If you plan to use your credit card outside the U.S., you need to find out if it has a foreign transaction fee. It is usually 3% of the transfer or purchase amount and is charged to your account each time you pay online or offline for goods or services from other countries.

Many financial experts recommend getting a card without international transaction fees if you plan to make purchases outside the US. There are a lot of such offers on the market, and this article will tell you about them.

No Foreign Transaction Fee Credit Cards: Best Choices

Choosing a good credit card can be tricky as there are dozens of suitable options in the financial market. In addition, when choosing, you must pay attention to many criteria, such as APR, additional fees, and user requirements.

So that you can choose from only the best options, we have selected eight no foreign transaction fee credit cards with excellent terms and conditions for people with different credit scores. Read the description of each one and apply for the credit card you like the most.

Chase Sapphire Preferred® Card

This credit card, with a small annual fee of $95, is one of the best options for travelers. It will allow you to earn cashback, avoid foreign transaction fees, and get a great sign-up bonus.

Let’s take a closer look at the terms and conditions of this credit card:

- You will receive a sign-up bonus of 60,000 points if you spend $4,000 within the first three months of opening your account (that’s about $750).

- While using the card, you’ll also earn 1 to 5 points per dollar cashback, depending on the category. The list of reward categories includes purchases made through Chase Ultimate Rewards®, restaurants and deliveries, streaming services, and supermarkets).

- Its APR is 19.74%-26.74%.

- Each bonus point is worth 1.25 cents.

- You must have a good or excellent FICO score to get this credit card.

Of the disadvantages of this option, we may note that getting an increased cashback is not available at all stores. For example, you’ll get 3 points for every dollar you spend at supermarkets like Target and Walmart. Other than that, it’s a great option with a generous bonus and cashback.

Capital One Venture X Rewards Credit Card

Do you want a travel credit card that you can use for travel and in your everyday life? Then Capital One Venture Rewards Credit Card is an excellent option for you.

There are many reasons why you should consider this option:

- It offers a massive sign-up bonus of 75,000 miles if you spend $4,000 on purchases within three months of opening your account (that’s about $750).

- It has a low APR compared to its competitors of 18.99%-26.99% Variable.

- Each mile costs 1 cent and can be spent on flights, hotels, or car rentals with 15 companies.

- You will receive 1% cash back on purchases other than those you make with the airline. In addition, if you book a hotel stay or car rental through Capital One Travel service, you will receive 5% cashback.

- With this credit card, you will receive two free passes to Capital One Lounge locations. Considering its annual fee is $95, this benefit alone will allow you to recoup its maintenance.

However, the Capital One Venture Rewards Credit Card also has a few drawbacks. For example, it offers low cashback compared to the other options described below and only allows you to spend points on one domestic airline.

Overall, this is a great airline credit card option for those with good credit because it can be used for travel and everyday life, earning additional rewards.

Read Also: Best Secured Credit Cards

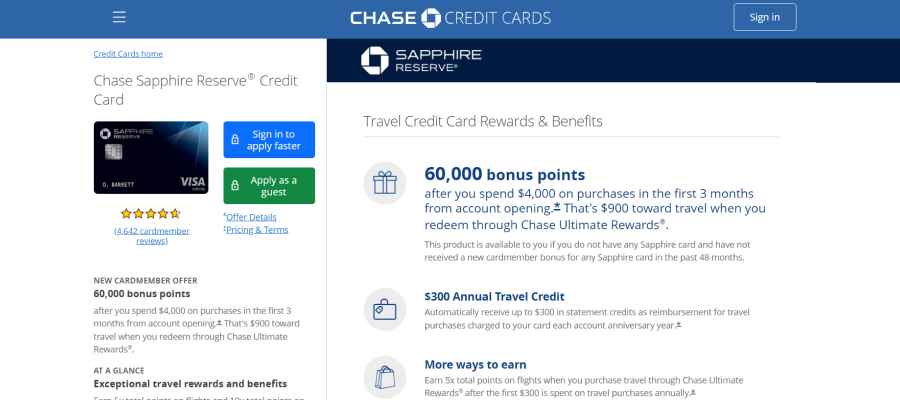

Chase Sapphire Reserve®

Do you want to travel in comfort and luxury? Then this credit card can be your best option. Here are its main advantages:

- You can earn cashback between 2 and 10 points for paying for dinners at restaurants, hotels, flights, car rentals, etc. For every dollar you spend in all other categories, you will earn 1 point.

- Once you sign up, you will receive 60,000 points if you spend $4,000 on purchases in the first three months from account opening (that’s about $900).

- Every year you will receive a $300 travel credit which can be used for travel purchases.

- This offer includes various insurance options that will protect you against loss of luggage, be available at the time of rental and help solve any problems that may arise if you miss your flight.

- With this elite credit card, you can access 1,300+ airport lounges worldwide.

- Its APR is 20.74% – 27.74%, and the foreign fee is $0.

The main drawback to this option is the very high annual fee of $550. If you do not fly abroad at least once every three months, you may find it more advantageous to choose another credit card. You will also need a high credit score of more than 750 points.

However, if the annual fee is not a problem, you can get a Chase Sapphire Reserve and travel with maximum comfort.

The World of Hyatt Credit Card

This credit card has a low APR and a small annual fee, so it’s great for those who are just starting to travel and have a good credit score. You may be suited to this option if you are looking for the following credit card benefits:

- Its APR is lower than that of many competitors, 19.74%-26.74% Variable.

- It’s a no foreign transaction fee credit card, but its annual fee is $95.

- After you spend $3,000 within the first three months of opening your account, you will receive 30,000 points.

- For every dollar you spend at Hyatt hotels, you’ll get four bonus points; for restaurant purchases, you’ll get 2 points per dollar.

- Each point equals 2.8 cents, almost three times more than many competitors.

- You can spend your points at Hyatt hotels for accommodation, room upgrades, fitness classes, spa treatments, and dining.

- As a World of Hyatt Credit Card holder, you can receive one free night each card anniversary year at a Category 1-4 hotel or resort.

Of the disadvantages of this option, we can only note that Hyatt, although a large chain, does not have locations in every location around the world. For example, you can find more than 7,000 Marriott hotels in different countries and only 900 Hyatt properties. By all other criteria, it is an excellent option for those who like to stay in hotels of this chain.

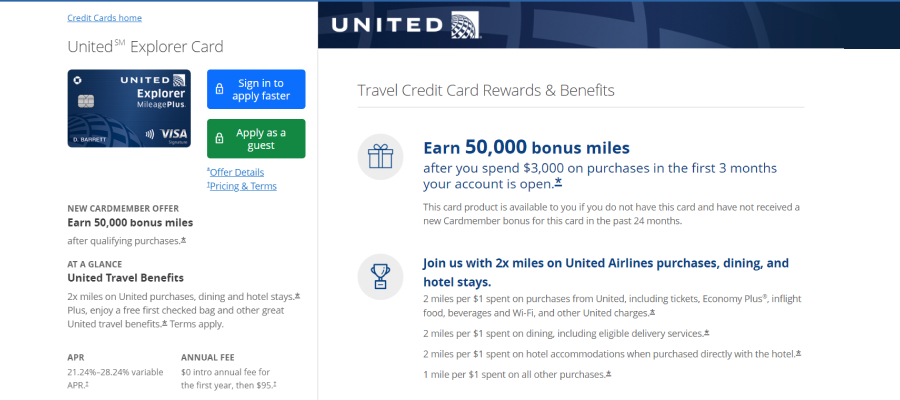

United℠ Explorer Card

Do you frequently fly with United? Then this airline credit card may be the best for you. It allows you to earn extra miles on travel expenses, receive various airport benefits, and use the big sign-up bonus to pay for your flight, hotel accommodation, or car rental.

Let’s take a closer look at the pros of this option:

- United Explorer allows you to earn 2 miles for every dollar spent on flights or other purchases from the airline, hotel stays delivery, or dining. You can earn 1 mile for every dollar spent on different expense categories (1 mile = almost 2 cents).

- It has a modest annual fee ($95), compared to similar offers, but gives you two free passes a year to United Club lounges (each costs $55).

- It’s a no foreign transaction fee credit card.

- You will receive 60,000 miles after you spend $3,000 in the first three months of account opening.

Among the disadvantages of this offer, users point out the minimum number of free checked bags and the limited possibility to spend points only in partner companies (there are few domestic airlines).

In general, this option is better suited to United loyalists than any other category of travelers. However, it is not a good option for daily use as it has a high APR of 20.24%-27.24%.

Read Also: Best Metal Credit Cards

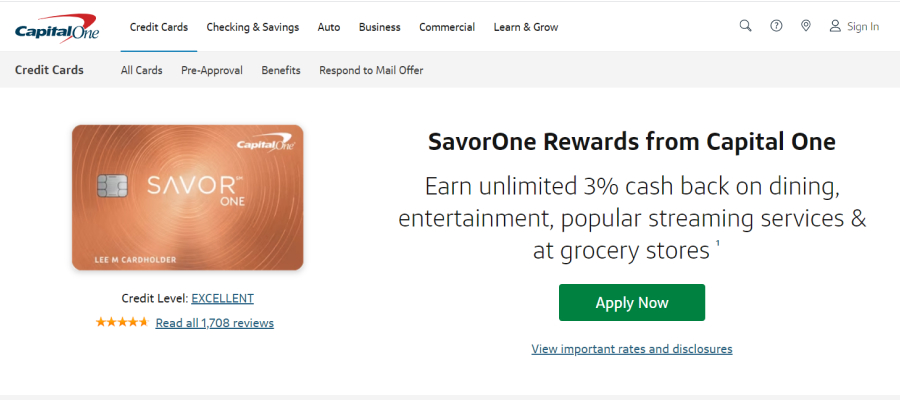

Capital One SavorOne Cash Rewards Credit Card

Another credit card with no foreign transaction fees but perfect cash back allows you to get back up to 3% of your spending at restaurants and supermarkets. In addition, you will receive 1% cashback on all other spending categories for a total of over $500 per year.

Of the other merits of this option, it’s worth noting:

- It has a $0 annual fee.

- It offers a welcome bonus of $200 after you spend $500 within the first three months of account opening.

- It gives you 5% cash back on hotels and rental cars paid through Capital One Travel.

- It has 0% intro APR for the first 15 months (then it raises to 17.99%-27.99% variable).

Of course, this credit card has one significant drawback – it’s only available to users with more than 720 FICO points. However, if you fit that bank’s criteria, you can take advantage of this great offer and save hundreds of dollars in intro APR, $0 annual, and foreign fees.

Petal® 2 “Cash Back, No Fees” Visa® Credit Card

With this credit card, you can get a credit limit of up to $10,000, even if you have no credit history. It also has a low APR (16.74% – 30.74%), allowing you to use it as your primary credit card in your everyday life.

Want to know even more perks of this option?

- You will not have to pay any annual or foreign fee.

- You can earn 1% cash back on eligible purchases and 1.5% cash back after making 12 on-time monthly payments.

- You can earn up to 10% cash back on purchases in certain stores and then withdraw it to your account.

- This card has mandatory identity theft protection and other Visa benefits.

- You will not have to pay a late fee if you have late payments.

Of course, this option also has a few disadvantages. For example, you won’t get the sign-up bonus since the bank didn’t include it in this offer, and you won’t be able to make a balance transfer or get a cash advance with it. But, other than that, the Petal® 2 “Cash Back, No Fees” Visa® Credit Card is an excellent choice, especially for those with a low FICO score or little credit history.

U.S. Bank Altitude® Go Visa® Secured Card

Do you want to get a card for users with bad credit which has no foreign or annual transaction fees and allows them to earn cash back? Then this option is the best for you!

In addition to those listed above, U. S. Bank Altitude Go Secured Card Rewards has the following benefits:

- You’ll earn 4 points for every dollar spent at restaurants, 2 points per dollar spent at supermarkets and gas stations, and 1 point per dollar on all other eligible purchases.

- All the rewards you earn have no expiration date, so you can spend them whenever you want (minimum must be over 2,500 points).

A significant drawback of this option is the high APR of 29.24% variable and the need to provide a deposit to get a credit limit (it’s a secured credit card).

This could be a great option if you have a low credit score. However, if you have a FICO score above 670, you are better off using the bank offers described above.

Read Also: Guaranteed Credit Card Approval No Deposit

What Are Foreign Transaction Fees?

A foreign transaction fee is a fee that a bank asks for each purchase made outside the U.S. (online purchases on foreign country sites are also considered international). It’s important to understand that this money doesn’t just go to the bank; they also use it to make transactions through a correspondent bank in another country.

It is also essential to know that even if the credit card has no foreign transaction fee, you may be required to pay international fees – these are fees for payment systems such as Visa, Discover, or Mastercard.

How Much Are Foreign Transaction Fees?

The law does not set one standard for all foreign transaction fees, so they may be 5%, 3% (the market average), or 1%. In addition, some cards do not charge any fees at all for payment of goods abroad, which is worth paying attention to for those who travel frequently.

It is essential to understand how to calculate a foreign fee. It is calculated in percent of the amount you paid or transferred, so if you buy something for $1,000, your account will be charged $1,030 (+ conversion between currencies); 3% is a foreign transaction fee.

Who Should Apply For a No Foreign Transaction Fee Credit Card?

Since foreign transaction fees are only charged for purchases outside of the U.S., a credit card without them would not make sense for those who don’t travel abroad. However, such a card may be suitable for those who like to buy goods from other countries online, as this, too, is considered an international purchase and entails a foreign fee.

In all other cases, you’re better off looking at the credit card’s APR or cash back, as these factors will play a much more significant role in your daily life.

How to Choose the Best Card With No Foreign Transaction Fees

To choose the best card among all those that have no transaction fee, you can follow the following plan:

- Decide what you need this credit card for.

If you fly on business trips frequently and want complimentary lounge access, you are better off getting an airline credit card. Or conversely, if you’re looking for an option with plenty of cashback for everyday purchases both domestically and internationally, then you’re better off with a standard travel credit card.

- Pay attention to the remaining fees and APR.

Some credit cards have annual fees of more than $500, so you should carefully read the terms and conditions of the card you like. In addition, if you plan to carry a balance on a credit card, you should choose options with an APR below 20%.

- Find out the bank’s requirements for users.

Your credit score may not be good enough to get the credit card you want, and you should consider alternatives.

Sources Used in Research for the Article:

- Sapphire Reserve® Credit Card, Chase, https://creditcards.chase.com/rewards-credit-cards/sapphire/reserve

- Venture X, Capital One, https://www.capitalone.com/credit-cards/venture-x/

- Sapphire Preferred® credit card, Chase, https://creditcards.chase.com/rewards-credit-cards/sapphire/preferred