How many credit cards such as best credit cards transfer balance no fee or unsecured personal credit cards should you have? Each person has this question in mind and desires to find the right answer. However, nobody knows the right answer for you. There is no magic number to say that this number is perfect for all consumers.

Carrie Hausner Casden

Summit Financial Management-Money Coach & Business Management Consultant

“The number of credit cards a person has is not a one size fits all answer. There are a few things to consider when you are deciding to expand or shrink your wallet size.

First and foremost, if you are the type of person who can’t resist spending even if you don’t have the cash to pay your statement balance in full every month, I would say less is more.

For these types of clients I suggest they only have one credit card and use cash so they are really aware of every dollar they spend.

If you are a responsible spender, despite how many cards you have, I would say to have a few cards and here are my reasons why:

- When you are trying to maximize your credit score, they look at the total amount of available credit between all cards and the percentage you are using every month. If you have one card with a $10,000 limit and you are spending $9000 every month and paying it in full every month, you may have a lower credit score than someone with three cards, each with a $10,000 credit limit and you still only spend $9000, spread amount the different cards, and pay it off in full.

- If you like to get points for travel or cash back, you may want to use different cards for certain items. If you travel often to a certain city and you always check luggage, it may be worthwhile to pick the most convenient airline for you and use their credit card to avoid these fees each way.

- Some people like to use one specific card for all their auto pay bills and online shopping so they can accumulate points and not risk losing this card and having to change all the auto billing they have set up.

Sometimes people open and close accounts because they like to earn the sign up bonus points,which can be significant depending on the time and company. Be aware that the credit bureau likes to see that you can maintain an account and keep it in good standing for an extended period of time so this is something to think about.

In conclusion, the first step to any healthy and stable financial future is to be honest with your financial literacy and patterns and if you feel you need to make some changes with your financial beliefs and behaviors, get help with those before you start exploring credit cards.”

Read Also: Best Business Credit Cards

Akeiva Ellis

MSFP, CPA/PFS, CFP®, ChSNC® is the co-founder of The Bemused, a financial education brand for young adults.

“The more important question is, “how many credit cards can you handle?” The answer to this question will vary from person to person. This issue is less about your age and more about your personality and readiness.

Some people shouldn’t even start down the credit card road at all, while others may be able to handle several cards. I’ve even seen some people successfully juggle over a dozen! You’ll want to consider your propensity for spending money if more credit is available to you and whether you are good at juggling multiple payment deadlines.

Don’t open a new credit card only because you feel like everyone else is doing it.

Having multiple credit cards is not bad if you can handle it. Different credit cards might come with different benefits and features that you may find beneficial for various aspects of your lifestyle and goals, like loyalty program status, travel-related benefits, cashback, or a sweet welcome bonus.

In addition, having multiple credit cards might help you improve your credit score, as responsibly maintaining numerous lines of credit generally fares favorably with lenders.”

Cristina Briboneria

CFP®, AWMA®, ADPA®

Managing Director, Private CFO®, oXYGen Financial

“It is not bad to have multiple credit cards as long as you can pay them all off immediately. The number of cards a person has depends on how much they spend each month and what types of points or benefits that would like to accumulate during the year, or specific period of time.

For example, if a person wanted to focus on strictly getting cash back when they used their credit card, it might be best to use one cash back credit card and put all of their spending on that.

However, if they wanted to have “points diversification” and accumulate American Express Points and Chase Rewards points for travel purposes, they may utilize both an American Express and Chase Card at the same time, depending on what they are spending on.

Additionally, if a person has a business, they should also consider having a personal card and business card to help delineate those expenses.”

Everything depends on the current financial situation of the person, their level of responsibility, financial circumstances, and monetary goals for the future.

But an answer to the question “How many credit cards should I have?” depends on several obstacles you have to clear up first. If you urgently need extra money you may need more than one card, if you have had issues with debt repayment you may only need one credit card you can afford to pay off regularly.

Is It Bad To Have a Lot of Credit Cards?

In terms of the number of credit cards should one have, consumers who have already experienced problems with massive debt repayment will probably say “one”. On the other hand, those who have immediate cash needs and urgently need additional funds will most likely request several credit cards.

Is it bad to have multiple credit cards? It may be not good for your financial stability as it can make your debt repayments unsustainable. On the other hand, there is no one answer on how many credit cards is too much. You may feel financially secure with one card or several cards.

Many experts agree on the fact that owning numerous credit cards may either help your credit rating or hinder it. Everything depends on how well you can manage your cards and finances in general.

Read More: Teaching Kids About Money – Expert View on Financial Literacy

How Many Credit Cards Should I Have to Build a Good Credit Score?

“The number of credit cards itself isn’t as important as your ability to manage all of your existing accounts and repay your debt on time,” mentions Ethan Dornhelm, vice president of FICO Scores.

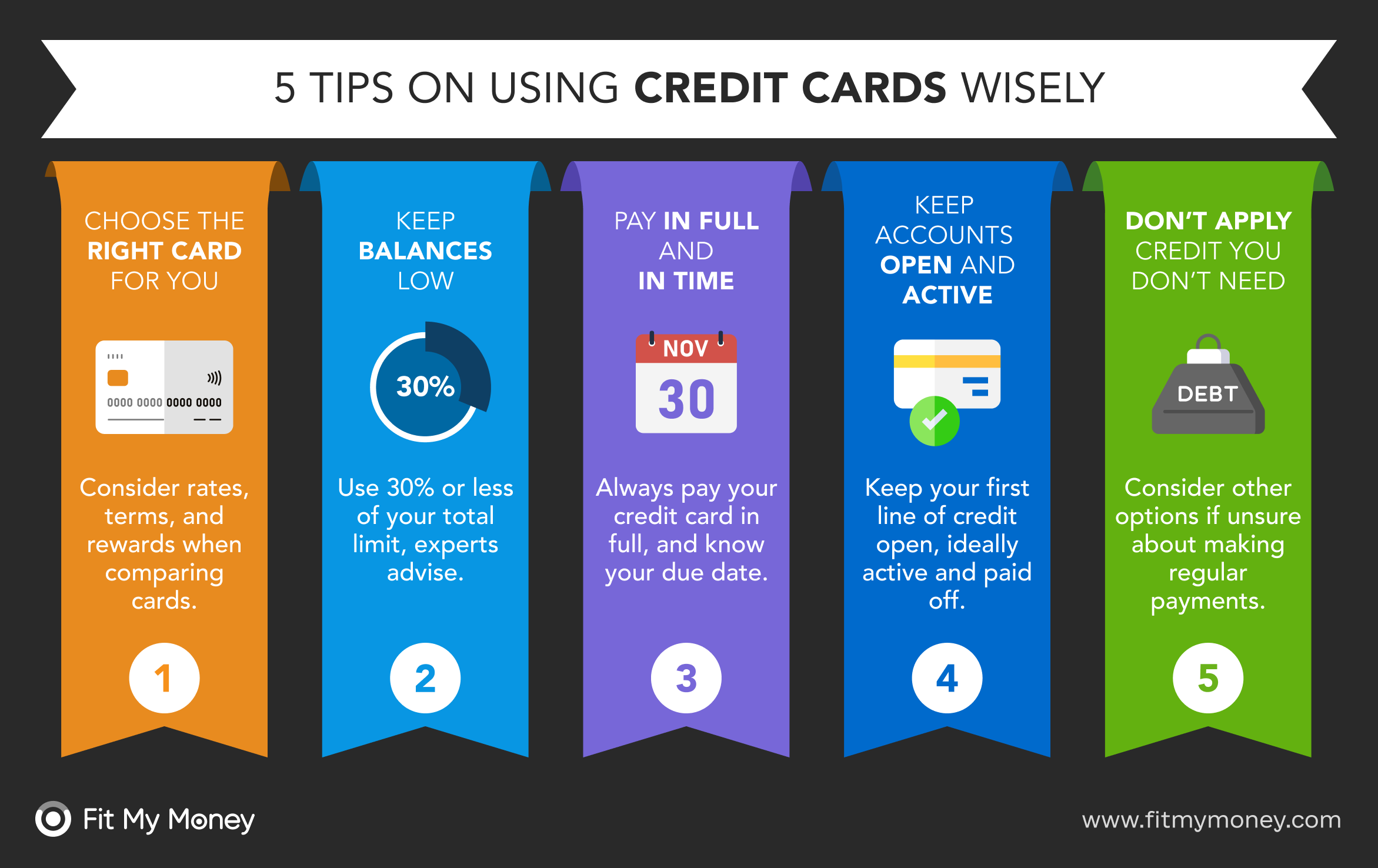

If you can afford to keep your balances low and pay the bills in full and on time, you won’t experience issues with having more than one card. How many credit cards can you have? It depends on your responsibility. Failing to pay down your debt may damage your credit score and the ability to qualify for more affordable lending solutions.

How Many Credit Accounts Should I Have?

You won’t get punished for having multiple credit accounts. Yet, you may have too few cards. Then, how many lines of credit should I have? Credit reporting agencies suggest that having five and more cards is normal.

You may have a mix of loans and credit cards in order to build your credit history. Having too few accounts can have drawbacks and make it difficult for credit scoring models to render a rating for you.

If you have less than four cards, you are considered to have a “thin” credit file. If a consumer has a thin credit file, it will be more challenging to qualify for various lending solutions as lenders will view this file as a risky one.

If you have too few credit accounts, it may have a bigger effect on your credit rating than if you have numerous accounts. On the other hand, if you miss your debt payments and find it more complicated to manage several cards at the same time, it may be a savvy decision to have just one card for your needs.

How Many Credit Cards Does the Average American Have?

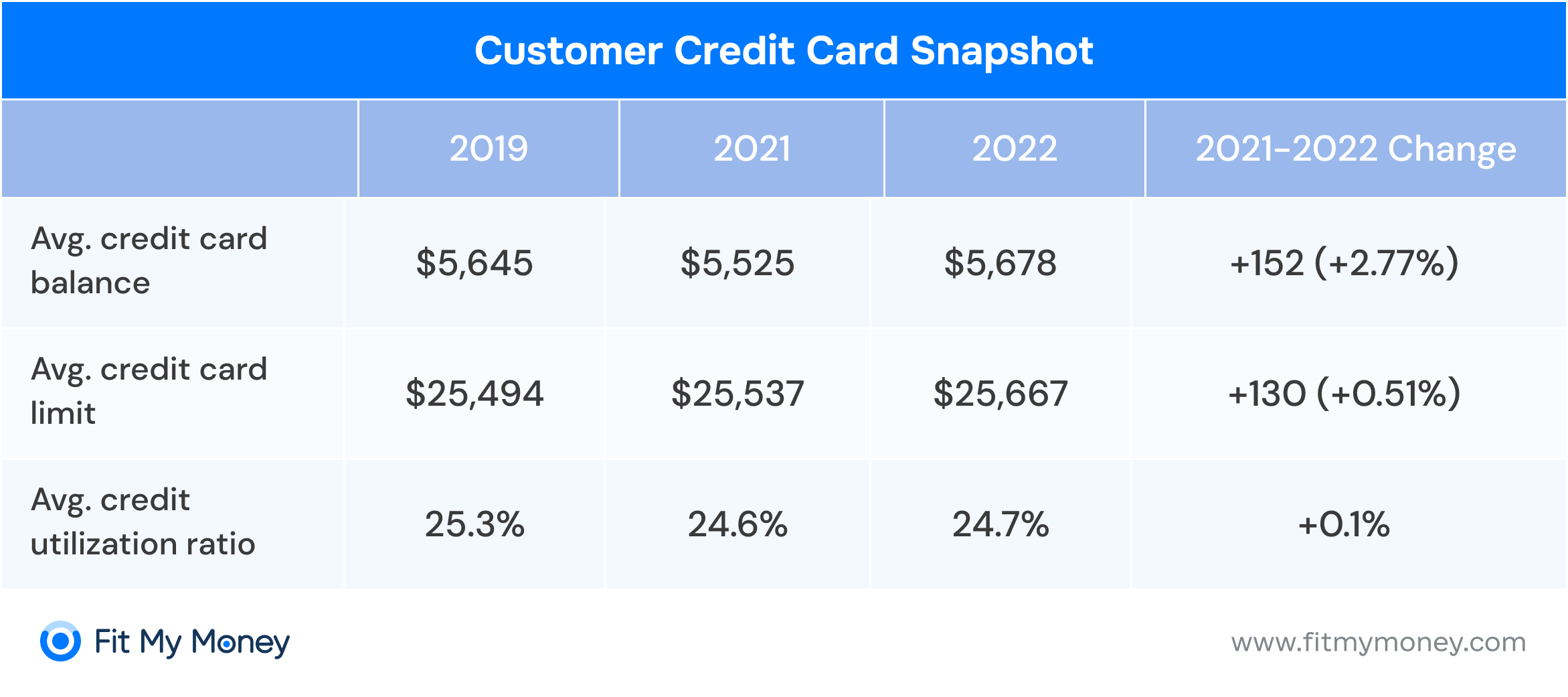

The Federal Reserve review of national credit report data shows that Americans hold an average of 3.84 credit card accounts which is 4% down from the previous year due to the pandemic and financial uncertainty caused by it.

Generally, your ability to repay bills and your spending habits define the perfect number of cards you should have. Should I have more than one credit card? Take into consideration that you can’t apply for a card until you are 18 years old, but many service providers issue credit cards only to consumers above the age of 21.

How Many Credit Cards Should I Have to Improve My Credit Score?

If you want to answer this question, you need to consider these factors:

- Getting a New Credit Card May Improve Your Rating

How does it happen? It is made by lowering your debt utilization ratio. As we’ve mentioned above, the average American consumer has about 4 credit cards. Hence, if you want to boost your credit you need to add a new credit card.

If you have several cards with zero balance you won’t boost your score. However, adding a new card will lower your debt utilization ratio, and having the same amount of spending will help you increase the total credit limit.

- Having a Lot of Credit Cards Closed May Affect Your Profile

Many Americans have about three closed cards today. You need to take into account that it may damage your profile. You may make a decision to have more than one card, but you shouldn’t hurry to close your old ones. Don’t forget that the age of your accounts matters. Hence, if you close your old cards the average age of your account will be lower.

- There Is Should Be a Clear Reason to Open a More Than One Credit Card

Does having multiple credit cards help? Yes, having more than one credit card may be a wise solution if you want to receive supplemental benefits and perks. You may add some cards that offer special bonuses and rewards on certain spending categories.

The cashback system will help you get discounts on many purchases. Is 5 credit cards too many if the average number of credit cards per person is four? No, having 5 cards can be reasonable if you understand why you need them.

Read More: How to Increase Your Credit Score

Should I Have Multiple Credit Cards?

So you should realize that first of all, the answer to “how many credit cards can I have” depends mostly on your self-organization skills and the ability to manage several cards at the same time. Is 3 credit cards too many? No, it’s not many cards and it may be even not enough to have a decent credit file.

If your goal is to improve your credit profile and score, it makes sense to add a new account. But only if your budget management skills are enough to deal with all of them.

These habits may help to boost your credit:

- Upgrading your financial literacy constantly. Because the answer to “how many credit cards should I have” depends directly on your ability to keep track of your spending and expenses. Unless you are prepared to do it, don’t add a new account.

- Make sure you pay the existing debt on time. Every person determines how many credit cards to have. Try not to accumulate too much debt though and pay the balance in full every month.

- Think about the number of credit cards that is good to have from the same bank. You may open more than one card from one bank if each of them offers different perks and cashback. But, remember that applying to new cards too often can damage your rating as it is connected with hard credit checks.

- Try to use credit to a minimum. And make sure to keep your credit utilization ratio below 30%.

Potential Issues with Having Multiple Credit Cards

So, from the above you got decent reasons why having multiple credit cards can be good for you, but it still might be isn’t very good for your credit. If you sign up for too many cards at once within a short period, the hard credit inquiries will be conducted by the issuer. Such hard credit pulls may damage and lower your rating.

While it’s not too bad to carry numerous cards, cardholders have to understand their limitations and how much they can handle. Remember that it might be challenging to manage payments for several cards at once. Every card is likely to have another payment due date so you need to keep that in mind. Also, if you have too many cards from different issuers, you will have numerous websites or mobile apps to make on-time payments and check your accounts.

Source: 3riversfcu

Source: 3riversfcuIt can be tough to pay attention to every card you have and not to forget about their due dates. If you don’t repay the monthly balance on time on each card, you will have to deal with piling debt and late penalties.

More than that, your credit utilization rate will grow and it will lead to credit rating damage. Should you have multiple credit cards? Think twice before you make the final decision as it may take a lot of time to fix your credit score.

The Bottom Line

Should I have more than one credit card or is it better to have two credit cards or even more? There are benefits and downsides to having multiple cards at the same time.

Make sure you can handle them, make on-time payments, and use them responsibly if you decide to add a new card. Review the benefits of each card and the bonuses it offers. Don’t forget also google “how do I change my name on credit cards” if you have new card.

Remember that having too many cards may lower your credit while having too few cards may lead to a “thin” credit file. There is no one-size-fits-all answer as it depends on your spending habits and money management abilities.

Keep your card balances low and try your best to pay them in full on or before the due date to use each credit card to your advantage. And always remember to develop your knowledge of banking system, for instance, how does loan consolidation work.

Sources Used in Research for the Article:

- Credit Scores, Federal Trade Commission, https://consumer.ftc.gov/articles/credit-scores

- Credit Cards Key Terms, Consumer Financial Protection Bureau, https://www.consumerfinance.gov/consumer-tools/credit-cards/answers/key-terms/

- What is a credit score, Consumer Financial Protection Bureau, https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-315/