Personal loans are a great option to help solve emergency financial crises for individuals who have thoughts “I need 2500 dollars right now” and also get extra funds for daily expenses. They’re the best alternative to a payday loan, offering much better rates.

Not only do emergency loans such as 300 dollar loan pull you out of a financial emergency, but they can also help improve your credit score, depending on the provider you get it from. An example of these loans is the 2500 personal loan bad credit, a sizeable and risk-free venture that you can apply for in a few steps.

This personal loan is offered by many verified best online loan places, giving you the flexibility to pick the ones with the best terms and conditions. In this article, we’ll detail some of the best providers of this loan amount, their repayment terms, APR, attached fees, pros, and cons, among others.

We’ll also discuss and highlight who should consider each personal loan and how to get it. These and more, including how to pick the best provider, how to search “no credit check loan near me,” are detailed in this guide.

Best $2,500 Personal Loans in 2024

In this section, our financial experts and reviewers have compiled some of the top-rated lenders for the $2500 personal loan. Our experts have tested them first-hand and have considered a number of features for your own good. These include the required credit score, APR, prepayment fees, and repayment terms, among others.

The lenders that met up to our standards using the above features are Upgrade, Upstart, LendingPoint, LendingClub, and Avant. In the headings below, we take an in-depth look at what to expect from these lenders. These will help you make an informed decision on what providers best suit your personal loan needs.

Upgrade

Upgrade is one of the leading lenders in all American states except Washington D.C., Iowa, and West Virginia. The lender has some of the best loan terms, offering up to $50,000 to borrowers. Upgrade has been in the lending business for just five years and has made itself a strong contender in the online lending scene.

Currently, the provider has an APR range of 8.24% – 35.97%, and the minimum you can load is $1000. The repayment terms are 24 – 84 months, and people with credit scores from 560 can apply for the loan. Upgrade has an origination fee of 1.85% – 8.99% and a late fee of $10. The loan is best for individuals with an average to a fair credit report.

Pros:

- Low credit score required.

- Low minimum loan amount.

- Mobile app available.

Cons:

- High APR.

- Late payment and origination fees apply.

Upstart

This lending marketplace is another reputable online loan giver, offering its services to residents of all 50 states. Upstart partners with over 100 banks and CUs.

The lending marketplace loans between $1000 – $50,000, and it’s the best loan for bad credit. You require little to no credit history to get loan approval from this provider. The minimum APR is 7.8% – 35.99%, repayment periods are between 3 – 5 years, origination fee ranges between 0 – 12%, and there’s a late fee of 5% or $15. This loan is best for people who need 2500 loan with bad credit pull and for those with a high debt to income ratio that may need long periods to repay loans.

Pros:

- Long repayment periods.

- Fast loan disbursement.

Cons:

- High APR.

- High origination fees.

LendingPoint

Lending point is a top choice for personal and business loans, guaranteeing your funds by the next business day. It’s the loan option for individuals with average to fair credit scores, a valid bank account, and an annual income of at least $40,000. Lending points offer financing options between the range of $2,000 – $36,500.

You must have a credit score of at least 600 to qualify for the process of submitting an application. The APR is high at 7.99% – 35.99%, and the loan terms are between 24 – 72 months. As the loan amount is limited compared to the others, it’s a good option for users who have relatively smaller expenses. If you’re in California, according to the California financing law, you must be at least 18 years old, have a social security number, and should have a valid means of identification by the government. The same applies to the other states Upstart provides its services.

Pros:

- Get a loan with no prepayment penalty.

- Get approved within 24 hours.

Cons:

- Need a relatively good credit history.

- High maximum APR.

LendingClub

With a few taps, you can easily get a personal loan with LendingClub. The lender has loan offers between $1000 – $40,000, and you must be at least 18 years of age and residing in any of the 50 American states to qualify. You must also have a verifiable bank account, and other considerations by the lender will include debt to income ratio and credit decisions.

The lender attaches an APR of 8.05% – 36.00%, and the length of repayment ranges from 24 – 60 months. This loan is best for users with good credit, but you can’t use the funds for secondary education costs.

Pros:

- They offer joint applications, implying you can apply with a credible co-borrower.

- If it’s a monthly payment, you can adjust your due dates.

- Available in all American states.

Cons:

- High interest rate.

- Origination fees apply.

- Compared to others, the terms are limited.

Avant

This lender is popular for its credit cards, mortgages, and installment loans. Avant is a highly-reputed lender, offering its services to users with poor FICO scores. The lender competes strongly with the likes of OneMain Financial in this aspect, and you can qualify for its services with a score of 580. Avant partners with credit bureaus and financial institutions to offer loans in the range of $2000 – $35000.

The lender has a high-interest rate in the range of 9.95% – 35.95%. There are fees attached to borrowing a loan, including a late payment fee of $25, a return payment fee of $15, and an administration fee of up to 4.75%.

Pros:

- Loan proceeds to approval almost immediately.

- No penalty for prepayments.

- Availability of a mobile application.

Cons

- High fees.

- High APR.

- Joint application unavailable.

- The loan isn’t offered in all states, including Iowa, New York, West Virginia, Hawaii, Colorado, Nevada, Vermont, and Iowa.

Types Of $2,500 Loans

You can use these $2,500 loans for a variety of purposes, which leads to the different types that’ll be discussed in this section. Primarily, they’re categorized into loans for personal use, title loans, installment loans, and union loans. These loans come with their advantages and disadvantages that you should consider before deciding on what loan to collect. The different loans also come with different repayment conditions and interests that will weigh largely into your lending decision. Most of these loans will help you improve your FICO score and profile, and they’re available in almost every state of America.

Personal Loans

These loans are the most popular in the country, offered by virtually all financial institutions. Such loans are given by credit bureaus, traditional banks, and, lately, online lending platforms.

This loan is best for individuals who need funds for tuition, home expenses, family emergencies, and large purchases, among others. A personal loan from a verified merchant gives you a chance to consider how long you want to repay, your interests, and quality customer service to influence your lending decisions.

You can get this loan in virtually all states in the country, and there are laws to protect you from exploitation by lenders. With many options to pick from, you want to get the best APRs and loan terms possible.

Title Loans

These loans are the types that require collateral before you can get them. Typically, a car is required as collateral by a majority of the lending platforms, and they come with high interest. They’re also great for users with low FICO scores, meaning there are not many requirements to fulfill before you qualify for the loan agreement.

The loan term common with these lenders is just 30 days, and you might be charged up to 25% in the monthly payment. This means an APR that could go up to 300%. However, the minimum amount to loan can be as low as $1000.

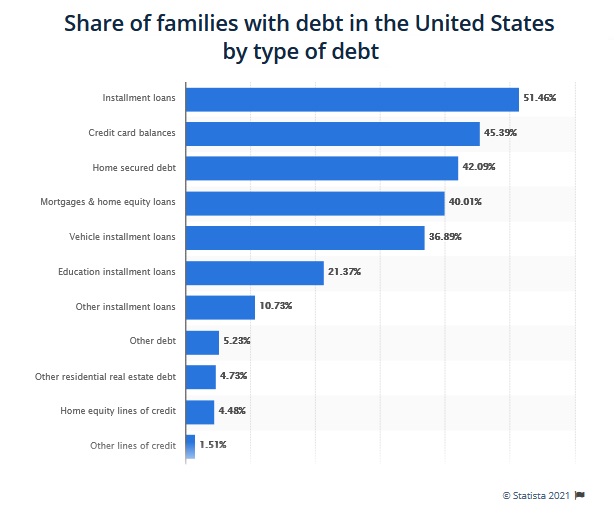

Installment Loans

These loans come in huge amounts and are required to be paid back at an agreed time interval. These loans can surpass the $50,000 mark and may require a good credit profile, appreciable annual income, and several other considerations. Examples of installment loan include mortgages, student loans, and auto loans.

Generally, the APR of these loans is considerably low since you’ll be paying over a long period of time. Depending on the lender, the loan can attract fees, including administration fees, late payments, and prepayments.

Credit Union Loans

These are popularly known as community or cooperative loans, where individuals contribute savings to provide credit. Credit unions have all rights reserved to dictate their APR, payment terms, and other conditions to help people qualify.

These loans come with low-interest rates and are typically within the low amount ranges. General conditions that apply include being in the same area as other credit providers, participating in pool savings, and having a decent income. These types of loans can be used for various purposes, from home expenses to large purchases.

Installment Loans: Benefits You Get

Borrowers can now access a vast range of loans and all possible loan amounts. And installment loans aren’t an exception. Alternative lenders online offer highly affordable interest rates. Plus, countless private creditors will cater to borrowers’ needs.

An installment loan for bad credit is one of the most popular loan types. The process of submitting an application is fully automatic. You fill out the application, and the most suitable lender will find you by himself. So, it saves you time.

Every fast loan online lender will provide you with an agreement where all the terms and fees will be mentioned. But if you know your credit score, you can search for which APR you can expect with it. Don’t be shy to calculate several offers and choose the most beneficial bad credit installment loan.

For example, let’s calculate installment loans for poor credit. If you get a 2500 loan no credit check and your APR is 15%, the number of monthly payments is 12; in the end, the loan will cost you $2,707 with $207,75 paid every month.

Eligibility Criteria For Applying For a $2,500 Loan

If you want to apply for a 2500 cash loan, the criteria will differ greatly depending on the lender. However, in all 50 states of America, a general requirement is for you to be at least 18 before you apply for this 2500 or 1000 dollar loan bad credit from any vendor. You’ll also be required to have a set number for social security, an account with a verifiable bank, and a government-issued photo ID.

Away from these general requirements, some lenders require that you have a FICO score of at least 500. Others might loan you the fund without a credit check, but you should watch out for the other conditions attached.

They’re generally still safer than payday loans, and once you can provide the required documents, you should get your fund within a day. In addition, some of these lenders might demand a certain amount in annual income.

Can I Apply For a $2,500 Loan With Bad Credit?

From the list of $2500 loans provided above, we can observe that virtually anybody can apply for the loan regardless of their FICO score. While many of them demand a minimum score and/or a minimum annual income, others are willing to give it out without checking your credit profile.

Some of these providers are Upstart and Upgrade. In the absence of a FICO score or profile, you only need to meet their other requirements, from photo ID to security numbers.

You can apply for these loans on online platforms or traditional institutions. With Upgrade or Upstart, residents of all states, including New Mexico, can apply for a $2500 loan no credit check. We highly recommend the online platforms as you can get a loan quickly with a few taps.

How Do I Repay My $2,500 Loan?

Before settling for a loan from any of the providers, you must have gone through the terms and conditions required to get it. Most loans stretch for at least a year to up to five years, and repaying means the amount you loaned will be spread over the repayment time. However, the annual interest rate will be added to the sum you might be paying monthly.

So, for instance, if you get the $2500 lump sum, and it comes with an APR of 20% over 12 months, the amount you’ll repay is $3000. This means a check of $250 per month.

Where To Get $2,500 Loans

In all 50 American states, you’ll encounter hundreds of vendors to help you secure this personal loan. These lenders are institutions grouped into online lenders, traditional banks, and credit unions. Each of these institutions has perks over the other, and we’d be discussing them in the following headings.

Regardless of the perks these financiers have over the others, they’re all recognized under state laws to protect you from scams and exploitation. Whether physical or online, you’d be able to get a 2500 loan now within 24 hours with zero hassles with these recognized vendors.

Online Lenders

Today, online lenders are the most popular financiers, offering all loans, including mortgages, auto loans, installment loans, and many more. A personal loan is one of the many offered, too, and they’re probably the easiest lenders you can experience in all 50 states of the country. The process is simple as you only need to enter the official website and follow through with the requirements.

These include submitting necessary documents and providing an account to transfer the funds. Once everything is verified, the online lender will send your funds within 24 hours. However, ensure you’re getting the loan with only verified websites with considerable APRs and extra fees.

Banks

Another institution famous for giving out loans 2500 is traditional banks. Unlike online lenders, these traditional banks require you to walk into their physical buildings and get a form to apply for the loan. It’ll help if you have an account with the bank to fast-track the application process.

For banks, you’d need documents like a government-issued ID, SSN, annual income slip, and credit profile report. The process might take longer than online lenders, but you should get your funds paid within 3 – 5 business days.

Credit Unions

These unions are cooperative loan services reserved for users who pool their savings every month. Not anyone can just walk into a union to get a personal loan; you must first be part of the “savings” group of that cooperative. There are several of these unions across states in America, and you can only apply for a loan when you’re part of the group. You’d have all your details submitted on registration, and you will not need to go through a complex process of submitting an application to get a $2500 loan

Choose 2,500 Personal Loan: What to Pay Attention To

Usually, people search for loans from lenders online via a browser and find lenders’ review websites with their top features and compared rates. On our website, you can find trusted direct lenders and choose the best one.

Read more: Check the best personal loan lenders to get financial support.

If you’re unfamiliar with getting loans, you need to remember the must-have features the best credit givers offer:

- High approval rates;

- Reasonable APR;

- Fixed interest rates;

- Fast approval period;

- Easy loan application process;

- Various loans;

- Gettable loan amounts;

- Flexible conditions for borrowers with bad credit.

Bad credit may be a deal-breaker at traditional banks, but with online lenders, personal loans for bad credit are possible. Just remember that the APR the lender issues on a loan are based on your FICO score and repayment abilities (or income size).