Need fast cash? Learn how to request a guaranteed $300 loan today with simple steps and explore the best options to get quick approval.

When facing an urgent need for emergency money, instant decision credit cards, and the best debt relief program become crucial. Obtaining a $300 loan quickly is vital for survival in financial crises. Despite challenges in finding lenders, we’ve put together this guide on how you can secure a personal loan on the exact same day you’re reading this article.

Get $300 Loan No Credit Check

Having trouble obtaining 300 payday loans? You are not alone and have encountered a common problem with banking services or your debit card. According to statistics, 45% of Americans have less than 300 dollar in savings, and 24% should ask for help to cover $1000 emergency, which means millions of people are forced to take out quick cash when emergencies happen.

This type of loan may often referred to as a cash advance, depending on the lender that works with easy approval credit cards with no deposit. Some licensed direct lenders may require that a credit card be linked to a borrower’s account to receive cash, making things even more difficult.

While it can be a helpful solution in times of financial need, you must understand that advances typically come with high interest rates and fees, making them an expensive borrowing option. If you’re having trouble getting a 300 dollar loans, there are a few things you can do.

First, consider other options for borrowing money, such as asking friends or family for 300 loans help the same day or using a credit or debit card with a lower interest rate. You may also want to look into community resources, such as local non-profit organizations that offer financial assistance.

Try to better your financial situation in the long term. This may include creating a budget, saving money regularly, and finding ways to increase your income. By taking these steps, you can reduce your reliance on advances and other expensive forms of borrowing and improve your overall financial well-being.

However, in certain scenarios, you may need to get 300 loan now without dealing with things like credit checks and employment records. Luckily, there is, in fact, a way you can quickly receive a personal loan.

When Can a 300 Payday Loan Help You?

Users who may need more money in their bank accounts to cover the direct deposits or an automatic payment can use a $300 or even $1,000 quick loan no credit check to avoid overdraft fees. With overdraft protection, you can rest easy knowing that your transactions will be covered, even if you don’t have enough money in your checking account.

By automatically depositing your paycheck or other payments into your checking account, you can avoid the hassle and potential fees of paper checks or other payment methods. Overall, using credit wisely can help you stay financially stable and avoid unexpected fees and expenses.

Some banks, such as FlexWage FlexWage and Stride Bank, offer flexible banking features that can help users manage their money more efficiently. The first one allows users to access their paychecks before salary, and the second one offers a high-yielding savings account that can help users save money over time.

Eligibility Requirements For Getting 300 Dollar Loan

The eligibility criteria for securing a guaranteed $300 payday loan for poor credit score may vary among payday lenders. Nevertheless, several general requirements are commonly assessed when considering a loan request.

Firstly, the applicant must be at least 18 years old and possess a steady source of income, whether from employment or regular government benefits. Additionally, trusted direct lenders may stipulate a minimum income history or credit score to ensure the repayment capability of the $300 bad credit loan.

Some payday lenders may impose a monthly membership fee or an extra processing fee for handling an online $300 payday loan application, although many operate on a fee-free basis. Loan lenders can request a proof of identity and residence, such as a driver’s license or utility bill from borrowers.

Adhering to these eligibility criteria can contribute to a smoother loan application and loan approval process. Moreover, accessing credit becomes a valuable solution for individuals facing unforeseen expenses, like medical bills or car repairs, providing a financial buffer without the risk of overdraft fees.

How to Apply for a Loan With No Credit Check From Direct Lender?

If you think, “I need $300 right now, ” we have good news for you. Just because you don’t have a good credit history doesn’t mean you can’t get a $300 payday loan.

You may consider getting cash without a credit check from a 300 loan no credit check direct lender. To apply for 300$ loan from a direct lender, you need to research and compare lenders. Then you will need to provide basic personal information, such as your name, address, and employment details, as well as your banking accounts information.

What You Need to Know About Cash Advances

When exploring the option of obtaining a 300 loan with bad credit, it’s essential to comprehend the terms and conditions associated with the loan. Carefully review the loan agreement, addressing any queries before committing to it. Timely repayment is crucial to steer clear of additional fees and prevent harm to your credit score.

To ensure prompt repayment, contemplate setting up automatic payments or utilizing reminders. Using credit to handle unforeseen expenses or supplementing your credit/debit card account can alleviate the stress of dealing with overdraft fees and other financial hurdles.

While payday advance apps offer a quick and easy way to borrow $300 today, often without a credit check, it’s imperative to explore alternative options first. These apps typically come with high-interest rates and fees, necessitating a thorough understanding of the terms.

An alternative approach involves using making debit card purchases, which may help sidestep overdraft fees and rapidly accumulating bank charges. Timely rent payments and vigilant balance monitoring contribute to avoiding unnecessary charges and sustaining a positive financial background.

For those favoring the convenience of automated payments, considering a monthly membership fee can assist in staying on top of bills. By making informed choices, borrowers can navigate the challenges associated with 300 dollar loans online, ensuring a more secure financial standing.

Step-by-Step Registration for 300 Dollar Payday Loan From Direct Lender

So if you need 300 cash now, you should go through a phased debt application:

- Check eligibility requirements: Make sure you meet the lender’s eligibility requirements, which may include income, age, and residency.

- Fill out an application: Complete the lender’s online loan request form with accurate personal and financial information.

- Submit supporting documents: Depending on the lender, you may need to provide supporting documents like proof of income, ID, and bank statements.

- Review and sign your loan agreement: Once approved, carefully review everything and sign the loan agreement if you agree to the terms.

- Receive funds: If approved, the funds will be deposited into your credit or debit card account within a few business days.

To avoid getting trapped in a cycle of debt, only borrow what you can afford to repay and make timely payments. You should also consider alternative options, such as negotiating a payment plan with your landlord or finding ways to reduce your monthly membership fee and expenses.

If you do decide to use a 300 loans app, you’ll need to go through a phased debt application process. This involves researching direct lenders, checking eligibility requirements, filling out an application, submitting supporting documents, and then receiving the funds into your debit or credit card account within a few business days.

A cash app and payday loan apps may also charge a monthly membership fee or other fees, which can add up quickly if you don’t repay the loan on time. So be sure to read the fine print before signing up.

Apps Like Earnin That Can Help You Get a Guaranteed 300 Dollar Loan Today

While apps like Earnin have gained popularity for their ability to provide paycheck advances, there are several other apps like Earnin that can help you borrow $300 you require right away.

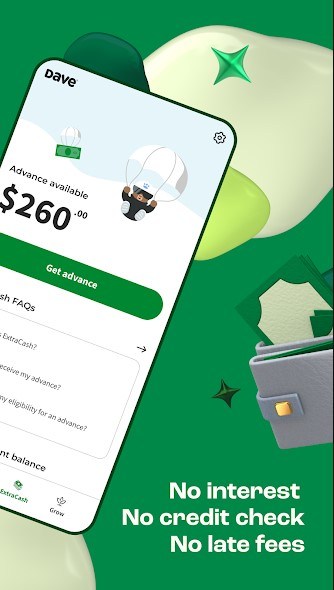

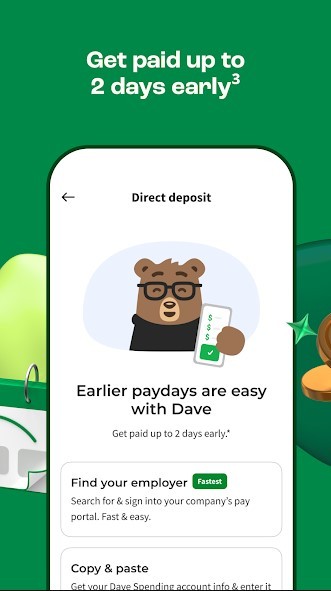

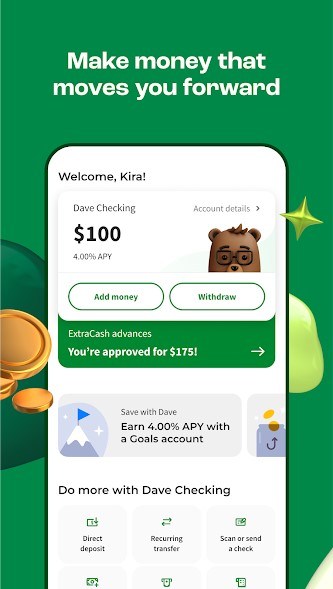

Dave

One potential choice to explore is the Dave app. Similar to Earnin, Dave provides paycheck advances up to $100, without the need for a credit check. Instead, they assess your eligibility based on banking history and employment details.

Applying online through their platform can save you time, and the approval process doesn’t hinge on traditional credit checks, making it an option for those seeking an unsecured loan.

To get such a loan, you can fill out their online request form and, if qualified, you may be approved for a loan. This approach is particularly advantageous for individuals who may not easily qualify for the best loan options, such as those with a loan cost limit as low as 300.

Additionally, it’s worth noting that payday loans are often associated with higher interest rates, but exploring alternatives like the Dave app could provide a more flexible and manageable solution for your financial needs.

Brigit and MoneyLion

Next among cash advance apps like Earnin is Brigit. Brigit Brigit also offers paycheck advances up to $250, and they don’t require a credit check either. They also offer overdraft protection, identity theft protection, and automatic budgeting tools.

If you’re looking for a slightly larger loan amount, apps like Earnin, MoneyLion MoneyLion, and Chime may be worth considering. MoneyLion MoneyLion offers loans up to $500 with no credit check required, and they also offer cashback rewards for using their app.

Chime

Chime, on the other hand, offers a Credit Builder loan program. Credit builder loans are a type of loan that can be used to help people build their financial history. They work by lending you a paycheck up to two days early when you set up direct deposit.

The amount is typically between $300 and $1,000. The payments you make on a loan are reported to the major credit bureaus, which can help you establish a positive financial background or improve your existing credit score.

Chime is one financial institution that offers a credit builder loan program. As you make your loan payments on time, the Chime checking account will report your payment activity to the credit reporting bureaus, which can help you build or improve your history.

Additionally, Chime’s Credit Builder loans have no interest charges or fees, making them a more affordable option than other credit builder loans.

One option to consider is a label name loan, which is a type of short-term loan that can be secured using your car title. These loans typically have a loan term of 30 days and are available to people with a resident license and a clear car title. However, label-name loans often have high interest rates and fees, so they should only be used as a last resort.

Other Alternatives

If you’re looking for a more affordable option, you can also consider credit unions or community banks that offer installment loans or the best personal loans online. Because some lend and borrow apps require access to your bank account, it’s necessary to carefully consider the risks and benefits before applying.

These personal loans no credit check lenders may be more willing to work with you based on your spending habits, credit reports, and tax returns. Additionally, many credit unions offer access to Moneypass ATMs, which can save you money on ATM fees.

Whatever option you choose, make sure to carefully review the loan terms and understand all fees and charges. All rights reserved by the Consumer Financial Protection Bureau.

While advance apps like Earnin and these alternatives can be a great resource for those in need of fast cash, they often come with high fees and interest rates.

Be sure to carefully review the terms and conditions of any loan you’re considering and only borrow what you can afford to repay. Additionally, remember that these apps are not a long-term solution for financial stability and should be used as a last resort.

How to Sign Up for Apps like Earnin

If you’re interested in exploring options for a 300 dollar loan, even with bad credit, there are steps you can take to initiate the process. Consider the following tips:

-

Research different loan apps like Earnin: Explore various loan options, including those catering to poor or bad credit borrowers, offering short term loan solutions.

-

Download the app: Once you identify a suitable app among those offering payday loans online, download it from your smartphone or tablet’s app store.

-

Create an account: Start the process by creating an account on the chosen app. This typically involves providing your email, setting a password, and linking your banking accounts.

-

Link your bank account: To facilitate the loan process, link your bank account to the app. This enables verification of your income and expenses, allowing direct fund deposits.

-

Provide employment information: Many apps, like Earnin, may require details about your employment, such as your employer’s name and work schedule.

-

Apply for a loan option: Utilize the app to apply for an advance or a short-term payday loan. Specify the maximum loan amount you need and provide essential information about the purpose of the loan.

-

Repay the loan: Understand the loan terms and conditions, especially the repayment schedule. Most apps require repayment within a set period, typically aligned with your next paycheck.

Remember, accessing a loan, even if you have bad credit, is feasible through online platforms. Conduct thorough research, read the terms carefully, and use these apps responsibly to avoid potential financial challenges.

Terms of Use of Apps like Earnin

Apps like Earnin typically charge fees or interest rates for early access to your paycheck. Read the fine print and understand the terms of use before using apps like Earnin.

Some apps may charge a flat fee for each early paycheck withdrawal, while others may charge a percentage of the loan amount you withdraw. You may also come across a subscription fee, membership fees, or an express fee with some apps.

In addition to fees, these apps like Earnin may also require you to connect your bank account and share personal information, such as your employment status and income. Be sure to review the app’s privacy policy and understand how your information will be used and protected. Consider other options, such as budgeting or saving, before relying on these apps for regular cash flow.

Pros and Cons of No Credit Check Loans

A 300 loan now without a hard credit check may be the solution if it’s difficult for you to get approved for a traditional loan from a bank or credit union. There are many benefits to this:

- They require less paperwork than traditional loans. You only need to produce a few documents that you likely already have on hand, unlike other types of advances, such as student loans, that require you to fill out multiple forms.

- They can provide 300 loan instant approval, especially for smaller amounts of money. This means you can receive the funds you require on the same day you apply without having to wait for a credit check or a lengthy approval process.

- With the availability of online lenders, you can easily borrow $300 instantly online from the comfort of your own home.

Let’s see the cons of loans that don’t perform hard credit checks:

- Loan like SpotLoan without credit checking account often carries higher interest rates compared to traditional loans.

- Some lenders may engage in fraudulent activities, such as charging hidden fees or requiring upfront payments.

Can You Get a Loan Online with Bad Credit History?

Some technology companies have started offering innovative financial solutions to help people meet their savings goals and improve their credit. For example, the credit builder program at the Bancorp Bank allows you to borrow small amounts of money, which are then deposited into a savings account.

As you repay the 300 loans today, you build your credit history and may even be eligible for cash prizes. Additionally, the budgeting app and service provider offer direct deposit and other convenient features to help you manage your finances and avoid ATM withdrawal fees.

Overall, if you have bad credit, there are still options available to help you get the funds you need. By working with a reputable service provider and taking advantage of innovative financial solutions, you can improve your credit over time and achieve your financial goals.

These days, there are many options for obtaining a 300 dollar payday loan — and you don’t have to sell your kidneys to make it happen.

Small Loan for Bad Credit: Peculiarities and Conditions

Ready to apply for a $300 loan now with bad credit? Make sure you read the fine print first. Cash advance loans can provide quick access to funds but often come with high interest rates and fees. You must fully understand the terms and conditions of the loan before accepting the funds.

Be sure to review the repayment schedule and calculate the total cost of borrowing to make sure you can afford to repay the loan in full and on time. Taking the time to do your research and read the fine print can help you make an immediate loan decision about whether a cash advance loan is right for you.

In some cases, bad credit cash advances come with conditions that you may not be willing to comply with, such as nitpicky fees and payment penalties. Depending on the personal loan you get, you could also risk losing your house or car if you miss an installment payment.

Also, be sure to check if the lender you borrow from is actually licensed in your state and that the lender you borrow from isn’t setting you up for financial trouble. There are hordes of predatory lenders who will issue cash advances to try to trap you into further debt.

Although you may be tempted to rush into requesting a personal cash advance with bad credit, double-check that you’re not on the hook for anything that could put you in a difficult financial spot. The best thing you can do before you settle on a lender is to explore offers from different companies, so you can compare and find the most suitable and trustworthy option.

Managing your credit can be overwhelming. Understanding the transaction fees and qualifying purchases, keeping track of your bank account balance, and navigating through the banking app can be daunting. Thanks to a clear and concise table of contents, you can easily find the information you need to stay on top of your finances.

How to Get a Loan with Bad Credit?

If you’re thinking to yourself, “i need $300 now,” there are plenty of ways to go about getting the cash advance you’re looking for. For example, you might consider applying for a paycheck advance loan to help bring you some relief. There is also a $300 installment loan online, so you don’t have to repay everything in one go.

Another option to consider is short-term loans. Such loan is a short-term which typically due on your next business day. However, note that cash advance loans often come with high interest rates and fees, so carefully review the terms and conditions before accepting the loan.

Additionally, 300 dollar loan direct lender may require a credit check, so it’s critical to be prepared for this possibility. Very often, payday loans are difficult to repay, so borrowers should make a payment plan and read the rules carefully.

Where to Get 300 Loans with Bad Credit

No matter how poor you believe your credit rating is, you can secure a guaranteed approval paycheck advance loan swiftly by applying through various online lenders today. Nevertheless, always conduct some research to ensure the company you’re borrowing from is trustworthy.

While numerous traditional lenders may tout a cash advance loan for 300 online, it’s crucial to beware of illegitimate lenders. Find the best place to get a loan online by dedicating some time to research, providing yourself with a diverse array of options.

When seeking guaranteed advances, the initial instinct may be to seize the first option that presents itself. However, it’s essential to take necessary precautions to avoid your small advance transforming into insurmountable debt.

How to Choose the Right Lender to Ask for Financial Help

So you’ve decided to apply for loans of 300 — but where can you find a $300 payday loan direct lender? And more importantly, who should you trust?

When looking for financial help, deciding the right lender is crucial to ensure you get the best terms and avoid scams or fraudulent activities. Here are some factors to consider when selecting a lender:

- Reputation. Stick to companies with consistently good reviews from other borrowers and who act in good faith. Avoid getting your three hundred cash advance from direct lenders with offers that seem unrealistic or significantly better than others.

- Reliability. Look for lenders that are licensed, registered, and have a physical address. Check their reputation with the Better Business Bureau or other consumer protection agencies.

- Loan Conditions. Compare the Annual Percentage Rate (APR), fees, repayment terms, and required minimum credit scores of different lenders. This will help you choose the best cash advance for your financial situation and hidden fees.

The bottom line is when it comes to selecting the right lender to ask for financial help, do your research and carefully consider all of your options. Payday apps like Albert Cash or 7 Eleven may offer instant delivery of cash, but they often come with high fees and short loan terms. Instead, consider credit unions or community banks that offer small loans with more favorable terms.

Before applying for a loan, make sure you understand the loan terms and all fees and charges. Additionally, consider your personal finance situation and your ability to repay the loan. If you rely on cash withdrawals or need access to funds per pay period, make sure the loan terms align with your needs.