How do you borrow money from cash app? Many consumers struggle to make ends meet or live paycheck to paycheck. How can I borrow money from cash app today?

“How to borrow money on cash app 2024?” was a common question thousands of people had in their heads last year and remains these days. There are several lending places where you may turn to if you require even an additional $3000 for the short term.

However, modern technology allows you to use every app that lets you borrow money, borrow money online, and finance your immediate needs. What can be better than having an opportunity to get funded from the comfort of your home?

A wide range of apps and online tools are available for borrowers who want to apply for cash app loan. How to borrow cash from cash app? We will discuss all the details of such a borrowing solution and explain what steps you should take to borrow from cash advance app quickly and with no hassle.

How to Borrow Money from Cash App?

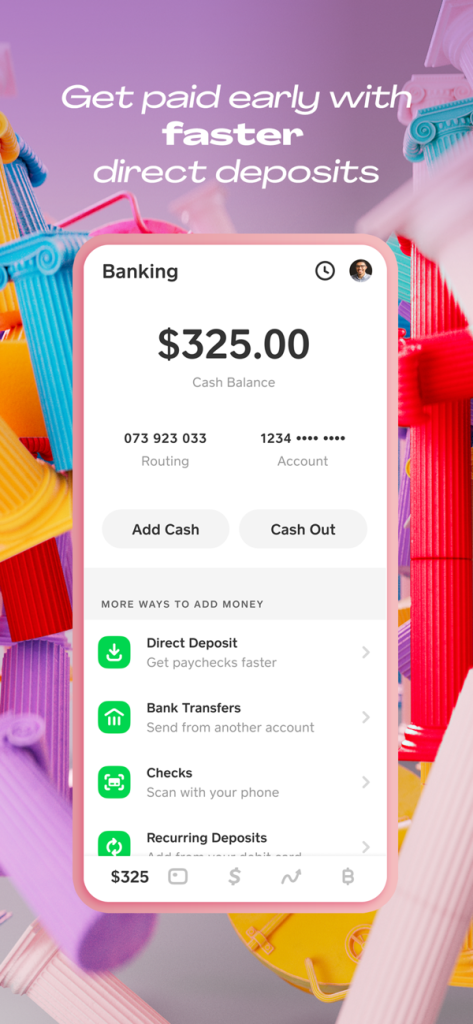

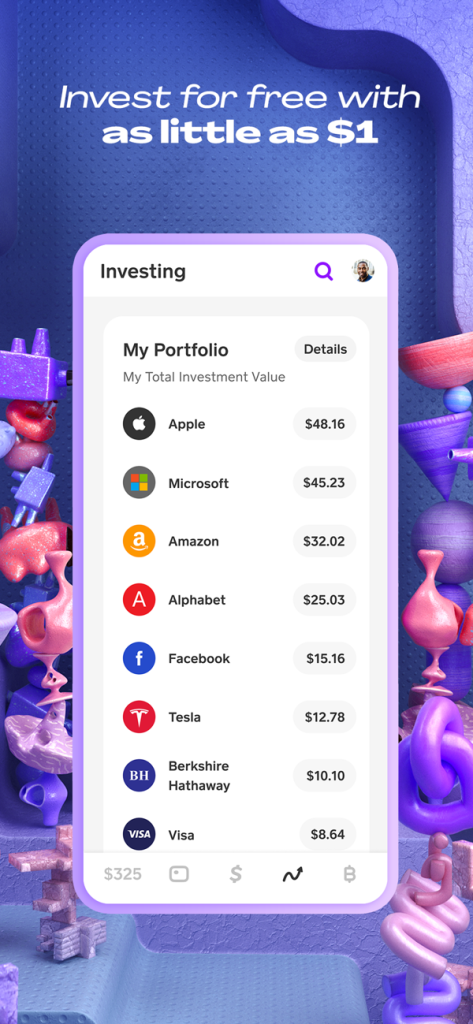

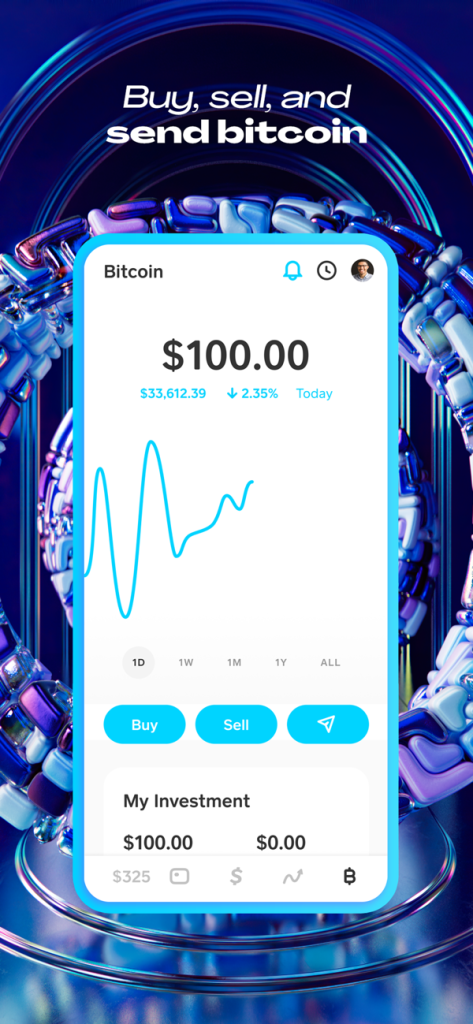

This Cash App is an online tool for getting additional money for your urgent needs. How do you get a loan from cash app? There are several features available in this online app: Cash Card, Direct Deposit, Cash from ATMs, and Cash Boost.

- Go to Cash App home page and press the Balance tab;

- Select Cash Out;

- Select the amount of cash and press Cash Out;

- Choose a deposit speed;

- Confirm with your PIN or Touch ID.

The Cash Card option is useful for consumers who want to obtain a free Visa debit card for their Cash App and make the necessary purchases. This card may be easily added to the person’s Apple Pay or Google Pay. It’s simple and secure for every client who has such thoughts as “how do I get a loan from cash app?”.

The Direct Deposit option is preferable for people who are looking for a quick deposit of their paycheck directly into the Cash App. This process can be done automatically once you set it up. Tax returns as well as monthly wages, may be deposited to the client’s Cash App balance.

You may get up to $25,000 per direct deposit or up to $50,000 in a 24-hour period. Such direct deposits are obtained two days faster than in the regular banks.

It is helpful and convenient to utilize your Cash Card to make ATM withdrawals once you urgently need some cash to make the necessary purchases or payments. More than that, the Cash Boost option allows clients to receive instant discounts at various merchants and stores.

Step 1: Choose the Best Cash App to Borrow Money

How do you borrow money on cash app? Can you get a loan from cash app? The overall process for getting supplemental financial resources isn’t time-consuming or tedious.

It takes minimum time and effort to get matched with the most suitable lending services or creditors using online technology.

Can you borrow money fast from cash app? Yes, you should take some time to review the apps that are currently available. Search their options and the amount of cash they can lend.

Also, it pays to compare the rates of different apps and their lending terms as well as review the feedback. Positive feedback from clients is what tells you about the company’s reliability.

B9 Financial Solutions

B9 Financial Solutions is a noteworthy mention when discussing digital financial platforms. Similar to Cash App, B9 provides a spectrum of financial services that cater to the modern user’s need for convenience and speed. B9 is well-regarded for its easy-to-use interface and robust customer service.

Although B9 doesn’t offer a borrowing feature like Cash App, it compensates by Advance as an optional service, up to 5% cashback from 4 categories by your choice and providing a secure and seamless payment experience. B9 also places a high emphasis on transparency, ensuring that users are well-informed about transaction costs, which helps to build trust and credibility. If you’re seeking a user-friendly and reliable digital financial platform, B9 is definitely worth considering.

Step 2: Fill the Application Online

Are you wondering how to get a cash app loan using the borrow money app? Are you in a situation like “I need money now cash app”? Once you’ve decided which app you would like to try, it’s time to fill in your loan request form.

The borrow money cash app application is simple and requires minimum time and effort. If you are ready to learn how to borrow from cash app, make sure you submit it with your valid personal (your full name), banking (your active bank account), and employment details.

How to get a loan from cash app? You need to check the information and make certain it’s typed correctly and without errors so that you have no issues with the money deposit.

Step 3: Wait for Loan Agreement

Now you know a lit bit more about the process of how to get a loan from a cash app loan money, but what’s next? The next step is to wait a few minutes while the managers connect your request with the most suitable lenders and service providers. No matter whether you need $50 instant loan money or a bigger sum, the process will take the same time.

How to get a loan on borrow cash app if you are approved? Once your request is approved, you will receive an agreement with all the information and details. Make sure you check all the data once again, review the terms, and check the interest rates and loan conditions.

Step 4: Sign the Contract and Obtain Cash

Do you have urgent expenses that need to be covered? Can u borrow money from cash app? Once your application is approved by the creditor and you get the agreement, it’s time for you to sign it electronically. Forget about traveling to physical pawnshops or lending stores.

Now you may perform this task on the web directly from your office or home. Sign the contract on your smartphone and get ready to receive the funds in your bank account.

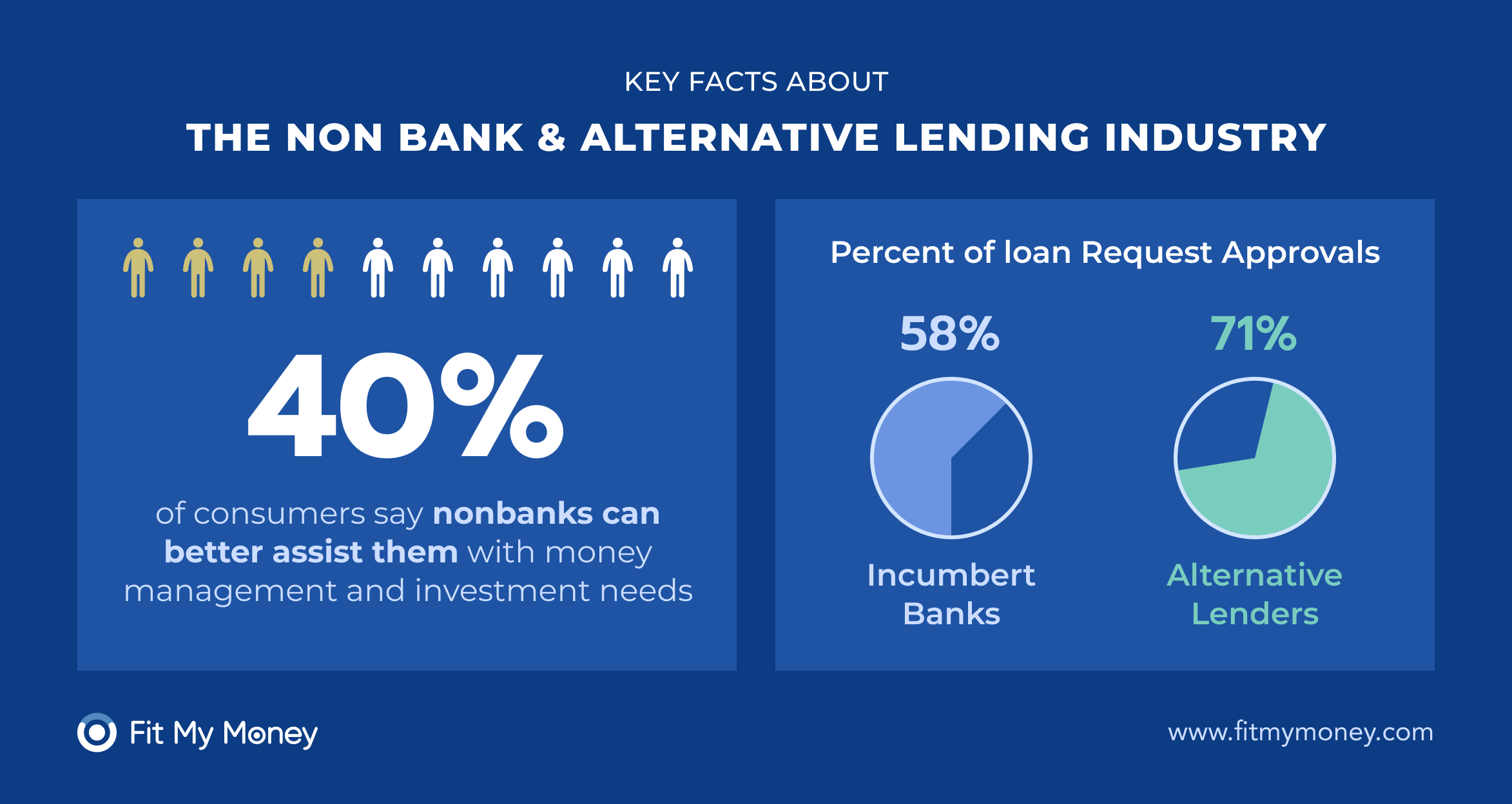

According to Business Insider, alternative lenders approve more than 70% of all loan applications. That is why by applying for a loan through the cashapp borrow, you have all the chances to get money!

Don’t hesitate to choose a desired cash app borrow money! Get funded today!