck to paycheck. Do you think a $1,000 loan may help you out?

You may experience various situations and unpredicted life events that need fast action and funding for which a $300 loan no credit check is insufficient. Medical problems, urgent auto repairs, debt consolidation to repay the credit cards for instant approval debt, or expensive items – everything needs money.

Check your loan options on how to choose a certain loan amount today and finance your unexpected expenses even with a poor credit score.

Best Lenders To Get $1000 Loan

One day, a 1000 dollar loan no credit check can become a valuable source of a lump sum for solving unforeseen expenses. But how to choose the best lenders?

Despite a wide variety of financing options, it isn’t easy to find a reliable lending company. To avoid scammers, you must consider the customer service and overall rating of the chosen company and its credit card.

Check with credit bureaus for any negative marks or potential errors on your credit report that could impact your ability to get approved for a personal loan.

This process takes much time and effort. If you are not ready to deal with it, you can look through our prepared options.

Our team has investigated the best providers of bad credit personal loans to help you make a well-informed decision.

Upstart

Upstart is the best website for loans for you to consider. It can boast of high ratings among the customers and deserves our trust.

This platform provides funds quickly. If you get a favorable personal loan decision before 5 p.m. ET Monday – Friday, you will receive money the next business day. If you accept it after that time, the funds will be sent to your account the following business day.

As to the loan amount, Upstart allows borrowers to get a 1,000 minimum loan. This lender is a perfect platform for solving a wide range of financial problems, including home repairs and educational expenses.

Upstart also allows pre-qualification with a soft credit check. It issues bad credit financial assistance, but this personal loan may cost you more than a traditional one.

If you don’t know your score, you can check your credit without affecting your rating. This process takes no more than 5 minutes.

The main advantage of Upstart is that it offers personal loans with fixed interest rates of 7.8% – 35.99%. The loan conditions range from 36 to 60 months.

Upgrade

Upgrade provides quick financial assistance for people living in all US states except Iowa, West Virginia, and Washington, D.C.

The minimum loan amount is $1,000, and the maximum amounts to $50,000. This lending platform issues money the next business day after personal loans approval. The clients of Upgrade are allowed a minimum of 24 months to repay their debt.

However, you should know that this lending company charges an origination fee between 2.9% and 8%. What’s more, for two-week-late payments, you may be charged an additional $10. A prepayment penalty is not applied.

Upgrade personal loans are available with fixed APRs ranging from 7.96% to 35.97%. It depends on the borrower’s credit score, loan terms, etc. If you make timely payments and ensure that your credit activity is reported to the credit bureaus, you can avoid high fees.

Lastly, if you need to borrow money and can’t meet the requirements for a loan, you can find a co-borrower. This option can be beneficial for those with bad credit who may not qualify for a loan on their own. Unlike many other lenders, Upgrade has these personal loan offers. Note that it is not the same with a co signer who bears responsibility for the loan only in case you fail to repay it.

Avant

Avant is another popular loan provider. We suggest reviewing the advertiser disclosure provided by the company. The available loan amounts vary from $2,000 to $35,000. The borrowed money can be used for any purpose. Its services are unavailable in New York, Hawaii, Iowa, Massachusetts, and two other states.

This lender sets a minimum credit score requirement of 550, according to the FICO score. Avant says most of its clients have a score between 600 and 700. The minimum monthly income required to get a loan is $1,200.

The loan process itself is quick and transparent. Just fill in an online application and get funds until the next day.

At the same time, Avant isn’t the cheapest lending option. Despite an average EST APR between 9.95 and 35.95%, it charges additional fees.

For example, a borrower has to pay an origination fee of up to 4.75%, a return check fee of $15, and a $25 late fee. The loan terms may be from 1 to 5 years. Consider that Avant doesn’t allow loans with co signer.

LendingPoint

If you have bad credit, LendingPoint may still be an option for you. It provides a quick and easy loan application process. In most cases, you will get the money no later than the next day after loan approval. The minimum credit is 600.

Remember that this lender doesn’t allow a third party in its financial assistance. Co-signers and co-borrowers won’t help you. Secured loan options are also unavailable.

EST. APR of this lender ranges from 7.99 to 35.99%, and the repayment loan term may vary between 2 and 5 years.

LendingPoint offers relatively small loan amounts: from $2,000 to $36,500. Its loan products usually appear to be not enough to cover some financial problems.

If you are not sure whether you can repay LendingPoint debt in time, look for other solutions because this lender reports to two of the three major credit bureaus. There are a variety of financial institutions that may offer alternative borrowing options or assistance with moderate credit checks.

OneMain

OneMain can boast of a 4,8 score from 5 on a Trustpilot. It means that this lending platform is secure and reliable.

It offers various credit decisions, including the ability to get a secured loan. You can use a car, boat, or truck as collateral. Joint loan applications are also allowed.

OneMain is an excellent lender for people with bad credit histories since it doesn’t set a minimum score and income requirements.

The minimum loan term is two years, and the maximum one is 5 years. If you can’t repay the loan in time, you can change without notice the date of loan payments twice.

OneMain allows you to borrow between $1,500 and $20,000 within 1-2 business days. Its APR ranges from 18.00% to 35.99%.

Unlike many other lenders, this one has branches in each of the 44 states. If an online cash advance is Greek to you, you can sign a loan agreement face-to-face with the company’s representatives.

You may think it is a perfect loan provider but keep in mind that it charges additional fees and penalties along with credit checks. A late fee will cost you from $5 to $30 or 1.5% to 15% of the loan proceeds. At the same time, the origination charge is between $25 and $500 or 1% and 10%. Non-sufficient funds on a credit card will cost you an additional $10 – $50.

Note that OneMain is unavailable in Washington D.C., Alaska, Arkansas, Connecticut, and some others.

Best Egg

Let’s consider the next popular lender with an advanced lender network called Best Egg. It doesn’t have a mobile app but presents quick and beneficial loan offers without credit history checks.

Best Egg allows borrowers to choose between secured and unsecured financial solutions and conduct a free previous qualification procedure, which can be beneficial for individuals with bad credit.

The minimum loan amount you can get is $2,000; the maximum one accounts for $50,000. The repayment term can be 3, 4, or 5 years.

Since Best Egg offers emergency cash loans for unemployed without a credit review, it charges relatively high fees. Its APR varies from 8.99% to 35.99%. You will also have to pay an origination charge between 0.99% and 8.99%, as well as a $15 returned check fee.

The Best Egg services are not available for residents of Iowa, Vermont, West Virginia, or Washington, D.C.

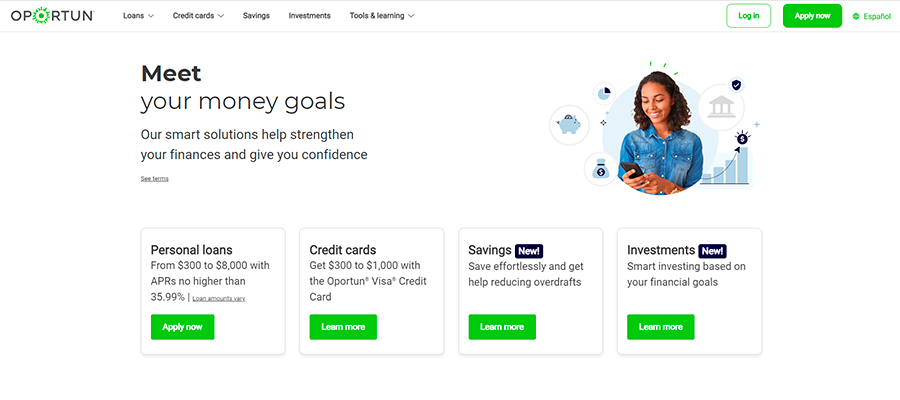

Oportun

Oportun is a provider of short term loans for low- and moderate-income borrowers with bad credit, regardless of their credit histories. It takes care of the clients and does everything possible to help them get funds.

Oportun doesn’t pay attention to a credit score and credit checks and allows joint loan options. If your friend or a family member has an excellent financial reputation, you can ask them to be co-applicants.

This lender is a perfect option for people who need small loans to cover unforeseen expenses. The application form takes no more than 5 minutes to be completed. Borrowers receive credit decisions within an hour and get the money during 1-3 days.

Oportun provides loan offers between $300 and $12,000 with flexible terms ranging from 1 to 5 years. However, this lender may charge an origination fee of up to 7%. The APR is also high and may be between 20.05% and 35.99%. For late payment, you will have to give an additional $5 – $15.

Oportun doesn’t work in CO, CT, IA, ME, MD, MA, NY, WV, or Washington, D.C.

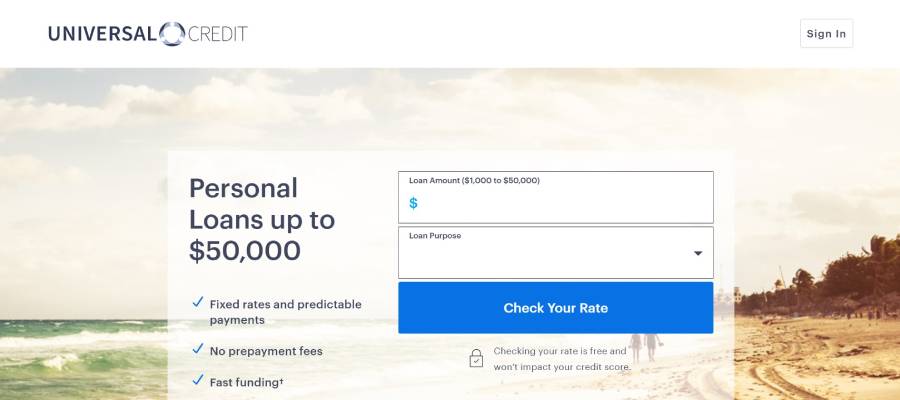

Universal Credit

The above-mentioned lender Upgrade runs Universal Credit. It is a financial service provider with same-day approval. When considering a loan from Universal Credit, it’s important to keep in mind that your payment history will be reported to credit bureaus, so it isn’t a good choice for those with bad credit.

If you have a poor credit rating, Universal Credit has a loan offer for you! If you live in Washington, D.C., note that this lender doesn’t operate there, unfortunately.

The company has a minimum credit score requirement of 560 points. Universal Credit charges an APR between 11.69% and 35.93%.

The origination will cost you between 5.25% and 8.99%, while late payments are $10. It isn’t the lowest charge, so you must consider all the pros and cons.

You can get a loan ranging from $1,000 to $50,000 with repayment terms of 3 or 5 years. Among other features, Universal Credit offers a 0.5% discount for setting up automatic payments.

Most borrowers choose this lender for credit building and getting instant cash.

$1,000 Loans: Money Support for Poor Credit Scores

If you face a sudden financial emergency and can’t cope with it on your own, you don’t have to feel frustrated. You need emergency money. There are financing options even for low credit score holders who need to borrow the best emergency loans.

Conventional lending organizations and local banks prefer to issue a payday loan only to their members and people with excellent credit scores, which is not very convenient. Alternative institutions offer personal solutions and personal loans to almost everyone with no credit checks.

If you can’t waste time improving your current payment history, you still have an opportunity to get one thousand loans for bad credit today. This is your chance to get financed for any urgent need or expense you have.

This way, you won’t have to beg your employer or relatives to lend you some cash. Choose smart solutions and modern ways of receiving money.

$1,000 Loans with Bad Credit

Are you a poor credit holder? If you failed to repay the previous debt or didn’t make consistent installment loan payments, your hard credit history may suffer.

The credit score is what almost every lender pays attention to before they make their decision to approve a request for one thousand personal loans.

When this number is below 620, you may face issues with having approval as it presents higher risks to the service providers.

In other words, the crediting company wants to make certain it will get its funds back, so it assesses the risk of lending money to a borrower by conducting a credit check.

Although a low credit score loan isn’t a large amount, it may impact the search for a reputable company to obtain quick funding when you need a personal loan.

How to Get a 1,000 Loan with Bad Credit Score?

If you want to acquire loans for a bad credit score or loans guaranteed approval of $1,000 and don’t wait until your credit score is boosted, you should turn to alternative crediting companies.

Don’t waste your time at the traditional lenders, as they will most likely reject your application. Instead, opt for online services that cooperate with direct lenders or lenders.

This is your chance to reach multiple creditors with a single personal loan application and have more odds of getting approved.

No Credit 1,000 Dollar Loan

What if you are a recent graduate? If you don’t have established credit for some reason, you may face additional issues with getting a personal loan with no credit check.

The crediting companies and service providers who are certified and work under state regulations have all rights reserved and want to eliminate risks of default. Hence, they often reject applications of borrowers with no rating at all.

When you need money, you may find alternative lending services that are eager to issue personal loans with no credit checks. Typically, they will ask you to provide proof of monthly payment of income and a bank statement to prove you have stable employment as part of your loan request.

So, if your source of income is steady and regular, your chances of getting approved for a loan with no credit score or bad credit score are higher.

How to Get a Loan with No Credit Score?

You may take out a small personal loan to establish your credit history. It’s important to choose reputable lending partners that offer fair and reasonable loan conditions. Make certain you learn about the repayment loan conditions and know the total sum you are going to repay a loan to the creditor.

Paying personal loans up to one thousand in time may help you boost your credit history and have a decent rating to qualify for more flexible terms and better rates in the future when you undergo a credit check and need financial assistance.

What Type of Loan to Choose?

If you have bad credit, your options may be limited, but you can still consider a quick loan, title loan, or installment loan. It depends on your preferences, current financial needs, as well as your credit history.

Generally, you may choose between a quick loan, which is a small personal loan, a title loan, or an installment lending solution.

Each loan option is suitable for covering unexpected expenses and disruptions. Let’s cover the basics of each offer to help you make a smart crediting decision.

Personal Loans

This lending option offers credit borrowers a personal loan to cover different expenses. You may take out a personal loan at 36% APR at maximum. The funds can be used to cover:

- Car repair

- House renovation

- Medical emergency

- Wedding/vacation costs

- Debt consolidation

Local banks and credit unions usually issue a 1,000 dollar personal loan you may get. They prefer to deal with low-risk consumers who have a stable income and a high credit score.

So, if you need a larger sum and have excellent credit, you may turn to such institutions.

Requirements For Getting a $1000 Personal Loan

All lenders share standard eligibility requirements for a personal loan. Before sending a loan request form, make sure you meet them.

To qualify for a personal loan, you must:

- be 18+ years old;

- ensure you have a steady income; (most lenders allow social benefits and net income)

- have a debt to income ratio of less than 40%

- make a monthly payment

- offer a valid phone number, ID, Social Security Number, checking account data, etc.

What’s more, if you deal with a lender that doesn’t offer loans for bad credit, you will face a credit check. If your financial reputation isn’t good, look for appropriate service providers!

Pros and Cons of $1000 Personal Loans

To make the right financial solution, you must learn the benefits and cons of different loan types. We understand that it may be a time-consuming process, and we want to help you! So, here we go!

Pros of personal loans

- Quick and easy funding

Thanks to online lenders, the loan approval process usually takes a few hours. Just fill in a short loan request form and receive funds the next business day.

- Lower interest charges

Personal loans will be more beneficial than credit cards in terms of APR and interest fees.

- Debt consolidation loans

You can get a 1k loan bad credit to improve your financial situation. How does it work? You take a small personal loan to repay existing debts. Then you will have to pay back the new loan, which is usually taken with lower interest.

- Easy-to-get

$1,000 loans are available for people with poor credit scores. And while for some people, it may be a small loan with no credit score, for others, it is life-saving.

Cons of personal loans

Fees and penalties

Some lenders charge an origination fee for their services. Among other things, borrowers can face late payments and early repayment fees.

- It may hurt your credit

If you don’t repay the debt, information about it will be added to your credit report. Consequently, your score will be damaged.

- Require collateral

If your credit score is very low, loans with collateral may be the only way to get funds. Such loans use your property as collateral. If you can’t repay the debt, you may lose it.

Installment Loans

This lending solution differs from a personal loan and a same day lending offer. If you submit a loan request for an installment 1,000 loan online, that means you can repay the debt in small parts that are called installments.

The repayment schedule for installment lenders is usually more flexible, as the debt is gradually repaid over the period of several months or even years. All you have to do is to make a monthly payment on time. This loan type may be more suitable for consumers who need to borrow and fund big-ticket expenses and want to have affordable fees and terms.

You may obtain an installment loan to cover:

- Home improvement

- Big-picture purchase

Requirements to get a 1,000 dollar Installment Loan

It is important to note that installment lenders typically require a credit check as part of the personal loan application process. The requirements for getting a car title loan will differ from the eligibility criteria for receiving an unsecured credit cards for 580 credit score. Anyway, let’s consider the basic demands all borrowers must meet.

To qualify for installment loans, you must:

- be 18 years old and older

- be a US resident

- provide personal banking information

- have a valid Social Security Number and ID;

- provide proof of income (pay stubs or bank statements)

- pay an origination fee

It may be more difficult to find an installment loan lender willing to issue a bad credit loan when compared with other options. However, it is more than possible through banks and credit unions.

Pros and Cons of $1000 Installment Loans

Are you still hesitating about taking an installment loan? To make a well-informed decision, let’s look at its pros and cons together!

Advantages of installments

- Long-term option

- All rights reserved

This loan type allows you to repay the borrowed amount over several months or years. Since you will pay it back in regular and equal monthly payments, it will be easier to manage your finances effectively.

- Lower interest rates

This financial solution will cost you less when compared with a same day or cash advance. It is an excellent opportunity to save your money and nerves.

Disadvantages of installments

- It is not suitable for credit building

If you want to improve your score, it is better to think about a credit card loan. If you violate payment terms, your loan with no credit score will decrease.

- Higher risks

As you know, installment solutions include secured loans as well. It means a borrower can be deprived of property in case of bankruptcy. Among other things, there is a risk you will pay back the debt longer than the item you bought for this money will serve you.

Same Day Loans

There is no need for a credit check when you want to get a 1,000 dollar loan for the short term. Lenders provide additional money for two or three weeks until you get the next salary.

You won’t be able to stretch the repayment term, as the funds should be automatically given back to the borrower on your next payment day. One thousand dollar loan money in 60 minutes can be taken to cover:

- Unforeseen costs

- Short-term expenses

- Rent/utility payments

- Overdue bills

- Urgent purchases

Requirements For Getting $1,000 Loan

You should remember that lenders may set different loan conditions. That is why it is essential to read the state laws and regulatory rules of the chosen lender.

Anyway, there are some essential criteria for all borrowers to get approved. So, let’s take a closer look at them!

To qualify for same day emergency loans, you must:

- Be at least 18 years old;

- Be a resident of the United States;

- Provide evidence of regular income; (it may be used to check the borrower‘s debt to income ratio)

- have an active checking account

All clients must specify a valid contact number and email address, ID, proof of residence, banking information, etc.

Some lenders may also set specific credit score requirements to assess your creditworthiness. But it doesn’t mean you can’t get the loan if your financial reputation is far from perfect.

Remember that many companies pay attention just to your income to make sure you can repay the loan. Such lenders allow you to borrow money instantly but at a higher percentage rate.

Pros and Cons of $1000 Payday Loans

Before you decide to get a 1000 dollar loan with bad credit from same day lenders, consider both the strong and weak sides of this option.

If you are submitting a loan request, it’s important to be aware of the significant disadvantages of payday loans. One major drawback is the exorbitantly high interest rates, which can surpass 400% APR, causing the loans to be very expensive to repay.

Furthermore, payday lenders often demand access to the borrower’s bank account and may automatically withdraw payments, which can result in overdraft fees and other financial troubles.

Short repayment terms and high fees can also ensnare borrowers in a debt cycle, making it challenging to repay the loan on time. This, in turn, can lead to additional charges and interest fees, making it even more difficult for borrowers to escape the cycle of debt.

How Does One Thousand Dollar Loan Work?

It works like 200 dollar loans. If you want to obtain a small personal loan or a loan with bad credit for the short term, you should pay attention to the application process.

While the majority of traditional crediting organizations and banks have strict eligibility criteria, credit borrowers may choose alternative creditors who work online and offer more flexible conditions.

To obtain a loan guarantee, you should fill in the application form on the company website. It’s much easier and more convenient to apply on the web and save time instead of traveling to physical lending stores and lending places.

Submit your personal, employment, and banking details, reach creditors, and get funded within the same business day.

How to Get a 1,000 Loan?

If you are willing to acquire a cash loan, no credit check, and a personal loan of up to 1,000 dollars, you should keep in mind that the application process has become streamlined and digital.

It’s simple to meet the demands of lenders provided that you satisfy such criteria:

- Proof of income. You should provide a pay stub and additional papers if the creditor asks to verify your steady employment. You should prove you have enough financial means to repay the debt on time.

- Age. If you are over 18, you may qualify for a loan with bad credit no guarantor. Credit unions can keep an eye on this.

- Bank account. Submit the information in the loan request form, and don’t forget to mention your active savings account or checking account. Sharing valid bank details is essential so that the loan funds are transferred faster. Additionally, it’s important to choose reputable lending partners that offer fair and reasonable loan terms and conditions

Where Can I Get a $1,000 Loan?

You may turn to several places to get an instant loan today.

- Banks. The local traditional lending institutions are certified and legal. They charge smaller fees and offer more affordable rates if you need to get a $1 000 loan no credit check. However, the downside is that you should have a great credit history and an excellent rating to be approved. Also, some banks agree to issue larger sums as they will earn more in the long run.

- Credit unions. These crediting companies only work with members. You should join a certain credit union and become its member before you can receive loans. Banks and credit unions work great for larger cash loan sizes as they offer smaller fees.

- Alternative creditors. These lenders offer a personal loan and short-term financial decisions tailored to the needs of the borrowers. Though the interest rates may be higher compared to other places, such creditors accept consumers with any credit. Hence, they have become popular in terms of borrowing money for urgent needs.

What Is the Simple Interest of a Loan for 1000 with 5 Percent Interest After 3 Years?

The simple interest rate of these thousand dollars in loans is 150. You may utilize an online resource to count the interest of a loan with an interest rate or APR.

Different creditors offer different rates, so it pays to shop around and compare lending conditions until you find the most affordable offer.

How to Choose The Best $1,000 Loan

If you look for 1000 dollar loans for bad credit, you’ll come across various lending options. However, it’s vital to make informed credit decisions and choose a lender that offers suitable loan terms and a reasonable interest rate to avoid exorbitant fees.

So, we recommend comparing fees and conditions offered by multiple lenders to ensure you find the best 1000 loans no credit check. Don’t overlook online lenders, and check their customer service and feedback to confirm their credibility.

Moreover, review the lender’s eligibility requirements to see if you qualify and can submit a loan request. You should also comprehend the positive credit history, loan conditions, and payment options to avoid any misunderstandings. By following these and the following guidelines, you’ll select the most appropriate $1,000 loan according to your financial needs.

Decide On Amount

You should decide on the funding amount you require and the purpose for which you need it, taking into consideration your credit standing. This ensures that you don’t borrow more than you require or end up with insufficient funds. It also helps in selecting the appropriate type of loan with favorable terms and conditions.

Moreover, we insist on evaluating the borrowing cost, such as interest rates and fees, to determine the affordability of the loan and check if they can manage the repayments.

Decide On Loan Type

Selecting the appropriate loan type is crucial to avoid unnecessary expenses and ensure that you can repay the borrowed amount on time. To make this decision effectively, you should consider your financial status, the purpose of the loan, and your ability to repay it.

Evaluating these factors can help you choose a credit with favorable interest rates and terms. In addition, comparing loan alternatives from various lenders can aid in making a rational borrowing decision that aligns with your needs and budget.

Compare Lenders

Comparing lenders is especially critical when seeking a loan from a California finance lender, as it enables you to assess the cost of borrowing and pick the most affordable option that suits your needs.

Different lenders have varying interest rates, fees, and loan terms, so evaluating these factors can help you make an informed borrowing decision that aligns with your budget and repayment capabilities.

Additionally, comparing lenders can help you avoid scams or predatory lenders, protecting you from financial exploitation. By taking the time to compare lenders of any credit union, you can ensure that you secure the best terms and conditions and borrow responsibly.

Fees

Loan apps can charge a variety of fees, including an origination fee, late payment fee, prepayment fees, and insufficient funds fees. The origination fee is a one-time fee charged at the beginning of the loan term, typically a percentage of the loan amount. Late payment fees are charged when a borrower fails to make a payment on time.

Early repayment fees are charged if the borrower repays the loan before the due date. Insufficient funds fees are charged if a payment is returned due to insufficient funds in the borrower’s bank account.

Borrowers should carefully review the terms and conditions of each app and calculate the total cost of the loan to compare fees between lenders. You can also consider the interest rates and payment terms offered by each app to guarantee the most cost-effective option for their needs.

APR

APR stands for Annual Percentage Rate, which is the total cost of borrowing money expressed as a percentage of the loan amount. This rate includes not only the interest charged on loan but also any fees associated with it, such as origination fees or late payment fees. A higher APR indicates a higher cost of borrowing.

What is considered a high annual percentage rate can vary depending on the type of loan and the lender. For example, credit cards may have APRs ranging from 15% to 25%, while $1,000 loans can have APRs well over 400%. Generally, APRs over 36% are considered high, especially for personal loans.

To compare APRs, borrowers should carefully review the terms and conditions of each loan offer, including any fees, and calculate the total cost of borrowing. They should also consider the repayment terms and any penalties for early repayment or late payments. Borrowers can then compare the total cost and APRs of different loan offers to determine the best option for their needs.

Loan Amount

The loan amount plays a crucial role in determining the affordability and suitability of a loan for a borrower. When comparing lenders, borrowers should consider the minimum and maximum amounts offered by each lender, as well as the loan conditions and repayment schedules.

It is important to choose a lender whose loan amounts meet the borrower’s needs without causing undue financial strain.

Borrowers should also consider any fees and interest rates associated with each loan offer, as these can vary depending on the loan amount. Ultimately, borrowers should choose a lender who offers an amount and terms that are best suited to their financial situation and needs.

Loan Repayment

Repayment terms refer to the length of time a borrower has to repay a loan and the schedule of payments. A good repayment term should strike a balance between a monthly payment that is affordable for the borrower and a repayment period that is reasonable for the lender.

Longer terms can result in lower monthly payments but can also lead to more interest over the life of the loan. Shorter terms can result in higher monthly payments. However, it may also save the borrower money in interest charges.

When comparing repayment terms, borrowers should consider the total amount of interest they will pay over the life of the loan, as well as the total cost of the loan, including any fees.

They should also take into account their ability to make monthly payments and any penalties for early repayment or late payments. Ultimately, borrowers should choose a loan with terms that fit their budget and financial goals.

Processing Time

Processing time is the length of time it takes for a lender to approve credit and disburse the funds to the borrower. It is important for borrowers who need quick access to funds, such as for emergencies or time-sensitive purchases, to pay attention to processing time.

Some lenders offer faster processing times than others, which can make a difference in situations where time is of the essence. Yet, borrowers should also remember the interest rates, fees, and terms of repayment offered by each lender and choose the option that best meets their financial needs and goals.

Check Requirements

By considering factors such as fees, terms of repayment, loan amounts, processing times, etc., borrowers can choose the best lender for their bad credit loans guaranteed approval $1 000. However, before applying for a loan, you should also be aware of the general requirements and any extra conditions that may be asked for by loan apps.

General requirements typically include proof of income, employment, and residency, as well as a valid ID, phone number, email address, and bank account. Extra conditions may vary depending on the lender and the type of loan but may include collateral, a co-signer, or a credit check.

Borrowers should be wary of lenders who require upfront payment or personal information such as passwords or social security numbers.

Decide On The Lender And Apply

After considering all of the factors discussed above (rates, loan amounts, fees, processing times, repayment terms, and required documentation), the final step for a borrower is to select the best lender for their needs, finish a credit inquiry, and submit an application.

It is crucial to carefully examine the loan terms and conditions before signing any agreement, ask questions if necessary, and ensure that the monthly payments are affordable and a repayment plan is in place.

By taking the necessary time to choose the appropriate lender and comprehend the terms, borrowers can avoid financial difficulties and obtain the best possible borrowing experience.

What Loan Amount Is Possible To Borrow With a Minimum Credit Score

The credit score is one of the most important factors that lenders consider when determining whether to approve a personal loan application and what interest rate to charge. A high credit score shows that you’re a responsible borrower who is more likely to repay a loan on time, as determined in the loan agreement.

Conversely, a low score may make it difficult to qualify for a loan at all. So, what score is needed to borrow money?

There’s no simple answer, as credit scores can range from 300 (the lowest score possible) to 850 (the highest score possible). The minimum credit score required for a loan will vary depending on the types of loan terms you’re applying for.

For example, most loan providers require a credit score of at least 620 to qualify for a conventional mortgage. However, if you’re looking to take out an FHA loan, you may be able to do so with a credit score as low as 580.

Of course, the higher your credit score, the better your chances of securing personal loans with favorable terms. So, if you’re hoping to borrow a large amount of money, or at least 1,000 dollar loans, it’s best to aim for a credit score of 750 or above.

This will give you the best chance of qualifying for the lowest interest rate and most favorable terms of repayment.

Your score is one of the most important factors that lenders look at when considering you for a loan. A minimum credit score is the lowest score that a lender will accept as proof that you’re a responsible borrower.

In general, the higher your credit score, the more loan options will be available to you. So if you’re hoping to borrow a large amount of money, or even get 1,000 dollar loans, it’s critical to make sure your credit score is in good shape.

Pros And Cons of Getting a $1,000 Loan With Bad Credit Online

Like any other life solution online, bad credit loans have advantages and disadvantages. And before you apply for it, let’s pay attention to the strong and weak sides of poor credit loans.

Pros of a $1,000 bad credit loan

The ability to get an emergency loan

If you need money immediately and have a low score, you won’t get funds from traditional lenders. At the same time, online lending platforms may become a helping hand. They won’t conduct credit checks and will focus on your income.

- Fast approval decision

A borrower can receive a loan with bad credit within one business day. To make it possible, you need to fill in a short online form and wait for a decision. No paperwork is required.

- Loan variety

There are many $1,000 loans available for borrowers with poor credit scores. It means that you can find an offer with the most beneficial terms and conditions exactly for you.

Cons of a $1,000 bad credit loan

- Interest rate

Since the company doesn’t check your credit, it bears the increased risk and charges higher fees.

- Hidden fees

You must be very attentive while choosing an online lender. Some of them may charge late payment fees or prepayment penalties.

All in all, before making a final decision, you should make sure the pros of an offer outweigh its cons. It is the only way to make the right choice.