The news is that the US government is running out of money. This is true that the USA may run out of cash in the nearest future. Of course, there are means to borrow several trillion dollars to avoid doomsday without any bad consequences.

However, the Republicans have declined to pass a bill to allow the government to increase the debt limit. This procedure has been already made in the past, which allowed the US government running out of money in 2017 and earlier to remain financially afloat. Will they do it this time?

Is the US Running Out of Money?

Janet Yellen, who is a Treasury Secretary has warned that the US government running out of money in October this year.

The risks are high that the US Census running out of money to do their jobs correctly which may affect the economic situation, the markers, and employment situation for millions of citizens.

It may happen unless special measures are taken, and the Congress increases the debt ceiling.

What is the debt ceiling?

This is a limit Congress of the USA imposes on the amount of the federal government’s debt. This limit was initially imposed after the First World War as a way to exercise prudence and avoid passing on the financial burden to children.

This debt limit has never been breached so far. Is the US government running out of money now? Yes, so this limit may be breached for the first time, and nobody knows what it may lead to.

“It is uncertain whether we could continue to meet all the nation’s commitments after that date.” – Janet Yellen

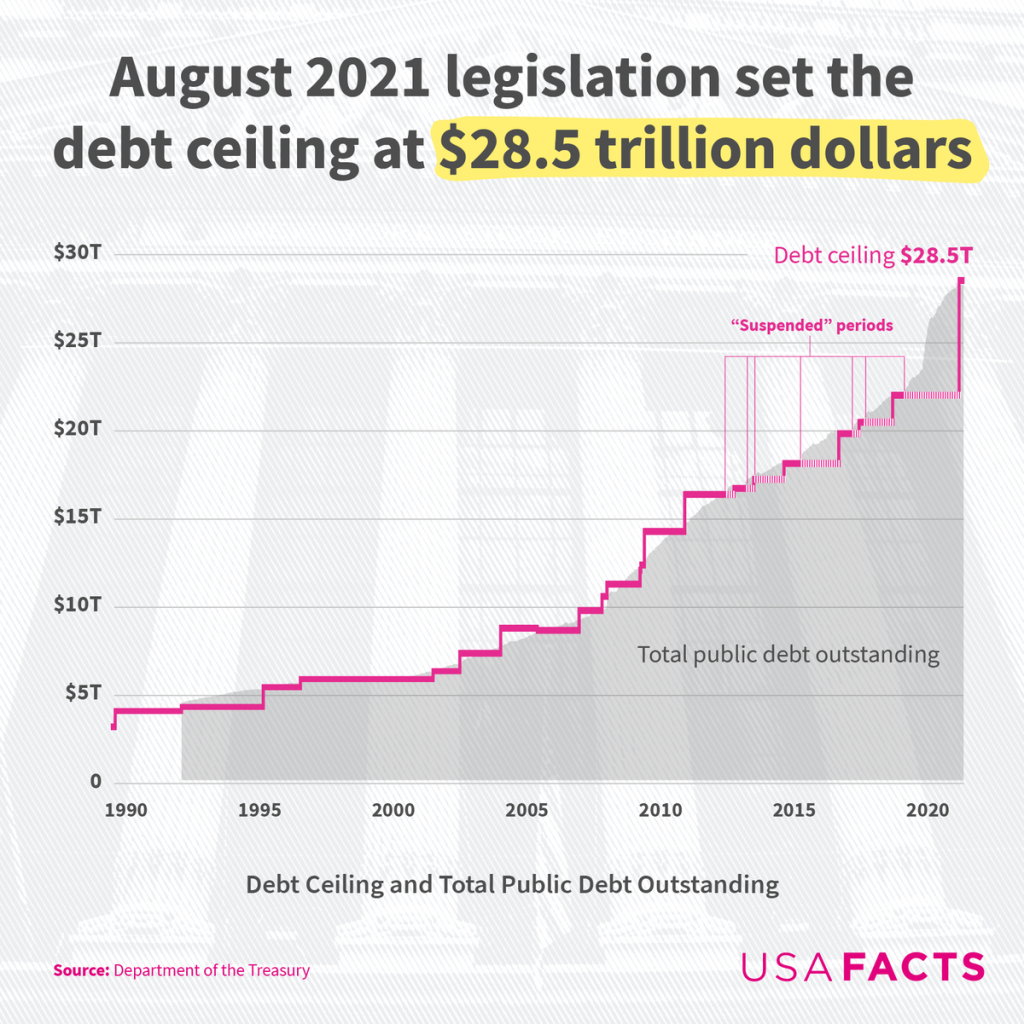

On July 23, August 2, September 2, and September 28, Treasury Secretary requested to raise the debt ceiling, and it was set at the point 28.5 trillion dollars.

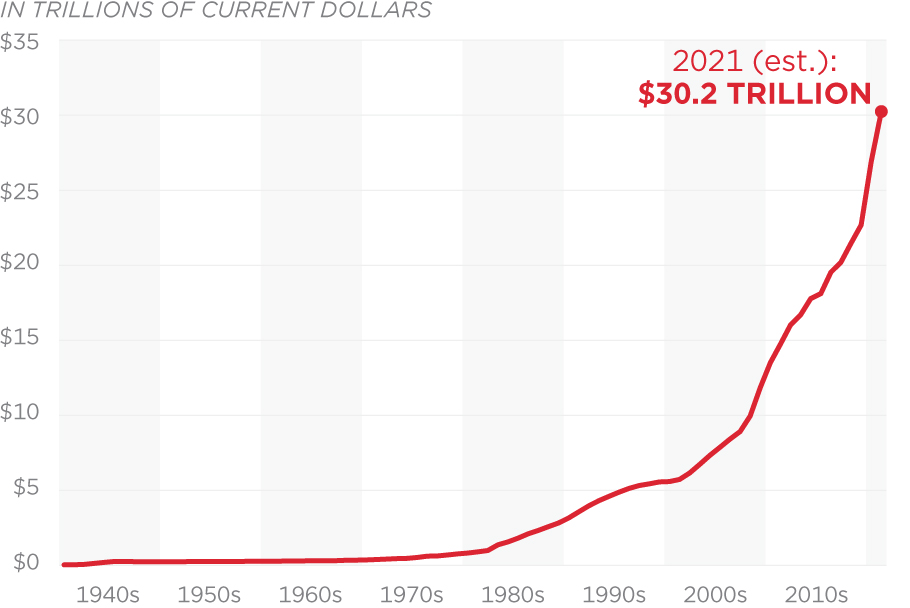

But all the ceiling exhausted by October 18. And now the debt limit should surpass $30 trillion!

Possible Consequences

First of all, people may start to panic. If the country fails to meet obligations and make on-time payments to federal and other workers, the unemployment rate might increase again and personal loans will become as popular as never.

The negative effects of the Us Treasury running out of money won’t be limited by one country. The USA does a lot of business with other countries around the world.

Debt crisis in our country may seriously affect the global economy, which has already been hit by the current pandemic.

The government debt obligations will be due at any time now while the US tax cuts running out of money. If the country defaults on its debt obligations it will turn into a nightmare. The present employment rate is below the pre-pandemic levels.

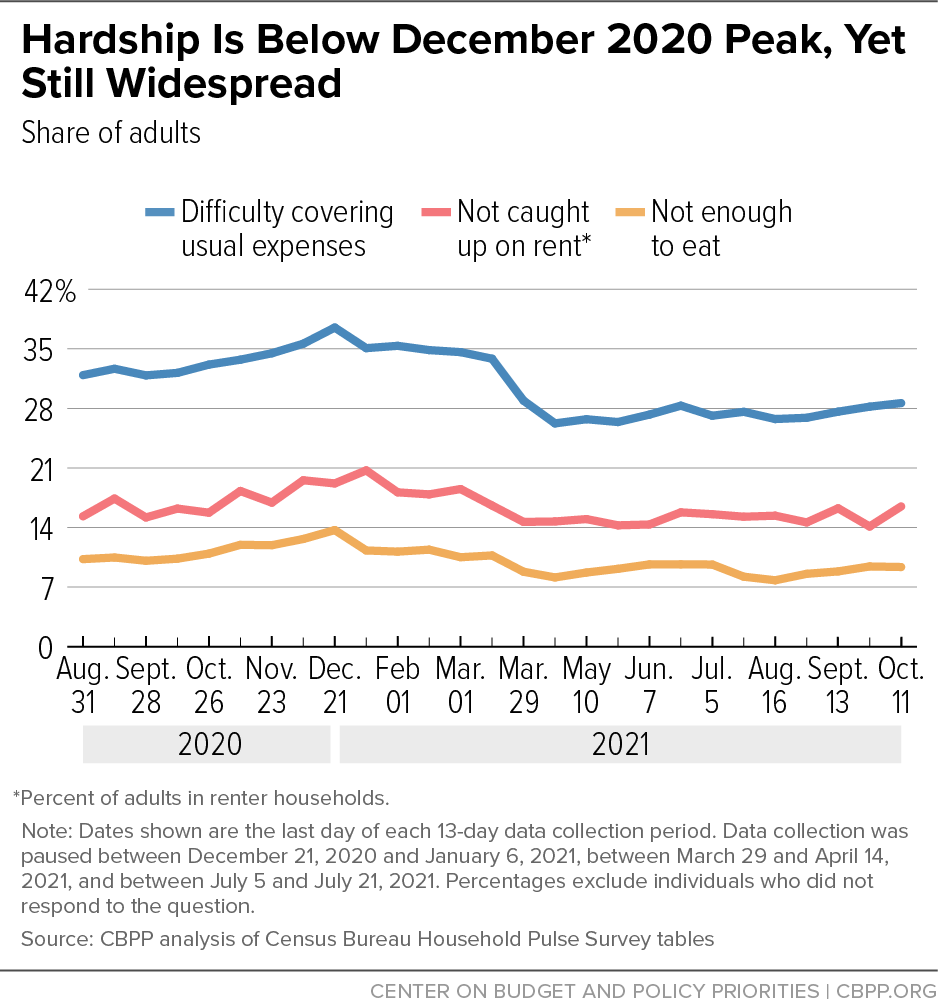

Millions of people are behind schedule with their rent payments and haven’t caught up yet.

Hardship rates have dropped in March 2021 when the American Rescue Plan gave $1,400 payments for millions of Americans as financial assistance, according to the Center on Budget and Policy Priorities.

- If obligations and payments to federal employees won’t be met in the nearest future, the unemployment rate may increase.

In August 2021, the national unemployment rate was at 5.2 percent. People from low-income households may suffer the most.

- Debt obligations or common consumers will rise while people won’t have the financial means to repay the rising debt.

A solution should be found now to avoid hardships and financial losses.

It may be a challenge for the government now that the Republicans have rejected to pass a bill to allow the increase of the debt ceiling. But this is just a matter of time.

Every lawmaker should value all the pros and cons of this situation and agree on this important matter until it becomes too late.

If the agreement isn’t found soon, the government will run out of cash while the consequences will be inevitable. We are all tied together and other countries will eventually be affected as well.

What happens if the U.S. defaults on loans:

- Millions of people would lose social security and Medicare;

- US soldiers may not get their paycheck;

- Food assistance will stop;

- Pension payments would lapse;

- 7 million Americans would lose their jobs.

Is There a Solution?

There is a possible solution. The government should find a relevant compromise to remain financially and economically afloat. Though the debt ceiling hasn’t been breached so far, it has been increased and altered a few times.

Why is the US running out of Social Security money?

If it does happen and the US government and US courts running out of money will become a harsh reality. Treasury would delay Social Security beneficiary payments, as well as other obligations and payments to Medicare providers, contractors, and agencies. It will become one of the most popular reason to get a loan.

The optional solution is to suspend the debt ceiling once again. It has been modified and revised several times in history to meet the current needs of the country and to avoid the breach.

Some sources estimate that this debt was increased about 98 times.

The first time was in 1917 when this number was $1 billion, and the last time it happened in 2017 when this debt was risen up to $22 trillion. So, it’s absolutely normal to modify and raise this div now to avoid a doomsday and save the economy.

Technically, there isn’t a certain limit to this debt ceiling. Thus, we can’t really break it. We may only expand this number to meet the current economic needs.

Of course, the lawmakers should act together and come to an agreement on this question. Raising and revising the present debt ceiling is the only positive outcome in this challenging situation that is in America’s best interest.

The effect of long-term spending will result in the US running out of money. Of course, the government will do everything possible and avoid this scenario.

Is the US running out of money for social security?

Yes, but only if the comprise isn’t found, millions of federal employees may be left without payments. The government will have to stop paying salaries to workers until the situation stabilizes, and they, in all likelihood, will run for the money. Furthermore, the stock market will be impacted as well.

Let’s hope that the Reddit comments about the US running out of money and other nightmares won’t come true. The lawmakers should act wisely and reach a compromise to increase the debt ceiling and avoid economic issues.