You may often find yourself in a tough financial situation when getting extra support is necessary. Not always do people have sufficient savings or a solid emergency fund to take some cash from when a sudden monetary shortfall hits them.

When you have a mountain of debt and want to consolidate it, you have more than one option. Consumers have a chance to select between balance transfer credit cards and small personal loans for their convenience. Every lending option has its advantages and drawbacks so you need to take some time and review its main features.

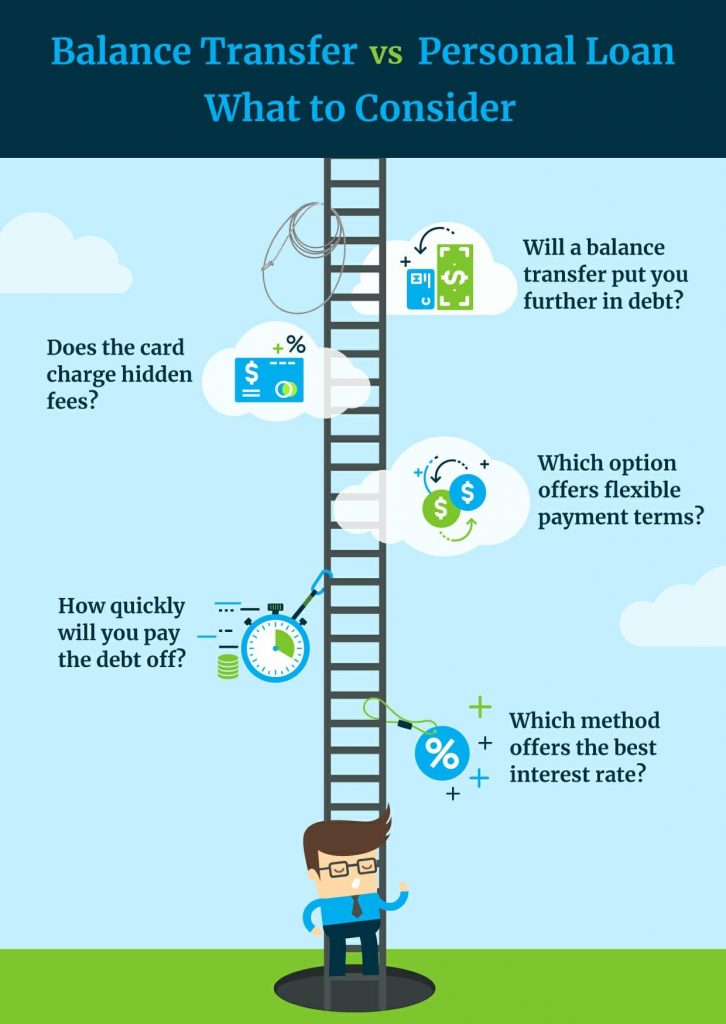

Choosing the right borrowing solution is important as it will allow you to save your funds and get rid of existing debt faster. Here is what you need to consider.

Personal Loan vs Balance Transfer: What Is the Difference?

While you are short of cash at the moment and need a quick helping hand with your finances, getting qualified for the most suitable lending decision is essential. Don’t rush with your decisions as any type of borrowing is associated with certain risks.

You need to review all the pros and cons of both options and stick to the most favorable solution tailored to your current money needs. There are the best rated credit cards which can offer you quick funds, but there are also small personal loans with low interest depending on your credit.

Both lending options are designed to assist consumers in saving cash and simplifying their personal finances. Every borrower wants to pay the debt off as soon as possible and become financially independent. So, choosing between these two solutions is straightforward and significant.

Getting a 0 balance transfer fee credit cards 2024 might be suitable when you are offered a low introductory APR for a particular period. It allows consumers to save funds and avoid interest provided that you are able to return the funds within this short time frame. If not, getting qualified for easy personal loans may also be helpful if you are offered low interest. The terms and conditions usually depend on the borrower’s credit history and other eligibility criteria.

Source: greedyrates.ca

Source: greedyrates.caPersonal Loan or Balance Transfer: What to Choose?

Many people aren’t sure which lending solution is more suitable for them to get rid of monetary disruptions and become debt-free faster. Below we will discuss the pros and cons of them to help each consumer choose between a personal loan or balance transfer credit card.

One is certain – both of these solutions are meant to consolidate the borrower’s existing debt into a single one so that you have one monthly payment and fewer obligations with lower interest.

Personal Loans: In case you’ve had poor credit history when you got your credit card, you may improve the situation by getting a personal loan with a lower interest once your credit rating is higher. Borrowers have a chance to acquire a larger amount of cash with a small personal loan. Also, the repayment schedule is more flexible with regular monthly payments and set terms.

- Low interest rates for good-credit holders;

- Origination fee between 0% and 8%;

- Larger amount to borrow: between $1,000 and $100,000;

- The usual APR between 5.99% and 35.99%.

Balance Transfer: this option may be useful when your credit history is great and you can qualify for a low introductory APR on your card. In case a borrower can repay the debt within this introductory period, he or she will be able to avoid all the fees and interest. Pay attention to the APR of your credit card if you choose this option. The intro offer is limited in time and the APR will become higher after this period ends.

- Low introductory APR;

- Limited period for low APR;

- Smaller credit limit: between $300 and $15,000;

- Balance transfer fee from 0% to 5%.

Which Lending Solution to Select

Now that you know the basics of both borrowing types, it’s time to ask yourself a few important questions to help you make the right decision.

What Types of Debt Do I Have?

When you think what lending option will be the best fit for you, balance transfer or personal loan, you should firstly analyze your current financial state. Depending on the type of your debts you may opt for the most favorable option.

Borrowers who have to pay down several credit cards have more opportunities to get a new balance transfer card with a low introductory APR so that their existing credit card debt is consolidated.

On the other hand, taking out a small personal loan will allow you to obtain the funds directly to your bank account and pay for any bills or purchases you need. A personal loan gives consumers more flexibility.

How Much Money Do I Need to Borrow?

It pays to be responsible for your borrowing decisions and think twice before you borrow funds. Any debt is still debt and your aim is to repay it as soon as possible.

What amount do you actually need to take out? It may be tempting to request a larger sum so that you have more freedom. However, this larger amount may cost you much more in the long run. Choosing between a personal loan vs. balance transfer you should keep in mind that a personal loan allows you to acquire a bigger sum of cash for a longer period.

At the same time, you may not be approved for the whole amount if your rating is less-than-perfect.

Will I Have to Pay Interest Rate?

Remember that you are not given the money for free. Every borrowing solution comes with certain fees and rates. A balance transfer may offer you a particular period with a low introductory APR but not every credit card offers it. A personal loan has more flexible terms and a lower interest rate that doesn’t change over the lifetime of the loan.

In conclusion, you should weigh all the pros and cons of each option. Even if you are not approved for the whole amount you need to consolidate all of your debts, make sure to start repaying the debt with the highest interest rates. Every lending solution is suitable for certain financial disruptions and choosing the best option is important so that you return your financial stability faster.

- Credit Cards: Balance Transfers, Office of the Comptroller of Currency,

https://www.helpwithmybank.gov/help-topics/credit-cards/balance-transfers/index-balance-transfers.html - Credit cards key terms, Consumer Financial Protection Bureau, https://www.consumerfinance.gov/consumer-tools/credit-cards/answers/key-terms/

- What is a balance transfer fee, Consumer Financial Protection Bureau, https://www.consumerfinance.gov/ask-cfpb/what-is-a-balance-transfer-fee-can-a-balance-transfer-fee-be-charged-on-a-zero-percent-interest-rate-offer-en-53/