The COVID-19 crisis all but crashed the global economy as a whole. There is an unprecedented spike in unemployment globally. Experts forecast that the situation is going to get worse before it gets better.

Therefore, even if you aren’t one of the millions of people who lost their jobs, you will likely experience some income problems. And the earlier you prepare for those, the easier it will be to get back on your feet.

This means that redesigning your entire budget right now is the best idea. If nothing else, this will help you be prepared for an emergency.

How the Coronavirus Crisis and Recession Will Affect the World

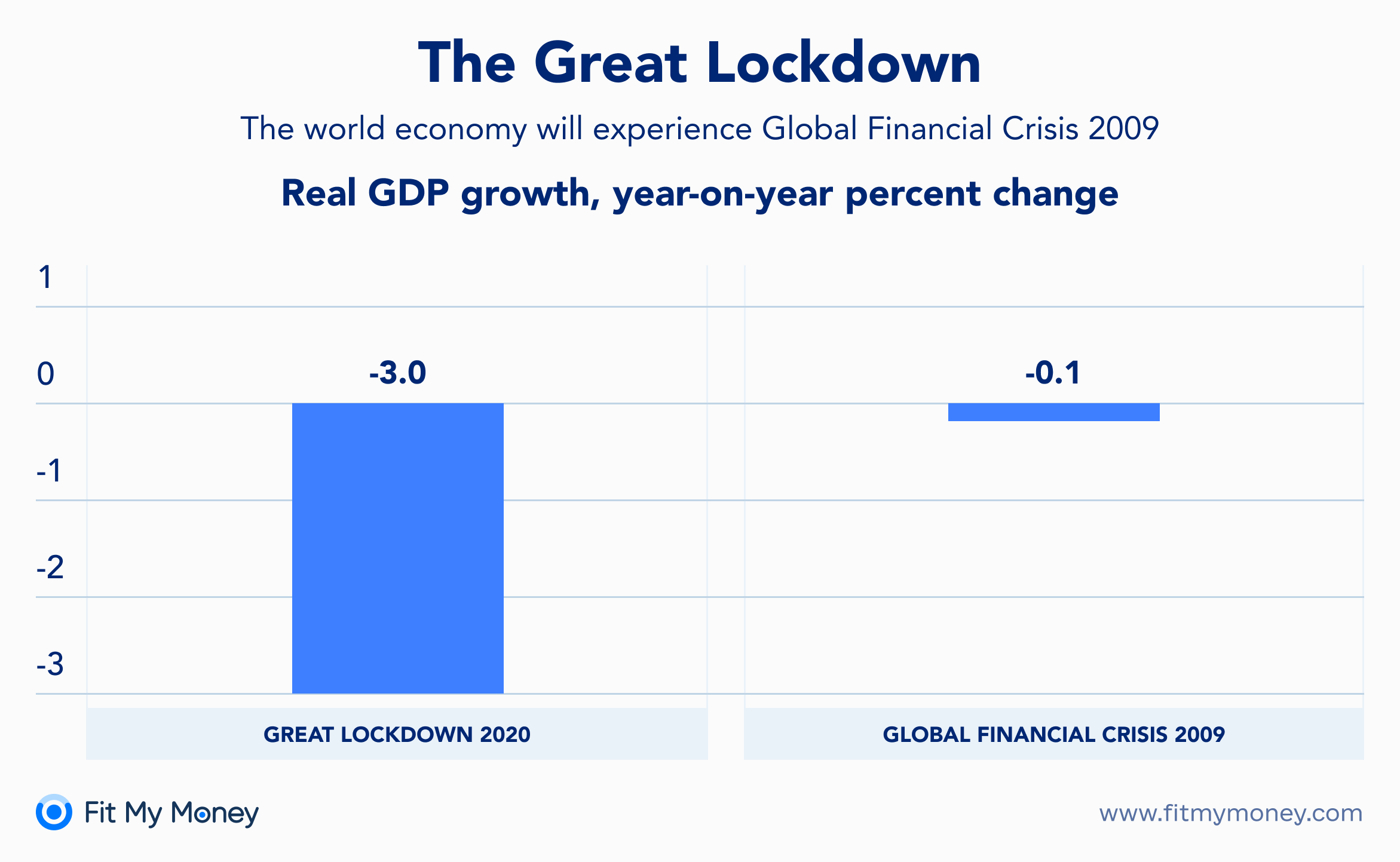

At the moment, experts agree on two things. One is that the COVID-19 crisis is unprecedented. Therefore, the true extent of its impact is impossible to predict with any accuracy. The main factor here is that the lockdowns and other restrictive measures almost fully stopped all the world’s economies extremely fast.

Usually, this is a more gradual process in a recession. But with everything shutting down rapidly and completely, the impact is staggering. On the other hand, the level of technology and globalization today help the recovery of both trade and manufactures.

The last time, a recession so bad was the Great Depression.

And there was no such technology or global community in the 1930s. Therefore, using it as an example to foretell the recovery after the COVID-19 crisis doesn’t help by much.

Sadly, the other thing that experts seem to agree on is that the worst is yet to come. While the shutdown was fast and brutal, the recovery of the global economy will be a slow and painful process. So, it’s best to prepare that the next few years will be harder than one could expect.

Budgeting Tips to Get Through the Crisis

- Rethink your debt (possibly, stop making it a priority)

It might sound shocking, after all, getting out of debt is the goal you should strive for financial stability. However, in times of crisis, you need to make your cash flow a priority. And yes, this might mean putting your debt on the backburner.

This is not a decision that can be taken lightly!

The debt will keep growing and make it harder for you to become truly independent in the long run. However, when money is scarce with no prospects in sight, you must prioritize.

In this case, you need to make keeping up with your essential expenses a priority. Therefore, look at your debt and calculate the barest minimum you must pay to avoid some drastic consequences. If you are sure about the question is a consolidation loan a good idea, consider taking a debt consolidation loan and definitely apply for refinancing if it’s possible for you. Overall, find a way to minimize your debt payments.

Also, be prepared that you might miss a few of those payments. This is especially important if you’ve lost your job. If this is the case, start planning for possible consequences of defaulting on your loans.

- Up the priority of your savings

Unlike debt, savings should go up on your priority list. Therefore, if you haven’t already, now is the time to understand what a savings rate is and how to use it right. It’s important to be systematic about your savings right now. And if you don’t have an emergency fund, you need to build it up ASAP.

Expert economists say that the recession will be long and brutal. Therefore, there is a high probability you’ll need to dip into your savings. This considered, you should increase that fund for as long as you can. If it’s possible, consider putting your funds into a high-interest savings account. Online banks today offer some great deals on those.

But remember to choose an account that allows for early withdrawal. You can’t be sure when exactly you will need the money in this situation.

- Maximize the value of your assets (beyond the cash)

It’s not only the cash you have that constitutes your money. An impending crisis is the best time to make a full revision of everything you own. Nothing is too small when preparing for the worst. Make a detailed review of all; your assets, for example:

- Check out all the food stores you have and plan meals to minimize your grocery spending.

- If you have any gift cards, see if you can use or sell them. Possibly, you can use them to get something only to sell it right away.

- Inspect all your possessions and make a list of what you can sell in a pinch. It might not come to this, but it’s best to be prepared. This is also a great opportunity to clear up your storage space.

- Consider renting out a room or some other part of your property if possible.

- Think about downgrading your car and definitely start a carpool with friends to cut your fuel expenses.

Simply put, you should sell everything that you can and put the money toward your savings. This is a smart thing to do even without a looking crisis. However, usually, we don’t have time to bother with small things.

Luckily, today you only need to take a few pictures of all the stuff you don’t need and put it online for sale. This requires very little work, but it can help increase your cash flow when you need it most.

Final Thoughts: How to Make It Through the COVID-19 Crisis

It’s impossible to say exactly how long this latest global economic crisis and recession will last. However, this situation will not be resolved fast. Therefore, you need to prepare for a long period of hardship that will likely affect every business on the planet.

Now is the time to get professional financial advice and start planning for the future that might be very challenging. And a complete overhaul of your budget should be the first thing you do.

Remember that you should be prepared to make some hard decisions. Maybe, moving out of your home or selling your car will become necessary. Keeping your family healthy and well-fed is paramount now, so you might have to go without many comforts.

But also, don’t forget that cutting your expenses ruthlessly right now can help you recover faster. Think long-term when preparing to battle this crisis.

Kate Bregovic has been working in the financial planning and investment services industry for over 10 years. Now being a freelance writer, she is well equipped to provide advice on a wide array of areas.