We all have experienced a sudden financial shortfall at least once in life. Sometimes you come across additional expenditures and unpredicted costs that need to be covered straight away. Reliable cash advance apps like Brigit offer supplemental money to pay that bill you can’t afford if you want to save up for something else.

When you don’t want to fall behind on bills and wonder where to get cash advances up to 250 for the short term, other cash advance apps like Brigit can be of great help. Indeed, another several hundred dollars during the pay period won’t hurt you.

If you don’t have enough time to wait for the next paycheck, have an active bank account, and feel pressed for cash, the best cash advance app may assist you. Look into our table of contents to find the best loan apps for you!

What to Look for in an App Like Brigit?

If you have a checking account, you can be eligible for a cash advance through this tool. The standard subscription doesn’t cost anything, and there are no overdraft fees or foreign transaction fees.

If you want to upgrade to a Premium membership, monthly fees will be $9.99 a month. Personal loans issued through this tool offer competitive rates and a relatively big loan amount.

If you want to obtain a larger loan amount or a bigger cash advance sum, you may try other cash advance apps like Brigit. Having an active and valid bank account is the only demand. The repayment date is flexible, and if you repay the debt on time, you won’t face any charges with these loan apps.

The borrow money app instantly conducts only a soft credit check which is only meant to verify the client’s personal and financial details. It is another benefit compared to conventional crediting institutions that perform only a hard credit check.

Best Apps Like Brigit

What is the best cash advance app with a low APR? Every consumer is looking for a direct deposit without a monthly membership fee and wants to borrow money by getting personal loans. Short-term monetary needs often make people search for cash advance apps today.

While some of them report to the major credit agencies and let you boost your credit limit, others don’t. The limit can be improved via this tool. Every transaction is secure here.

Also, there are interest free cash advances, while some cash advance apps while others have interest fees and monthly fees to pay.

We can’t say what cash advance apps like Brigit are better or worse, as it all depends on your financial stability and current needs.

On the flip side, you should look through our review of the top-rated apps that offer cash advances and choose the one that suits your monetary needs, offers the maximum amount of cash advances per pay period, and doesn’t have overdraft fees. The loan balance and transfer fees can define the most suitable app for financial assistance. One common perk they all offer – there is no work schedule like in the bank. Apps are available 24/7.

Read More: Apps That Let You Borrow Money

Chime

If you need to cover unpredicted costs or obtain a portion of your earned wages in advance, Chime can be of great help. This app allows you to obtain a more substantial chunk of your income. You may still apply with a positive balance or a poor credit rating.

This app doesn’t check your credit history, so the same employer can apply more than once. It’s better and more affordable than Empower.

There is also no annual fee or APR. Any credit score is welcome with Chime, and there are no overdraft charges, as we can see from any article about this app.

Advantages:

- 60,000+ ATMs Available

- Fund Any Purchases Unlike Banks

- Any Credit Score

- No Overdraft Fees Or Late Fees Paid

- Annual Percentage Yield Is Just 0.50%

Dave

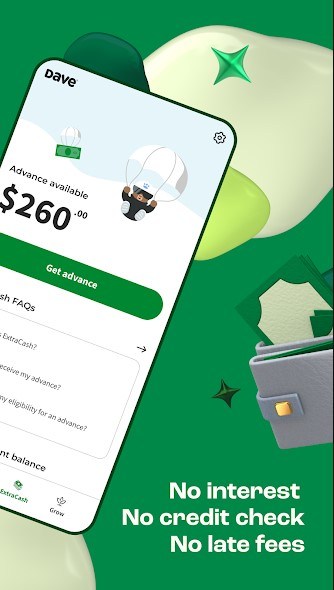

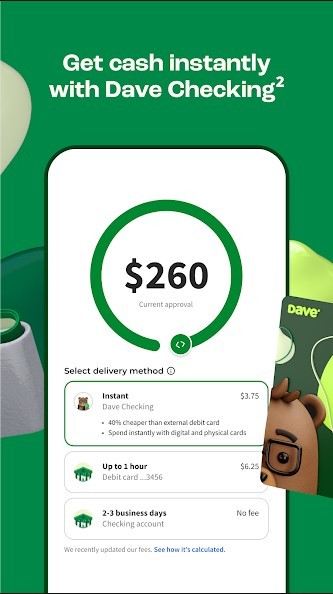

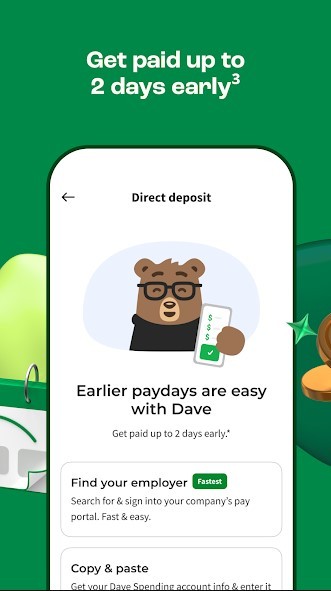

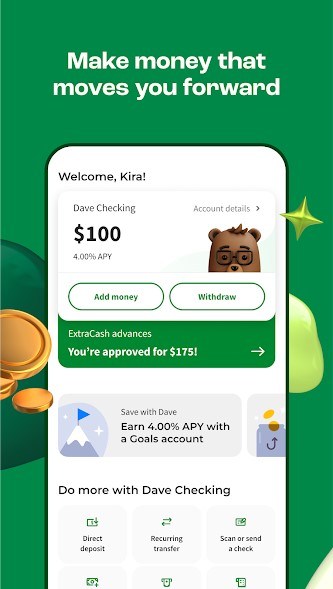

Do you need extra capital? Fair lending is available at the app like Dave. It offers a structured process for obtaining a quick loan. Dave allows clients to receive a big portion of their monthly income in advance.

The company site mentioned that it provides the ability to get different financing options without interest rates.

Every user may apply and only pay $1 per month for usage. Of course, there are no hidden fees, late payment fees, and no APR. If you want to invest in a big-ticket purchase or finance an urgent repair, this app works perfectly. There are no limited fees or interest like Earnin.

Advantages:

- A Safe And Secure Budgeting App

- Quick Cash Advance for Your Needs

- No Overdraft Fee Or Interest Charges

- Flexible Repayment Conditions

- Only $1 Fee Per Month Is Need To Be Paid

Earnin

This online tool can also track the hours you’ve worked and offer a cash advance. The payments can be done each month if necessary. Once you return the initial debt, you can apply for the next sum and sign in again.

This tool doesn’t belong to any banking branch. The gig economy has made our lives more challenging, but a quick advance may reduce our stress.

Hourly workers, salaried workers, and on-demand workers may use Earnin for a small advance. It issues the funds within one or two business days. Featured placement of this online tool allows you to make debit card purchases and get e-mailed without other fees and APR.

Advantages:

- Up to $100 Paid Per Month

- Get More Within One Or Two Business Days

- Free Service

- A Web Request in Just a Few Minutes

- Workers From Various Companies Can Apply for These Services

Affirm

Affirm is another app like Brigit that offers quick financing and other banking services. APRs from 0% to 30% are available through Affirm based on your credit record. You can get up to $17,500, however, the maximum varies depending on the creditor.

Affirm allows for cash advance terms of 3, 6, or 12 months. However, they can also be from 2 weeks to 3 months long. Although there is no minimum credit score to fit eligibility requirements, Affirm takes into account the economy as a whole and your prior dealings with the company.

You can download this cash advance app on the app store. Take advantage of their budgeting tools. You can get qualifying direct deposits in your bank account within 1 to 3 days.

Advantages

- Immediate approval of funds

- No transaction fee, unlike payday loans

- You may receive funds within 2 days

Empower

Another app that offers a cash advance with no credit check is Empower. This app lets you borrow anywhere from $10 to $250 per month. They do not charge any maintenance fees, and you can get the app easily on the app store.

The amount of money you can qualify for is based on your personal finance. The app costs 8 USD per month, but you get a free trial for 2 weeks! Aside from the 8 per month, there are no additional fees or costs.

If you make regular payments with Empower, you might also build your credit. Unfortunately, they do not have an atm network established.

Advantages

- Relatively cheap

- Helps track your spending activity

- Quick way to cover expenses

- Credit score is not relevant

MoneyLion

Get MoneyLion on the app store and borrow money at lightning speed. You can get a loan from $25 to $250. There is no minimum credit score required, either! MoneyLion is based in New York, and they offer financing tools for everyone. With their program, Instacash Advance, you can get up to $ 100 per day! They provide quick deposits but charge a small fee.

Advantages

- Easy and instant approval

- The requirements are not strict

- No credit score monitoring

DailyPay

With DailyPay you can borrow money of up to 100% of your following salary. They charge a low membership fee of $2.99. There are no other hidden costs with DailyPay.

To keep their users safe, they use modern encryption methods. They also have a great customer support system developed. Their products and services can help you get out of serious financial trouble!

Advantages

- Allows you to borrow up to 100% of your earnings

- Uses high-end encryption technology

- Charges a very small fee

Cleo

Cash advance apps offer great solutions to your urgent expenses. With Cleo, you can get up to $100 until your next paycheck. They do charge a monthly fee of $5.99, which is only $0.19 per day for great services!

Cleo can help you get cash with no credit checks that can harm your score. They even offer students a discount of $ 9.99 per month. That way, students get to save up to 33%.

Advantages

- No interest on cash advances

- Excellent tools for budgeting

- No credit rating checks

Albert

Albert app can help you get up to $250 with 0% interest! They only charge a transaction fee for a quick deposit. However, that is the only fee you will face with Albert!

This application, called Albert, seems to be able to handle everything related to finances. It can organize your accounts, regulate budgeting, create a personalized portfolio, and much more. Albert will give you the pay 2 days prior to when the following salary is scheduled to arrive if you frequently run out of money right before it’s due.

Advantages

- No hidden fees

- Instant funding

- Manages your savings

- Creates an investment portfolio for you

Possible Financing

Would you like to get, for example, $500 per pay period? Such services as Possible Finance give consumers a chance to get more than any other similar lender offers. While banks and other lenders have strict eligibility criteria, this website allows every worker and employer to obtain a fast loan. This amount can be issued per month depending on your working hours.

This is not a branch but an independent lender. You may give tips, but there is no collateral required. You can get less money in a day or 500 within a couple of days!

If employers don’t give you a salary straight away, you can determine how much you can receive here. Don’t worry about unforeseen costs, just sign in and request any sum. It’s better than Empower and even Instapay and has a competitive APR.

Advantages:

- A Local Branch Available In Many States

- Option To Delay Your Payment Deposits

- System For Tracking Your Costs

- Reports Payments to the Credit Agencies

Read More: Best Unemployment Cash Advance Apps in 2025

How to Compare Apps Like Brigit

Although it offers the same functionality as a typical cost planner, Brigit is unique in that it enables users to obtain loans cheaper than payday loans in a matter of seconds.

Receive up to $250 and no credit rating checks. There are also no high interest rates . Spend less and save more wisely with Brigit. The best part is that there are other similar apps, but you need to know what to look for! See below for more ideas on how to compare these apps!

Borrowing Limits

Most apps restrict users from getting a large loan at the beginning. For example, MoneyLion allows first time users to get only $250 per day. How many debts and reservations you can have at once is determined by the app.

Borrowing caps preserve the stability of financial institutions, encourage loan diversity, and support fair access to financial services for everyone!

Turnaround Time

There are other extra considerations in addition to the standard turnaround time for a loan, which ranges from 7 to 30 days. Some creditors can deposit money into your account right away! Cash advance loans are often made available within two or three business days.

When picking the right app, it is important to ensure quick funding. The entire point of cash advances is that you get them before your next salary. They serve to cover immediate and unexpected expenses.

Fees

Make sure to look into the various charges that these apps might charge. Some have fees for members, transactions, maintenance, and so on. Always check for these fees and any potential hidden charges before you opt for an app.

Once you compare multiple lenders, you will get a better grasp of these expenses. That way, you will know which app charges too much and which one charges an optimal amount. You might even be able to find some that have no fees other than those for transactions!

Requirements

A short-term borrowing from banks or other types of lenders is known as a cash advance. In general, charges and APR on cash advances are high. But they also offer swift approval and financing, which makes them appealing to consumers.

Every lending platform can have different requirements that you need to meet in order to qualify. Usually, the app will require some of your personal information, such as your full name and phone number. They might also look for pay stubs and other proof of income.

Rarely, but not impossible, the lenders might get access to your bank account. The best part is that most of them will not care about your credit score. However, on rare occasions, this might be a requirement as well.

Other features

The use of cash advance applications enables you to deposit funds into your bank account before you get your paycheck. These apps typically have no cost or just a small charge, but they do not add any interest. Apart from the general features, these apps have many useful tools.

For example, some of them allow you to use amazing features for budgeting. You can boost your savings and manage your earnings better. Some apps can even be useful when it comes to building your credit rating!

Reviews

Lastly, in order to get a good grasp of what an app is really like, listen to people that used it before. Go online and look for credible sources that provide reviews. Find good websites that write articles on such topics.

You might also be able to find reviews from individual users on the actual app. There are always ratings and comments right before you click ‘download.’ Ensure your sources are credible and avoid any scams!

Read More: Apps Like Earnin

What Is the Brigit App?

Brigit is a modern service for getting quick loans. You may be aware of alternatives and other fair apps in California and other states. There is more than one way in which Brigit is different.

Firstly, it is cheaper as it’s free to use. For example, up to $250 can be paid at once or half of this amount and cover any purchase or car expenses. Using a credit card can be more expensive, while banking options require a hard credit pull that may affect your rating.

Dave App and Brigit don’t work like a credit card. Every person can easily create a profile and use deposits. The main feature of this tool is to help you with budgeting and maintaining account balance. Unlike credit cards that cost a lot, Brigit makes a difference.

You can download a free app on Android or iOS and join 1 million members. Transactions are instant here while there are other rewards and no overdraft fees, there is no APR. It’s a competitive platform for getting earned money before salary day.

How Does Brigit App Work?

Can I obtain cash advances via direct deposit if I have a checking account? How much can I get per pay period? Is there a monthly membership fee? Does Brigit report to the three major credit bureaus? Let’s talk about the way Brigit works.

If you are short of cash and want to get installment loans via direct deposits, you’ve found the right company. One of the major benefits of this online tool is the absence of hidden fees or monthly membership fees.

It is one of the best cash advance apps, and there are enough reasons for that. The tool lets borrowers gain access to up to $250 per pay period, and it can be paid to save money while other apps need your bank balance and have high-interest rates. This tool does not conduct a credit check which may damage the score of the client.

While local banks and other financial institutions that offer debt consolidation loans have strict eligibility criteria and perform a hard credit check, there are no credit checks at Brigit.

The loan amount of $250 is suitable for many applicants who don’t have savings accounts or just want to get a quick loan on their Visa debit card without the monthly fee. The flat monthly APR is just $9.99.

You have a chance to borrow money and get a loan within a few minutes here. It is free, and it links to the bank accounts of the borrower. There is no monthly fee for a standard subscription, but premium users will have to pay a membership fee of $9.99 per month.

Luckily, there are no high fees, and you can open a spending account to track your expenses for free. These apps like Brigit offer overdraft protection and fast installment loans without a hard credit check.

Read More: Best Money Saving Apps

How to Use Brigit App?

Once you download this tool, you need to take the following steps to submit your request for extra finances:

- Set up a user account on the site. Connect it to your checking account, as it will be used to deliver finances in the future without waiting. Also, the tip will be deducted by the lending app from your banking account.

- The tool gets access to the customers’ account, gives them a score, and decides if they qualify for banking loans till the paychecks.

- Note that if you qualify, you will need to pay a tip and a subscription fee if approved. You may opt for apps like Dave and Earnin app to avoid it.

- Now you can select states and request small amounts of cash up to $250 to make ends meet. You get paid at once for free.

- A client obtains a note two days before and one business day before the sum should be repaid. Employees may choose alternatives or take advantage of other options in the long run. If certain factors make you repay the sum earlier, just press the “Repay now” button.

- The lending app withdraws the advance sum from your account. The flat APR is only $9.99 a month. It transfers the money automatically and reports to the credit bureaus.

Brigit Experience

Many consumers have a question in their mind, “Why should I use what Brigit offers if there are other cash advance apps like Brigit for free?” They wonder if it’s a safe and secure place to get same-day funding until the next paycheck.

Does the loan amount differ? Many lenders offer auto title loans and cash withdrawals within the same business day, but if you fail to pay the debt off on time, you will face late payment penalties.

Brigit is different from SoLo Funds and other places with the next direct deposit. This is a pay advance app that allows consumers to receive instant money in a blink of an eye.

A debit card and a bank account are required to obtain a small loan, apps like Brigit offer money until the next paycheck. The experience of many clients shows that this app stands out from the rest of the competitors.

While other tools ask for at least a small fee and want to check your cash flow, Brigit gives you early access to money immediately. It doesn’t charge interest, and there are no late fees. Besides, many borrowers mentioned they managed to build credit and improve it with a credit builder loan from Brigit.

Brigit Requirements

The requirements for getting immediate access to this lightning-speed program are basic. If a borrower has a bank account and steady employment, the tool offers cash advances to cover any unexpected expense.

Eligible users may enjoy a short-term loan without late penalties while the approval odds are high regardless of their credit score. You can budget, use a savings account, and utilize other services such as a direct deposited loan.

While financial literacy is essential these days, not all people know how to budget. They turn to cash advance apps for assistance until their paycheck arrives. This is a reliable service provider without crazy rates and charges. There is no annual fee for the standard subscription, and the funds can be delivered to you within the same business day. They only charge $ 9.99 per month!

If tracking your spending isn’t easy for you, this tool will support your daily needs and answer any financial concerns. Get your money today by signing on to this platform till the next salary comes. It is a good option to get access to extra money.

Sources Used in Research for the Article:

- Cash & Payday Advance Apps,

https://www.debt.org/credit/loans/cash-advances/apps/ - Payday Loans and Cash Advances,

https://consumer.gov/credit-loans-debt/payday-loans-cash-advances - Payday Loans: Fast Cash and Costly,

https://mycreditunion.gov/life-events/consumer-loans/payday-loans