A cash advance, including through a no balance transfer fee credit card 2024, is a short-term loan from a bank or another lending institution. It can also be referred to as a service offered by credit card companies that permits cardholders to withdraw a specific amount of cash. The cash advance fee is the amount that is paid.

Getting approval for a cash advance is fast; this is one of the reasons people like and use it. However, some people tend to avoid it because of the terms and conditions attached to cash advance fees.

It is more like counting one’s eggs before they hatch. The huge fees attached to cash advances are usually more than other types of loans, which is discouraging.

What is Cash Advance Fee?

A Cash Advance fee is an amount a bank charges for using a credit card with them. The charge could come in different forms, such as the percentage of the amount obtained or the flat rate of the transaction.

Many people are aware of the risks of using cash advance fees. Still, unforeseen circumstances are reasons people do it. The best thing to do would be to stay aloof from situations that could lead to having to get some amounts from the bank.

Types of Cash Advance Fees

There are different cash advance fees. However, the varieties are based on the person collecting and lending the fees. For example, companies receive Company Advance Fees to run their activities in advance. Credit Card Cash fees are also given to people with from banks.

Another one is Payday fees/loans. Payday loans are issued based on the state’s regulations where the body giving them is located. One important thing is that the credit advance cash fee is calculated from the total credit score. Let’s take a quick look at some types.

Flat Cash Fees

As you might have died, a flat fee is a sum of money that you pay your money lender in exchange for their services. This charge is a recurring monthly expense. No matter how many times you handle credit card sales or how big your transactions are, the flat cash fee never changes. For this reason, a flat fee is also referred to as a membership or monthly maintenance fee.

A flat fee is often seen as the best option because it takes care of all aspects of your processing for a single price. Every month, merchants know exactly what they are spending and are free from unforeseen fees or taxes.

Flat Percentage Fees

A flat percentage fee is a set sum you must give your payment processor for each transaction. Paying flat rate percentages is frequently more expensive for retailers.

A flat rate percentage is suitable for businesses that run low transactions on instant-approval credit cards. It is difficult for companies with big transactions to run because they pay higher. It is more like as purchasing power increases, the payment would follow too.

As a form of illustration, let’s imagine that your transaction fees are a flat rate of 5%. On a $100 transaction, paying your payment processor $5 might not seem like much. However, paying $50 on a $1000 charge could start to feel a bit excessive in your pockets.

Can you avoid a Cash Advance Fee?

Cash Advance Fee is a charge paid on cash advances. This means that the fee rate would be determined by the cash advance payment from your credit credit card limit 500 transactions. Loads of transactions on your credit card are used to calculate the number of cash advances you could get per time.

Though the conditions and the reason for getting an advance vary, you should avoid it at all costs if you want to avoid the fee. Better still, ensure you cut your advances. Minimizing cash advances is equivalent to cutting off the fees that come with it.

Best Credit Cards with No Cash Advance Fees

Since there are instances where one may need to get advanced cash, it is important to know the best guaranteed approval unsecured credit cards for bad credit no deposit. There are cards without fees. On others, there are minimal fees. Actually, these cards are designed specifically for cash advances. This is the more reason you would need to have any of them. The ones with no fees serve a different purpose and a minimal amount compared to the ones with fees. Thus, when you want to consider having a credit card cash advance, you can choose any of the following:

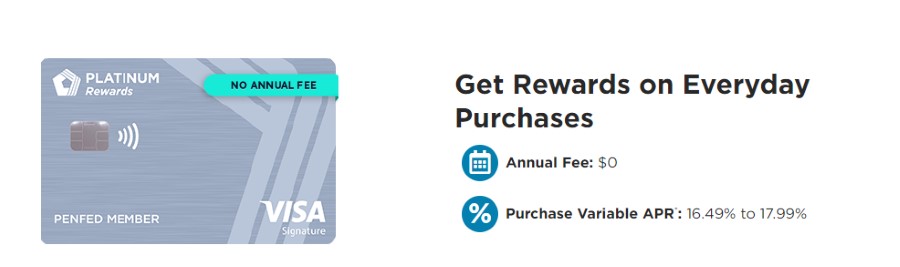

PenFed Platinum Rewards Visa Signature® Card

The PenFed Platinum Rewards Visa Signature® Card comes with a $0 annual fee. It offers unlimited 5 points per dollar spent at the gas pump.

You won’t likely find better reward rates anywhere than that.

The card offers unlimited 3 points per dollar on groceries. Also, there is 1 point per dollar on all other qualifying transactions.

But, there are certain restrictions. Cashback is not a redemption option. Also, point values might not be equal to reward currencies from other cards. Additionally, to apply, you must join PenFed’s credit union.

Benefits:

- It has huge rewards

- It has no annual fee

- Cash advance fee: 0$

- Cash advance APR: 17.99%

- Annual fee: 0$

- Regular Purchase APR: 14.49%-17.99% Variable APR

For a credit card with good rewards, you should consider this credit card.

DCU Visa® Platinum Secured Credit Card

For those with poor credit, a low-interest rate and no fees are fantastic benefits. However, you’ll need to clear a few hurdles to use this secured card. One of the challenges is that you will need to provide a deposit of $500 to use this credit card.

One of the rewarding companies in the predatory secured-card market is DCU. The company provides the DCU Visa® Platinum Secured Credit Card. For a secured card, this DCU card includes many commendable consumer-friendly features, especially low-interest rates and a lack of fees, including a $0 annual fee.

Benefits

- It has a low-interest rate

- It has no advance fees

- It has no foreign transaction fees

- Cash advance fee: 0$

- Cash advance APR: low APR

- Annual fee: 0$

- Regular Purchase APR: 24.49% Variable APR

In summary, DCU Visa® Platinum Secured Credit Card offers a low-interest rate but a compulsory initial deposit.

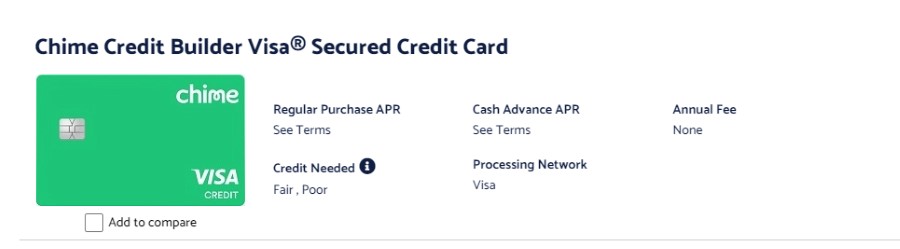

Chime Credit Builder Visa® Secured Credit Card

Although technically a secured card, the Chime Credit Builder Visa® Credit Card from Stride Bank does not need a security deposit. Instead, the $0 annual fee card functions with a Chime checking account. The account must have received at least $200 in eligible direct deposits.

Your spending limit will become whatever amount you transfer from your checking account to your secured Credit Builder account. Payments are reported to the three major credit agencies. However, because credit use is not one of the reported characteristics, maxing out the card won’t impact your score. The card has an autopay function called Safer Credit Building to avoid late payments. Additionally, there is no APR; thus, interest cannot be added.

Benefits

- No annual fees

- No foreign transaction charges

- No check on credit

- Cash advance fee: 0$

- Cash advance APR: none

- Annual fee: 0$

- Regular purchase APR: none

To sum up, Chime credit has no bonus but with incredible benefits of no credit check and fees.

Alternatives to Credit Card Cash Advances

We have stated what cash advance and cash advance fees are. It is clear that they either require some inconvenience or paying back extra fees. You could indeed find yourself in a situation requiring you to get advance cash, but are there other alternatives?

Yes, there are alternatives to having credit cash advances. You could get a personal loan or a balance check transfer/credit. Also, you could plan your monthly budget and follow it up. Additionally, you could try to have some funds for impromptu plans.

Low-interest or 0% intro APR credit cards

How does it work?

Let’s say you have a credit card with a 15-month promotional 0% Advance Purchase Rate. For the first 15 months that you have the card, there will be zero percent interest charged on all purchases. You will be charged interest on your outstanding balance after that promotional period expires.

No “retroactive” interest exists. (With that said, a word of caution. Pay your account on time monthly if you have a 0% deal. A missed payment will cancel your 0% rate and immediately switch to the continuing rate.)

The “no interest for 12 months” deals you see in stores differ from zero percent credit card terms.

When to use it?

A 0% credit card should be used to reduce debt, not just to put it in one’s wallet and ignore it. It’s time to think about different debt solutions if you consistently transfer debt from one 0% credit card to another without ever paying it off.

Credit card loan programs

A personal loan known as a credit card debt consolidation loan is used to pay off high-interest credit cards. This happens by combining several payments into one fixed monthly payment over a predetermined period.

How it works?

It is more like your personal bank loan. A credit card loan involves directly depositing funds into your bank account. Repayment for this will be monthly.

When to use it?

You should use it when you don’t have money for important things. You should also know that there are payment procedures and qualifications for this type of loan program.

Where to use it?

You would use Credit card loan programs in the bank or other companies that offer such services. You pay a fee as you earn, and the bill varies over time.

Some of the credit loan programs include SoFi, LightStream.

Buy now, pay later services.

These services are similar to what credit cards do. You could buy a product and pay later. Most times, companies partner with other companies that offer the buy now and pay later services. And they use it to give their customers a better sales experience.

Though one could buy in advance, the amount one could use is always limited. The limitation of the buy now and pay later service varies by company. For example, Affirm, one of the best buys and pay later apps, offers up to a $17,500 purchase limit.

How it works?

Buy now, pay later services work when you have some money to pay for a given good, but you need to buy other things to make it work. Then, you could buy those things, such as a car battery charger after buying the battery and pay later.

When to use it?

You could use it either when you don’t have any amount or some of the amount of a given product.

Where to use it?

You will use it with authority, offering you the buy and pays later service.

Personal loans

Personal loans are from money lenders. Usually, they are calculated based on the borrower’s money with the issuer. Or, sometimes, the amount of collateral put forward by the borrower.

How it works?

Personal loans work by getting money based on the amount deposited with the issuer. Credit unions are known for giving personal loans, but with varying advantages and disadvantages.

When to use it?

You should use it when considering the lender’s annual percentage. However, interest and monthly payments would contribute to when to use personal loans. Nevertheless, considering what percentage you will pay per year is more important.

Also, it is advisable to use it when you only need amounts to augment what you have. You should not get personal loans to pay debts.

Where to use it?

Banks, credit unions, money lenders, and online lenders offer personal loans. Every choice has advantages and disadvantages.