If you can’t manage your personal finances properly, have issues with budgeting, or want to save more cash, you may benefit from special apps such as saving or borrow money apps that help you save money.

They are designed for people who need a helping hand with their funds and want to avoid common mistakes. Saving money apps are usually tailored to your financial needs and current preferences.

Whether you are willing to meet your financial goals, get rid of debt, or just spend less each month, go ahead and select the most suitable app for you.

We’ve made an overview of the top-rated and free apps for saving money during shopping and for saving aims.

Bonus post: Read about apps that let you borrow money.

Free Money Saving Apps

One of the key strategies of getting your personal finances under control is to create a budget. Now that we are living in the era of new technology and digital innovations, consumers can take advantage of the best apps for saving money.

Some of them cost a fee while others are completely free of charge. So, if you want to track your spending and see where your money goes each month, here is a list of the free online tools to help you get started.

Mint

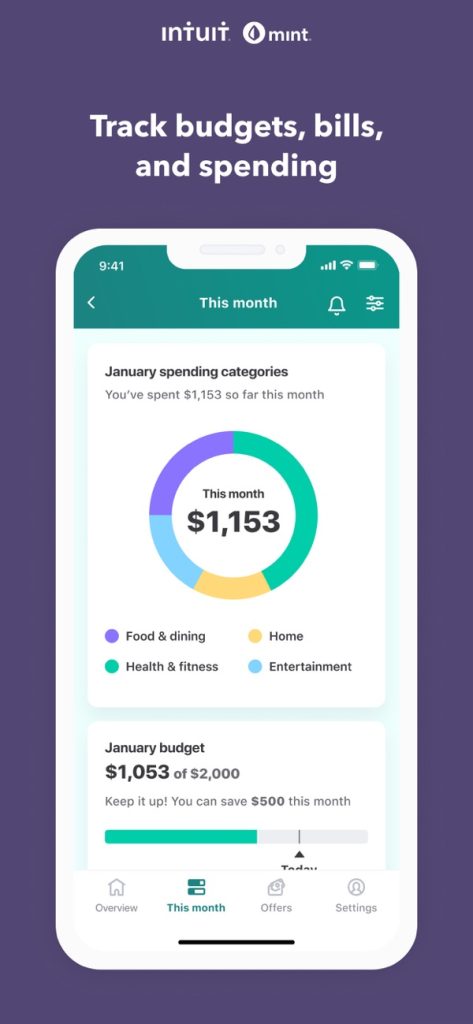

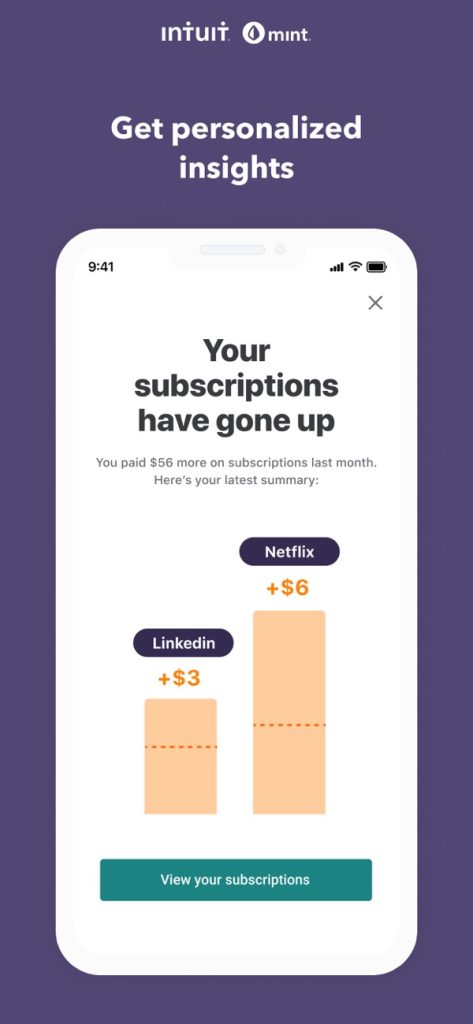

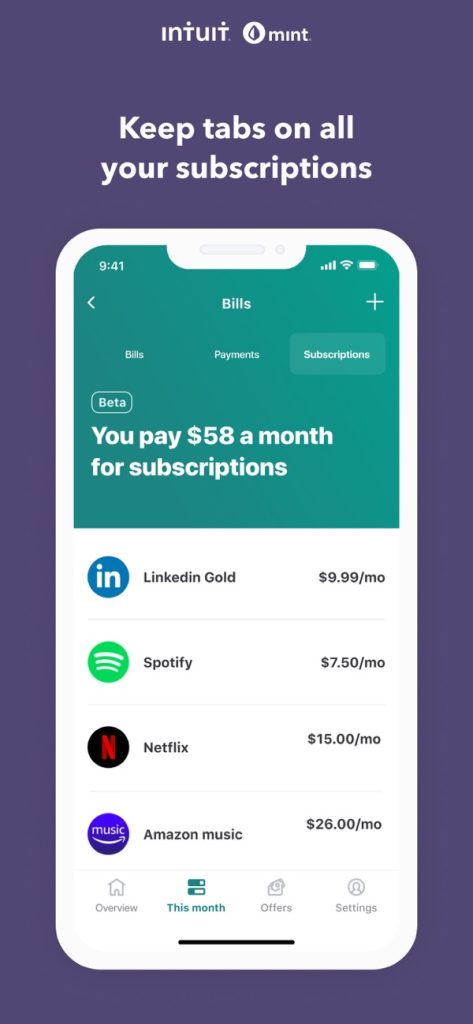

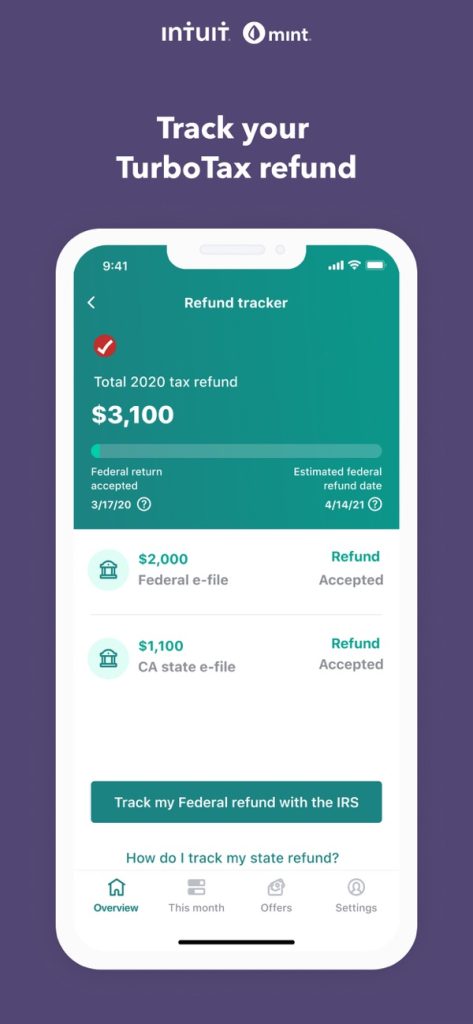

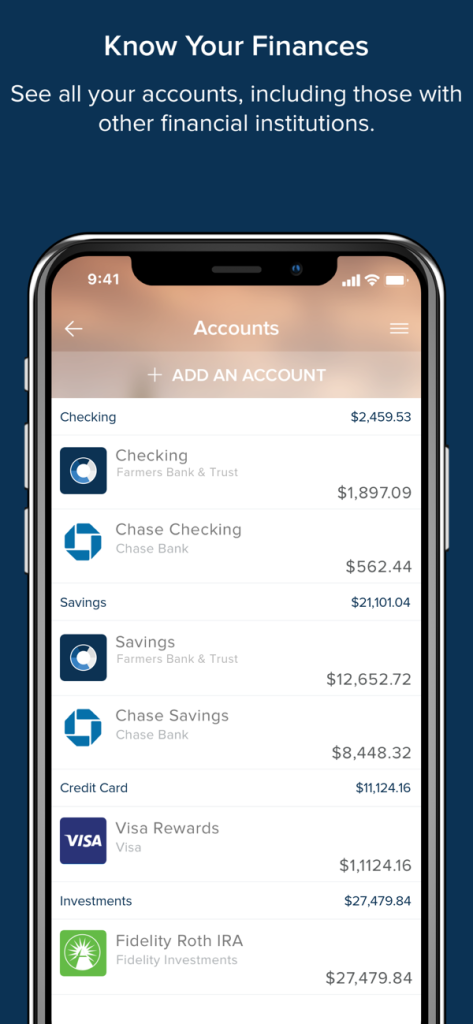

This is probably one of the most popular budgeting apps available today. It is also one of the top free money saving apps for consumers who are short of funds but want to improve their personal finances and manage them better.

This is a wonderful and useful app for budgeting as it allows you to categorize and update various transactions and have a real-time picture of your spending. Such money saving apps free of charge like Mint link to the person’s credit or bank account and analyze the given data from those accounts.

By the way, you can use Mint as a borrow money app.

Cost: Free of charge

Pros:

- Easy to utilize;

- No fees;

- Alerts and financial summaries via email;

- Ability to order a free credit score from Equifax.

Cons:

- Many ads;

- Issues with account synchronization;

- Not enough investing options.

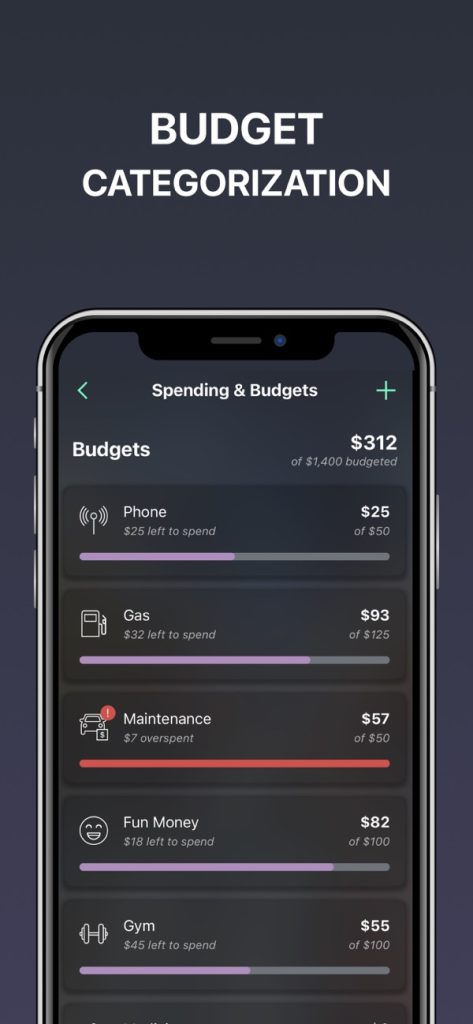

PocketGuard

This is one of the best money saving apps 2024 as it helps you budget and save more cash. This is a great tool for tracking your expenditures and knowing how much you spend every month.

The tool connects to your credit, savings, and checking accounts automatically. There are categories like “utility bills” or “travel costs”. Such apps that help you save money for a goal also send notifications when you are about to spend the last cash so that you stop in advance.

Cost: Free of charge

Pros:

- Accounts get synchronized;

- Custom reports of the person’s spending;

- Helps to build budget;

- Special In My Pocket spending feature.

Cons:

- Free account has certain limits with getting personalized details;

- You must synchronize accounts to utilize this app.

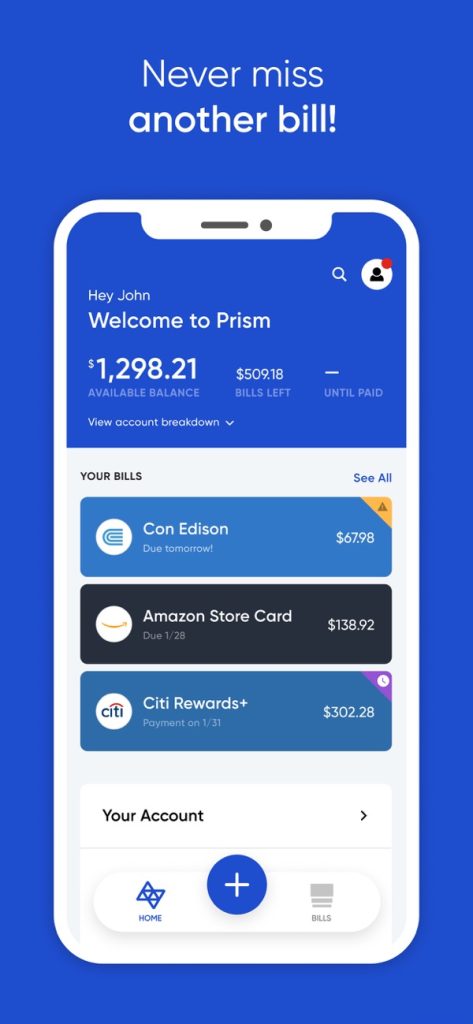

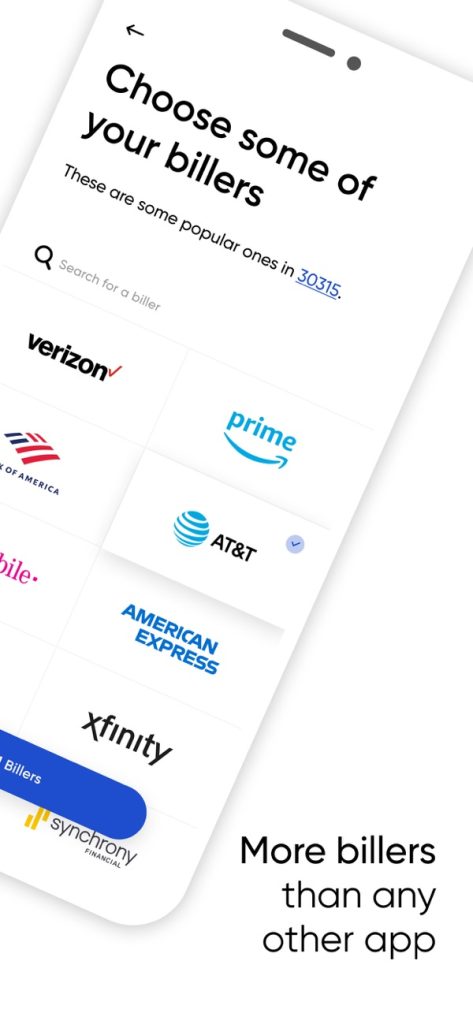

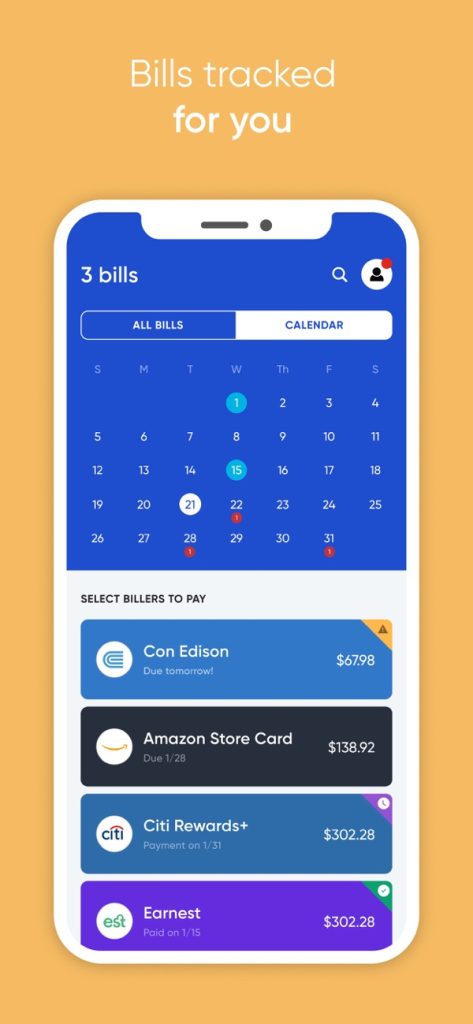

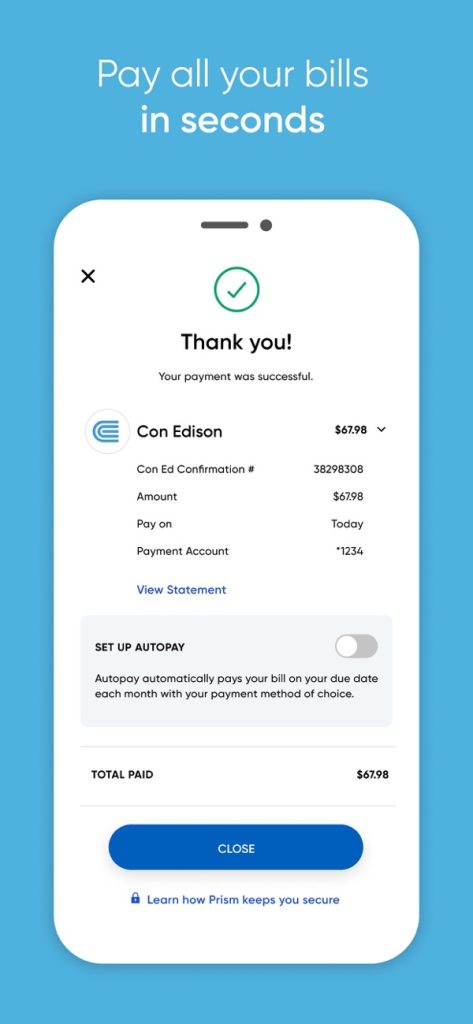

Prism

This is one of many good money saving apps that is free to utilize. It is designed to help people stay on top of their spending and improve these habits. You have all your bills in one place as Prism syncs your accounts in the app.

You may make regular payments through this online tool. It is convenient for avoiding late charges as it gives you an overview of how much you spend on a monthly basis.

Cost: Free of charge

Pros:

- Easy bill payments;

- May help to boost your credit rating;

- Free of charge;

- Secure private data.

Cons:

- No autopay;

- No paper statements;

- Many ads;

- Available only to the US clients.

Wally

This is one of the top money saving apps that helps people understand their personal finances better and keep track of spending. It helps with budgeting and maintains a balance between the client’s expenses and income giving frequent notifications about the current balance and where the money is spent.

Cost: Free of charge

Pros:

- Helps keep track of spending;

- Very intuitive;

- Free to use.

Cons:

- Only for iOS users;

- In-app purchases.

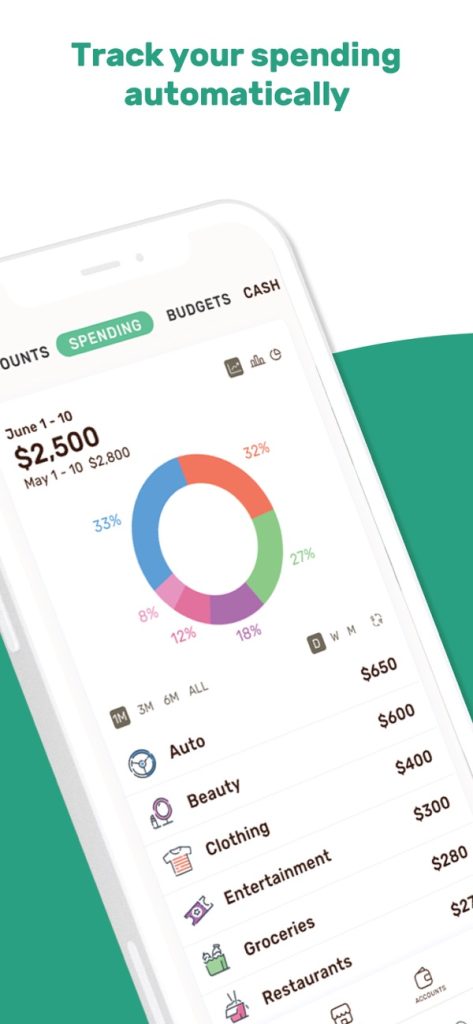

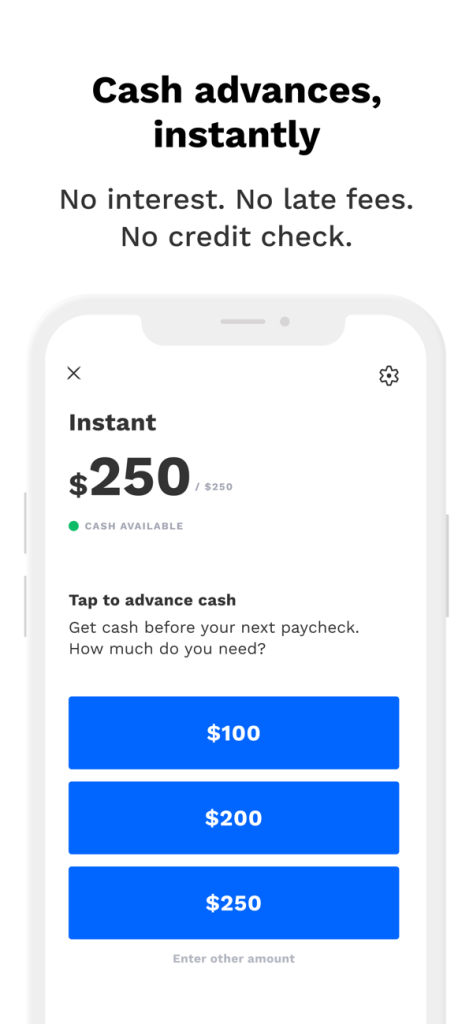

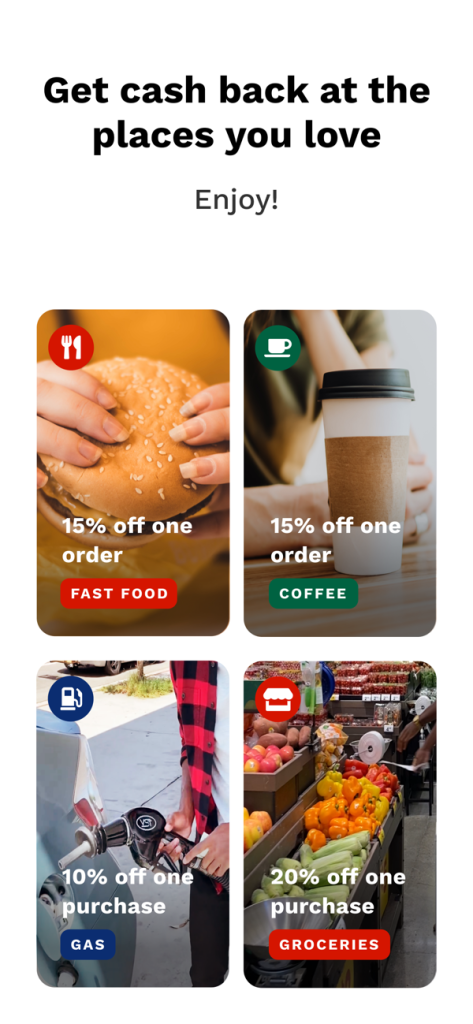

Albert

This is one of the most useful apps for saving money goals that doesn’t cost anything. It helps to analyze your payment history and craft a custom budget to help you avoid overspending especially when you don’t have a steady source of income.

Moreover, you may receive special notifications and alerts about rising bills.

Cost: Free of charge

Pros:

- No fee for usage;

- No minimum deposits;

- Ability to get paychecks 2 days early.

Cons:

- No joint accounts;

- No physical locations.

Bonus post: If you don’t have savings but need money right now, check $50 instant loan apps reviews.

Money Saving Apps for Shopping

YNAB

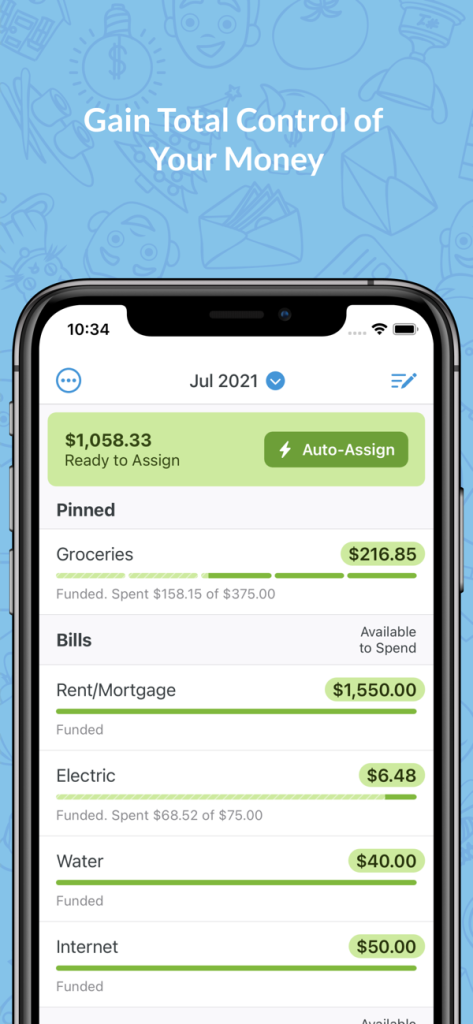

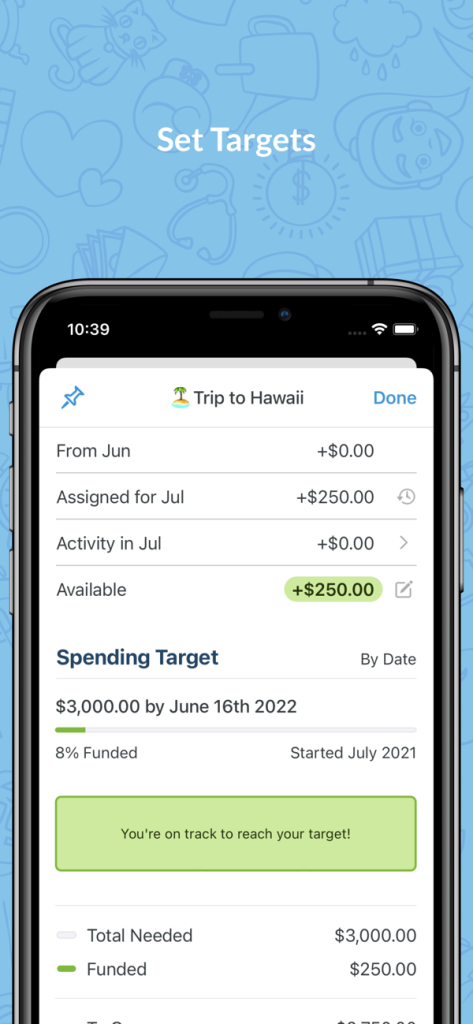

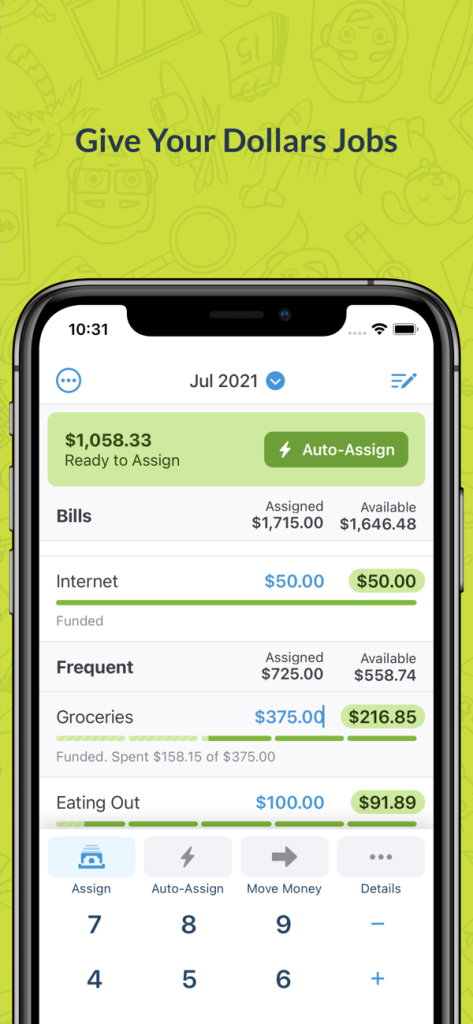

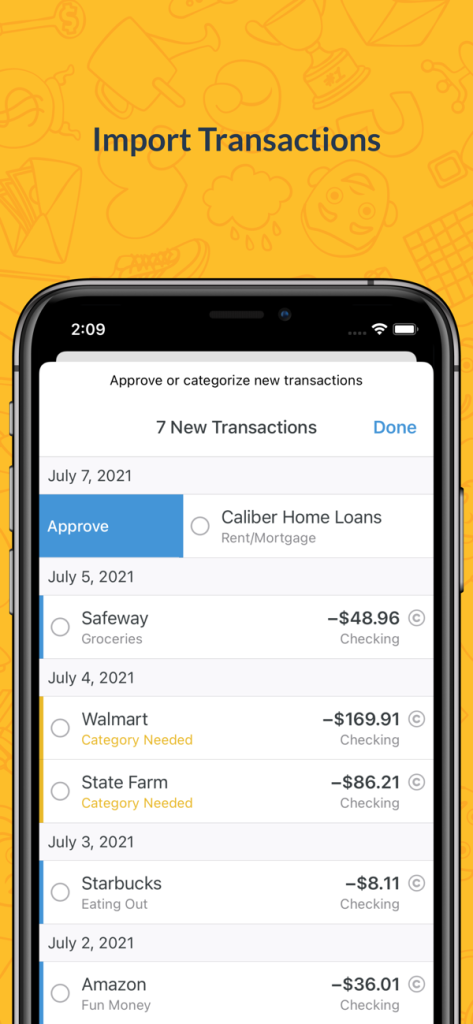

YNAB (You Need a Budget) is one of the easiest money saving apps for shopping as well as for keeping track of spending. It offers clients real-time access to the information about your spending taken from your accounts. You may track your costs from any device and at any time which is convenient.

This way you may think twice before spending spree if the app sends you a notification that you are short of cash. Such apps that help you save money from purchases are very useful.

Cost: $83.99 per year or $6.99 per month

Pros:

- Syncs with numerous devices;

- Free for 34 days;

- Keep track of spending easily;

- Syncs with 12,000 banks.

Cons:

- Lack of reporting;

- Has fees;

- No bill tracking features;

- Doesn’t demonstrate the client’s overall financial success.

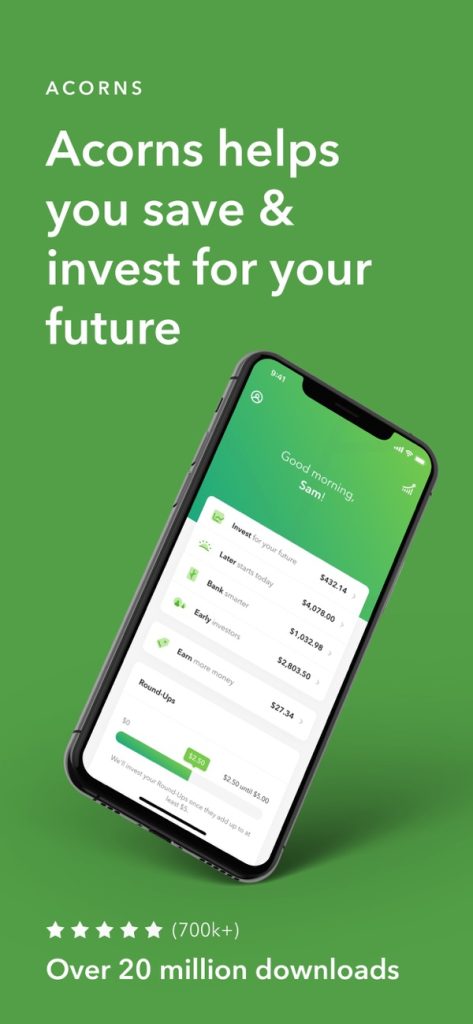

Acorns

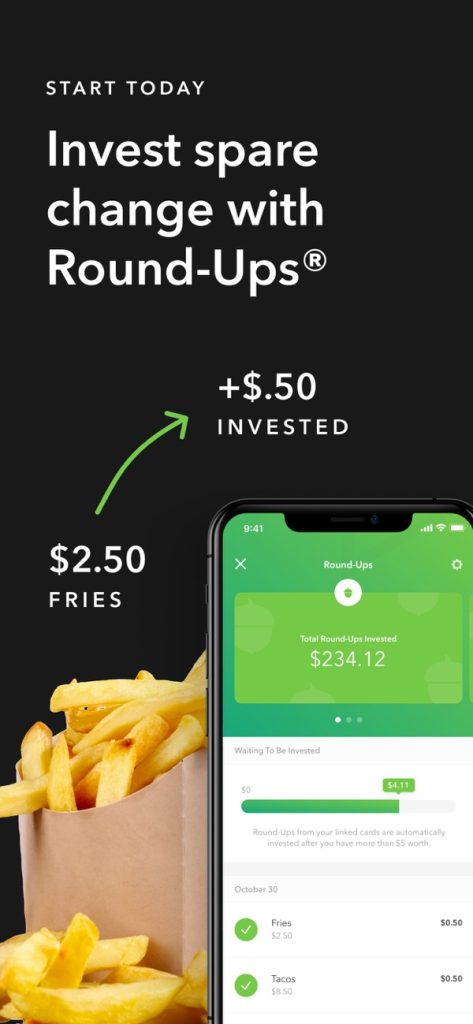

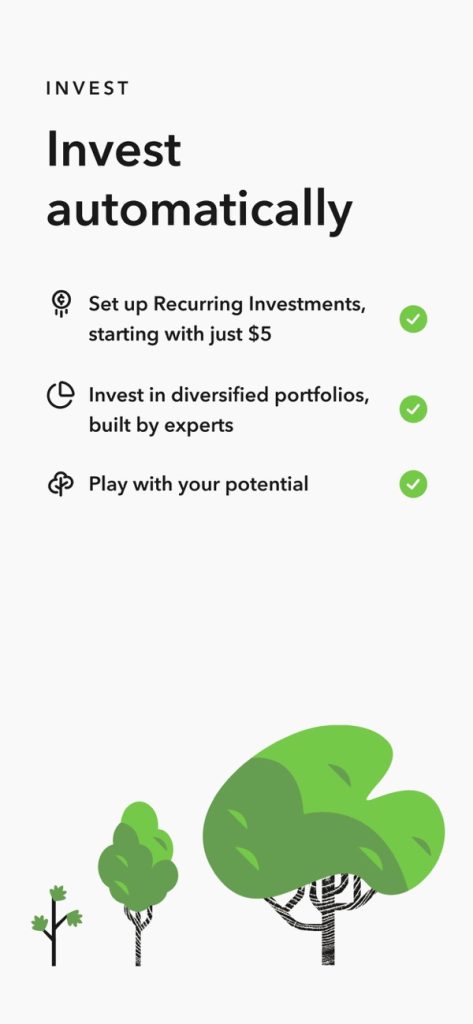

This is one of the best money saving shopping apps that helps to save your cash without too much effort. Each time a client swipes a linked credit card this online tool will keep the change to help them save more. The change will be transferred to your investments.

This is a comfortable way to build up your savings or an emergency fund if you don’t have one and one of the most convenient technology apps that help you save money when shopping.

Cost: $1, $2, $3 per month

Pros:

- Cash back at certain retailers;

- Educational and other useful content;

- Invests your change automatically.

Cons:

- High fee on small account balances.

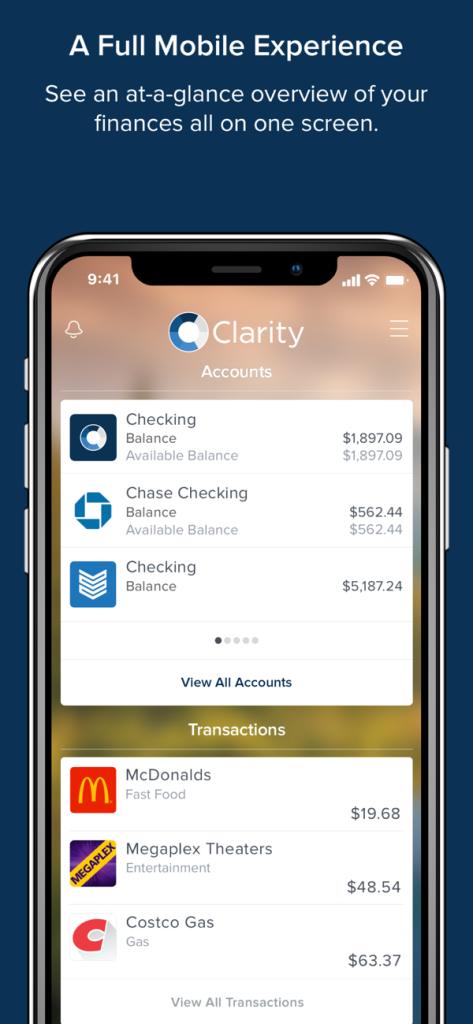

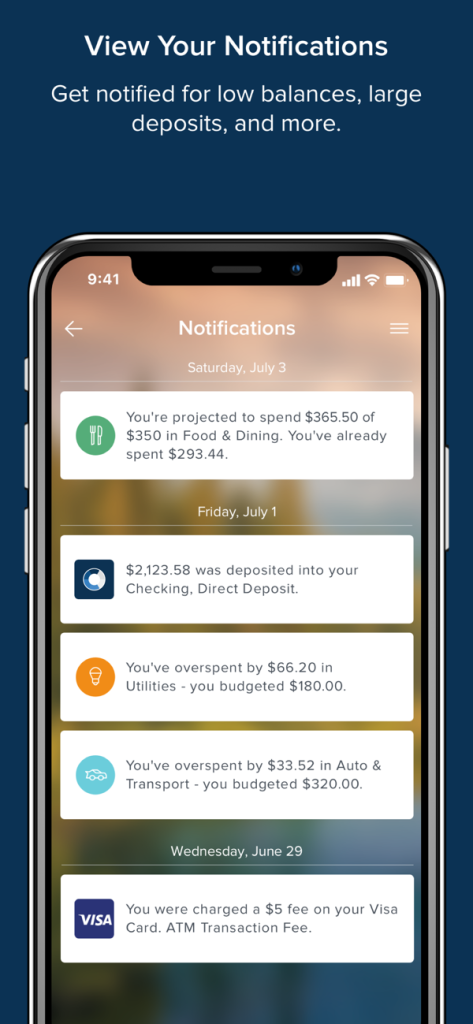

Clarity Money

This is one of the best grocery apps for saving money. It is designed to help consumers cancel unnecessary subscriptions, lower their monthly bills, and craft savings account to reach long-term financial aims.

This app helps you gain control over your personal finances and avoid wasting money on shopping. It strives to make clients stop overspending so they have more funds left for their targets.

Cost: Free of charge

Pros:

- Easy to utilize;

- Free to use;

- Subscription cancellation;

- Product recommendations.

Cons:

- Certain options available only on iOS;

- Not many financial institutions and banks are supported.

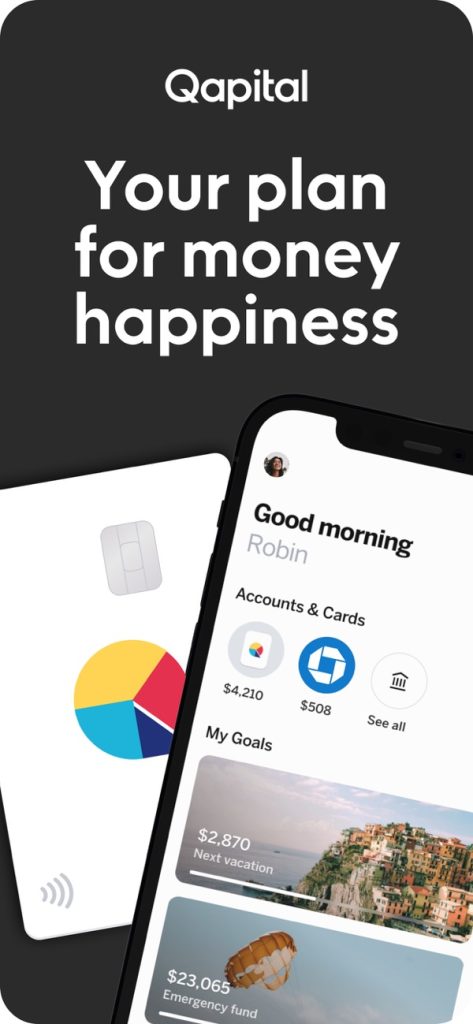

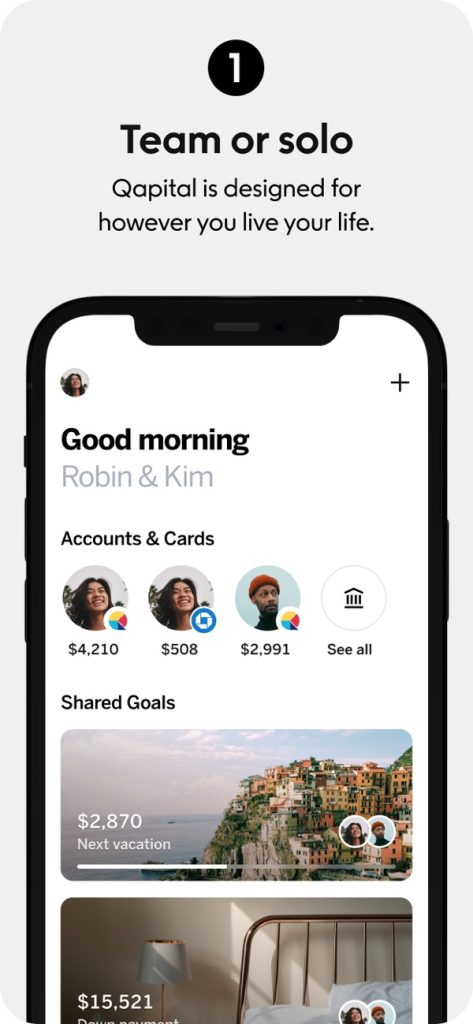

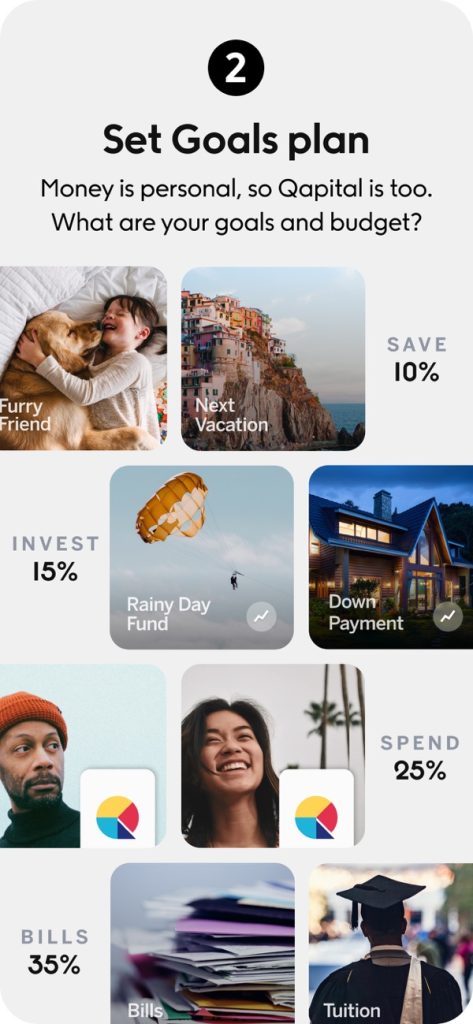

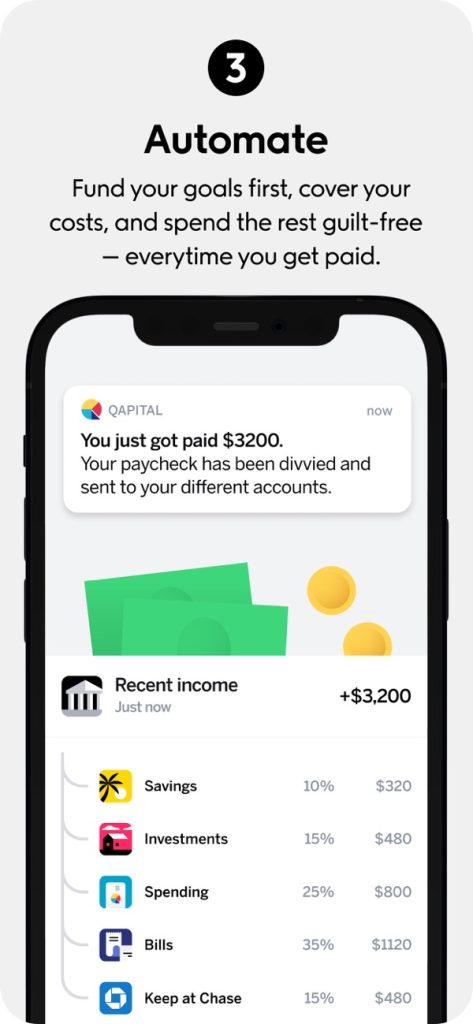

Qapital

This is one of the money saving apps Android and iOS users may benefit from. It is designed for automatic saving and helps clients set aside a small portion of their income each month while keeping track of monthly bills and necessary payments.

The change from every purchase is rounded up and transferred to your savings account to help you build up your budget.

Cost: $3 for a basic plan, $6 for a complete plan

Pros:

- Easy usage;

- Useful interface;

- Automatic savings;

- No transaction fees.

Cons:

- Low interest rate.

Halfdollar

This app is simple for every user and person who wants to master budgeting but has a lack of financial skills. No matter what your current income is this app will be useful for both full-time employees and even freelancers. You may include several types of income depending on your needs and wants.

Cost: Free of charge

Pros:

- Available for all people;

- Helps full-time, part-time workers, and freelancers;

- Quick and easy sign-up.

Cons:

- Not many banks supported;

- Doesn’t show your overall financial health.

Apps That Help You Save Money for a Goal

Who doesn’t want to have a lot of savings set aside for planned expenses or unforeseen costs? The following apps for saving money goals are tailored to your monetary needs and help you save more cash in the long run and meet your financial aims.

Swagbucks

This is one of the top-rated money saving apps for goals and financial targets. Swagbucks is a perfect tool for helping clients to save during shopping and doing various activities.

It provides special points for searching and offers a chance to obtain points for shopping at partner stores and completing online surveys. You may collect these points and get free gift cards at Amazon and other stores.

Cost: Free of charge

Pros:

- Easy to use;

- Various reward options;

- Different ways to earn cash and get points;

- Cash back features.

Cons:

- Needs a lot of work and effort to earn points;

- Small amounts are paid for completing tasks or surveys.

Honey

This is one of the top money saving apps for goals today. This is a browser plugin available for different browsers including Firefox, Safari, Chrome, and Opera. It is meant for helping consumers save more cash for their financial targets by using coupon codes.

Once you install this plugin you may notice popups when you checkout at various online stores. Also, there is a rewards program for its users.

Cost: Free of charge

Pros:

- Easy to install;

- No fees;

- Save money for your goals;

- Supported lots of online stores.

Cons:

- Not great customer support;

- Can’t use it on the mobile phone;

- Not many coupons available.

Shopkick

This is another online tool that is one of the best apps for saving money for a trip or other needs. Shopkick offers a chance to find different products, save your money, and find great deals at such stores as Macy’s, Target, Best Buy, and others.

You may earn special points and rewards for inviting your friends, buying products, etc. Points may be used as gift cards to use them at the partner stores and save your cash.

Cost: Free of charge

Pros:

- Easy and fun to use;

- Simple sign up;

- Many options for earning points.

Cons:

- Takes a lot of time to earn points;

- You must use only mobile phones.

Capital One Shopping

This is one of the money saving apps for iPhone and Android users. It’s a browser plugin you may use for Firefox and Chrome. It allows you to download a mobile version as well.

You may get coupons and save your cash for important financial aims as this app is similar to Honey.

Cost: Free of charge

Pros:

- Easy to install and use;

- Free of charge;

- Works directly in the browser.

Cons:

- Doesn’t work with all browsers;

- Limited cash-out features;

- Doesn’t guarantee the best coupon code.

CamelCamelCamel

This is one of the useful apps that help you save money for a trip or other near-term and long-term financial goals. It doesn’t sell you camels or anything unnecessary but aims to offer a money-saving online tool in the form of a browser extension.

You may compare current prices at various stores and find the best deals to save more cash and increase your savings account.

Cost: Free of charge

Pros:

- User-friendly interface;

- Easy to use and install;

- Compatible on mobile devices.

Cons:

- No Twitter notifications;

- Not compatible with Safari.

In conclusion, you may review these online tools and money savings apps and select the most suitable one that will meet your current financial needs and help you with budgeting or saving.

Cleo

Cleo is a financial technology company that offers a suite of products designed to help consumers manage their money. Cleo’s primary product is a mobile app that connects to a user’s bank account and provides insights into spending patterns, balances, and transaction history. The app also offers budgeting tools and the ability to track bills and payments. In addition to the mobile app, Cleo also offers a web-based platform and a chatbot service.

Cleo’s products are available in the United States, Canada, the United Kingdom, and Australia. Cleo has raised $13 million in venture capital funding from investors including Accel Partners, Greylock Partners, and Khosla Ventures.

Cleo is a financial technology company that offers a suite of products designed to help consumers manage their money. Cleo’s primary product is a mobile app that connects to a user’s bank account and provides insights into spending patterns, balances, and transaction history.

The app also offers budgeting tools and the ability to track bills and payments. In addition to the mobile app, Cleo also offers a web-based platform and a chatbot service.

Cleo’s products are available in the United States, Canada, the United Kingdom, and Australia. Cleo has raised $13 million in venture capital funding from investors including Accel Partners, Greylock Partners, and Khosla Ventures.

Cost:

Cleo’s products are free to use for individuals. For businesses, Cleo charges a monthly subscription fee based on the number of users.

Pros:

The biggest advantage of using Cleo is that it can help you save money by identifying areas where you are overspending. Additionally, Cleo can help you stay on top of your bills and payments so that you don’t incur late fees or penalties. Finally, Cleo’s chatbot service can provide personalized support so that you can get answers to your questions quickly and easily.

Cons:

A potential disadvantage of using Cleo is that it requires linking your bank account to the app. This could be a concern for some users who are worried about security or privacy issues. Additionally, some users may find the chatbot service to be less helpful than speaking with a human customer service representative.

Overall, Cleo Services is a great way to manage your finances and save money. The biggest advantages of using Cleo are its ability to help you identify areas of overspending as well as its chatbot customer service feature.

However, there are some potential disadvantages to using Cleo such as its need to link your bank account and some concerns about security issues. Ultimately, whether or not Cleo is right for you will depend on your individual needs and preferences.

Sources Used in Research for the Article:

- What Is Mint and How Does It Work, Mint, https://mint.intuit.com/how-mint-works

- Bill payment tracker, PocketGuard, https://pocketguard.com/bill-payment-tracker/

- World’s 1st AI-Powered Personal Finance App, Wally, https://www.wally.me/