You may face various situations when using a personal loan to pay off credit card debt is a necessity to solve financial problems. When you already have several credit cards, know how to get a bank loan, and struggle to pay them off on time you should look for alternative solutions to become financially independent again.

Having multiple best transfer credit cards with no transfer fee may lead you into a vicious debt cycle. Getting a personal loan to pay off credit card debt may be a decent way out. Sometimes even 1000 dollar loan can significantly fix the situation.

Keep on reading to find out the advantages and drawbacks of this solution.

How Getting a Personal Loan to Pay Off Credit Card May Help You?

When you use multiple credit cards to make ends meet and finances your needs, you eventually accumulate debt. It may be challenging to get out of debt on your own.

Will you have enough means to make more than the minimum payment on every card? Do you need to focus on repaying the credit card with the highest interest rate or with the highest balance first?

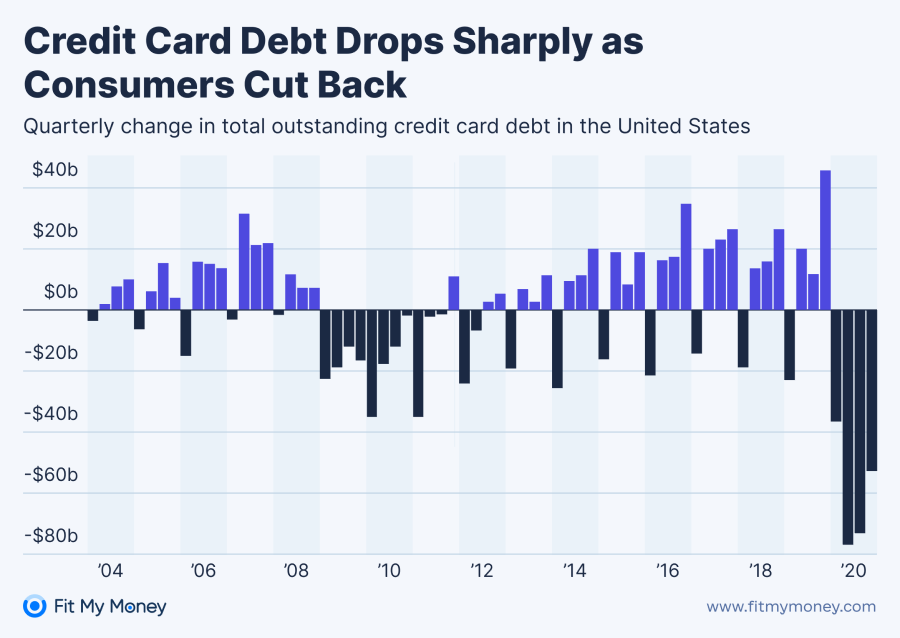

This year credit card debt dropped by $76 billion and it became the largest decline on record.

Using a personal loan to pay off credit card debt may save you from an endless debt cycle and bring you peace of mind. Of course, there are pros and cons in every financial decision so you should value the risks and know all your options.

A personal loan to pay off credit card may solve many monetary issues as they often come with lower interest rates. It’s a widespread concern many consumers have in their minds about how to get a personal loan to pay off credit card debt.

Bonus post: US Running Out of Money: Is It True?

Personal Loan for Credit Card Debt

Many people who can’t cope with their credit card debt decide to opt for another lending solution. You may obtain a personal loan to consolidate existing debt on your credit cards. The reality is that consumers often request a new credit card each time the debt starts to accumulate on the first one and they can’t cope with it.

You may end up having multiple credit cards with the debt amount rising each time. If you can’t cope with these payments while the total debt increases, a smart choice is to take out a loan to pay it off.

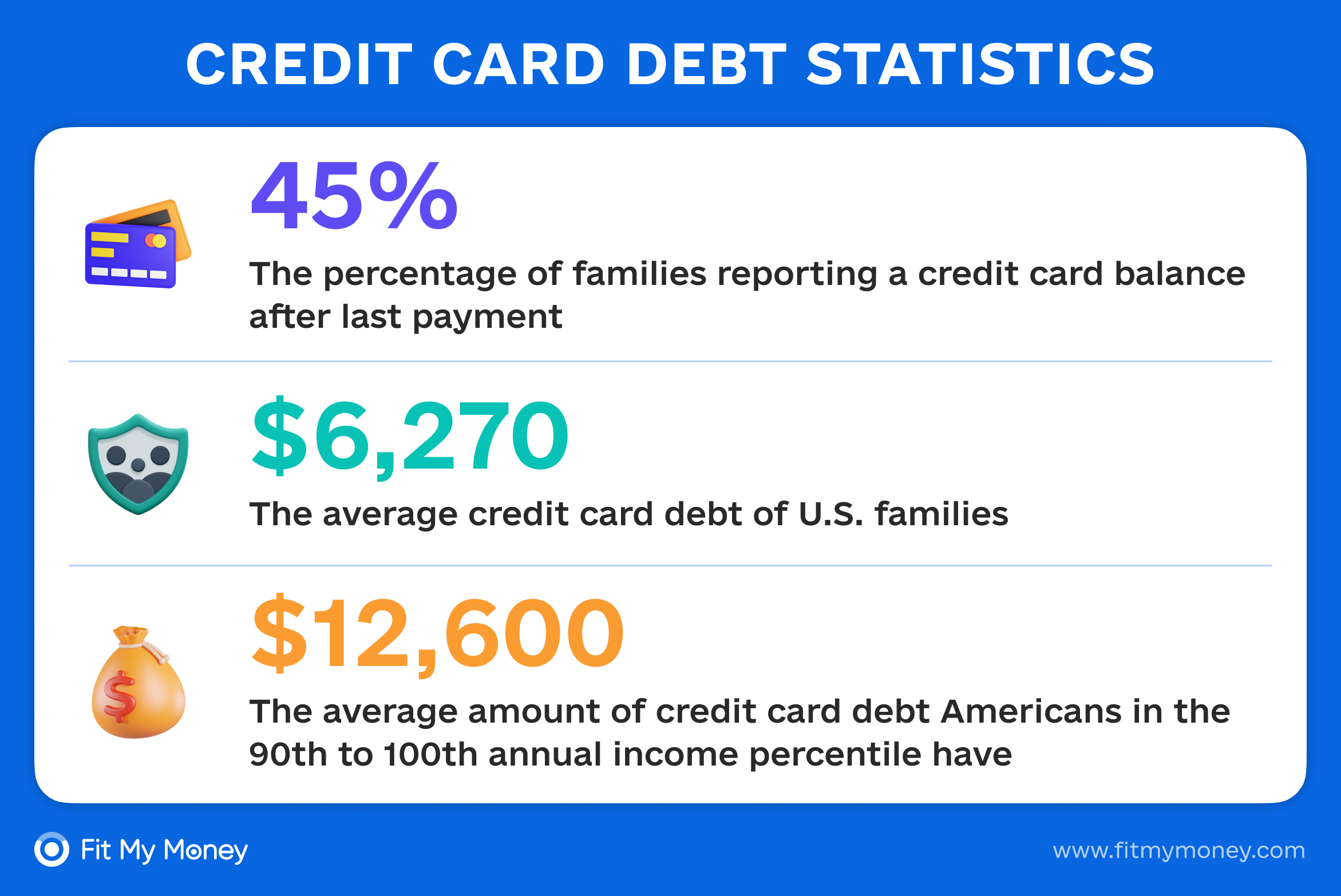

Financial experts advise clients to keep the total balance on their credit cards below 30%. Then you will be able to make on-time monthly minimum payments or even pay more. If you can’t handle existing debt you may want to obtain new cards that will inevitably lead to the endless debt cycle.

Do you want to finally break it and become financially stable? Think of getting a personal loan for these needs.

Advantages You Will Get: Personal Loan for Credit Card Debt

Many people wonder should I get a personal loan to pay off credit card debt. They aren’t sure whether this lending solution will bring them peace of mind.

“If you find a loan with a smaller interest rate then it makes sense to use it for credit card repayment,” says Breanna Reish, a certified financial advisor.

Of course, every borrower should evaluate the risks and know their rights when it comes to taking out a new lending solution.

- Smaller Interest Rates

This is the first and most important benefit of getting a personal loan to pay off credit card debt. Credit cards often come with higher rates and fees so if you have several of them the total cost may be ridiculous.

Instead, why don’t you search for a low-rated loan to cover these expenses and pay down the cards? Keep in mind that you need to have a great credit rating and a decent credit history to qualify for a low-interest loan. Then, it will make sense to utilize this option.

According for Federal Reserve’s G, for all credit cards, the average APR was from 14.54% to 17.13%. And the current personal loan rates start from 3.99%.

- Fewer Payments

Where can you find the best personal loan to pay off credit card debt? There are local traditional crediting organizations and alternative lending services where you may turn to.

If you are tired of making numerous monthly payments for every credit card and keeping track of these payments, you may benefit from making a single monthly payment on a personal loan instead. Should I get a personal loan to pay off my credit card? It makes sense as you will have fewer payments.

- Improve Your Rating

Should I use personal loan to pay off credit card? If your aim is to increase credit score, you may utilize this option.

Taking out a small loan for credit card consolidation will help you pay the debt off faster and with less effort. It will take away additional stress while boosting your rating and lowering your credit utilization ratio.

Applying for a Personal Loan to Pay Off Credit Cards

If you decide to apply for a loan to repay your credit cards you need to think about the best place to do it. You may want to go to physical lending institutions and conventional banks in the first place.

However, it may be a smart option only if you have a decent credit history. If your rating is less-than-stellar the bank will probably approve your request but offer higher interest rates. As a result, it won’t be affordable to repay your debt as you may end up having even more debt.

Alternative crediting companies present a more flexible solution. Consumers who want to get competitive rates and more flexible terms may opt for these lending services and get quotes.

Take some time to compare several service providers. It may take some effort but you will understand what rates and conditions you can qualify for. Hence, you will be able to find a legal opportunity with the most suitable terms to repay existing credit card debt.

Pitfalls You May Face

If you notice that your credit card debt starts to accumulate faster than you are able to cope with it, it’s time to take action. Financial coaches advise consumers to keep the total credit card balance below 30%.

If you can’t keep it this low, you have to take out numerous cards and it turns into a debt cycle. You may use a credit card to pay off personal loan or vice versa. Sometimes, it’s not suitable to request a loan for covering credit card debt.

- Higher Fees

Can I use a credit card to pay off a personal loan or vice versa? Yes, you can. But you need to take into consideration that certain loan providers charge origination fees, prepayment fees, and other additional charges between 1% and 8%.

Hence, the total cost of borrowing may even be higher than you currently have on your credit card. So, calculate how much you will have to pay and compare it with your present payments.

Some personal loans don’t have an origination or prepayment fee but they have strict eligibility requirements.

Get No Fee Personal Loan!

Fill out a request form and get a personal loan without extra fees.

- Credit Score Damage

Is it worth getting a personal loan to pay off credit card debt? It may be worth it if there is no damage to your credit rating. The truth is that many conventional lending companies and local banks perform a hard credit inquiry that may ruin your credit rating.

If your credit history isn’t excellent you may lose several points or your application may even be rejected. It takes more time to seek alternative providers who conduct only a soft credit pull that doesn’t harm the credit. so, does getting personal loan damage your credit score?

- Overspending

Is getting a personal loan to pay off credit card debt good idea? It may be a good idea unless it leads to overspending. This is a common problem that may arise when you request a new loan for covering credit card payments.

Also, the amount you owe in the form of your credit card debt lowers your ability to spend more cash. If you obtain a small loan your ability to utilize the card to maximum will come back so you may end up overspending the funds.

Other Options for Paying off Credit Card Debt

You may also review the following additional ways of credit card debt repayment:

- Debt Consolidation Loan

This is a type of personal loan that is issued to consolidate numerous debts of the borrower. In other words, you obtain a loan with a single monthly payment instead of several ones from a consolidation debt help company.

There are many benefits of a debt consolidation loan. Apart from turning your multiple debt payments into a single one, you may also improve your credit if you keep on doing on-time payments. Also, you may get lower interest rates and repay the debt faster.

- Use Emergency Fund

If you can’t qualify for a personal loan or get only quotes with sky-high interest rates, you may want to avoid lending solutions at all. Why don’t you utilize the cash from your emergency fund to pay the current debt on your credit cards?

This way you will avoid extra fees and become financially independent faster. This option is suitable only if you have enough funds in your emergency fund.

- Pay the Highest Debt First

Another option is to tackle one debt at a time. You may start from the most expensive balance and work your way down until you pay the smallest debt. This method is called the “avalanche” technique of debt repayment. It is a convenient strategy for many people.

You should make the minimum monthly payments on every credit card but pay additional cash at the highest-interest debt. Once it’s repaid you will feel more relaxed and it will be easier to tackle other debts.

Choose the Best Personal Loan to Pay Off Credit Card Debt

Can you use personal loan to pay off credit card? This may be a smart choice provided that you’ve considered all the benefits and drawbacks of this solution.

As with every other lending solution, requesting a new loan to repay your credit card debt has pros and cons. If you have several cards and can’t cope with making on-time payments and covering the balances you may need to take out a loan.

You should evaluate the risks, take some time, and do your research before you make the final decision. Review several service providers and compare their rates and conditions until you are satisfied with the offer.

Remember that your credit rating may affect your ability to obtain a low-credit loan. Also, choose the creditor that performs a soft credit check and doesn’t have additional charges.

Moreover, pay attention to the term of the lending offer. If a provider is eager to issue the funds at lower rates and for a shorter repayment period, it may be worth giving it a try.

Otherwise, it doesn’t make sense to take out more debt and spend months trying to pay it off. Don’t rush with such important decisions and make sure you make a wise decision about everything, even conventional 97 loan rates.