Being hit by unexpected costs can get you into a whole heap of troubles. To fix things, a savings account would be a huge help.

The bad? You can’t boast savings or stellar credit score. Sure, not a bed of roses, yet that’s not all that bad.

The good? Getting a personal loan from an online lender might be your best bet, even if your credit is below average.

How to get loan from bank? Frankly said, no one guarantees that you’ll be approved, but it never hurts to try. The good news is that personal loans for credit scores under 550 exist and you can take advantage of them.

Americans borrow. A lot. Ranging anywhere from $100 to $10,000, the best personal loans for fair and good credit have quickly become an in-demand choice. So you’re not alone with your thoughts like is a debt consolidation loan a good idea. But before you apply, there’s something you need to consider.

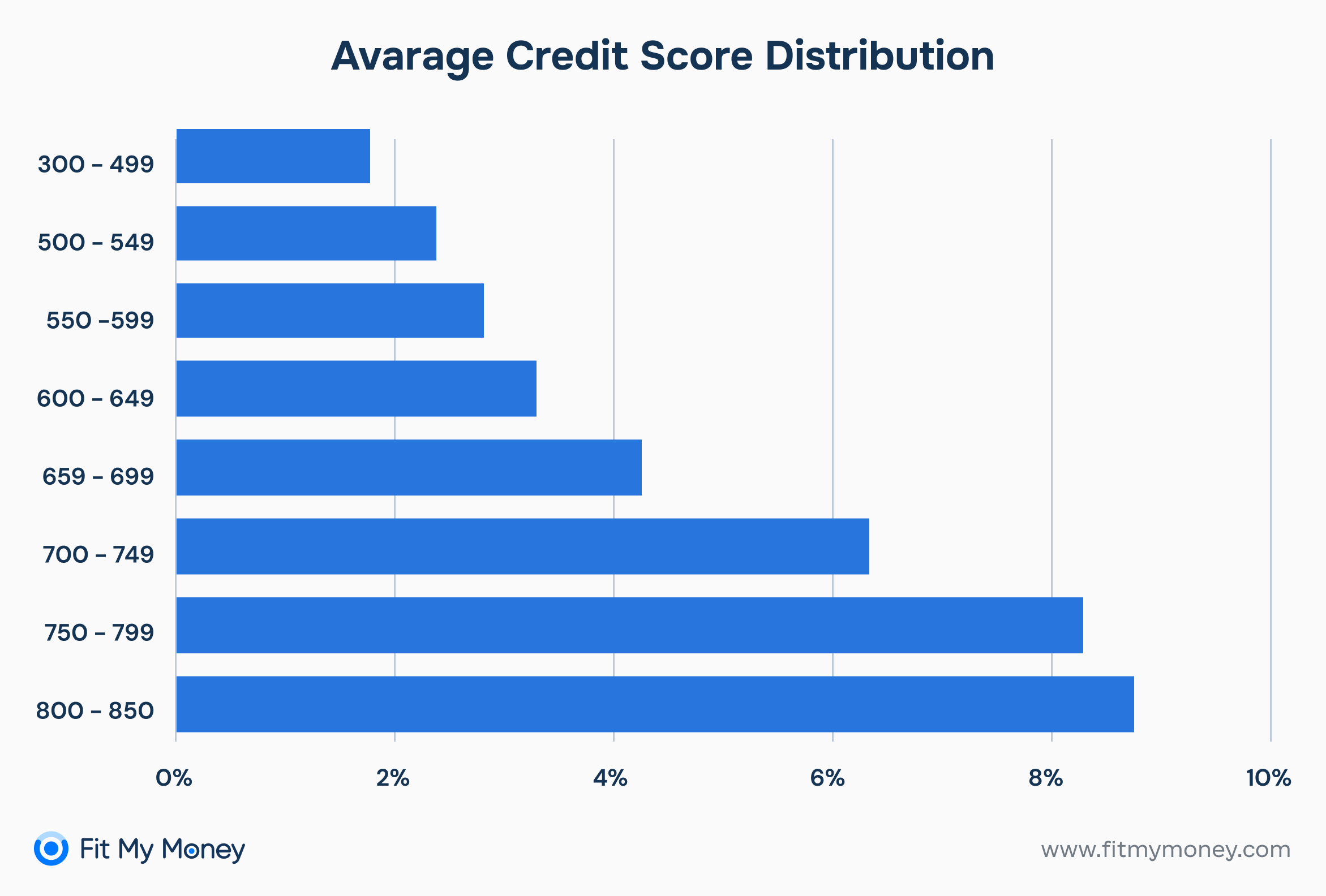

No matter what type of financial product you want to apply for, a credit score check is the first thing you need to do. This three-digit number could be anywhere from 300 to 850. The higher the score, the lower the credit risk.

As such, in times where you’re about to apply for a personal loan, make sure your credit score is at least 660 or higher. Got a 700’s credit score? Great!

Odds are, you can save up to $41,416 in total interest paid over the life of your mortgage loan. Sure, nobody wants to see its credit score in the poor zone, yet the reality could be tough. Although, you’re not alone in your credit struggle.

For 16 percent of Americans, a FICO score between 300 to 579 is a reality. To compare, the number was 16% in 2009. Whereas 20.2% percent of consumers have a score between 580 to 669.

And once you understand that you have a score that’s considered poor, options are.

How Can You Get a Loan with a 550 Credit Score?

Let’s face it, getting personal loans for 550 credit score can be challenging. The reason for that is that loans with even the most lenient approval requirements consider a credit score between 550 to 590 bad.

The truth is, there’s always a chance to borrow money even with the score in the 550’s. The trick is yet to have an extremely high APR interest rate. The numbers might be as high as 155% in one time cases.

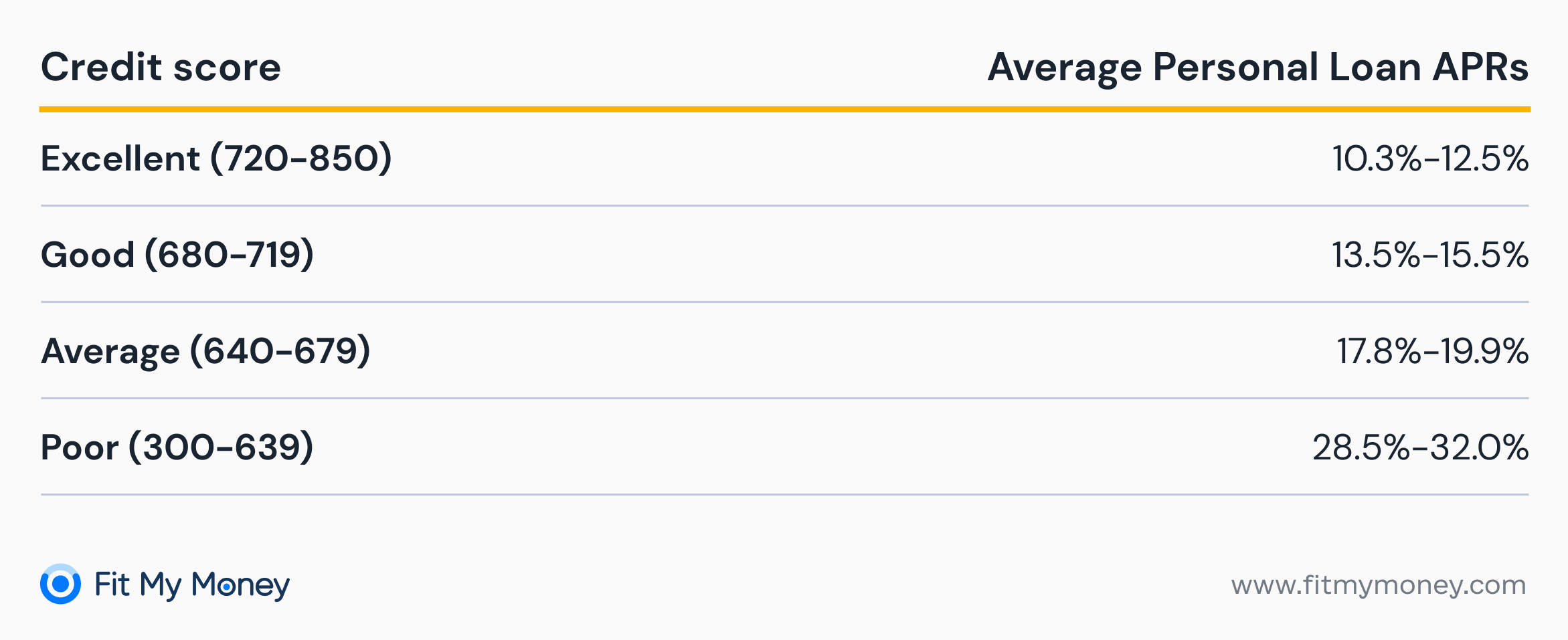

Moving from bad credit to an excellent one requires some time and effort. Nothing happens overnight, the same with the credit score. But who said you can’t apply to the top personal loan lenders for credit under 550? The following picture would be a nice extra for those looking for APR rates depending on the score.

Finally, lenders. Just because the number of online lending companies that issue loans to people with a credit score under 550 is big enough, APR rates vary.

Where Can I Get a Personal Loan with a Credit Score of 550?

Traditional banks won’t offer personal quick no credit check loans to people with a credit score in the poor zone. Exceptions could happen. Yet, your chances are almost next to impossible.

On the other hand, online lenders can give you the helping hand you need. Being more flexible to people affected by financial emergencies, online lenders are more likely to approve your request for a loan. Thus, if you are in a tough spot where every second counts, turning to an online lender would be right up your alley.

The bad? The terms you get will not be favorable.

Think of the situation this way. You need a personal loan with a 550 credit score. You’re risky. There’s a chance you might miss payments or even worse, default. To be safe, very high-interest rates come into play. There are different lenders who work with bad credit borrowers.

So, once you’re about to apply for a loan, lean your options. Sometimes turning to an online marketplace would be a smart idea. As such, you fill a single loan request and see what options you could get.

How Much of a Loan Can I Get with a 550 Credit Score?

Even if you’re 150 points away from good credit, that isn’t the end of your journey.

There are several options for improving your credit, and you shouldn’t underestimate them. Improving your score can be very helpful when you apply for your next loan. As a result, you’ll get the best terms and interest rates available.

By way of example, to apply for an FHA loan, you need to have a minimum 500 or 580 credit score. A down payment is a must here. The higher your rating, the lower is the down payment. Thus, with 500 points, you’ll get a 10% down payment. With a 580 score, you’ll have a 3.5% down payment.

As Experian states, the primary mortgage insurance (PMI) can cost you as low as 0.5% to upwards of 2% of your loan amount annually.

So, can you get a personal loan with a 550-credit score? Probably. All in all, there’s nothing to stop you from qualifying for a loan. A good place to start is to connect with lenders through online marketplaces. Thus, in a matter of minutes, you can have up to five offers.

But before you apply, always remember about interest rates. A lender understands you have few options available. As a result, it’s in his own interest to take full advantage of your situation. Shady lenders use this approach to get you to default on a loan, so think on your feet.

How Much Could It Cost You?

To better understand how much a 550-credit score loan could cost you, a survey by LendingTree shows.

The same amount of an $11,342 loan will cost $6,325 a ‘fair’ credit score (580-669) person in total interest, while a person with a ‘very good’ (740-799) one will pay $2,889 in total. See the difference?

Because of these factors, it’s extremely important to keep your credit rating safe & sound. It’s easy to have a poor score. Even though getting a perfect credit score is a tough gig, it’s still possible. At the end of the day, your wallet will thank you.

Considering that there’s no ‘official’ minimum credit score, you can still qualify for a loan. There are no barriers to that. Factors like your payment history, amounts you owe, and income, is the key to being approved.

Let’s say, you want to take out a $20,000 loan with a three-year term. Thing is, the same loan with a 7% interest rate would come out to $2,231 in total interest. A loan with a poor credit score and a 25% interest rate would cause $8,627 in the total. Now, think of your score. See how much you can save with a good credit score.

Yet, don’t dampen your spirits. The key task here is to show to a lender that a low credit score is a permanent stain on your finances. Don’t apply for the amount that’s more that you need. It’s much easier to get access to more affordable credit and show that you can make payments on time. With that attitude, you can increase your chances of getting access to the funds you need.

Credit score distribution stats source: WalletHub.com