Need a small loan instantly? Check out the best $50 loan apps and how they can make a difference in tough situations.

If you’re looking for a quick and easy way to get a $50 cash advance, TriceLoans offers a simple application process with fast funding and repayment aligned with your next paycheck.

Best cash advance services

One of its key features is express delivery, which ensures that eligible borrowers receive their money faster when they need it most. However, as with any short-term loan, it’s important to review the terms, including fees and repayment conditions, to avoid unexpected costs.

In today’s fast-paced world, financial emergencies can strike at any time. Sometimes, a small, quick $50 loan straight to your bank account or debit card can make all the difference between getting by and struggling to make ends meet. That’s where a $50 loan instant app to get comes in. These innovative apps that lend you money provide a credit check-free solution to your financial troubles.

With just a few taps on your phone, you can apply for a $50 fast cash loan and instantly transfer the money through direct deposit to your bank account. No more waiting in long queues or filling out lengthy paperwork! If you need money fast, these are the best cash advance apps to turn to.

A $50 loan instant no credit check is designed to help you overcome money difficulties quickly and efficiently. Whether you need a $50 loan to pay an unexpected emergency fund, cover an emergency cash expense, or simply tide yourself over until your next paycheck, these apps can help you get a cash advance. When you need the money urgently and can’t wait for the next direct deposit, these apps provide a convenient solution.

Best $50 Loan Instant Apps: Overview

If your bank account or credit card is in need of a quick cash advance to cover an unexpected expense or bill, look no further than the best instant loan apps. These up to $100 loan apps can help you get instant money and let you borrow money instantly, without any checks, with just a few clicks on your smartphone, even without direct deposit.

However, with so many quick $50 loan options available today and financial decisions to make, downloading the app from the App Store and Google Play can be overwhelming.

That’s why we’ve done the research for you and put together a comprehensive review of the best 50 instant loan apps on the market that offer credit check alternatives.

From fees to the repayment schedule, we’ve examined every aspect of cash advances to help you make an informed decision about using these loan apps to get instant cash.

So, whether you need to borrow $25 instantly or don’t want a loan and the high rates that come with it, read on to find the best borrow 50 cash advance app with no credit check that helps fulfill your needs while also giving you the opportunity to build credit without requiring a bank account.

Here are the top 4 $50 loan instant apps in 2025:

- B9

- Brigit

- Dave

- Earnin

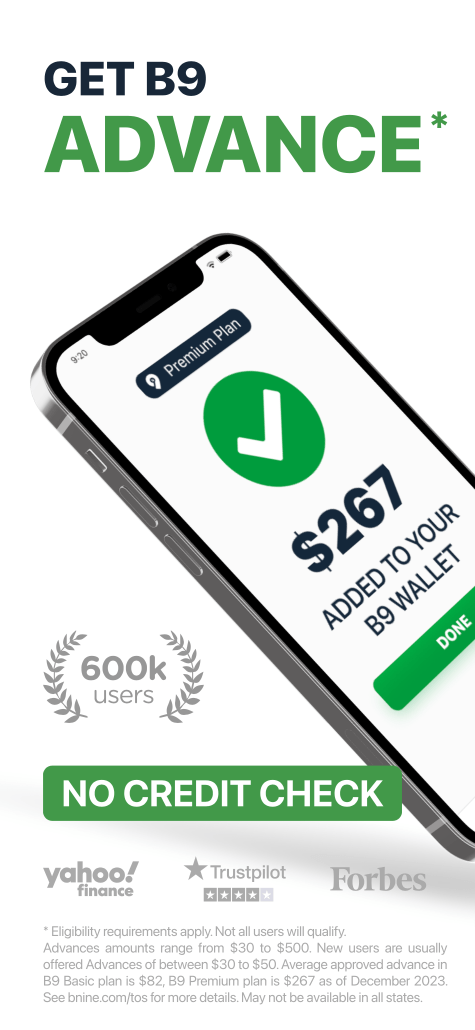

1. B9

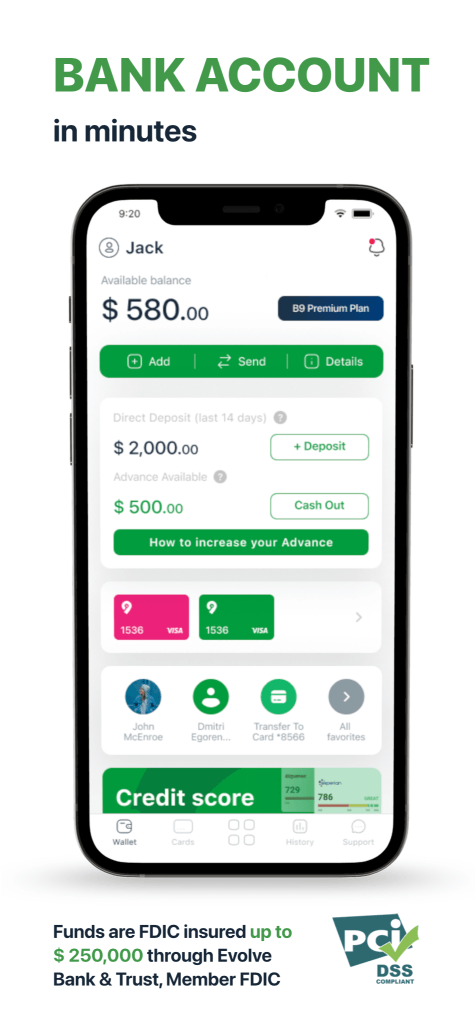

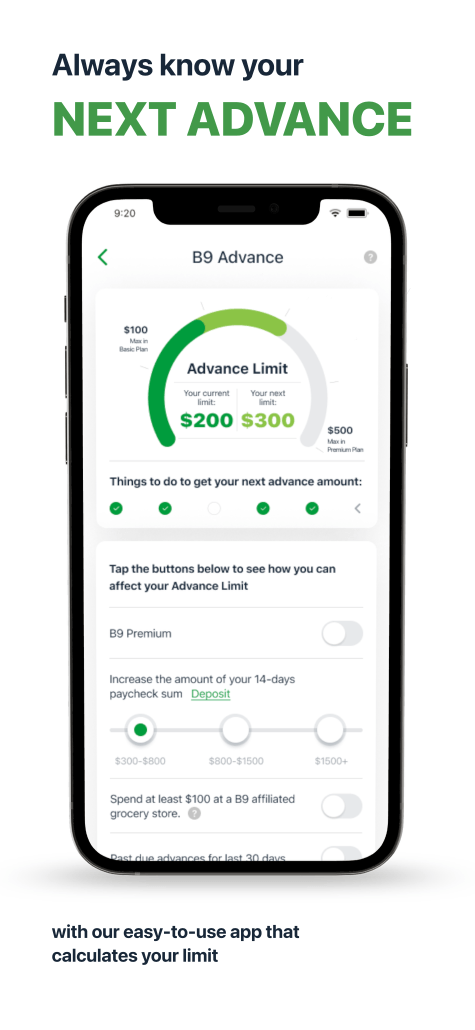

With up to 5% cashback and a range of mobile banking features, B9 is the perfect solution for anyone looking to maximize their earnings and simplify their day-to-day finances.

But with so many banking apps on the market, is B9 really worth your time and money when you need to apply for a loan and get your money quickly through direct deposit funds? Here, we’ll take a closer look at the pros and cons of this innovative app, as well as the key requirements, terms, and fees you need to know before signing up.

Pros:

- Up to 5% cashback on 4 categories of your choice;

- Zero-fee advances ranging from $30 to $500;

- Visa debit card with up to 5% cashback;

- No-fee ACH transfers;

- No-fee instant transfers to B9 members;

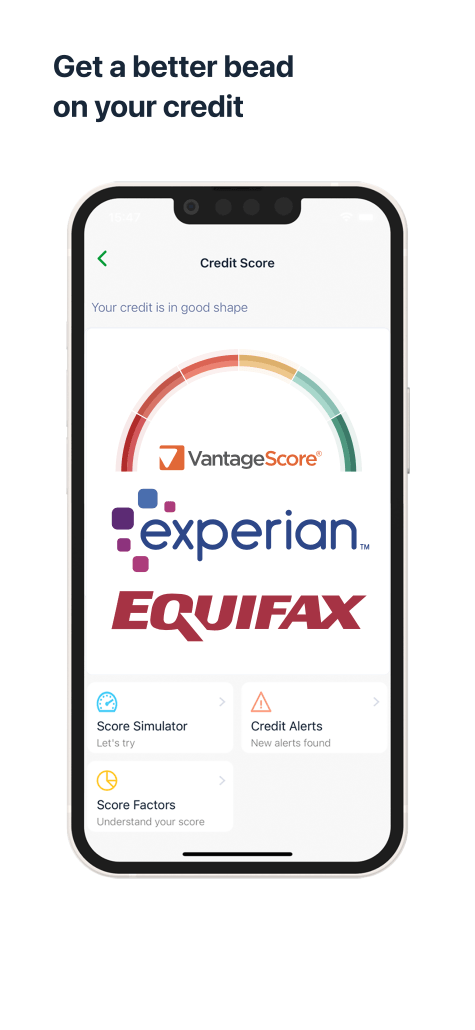

- Credit reports, scores, and simulators are included in the premium plan.

Cons:

- Monthly membership fees of $9.99 and $19.99 for basic and premium plans, respectively;

- Must have income, social security number, and US mailing address to qualify for advances;

- Limited to US residents only;

- No savings or investment options.

Requirements:

To qualify for a B9 pay advance, you must have income from any source, including full-time, part-time, contract, and freelance work. You must also have a social security or individual tax identification number, a US residential mailing address, and a government-issued photo ID. Once approved, the app will automatically deduct the agreed-upon amount and transfer the money to your bank account, ensuring swift acceptance of your loan request.

Terms and Fees:

The B9 Banking App includes basic fees and offers advance loans from $30 to $500. New members can initially receive advances ranging from $30 to $50. As of December 2024, the average advance for the Basic plan is $82, and for the Premium plan, it’s $267.

There’s no charge for instant advance delivery. A $2.50 fee applies for transactions at ATMs not affiliated with B9, and a 3% fee is assessed for transactions made abroad. ACH transfers are conducted without any fees. Additional charges may apply for specific services, and it is recommended that you check B9 Banking’s updated fee schedule for precise information.

Overall, if you’re looking for a flexible, convenient, and rewarding fintech banking app, B9 is worth considering. With its range of features and benefits, it’s the perfect solution for anyone looking to make the most of their hard-earned money.

2. Brigit

At its core, the $50 cash advance app Brigit is a financial safety net cash advance designed to help users avoid the pitfalls of overdraft fees and costly penalties. Brigit is a budgeting app that allows you to use it as a budgeting tool with its personalized spending insights and predictive algorithms.

Brigit Brigit analyzes your spending habits through your banking history and debit card usage. Then alerts you when you’re at risk of overdrawing on your $50 loan bank account – all without any checks.

But the real magic lies in its ability to provide you with an instant loan amount of up to $250, ensuring that your financial hiccups are nothing but a fleeting memory. The Brigit 50 dollar loan app is a breeze to use, with its user-friendly interface, prompt direct deposit, and automatic approval process. If you need money in a hurry, Brigit is one of the best loan instant app Chime alternatives to consider, offering a loan to help you out in your time of need.

Pros Offers of the App:

- Quick money transfer. Cash is deposited directly into the borrower’s bank account on the same business day unless you request an instant transfer. You can borrow $50 and use the funds early with an instant transfer for anything you like.

- No hassle. This $50 loan instant app no direct deposit is best for consumers who value their time and want to download apps for instant money with less effort or struggle. You can complete an online loan request at any time without papers or collateral.

- Bill alerts. This banking $50 cash advance app provides notifications for bill and balance requirements, helping consumers stay informed about upcoming bills and take prompt action.

Fees and APR:

Brigit, a technology company, is a typical $50 loan instant app that can fund your everyday needs with up to $250 until your next paycheck. Be aware, though, that the mobile app requires a $9.99 monthly membership fee to get it instantly early with an instant loan. But this fee is still less than expensive payday loans and credit cards.

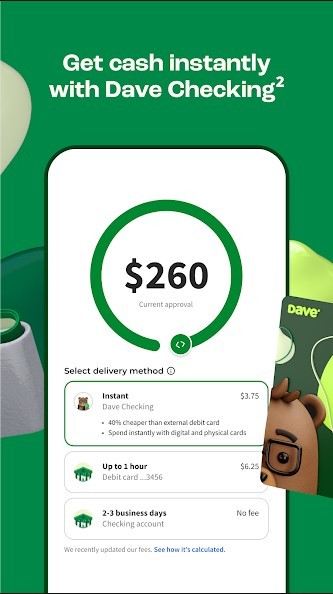

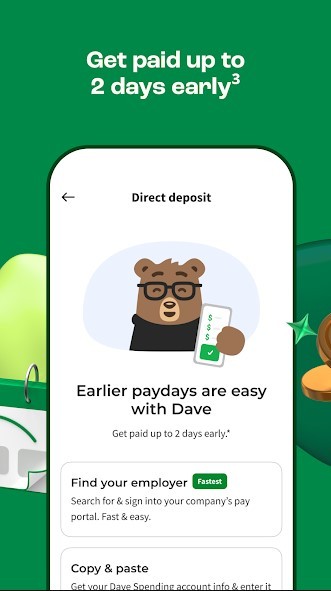

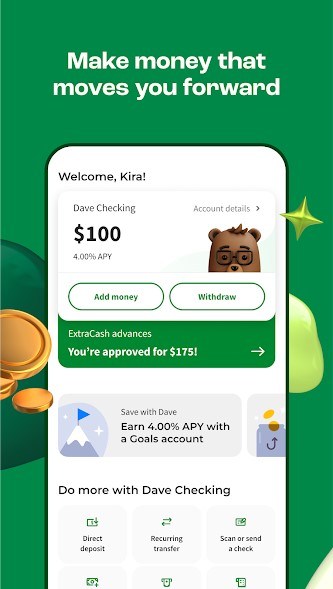

3. Dave

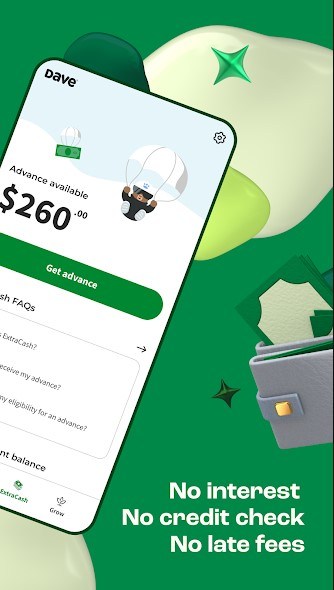

The Dave $50 loan app is a great solution for those moments when your bank balance is teetering on the edge of a financial abyss. What sets Dave apart from the other best 50 loan instant apps on this list is its uncanny ability to predict when you’re about to be hit with the dreaded overdraft fee.

By analyzing your spending habits and upcoming expenses, Dave sends you a friendly nudge to alert you of impending financial doom.

If that wasn’t enough to have you singing its praises, Dave also offers up to $500 in interest-free cash advances, all without a credit check. This helps you avoid the evil clutches of expensive fees like those that come with payday loans. With Dave, money is sent instantly, and the best part is that it won’t negatively affect your credit score.

Benefits You Will Get:

- Online application. There’s no need to waste your time when you need to fill in numerous papers. Here, the loan request process is quick and secure.

- Helpful get emergency cash now app. Apart from giving you additional funds, this online tool can help consumers find a side gig. A paycheck advance is so important for many people living from paycheck to paycheck trying to make ends meet.

Fees and APR:

This modern-day Robin Hood doesn’t believe in robbing a person already in need, so they’ve kept their $50 loan instant app membership fee to a minimum – just $1 per month. That’s less than the cost of a cup of coffee to keep your finances in check.

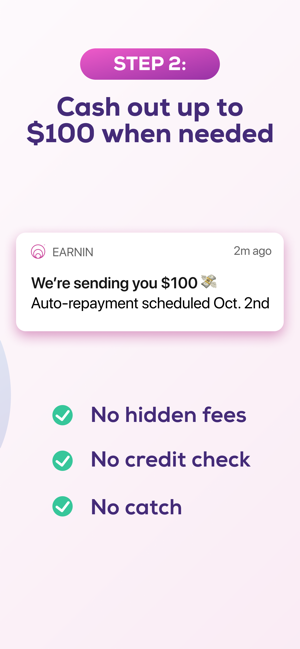

4. Earnin

The Earnin $50 loan instant app is incredibly easy to use. Simply sign up with your email address, connect your bank account, and provide some basic banking information about your job and pay schedule.

Once you’re set up, you can borrow money online instantly with a loan amount of up to $100 per day in cash advances. Similar to the 50 loan instant app Chime and a Chime checking account, the money is sent straight into your checking account through direct deposit.

One of the best things about apps like earnin is that there are no fees, interest charges, or other penalty fees to worry about. Instead, the $50 loan instant app legit operates on a pay-what-you-think-is-fair model, where users are encouraged to tip what they can afford to support the service.

Another example of Earnin diverging into new financial realms is its Balance Shield feature, which can protect you from overdraft fees. Suppose your bank account balance dips below a certain threshold or above your withdrawal limit. In that case, the 50 loan app will automatically deposit cash into your checking account to help cover your expenses.

Benefits You Will Get:

- Cash without fees. This is the greatest $50 loan instant app for an emergency fund regarding borrowing. Unlike a payday loan, it allows consumers to obtain extra funds without any fees or a credit check.

- Automatic withdrawal. Provided that you have steady employment and receive your paycheck in your checking account, the cash from the borrowed $50 with bad credit apps for instant money will be given and withdrawn directly from your bank account or debit card on your next salary day.

Fees and APR:

One of the best things about the instant 50-dollar loan app Earnin is its free use. Unlike Cleo Plus (which offers the same amount of money but with a higher fee), there are no fees or interest charges, so you can access your money without worrying about additional costs. However, this lender does ask for an optional tip.

Factors To Consider For Choosing The Best $50 Loan Instant App

If you’re in need of a quick pick-me-up, one option is to use a quick 50-dollar loan app. However, not all 50$ cash advance apps are created equal, and it’s important to consider various factors before choosing the perfect one for your needs.

This is because, when it comes to selecting the best $50 payday loan instant app, there are a number of aspects that should go into your decision process. You don’t want to end up with an unreliable lender or put an unnecessary dent in your history. But fear not, and we’ve selected the top factors you need to think about before making a decision.

Amount To Lend

When it comes to borrowing money from instant $50 loan apps, the whole point of taking out a loan is to get the funds you need to cover expenses or invest in something important. So, how do you compare the loan amounts offered by each different cash app?

- First, you need to have a clear idea of how much money you actually require. This will help narrow down your search to credit builder loan instant apps that offer money in your desired range.

- Once you have a list of potential cash advance 50-dollar loan apps, it’s time to start comparing. Look at each app’s maximum money amount and minimum requirements.

Remember that the amount of money you can borrow will depend on various banking activity factors, including your credit, income, and other financial obligations. Ultimately, the amount offered by an instant loan app, together with a credit check, will play a significant role in determining whether or not it’s the right choice for you.

- If you need a larger sum of money, you’ll want to find an app that offers high loan limits.

- On the other hand, if you only need a small amount, you can find cash apps with lower requirements (e.g- no credit check and no other transaction fees)

Interest Rates and Fees: What You Should Know

Understanding the costs associated with instant loan apps is crucial to making informed financial decisions. While these apps typically offer lower costs than traditional payday loans, there are still fees and membership costs to consider.

Interest Rates

Most instant loan apps avoid traditional interest rates, making them more affordable for short-term borrowing. Here’s how the most popular apps handle interest:

- Earnin: Operates on a pay-what-you-think-is-fair model, meaning no mandatory interest rates apply. Users can tip voluntarily to support the service.

- B9 and Brigit: Offer zero-interest cash advances and focus on monthly membership fees for service costs.

- Dave: Provides cash advances with no interest rates, keeping borrowing simple and predictable.

The absence of interest charges makes apps like B9, Brigit, and Earnin ideal for short-term borrowing. However, users should review membership fees or optional tipping requirements to fully understand the cost.

Membership Costs

These apps charge membership fees that replace traditional interest rates, ensuring clarity and affordability:

- Earnin: Free to use, with no required fees. Users are encouraged to leave a voluntary tip after accessing advances.

- B9: Charges $9.99 per month for its Basic Plan and $19.99 per month for its Premium Plan, which includes added perks like cashback and fee-free transfers.

- Brigit: Requires a $9.99 monthly fee, covering up to $250 in advances as well as financial tools like budgeting and account monitoring.

- Dave: Keeps costs low with a $1 monthly fee, making it one of the most budget-friendly options for small cash advances.

Additional Fees

While most apps avoid high APRs and hidden costs, some additional fees may apply, depending on usage:

- ATM Withdrawal Fees: B9 charges $2.50 for non-network ATMs.

- Foreign Transaction Fees: B9 applies a 3% fee for international transactions.

- Instant Transfer Fees: Some apps, like Brigit, offer expedited cash transfers for a small additional fee.

Practical Tips for Managing Costs

- Compare Options: Before choosing an app, compare membership fees, tipping requirements, and other potential charges.

- Evaluate Your Needs: If you only need occasional advances, apps like Dave and Earnin are often the most cost-effective due to their low or no fees.

- Check Fee Transparency: Always read the app’s terms to understand the full cost structure and avoid surprises.

By evaluating the costs and benefits of each app, you can select the one that best fits your financial situation without adding unnecessary expenses.

Sign-Up Bonus

Let’s talk about $50 loan instant apps and the sign-up bonus. First things first, what is a sign-up bonus? In the world of apps for instant money, it’s simply an incentive for new users to join the banking services platform. Usually, it comes in the form of cashback, discounts, or reward points. Think of it as a welcome gift for choosing the app over its competitors.

Now, is it bad if an app doesn’t have a sign-up bonus? Not necessarily. It’s just one factor to consider when selecting the best cash app. There are other important things to look for, such as:

- Interest rates

- Repayment terms

- Customer service

However, if you’re torn between two or more $50 instant loan apps that offer similar benefits, the sign-up bonus can be the tiebreaker.

Waiting Period

What is the waiting period, you ask? Well, it’s the time it takes for your application form to be processed and approved. In most cases, this process may take anywhere from a few hours to two days. However, typically, the waiting period falls between 1 and 3 days when performing a credit check and assessing whether you are employed and get direct deposit.

Now, you might be thinking, “But I thought these were instant loan apps!”. And while these apps do offer fast and convenient access to cash, they still need to verify your information and make sure you meet their lending criteria, including the purpose of the money, in order to increase your chances of requesting a loan. And that takes time.

So, what should the waiting period be? Ideally, it should be as short as possible—lightning speed even. After all, the whole point of using an instant loan app is to borrow $20 instantly. However, it’s important to remember that lenders need to do their due diligence to protect themselves from fraud and ensure that the $20 loan is paid back in time.

Ultimately, the waiting period will depend on various factors, including the lender’s policies, the amount of the minimum dollar loan, and your creditworthiness. But if you’re in a hurry, be sure to choose a lender that offers a fast and efficient application and be prepared to provide all the necessary documentation to speed up the approval and application process.

Credit Checks: Reality vs. Claims

One of the most appealing features of instant loan apps is their promise of “no credit checks.” While many apps like Earnin and Brigit truly avoid traditional credit inquiries, it’s important to understand how they evaluate eligibility and comply with lending regulations.

No Traditional Credit Checks

Most apps do not perform a hard credit check, which means using these services won’t negatively impact your credit score. Instead, they rely on alternative data like your income, banking activity, and transaction history to determine eligibility. This approach is particularly beneficial for users who have poor credit or no credit history.

State-Specific and Local Restrictions

In some states with strict payday lending laws, apps must adhere to local regulations, which may include restrictions on cash advance amounts or additional reporting requirements. Always verify whether the app is licensed to operate in your state, as some may not offer full functionality in regions with tougher restrictions.

Soft Credit Assessments

Certain apps may perform soft credit checks or background reviews to ensure eligibility without affecting your score. These assessments focus on your capacity to repay, such as your steady income and consistent direct deposits, rather than relying solely on traditional credit histories.

International Availability

While many apps cater primarily to U.S.-based users, Earnin has been reported to offer some services. However, users outside the U.S. should verify if the app’s features, such as bank linking and income tracking, are fully compatible with non-U.S. accounts. Not all apps are designed to handle international banking systems, and functionality may vary.

Practical Considerations

- Transparency Matters: Always read the app’s terms and conditions to confirm their credit-check policies and ensure you understand their eligibility criteria.

- Better for Poor Credit: Apps like Earnin, Dave, and Brigit are specifically designed to help users with poor or no credit. They evaluate your income and banking habits, offering a more inclusive approach to short-term lending.

- Improved Approval Odds: Maintaining consistent direct deposits, avoiding overdrafts, and keeping a stable bank account can increase your chances of qualifying for cash advances.

By understanding how these apps evaluate users, you can choose a service that aligns with your financial situation while ensuring compliance with current lending laws. Whether you need funds quickly or want to avoid traditional credit checks, these apps provide a transparent and accessible alternative to traditional lending.

State and Country Restrictions: Where Can You Use These Apps?

When choosing an instant loan app, it’s essential to consider both state-specific and country-specific regulations. While many apps, such as Earnin, Dave, Brigit, and B9, are designed to operate across most of the U.S., not all states or countries permit payday loans or similar cash advance services. These restrictions can limit the availability of certain apps in regions with stringent lending laws or outside the U.S.

-

Restricted States: States like New York, Connecticut, and West Virginia impose strict limits or outright bans on payday lending, affecting the services these apps provide. Apps like Earnin and Brigit comply by limiting or excluding their offerings in these regions.

-

International Availability: While Earnin primarily focuses on the U.S. market, some users report its availability for cash advance services. However, features such as bank linking and direct deposit tracking may not be fully compatible with non-U.S. accounts. Always confirm with the app’s customer support or website for accurate information regarding international use.

-

App-Specific Availability: Apps like B9 and Dave cater exclusively to U.S. residents with valid Social Security numbers and residential addresses, making them inaccessible to non-U.S. residents or undocumented workers. Meanwhile, Brigit and Earnin focus on compatibility with U.S.-based banking systems, limiting their global reach.

-

Lender Compliance: These apps ensure their services align with state and country laws. Features like cash advance limits, fees, or interest rates may vary significantly based on your location. Verifying both state and country availability before signing up is crucial.

Practical Tips:

- Check Regional Availability: Review the app’s website or FAQ section to confirm it operates in your state or country. Look specifically for details about non-U.S. account compatibility.

- Stay Informed: Regulations can change. If you relocate to a new state or country, revisit the app’s terms and conditions to ensure continued service availability.

- Explore Alternatives: If your location restricts payday lending, consider alternatives such as credit unions, employer-sponsored advances, or local emergency assistance programs, which often provide low-cost options.

By understanding how state and country regulations impact these apps, you can make informed choices and avoid unnecessary complications when seeking financial assistance.

Borrow 50 Dollars App: Fast Money Online

Are you in a bind and need a quick 50-dollar cash advance? What app will give me $50 instantly? Where can I borrow $50, or who could let me borrow $40 now? Look no further than these $100 instant money apps – the fast money online solution you’ve been searching for. With just a few taps on your phone, you can find a $50 loan instant app here that will get you the $50 instant cash advance when you need it.

No more waiting in long lines at the Bancorp bank or filling out endless forms – these apps streamline the borrowing process and make it easy to borrow $20 dollars instantly. Plus, with their user-friendly interface and intuitive design, you’ll have no trouble navigating the app and finding the perfect loan.

But don’t just take our word for it – these apps have received rave reviews from satisfied customers who have used them to get short-term cash loans through direct deposit in a pinch. So why wait? Download any of these best instant money apps today and see for yourself why they’re the go-to solution for anyone who needs cash fast while avoiding loan app scams.

50 Dollar Loan Apps: Poor Credit Is Not a Problem

With poor credit, it can be tough to find a lender willing to work with you, but these apps make it easy. You can find a 50 cash now loan instant app straight to your checking account and get the money you need.

One of the great things about cash apps like Possible Finance is that they are designed to be quick and easy. You can apply from your phone or computer and get a decision in minutes. This means you don’t have to beg and borrow for a cash advance of $50 from friends or family members or wait in line at a bank. You may borrow 60 dollars for your emergency fund and return to your life.

Another benefit of these 50 dollar advance apps is that poor credit is not a problem. Many traditional lenders like Lendly or Stride Bank will turn you down if you have bad credit, but these loan apps are different.

They use a variety of factors to determine your eligibility, including your income, employment history, bank account history, and other financial information. This means that even if you have a less-than-perfect credit score, you may still be able to qualify for a loan.