A personal loan for bad credit is almost the same as a standard personal loan, the only difference is its availability to borrowers with a credit score below 580. There are many types of such loans and credit cards for fair credit.

However, the most popular are unsecured, which do not require collateral, although some lenders may offer secured loans with a bad credit score.

The best of them have transparent pricing, including interest rates and origination fee, fast funding and approval times, various repayment terms, and loans that can be used for various purposes. Therefore, we want to introduce you closer to credit loans and tell you about their features.

Best Loans for Bad Credit in 2024

To be approved for a personal loan application, you must pass a background check and have good credit report. Online lenders will look at your good or bad credit score and credit history to determine whether it is profitable or risky to lend you money.

The rating is normal (from 580), bad (from 300), and excellent (from 700). A low score can be caused by thin credit history, multiple late payments, and depleted credit cards.

If you have bad credit scores, you may need to go to lenders who offer bad credit lending. These personal loans are either secured (secured by collateral such as a house or car) or unsecured but often carry higher interest rates than other personal loans.

Upstart

Upstart works with borrowers with a minimum credit score minimum is 300 in most states. The minimum annual interest rate is 7.8%, and the maximum annual interest rate is 35.99%, which is quite high, but the average annual percentage rate is 6.4%. The origination fee that Upstart charges is between 0-12%.

Like many other best loan companies online that offer similar services, Upstart allows its customers to check the rate without affecting their credit score. Loan amounts that this bad credit loan offers are of a wide range, from $1,000 to $50,000. Regular,verifiable source of income of $12,000 or more annually—such as a job, a job offer, disability or retirement income will be enough.

This personal loan company is ideal for those who have a lower credit score and may not qualify for loans from traditional lenders. Upstart uses alternative data to assess the risk of borrowers, such as education and employment history, in addition to credit score. This makes it easier for individuals with limited credit history or damaged credit to secure a loan.

The application process for Upstart is simple and can be completed online within minutes. Once approved, borrowers can receive their funds as soon as the next business day. This quick turnaround time makes it a great option for those who need immediate access to funds.

One unique feature of Upstart is their ability to offer joint loans where multiple individuals can apply together and combine their resources to increase chances of approval or secure a larger loan amount. This can be beneficial for couples, family members or friends who want to borrow money together.

In terms of interest rates, Upstart offers competitive rates based on each individual’s creditworthiness and other factors. They also offer flexible repayment options, including autopay and the ability to change your payment due date if needed.

Upstart also stands out for their personalized approach to lending. Instead of solely relying on traditional measures such as credit score, they take into account a variety of factors when assessing a borrower’s risk profile. This can result in more fair and accurate loan approvals for individuals who may not fit the traditional mold of creditworthiness.

Overall, Upstart is a great option for those looking for quick access to funds with competitive rates and a personalized lending experience. With their user-friendly website and transparent terms, it’s easy to see why they have quickly become a popular choice for borrowers.

But as with any financial decision, it’s important to carefully consider your options and make sure you fully understand the terms and conditions before taking out a loan. Make sure to compare rates and fees from multiple lenders, and only borrow what you can comfortably afford to pay back.

We understand that every individual’s financial situation is unique. That’s why we provide unbiased information and resources to help you make informed decisions about your money. We recommend using our loan comparison tool to easily compare rates from different lenders, including Upstart.

LendingClub

LendingClub matches potential borrowers and investors, acting as a broker and being a peer-to-peer company. Investors, not banks or financial institutions, act as online lenders and finance your loan.

LendingClub allows its clients to take out personal and business loans with negative credit scores and enjoy the benefits of auto and medical financing.

Unsecured personal loans range from $1,000 to $40,000, and the interest rates are not the lowest among available (between 8.30 and 36.00 percent). The company charges a commission for creating an application (from 3 to 6 percent) and requires borrowers to have an excellent credit history (from 600).

The commission is deducted from the unsecured loan amount in advance. Therefore, you will have to take this feature into account when calculating the total loan amounts you want to borrow. And LendingClub does not charge a prepayment penalty but may charge a late payment fee.

Upgrade

It is an online and mobile credit and banking service in all states except Iowa, Vermont, and West Virginia. Borrowers can take out a personal loan from $1,000, which is very flexible but not more than $35,000, which is lower than lenders who target lower-risk clients. Unsecured loan terms last from three to five years.

When renewing, a commission for issuing from 2.9% to 8% of the loan amount is charged. However, the borrower is charged an origination fee of $10 if the payment is delayed by more than 15 days.

Minimum credit score requirement for potential borrowers is to have at least 560 to qualify for a bad credit personal loan. The applicant must have a maximum pre-loan debt-to-income ratio of 45%, excluding their mortgage. Ideally, also have a minimum monthly cash flow of $800. The loan repayment period can vary from 24 to 84 months. Interest rates start from 6.95% to 35.97%.

Best Egg

Loan amount from Best Egg ranges from $2,000 to $50,000. After successful verification, the money can be credited to the borrower’s bank account within 1-3 business days. Massachusetts residents may qualify for a minimum loan amount of $6,500; New Mexico and Ohio – $5,000; and Georgia, $3,000.

For a second loan from Best Egg, your total existing account balance cannot exceed $50,000. Annual interest rates range from 7.99% to 35.99%. Commission for issuing a loan for a period of 4 years or more will be at least 4.99%.

To qualify for the low annual rate, you need to have a minimum of 700 FICO® points and a minimum individual annual income of $100,000. Otherwise, you will have an loan approval even with a bad credit level.

LendingPoint

LendingPoint is different in that it has relatively low transaction fees and no early redemption penalties. A borrower can also have a rating of 580 or more to qualify for personal loans for bad credit. Services are available in 48 states except Nevada and West Virginia. Payday loans for bad credit can be used to consolidate debt, home or car repairs, medical expenses, and other large purchases.

You can take out unsecured loans ranging from $2,000 to $36,500 with annual interest rates ranging from 7.99% to 35.99% and maturities ranging from 24 to 60 months or two to five years. LendingPoint has two major drawbacks.

The first is high maximum annual interest rates and creation fees. You can avoid them if you maintain your high credit score. And also, the LendingPoint commission (from 0% to 7%) depends on the state in which the borrower lives.

OneMain

OneMain Financial provides online personal loans to borrowers with fair to bad credit histories. You can choose between an unsecured and a secured loan, which is great for you if your finances are in bad shape. But the first type is easier to qualify, as they require the use of collateral when applying for a loan. When your application is approved, the company will send your funds to your bank/credit union.

The processing fee can reach $500 or 10 percent of the loan amount. You can also qualify for a loan between $1,500 and $20,000, although some states have higher minimums or lower maximums. Personal loans have a fixed APR from 18.00% to 35.99% (varies depending on creditworthiness).

For late payments you will be charged between $5 and $30 for late payments or 1.5 to 15 percent of your monthly payment or overdue loan amount. The shortfall fee is between $10 and $50 for each returned payment.

Universal Credit

Universal Credit is an online lending platform that, through its partners, offers personal loans ranging from $1,000 to $50,000 if your credit score is over 560. This makes the lending process suitable for a wide category of borrowers.

The repayment period is different and can be either in the range of 36 to 60 months or, in other words, three to five years. Personal loans have APRs ranging from 11.69% to 35.93%. In addition, they have a commission for issuing from 5.25% to 8%, which is deducted from the proceeds of the loan.

Once your application is approved, Universal Credit will send your funds to your bank or credit union within one business day. However, the transfer of funds to the account depends on how quickly that bank can process the transaction.

What Bad Credit Loans Are

These types of loans are designed for people with less than perfect credit history or who have little to no credit history. These loans usually come with higher interest rates and more severe restrictions, as this helps lenders reduce the risk of losing money, bills on time or owing too much money, and their rating is below 580 on a scale of 300 to 850.

How Bad Credit Loans Work

Debt consolidation loans for bad credit work in the same way as any other kind of loans. Lenders borrow monet to individuals that typically repay the loan in fixed monthly payments. They can be used for financial emergencies such as medical bills, car repairs, job loss, and debt consolidation.

How Can I Get a Loan With Bad Credit?

Follow these steps to get cash advances:

Pre-Apply Process

1. Determine the payout amount

First of all, determine how much you can pay monthly without problems.

2. Explore your credit report and lender options

Find out your credit score and determine your creditworthiness.

3. Explore lender options

Compare loan terms from different companies online to find the best personal loan with a bad credit lender. Lenders sometimes pre-qualify borrowers to determine if they qualify for a loan and what terms are available to them. Pre-qualifying for a loan usually does not affect your credit score.

Collecting the necessary information

Basically, you may be required to provide information about your maximum or minimum annual income, the name of your employer and how long you worked, your social security number, a summary of your household expenses, your debt-to-income ratio, and if you rent or own your home.

Applying for the loan agreement

Once you have identified the loan that seems most suitable for you, start with a single loan request application. Applying for numerous loans at the same time in a short period of time can lower your credit score. And this, in turn, will reduce your chances of getting approved for a loan and increase interest rates.

What Is a Poor Credit Score?

Some lenders use the FICO credit scoring company, which ranks poor credit as 580 or lower. Others use VantageScore, which puts a “sub-standard” credit score between 300 and 600. Therefore, on average, a bad rating is considered to be between 300 and 629 points.

But what affects the rating? Here are five categories and how much each one affects your bad credit score.

- Payment history: 35%.

- Amounts owed: 30%.

- Length of credit history: 15%.

- Credit mix: 10%.

- New credit: 10%.

Types of Bad Credit Loans

There are two main options for getting a personal loan if you have not good credit scores: secured and unsecured, but there is a wide variety of other options as well. Let’s compare loan types so that you can find the one that suits you best.

Secured & Unsecured Bad Credit Personal Loans

Secured personal loans are those that require collateral from the borrower, like a house or car. As a rule, they offer better rates and conditions, as well as higher credit limits, because it motivates you to pay off your loan faster. If you have a poor rating, it may be easier to get a secured loan than an unsecured one.

Unsecured personal loan, on the other hand, do not require collateral. And the loan rate depends on your creditworthiness, income, debt payment obligations, loan amount, but you may have difficulty getting it if your credit is below average. Generally, this type of personal loan is the best option for most people.

Bad Credit Student Loans

Such a loan may suit your needs if you are trying to pay for education expenses such as tuition, textbooks, accommodation, and board. But you will have to try hard to find special lenders for such services. If you have a minimum credit score, you will almost certainly need a guarantor to qualify. And unlike the other options on this list, student loans can be used for one purpose only.

Bad Credit Auto Loans

Auto loans are here to help you buy a car as they offer you money needed for that purpose. Since car loans are usually “secured”, they stipulate that you must use the car you are buying as collateral against the loan. Therefore, you expose it to the risk of forfeiture if you do not repay the loan. You can qualify for better loan terms and lower interest rates if you have collateral. Such loans are typically provided with loan terms of two to seven years and fixed interest rates.

Bad Credit Payday Loans

They can also be called “buy now, pay later.” These are short-term loans, typically in the amount of about $500-1000. They charge incredibly high fees in exchange for fast cash, and the repayment is often before the next paycheck.

It is not recommended to use such services. Because interest rates are incredibly high, payday lenders can also be predators. Research the company before applying and be realistic about your ability to repay the amount.

Bad Credit Home Equity Loans & HELOCs

Bad Credit Home Equity Loans give out a lump sum of money upfront that you pay in fixed monthly installments. Like auto loans, they have collateral – in this case, your home. You can also use the home improvement loan to increase the value of your home or otherwise improve your financial situation.

How to Get a Loan with Bad Credit

No matter what lender you’ll end up with, the first thing is to know where your credit score is. The process of applying for small no credit loans for bad credit online is the same – it starts with your score. The best thing is that different lenders have different credit score ranges, so there will be at least one lender who meets your needs for sure. So, take advantage of getting your free credit report.

The next step is to make sure your report is error-free. If you’re looking for quick loans for bad credit, then consider a co-borrower. Sometimes when chances of getting approved are next to nothing, applying somebody who could help would be smart.

Where possible, pre-qualify. Just because not all loan providers do soft inquiries, there’s a chance to drop your score. Do it, especially if you’re looking for very bad credit loans.

The good thing is that you can use the funding for a broad range of purposes. Whether you want to get a loan with bad credit to cover the housing situation, wedding, or funeral expenses, the choice is big. Yet, there are still lenders who have some restrictions when it comes to the purpose of credit card unsecured bad credit.

And of course, keep an eye out for extra fees. This is especially true for lending platforms that connect borrowers with direct lenders. Often, there’s hard to find the end sum of fees until the agreement is signed. So, whatever your situation, getting immediate financial assistance is possible. Do the research and compare your options.

Where Can I Get a Loan with Bad Credit

It’s hard not to take advantage of the online world we live in today. Everything — from voting to checking your balance can be done online. Shopping for cash loans for bad credit is also a great option that could save you the day. Banks, credit unions, and loan lenders, all offer their financial assistance online.

The process of applying for fast loans for bad credit online follows the same rules. It starts with a credit score. Best loan companies for fair credit have a loan calculator on their website to help you do the math.

Often, you can find lenders promise a guaranteed approval. Better yet, some lenders offer loans for people with poor credit and no credit check. Be careful. Don’t confuse guaranteed loans for bad credit with loans that promise guaranteed approval.

The truth is no lender guarantees a loan approval. And the bad score is not always the reason for that. Often, incorrect information on your report could be much more important than your score. While, a guaranteed loan is a loan that would be repaid, whatever the outcome. Thing is, it’s secured by a third party (typically by a government agency) that guarantees to pay it off if a borrower defaults.

The same story with lenders that promise an instant decision for a borrower. No lender (we’re talking about legit lenders) will take the risk of dealing with unreliable borrowers without doing a check. Sometimes it’s hard to go five minutes without checking Insta, and here’s money at stake.

No matter how quickly you need funds, get ready to wait. Indeed, emergencies happen on sight. Yet, fast loans for bad credit take time. Generally, you can get the funding as quickly as the next business day, while other lenders need up to seven days for decision-making.

Which Loan Company is Best for Bad Credit?

Before answering this question, picture this. Since the lending marketplace gains in popularity, consumers go online first to find the best bad credit loans offer. Lenders first overtook bank and credit unions with more than 50 percent market share back in 2017.

Getting a loan with bad credit is possible, yet the options are limited. The good news is that many consumers who apply for a loan with bad credit are getting approved. Better yet, the legitimate lenders are also willing to provide that help.

It’s important to focus not only on who the lender is but also on how the loan is priced and structured. When shopping around for online loans with bad credit, consider the following things. First, look at the price and how long the lender is giving you to pay back the loan.

Second, no matter who you borrow from, take the time to review the loan terms carefully. Finally, if you don’t want to be exploited by predatory lenders, make sure you deal with legit ones.

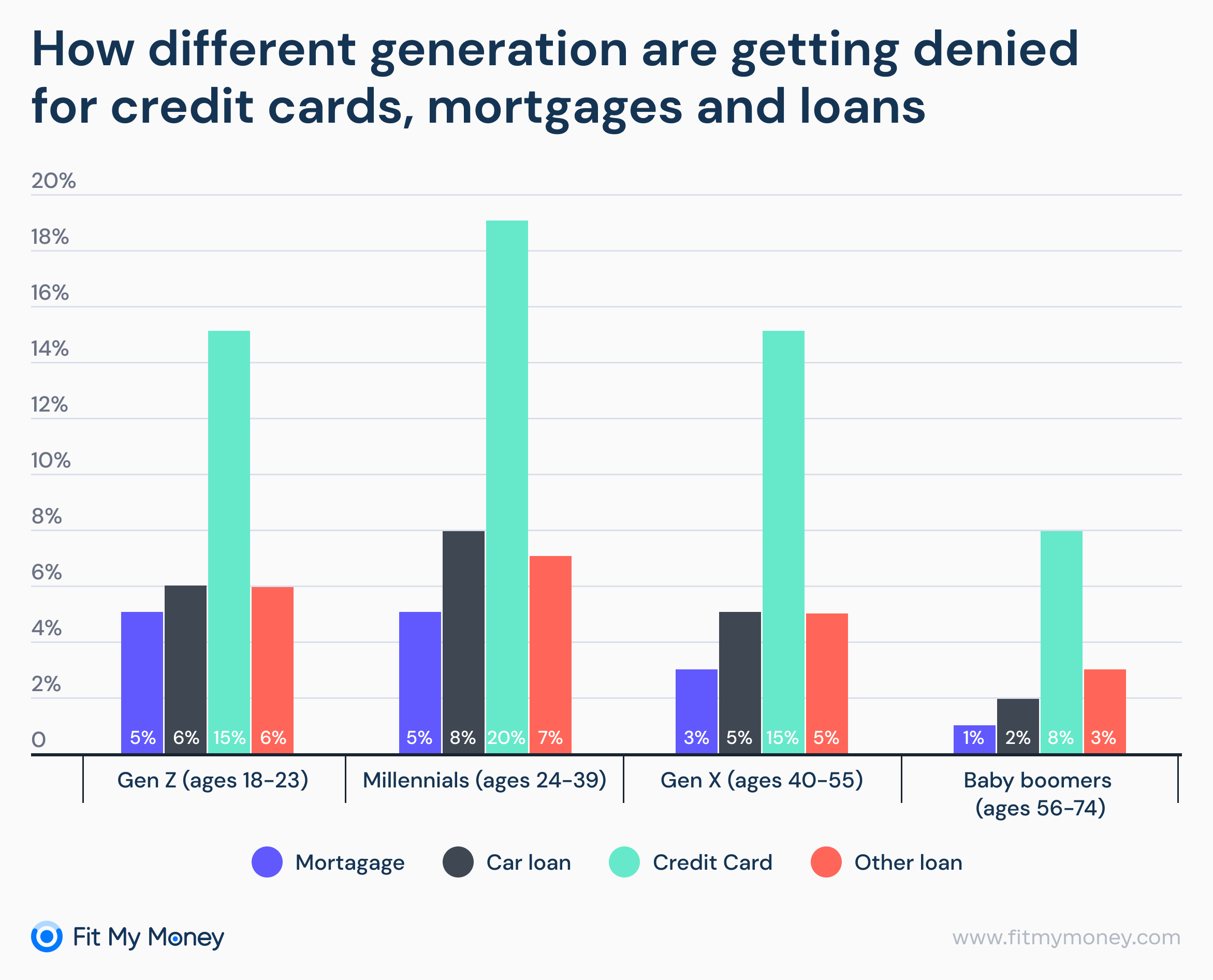

Anyway, there is always the risk of getting declined when opting for easy loans for bad credit and that’s nothing wrong with it. According to Bankrate’s survey, about 21 percent of all U.S adults were denied a financial product this year. No surprise that those with lower incomes were more likely to face rejection.

And finally, customer support. Think that doesn’t seem like a big deal? Then think again. Instead, it can make a huge difference if you encounter issues with payments. Review the lender’s customer service before signing an agreement. It will save time & effort at the end of the day.

How Much Can You Borrow If You Have Bad Credit?

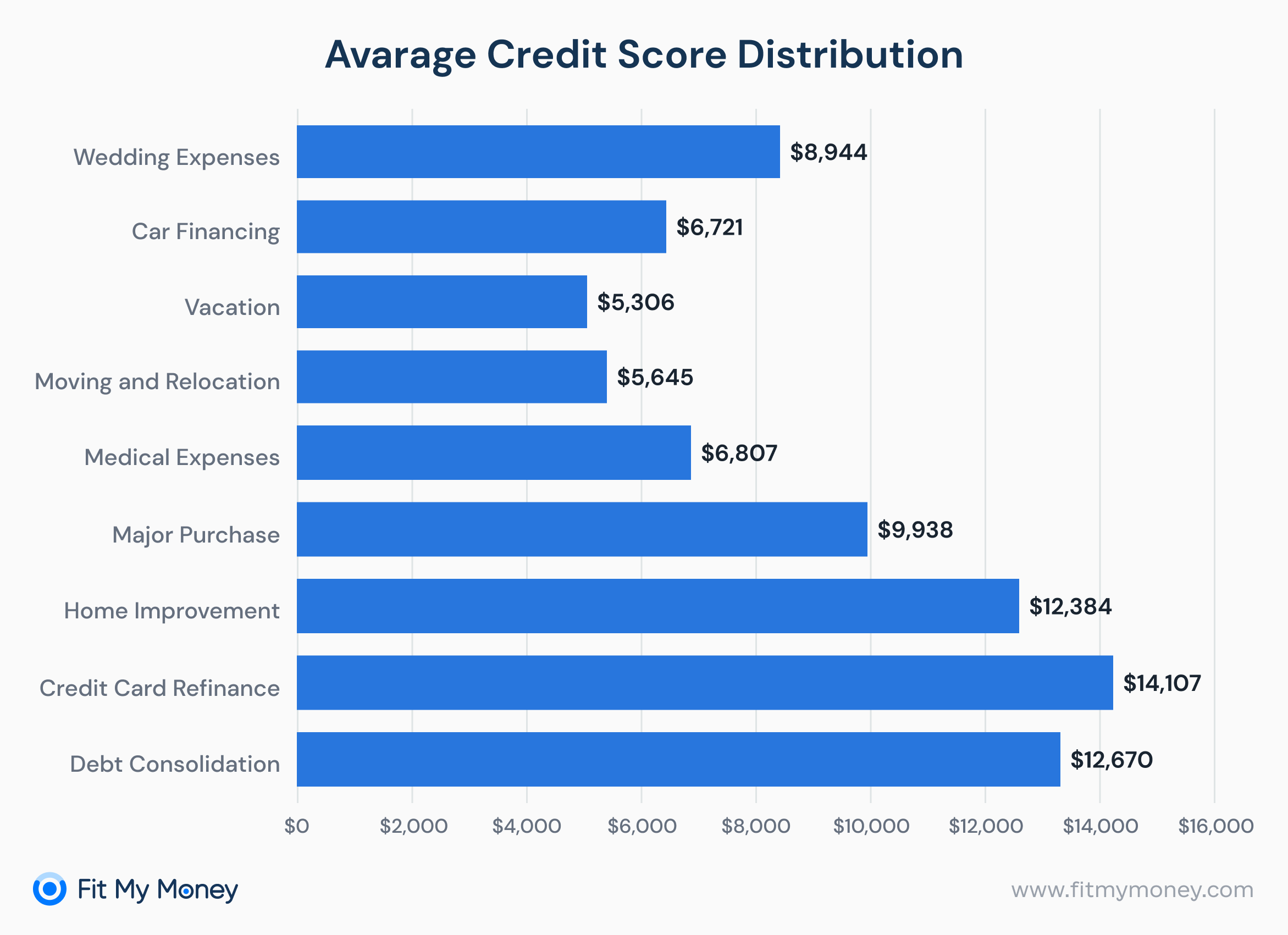

When you are on the hunt for the best loan online for bad credit, you have a specific purpose in mind. It could be car financing, medical expenses, or home improvement reasons. Some lenders have strict restrictions on how to use online loans for poor credit, while others don’t.

In some cases, the sum can be as low as $500, or as high as $100,000. It all depends. And your credit score is one of those factors that affect the sum you can take.

Before you get a loan with bad credit, it makes sense to use an online calculator and get an idea of how much you can expect to get. Most lenders that provide the best online loans for bad credit have this option on their websites.

There are a number of factors to consider. Your financial situation, FICO score, state of residence, and the lender that you are connected with. Everything impacts the amount you can take. Lenders have definitely gotten stricter when approving loans for very bad credit.

It means that it is more likely to get harder to qualify for loans for bad credit with no guarantor. Thus, if you’re looking to apply for a bad loan, it’s more important than ever to do your homework before you act.

So, know where you stand to be ready when your shoe drops.

How to Improve Your Chances of Loan Approval?

The bad news is having poor credit is expensive. The good news is that you have an opportunity to increase your score. And the first step to make is to check your credit report. Review it on errors or any credit missteps in your credit history. Thus, improving your score by just 35 points can save money. Picture this: you have a subprime score of 660. Now by adding 35 points, you have a good score of 695. As a result, you save $301 a year.

The best way to improve your chances of online approval is to pay your debt off each month. Having poor credit results in a number of financial consequences you are more likely to avoid.

So, make a habit to access and track your credit score for free. Also, learn how spending habits can affect your score. Besides, some lenders that offer loans with poor credit can provide you with educational resources.

If you need a loan with bad credit, make more money. Sure, it’s not the easiest way, yet it can increase your chance of approval. The lower your score, the harder it will be to find a good option with a decent APR. it’s not a novice that loans for those with bad credit have a much higher interest rate. As such, when looking for the best online bad credit loans, do your best to raise your score.

Pros and Cons of Loans For Bad Credit

Let’s look at the advantages and disadvantages of this type of loan.

| Pros | Cons | |

| Most personal loan applications respond within a few hours and are available online. | High-interest rates. | |

| Availability of loans for poor repayment history. |

|

|

| It will most likely have a lower interest rate than you are paying on instant approval credit cards with instant use debt. | Sometimes collateral is required. | |

| Wide variety of lenders. | Not every online lender is licensed in every state. Make sure the company you choose is certified in your state before using its services. | |

| The repayment period can vary from one to five years, depending on the lender. | Predatory creditors can increase your debt. You have to be careful. |

Conclusion

Borrowers who have a poor repayment history will always be able to find good personal loan options because there is such a wide variety among loan options. Your best loans for bad borrowing option will depend on how well it fits your specific needs.

You can choose between unsecured loans, such as personal installment loans, or a secured one from a reputable lender. These options tend to have lower minimum credit rating requirements. But be careful with secured loans. Because many of them require you to risk losing collateral in order to get the 300 cash loan no credit check funds you need. However, they are still easier to obtain.

Finding the right personal loan company, low annual interest rates, and low loan origination fee is what you need to do if your rating suffers. And don’t forget to organize your budget and finances so that you can always repay the loan. Otherwise, you will lose more than you gain.