Your credit report is one of the most essential pieces of information in your financial life. It’s a document that details your financial history and indicates how likely you are to repay any loan. Your report will help lenders decide whether or not to lend you money and on what terms.

If you’ve ever wondered what a credit report looks like, then you’re in luck. If your file has mistakes or unfavorable information, it can affect your opportunities for financing and leasing real estate for years to come. Read on to find out how to read a report and what it can reveal about you financially.

What is on your credit report?

Your credit report is one of the pillars of your financial profile, so it’s crucial to comprehend precisely what’s included in it. Understanding what’s in your file will give you a better sense of how you can improve your credit score.

Credit bureaus track your borrowing history and monitor your creditworthiness. Your report contains detailed information about your financial history, including unpaid bills, loans, and other debts, as well as negative marks on your file, such as bankruptcies.

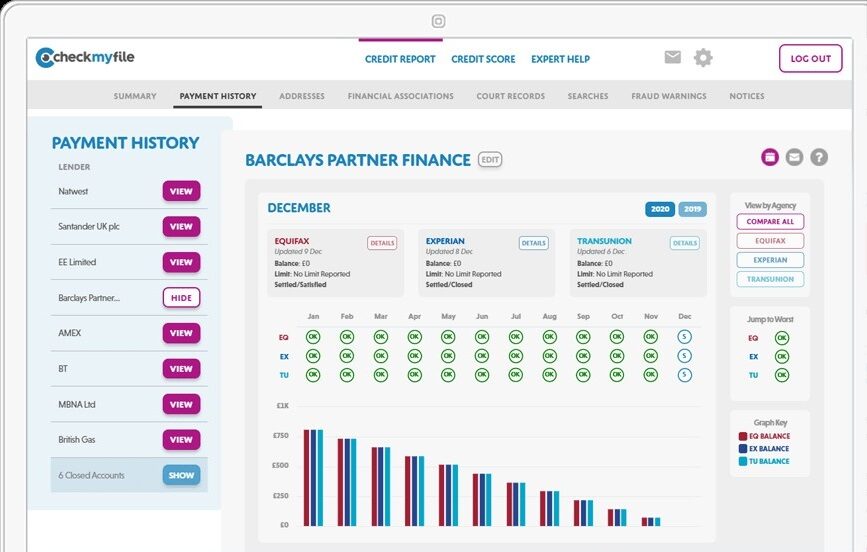

Equifax, Experian, and TransUnion, the three major consumer reporting agencies, compile your financial records and share them with potential lenders. Your report has a lot of information, so let’s review each section.

Personally Identifiable Information

So, what does a credit report look like? Credit reports include several pieces of personal information that appear on them, including:

- The number associated with your Social Security card.

- Addresses you have lived at in the past and currently. It will also display the dates you spent time at each address.

- Your telephone number. This is usually your primary phone number, and sometimes your other numbers if you supply them yourself.

- The date of birth. Your exact birth date, month, and year are included here.

- Your full name, including variations (maiden or married name)

What to check in Personally Identifiable Information?

Ensure your file includes all the correct personal identity information and no typos. There is a possibility that your report has been confused with another person’s report if the name is misspelled (even the middle initial), the address is unrecognizable, the Social Security number has a mistaken digit, or the phone number isn’t your own.

There is no problem if you don’t have all of your employers or phone numbers. Nevertheless, be on the lookout for addresses you are unfamiliar with – especially if you later see accounts you are unfamiliar with. It suggests that someone has opened fraudulent charges in your name using your personal finance information.

Credit Accounts

Your creditors and lenders provide a financial agency with information about your credit accounts. Among the information provided are the amount and loan limit of your accounts, the balance on your bills, your payment history, and the types of accounts you have (vehicle, home, and personal loans). Unreported and closed accounts may not be included in your financial account details.

For lenders to make a lending decision about you, your report will include information about your past and current accounts:

- Any accounts you have should be listed when they were opened. Additionally, you will be able to see the dates of any closed accounts

- Any outstanding loans or debts are included in the account balance

- Mortgages, installments, revolving accounts, etc., are examples of current and historical accounts.

- All current and previous payments are included in the account payment history

- There will be names of all present and previous lenders, companies

What to check in Credit Accounts?

You can see all your credit accounts that haven’t been collected or defaulted in this section. This is the core of a report. At the top of every account is a summary. Make sure to check the following items for any typos or inaccurate reporting.

- Check the account number, the name of the lender, and the date the account was opened

- Check the status of the account, including whether it’s open, closed, or transferred, as well as whether you’re paying on time

- Check the account type is correct (student loan, payday loan credit cards, etc.)

- Check if the account is owned by you or by one of your joint owners; make sure to check if any authorized user accounts are correct

- Check the installment loan’s original amount or limit

Besides account balances and payments, you’ll also see the last time the lender sent information to the bureau. Don’t expect it to reflect your balance immediately. If your card activity was reported mid-billing cycle, your report might show a balance even if you pay your credit cards in full every month.

Check your payment history for errors, such as on-time and late payments. Your account limits should also be correct since they can affect your credit utilization ratio, which affects your score.

Your report will indicate who closed an account and when it was closed. Credit reports can include closed accounts in good standing for an indefinite period. In contrast, creditor-closed accounts for non-payment should disappear seven years after the lender first notified you of the problem.

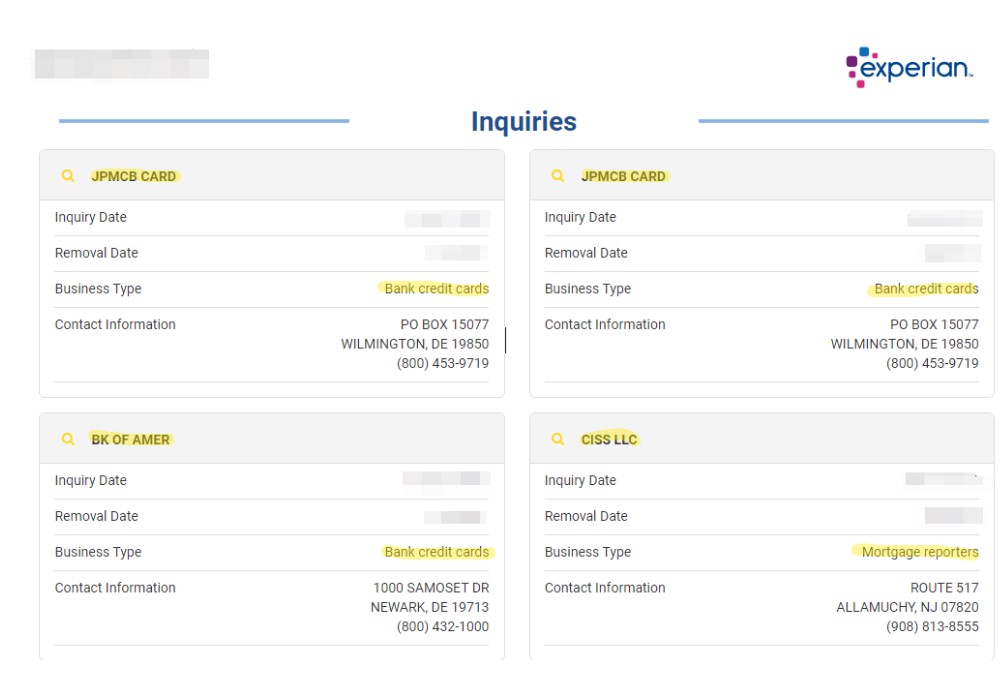

Credit Inquiries

A lender or another individual will review your file if you apply for a new credit card, phone contract, or loan. This is referred to as a hard inquiry. These hard inquiries can negatively affect your score for up to two years.

Checking your statement can result in soft inquiries, as can pre-approvals for credit or insurance or periodic reviews by your current lender. Soft inquiries do not impact your score. In addition, you can identify potential identity theft if you regularly check your report for inaccuracies or incomplete information.

What to check in Credit Inquiries?

Inquiries about your credit history are listed in this section. Your statement will show searches when you apply for new financing or limit increases and those associated with housing and utility applications. There can be a separation of entries based on their type (hard or soft inquiries)

If you have authorized a prospective lender to check your report as part of an application, this will uncut a hard search. You should verify any hard inquiries on your file are correct. If you have checked your file or a potential lender offers a promotional offer, you make a soft inquiry. Ensure any soft checks are correct. The organization’s name and address should be included, no matter the inquiry type. Make sure that you have authorized all inquiries.

All inquiries listed should be removed after two years, so make sure they are up-to-date. A hard search can permanently be removed by filing a dispute.

Identity theft can occur if you notice an inquiry you don’t recognize. An unusual inquiry on your file could indicate that multiple potential lenders pulled your report after applying for a loan. It should be noted, however, that issuers often consider similar close-timed inquiries to be a single inquiry if they occur within a specific time frame (usually 45 days or less).

Get documentation to back up your claim if you find any inaccuracies lowering your scores. You can dispute errors with the reporting bureau if you find errors on your report. Provide copies of documents proving your identity and why the item is incorrect.

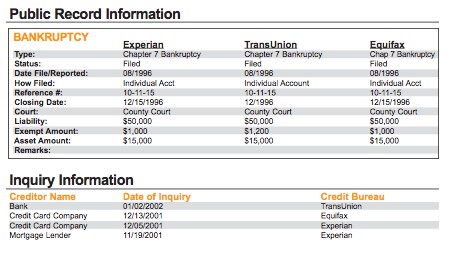

Public Record and Collections

Credit reports include information about election rolls, corrections, and insolvencies. During financial checks, lenders, employers, and landlords frequently use this data as proof of identity. The date on which the bankruptcy was filed, the chapter (kind of bankruptcy), and public records on bankruptcy are recorded in your file.

You will see the foreclosure in your file a month or two after the lender begins foreclosure proceedings. If you miss a payment that leads to foreclosure, the entry will remain on your file for seven years after it was made.

What to check in Public Record and Collections?

In your report, you will find public records about debt. Foreclosures, repossessions, and bankruptcy are among these. Except for bankruptcy filings filed under Chapter 7 (which lasts for ten years), all public records remain on your record for seven years. Each of these shows a pattern of serious delinquency, which can hurt your score. This section does not include infractions unrelated to the law, such as speeding tickets.

Your financial prospects can be seriously affected by public records. Credit report explanations are required if a negative item is included on your file due to a public record. They should consist of your date of birth, name, address, and Social Security number. It is essential to ensure this information is accurate to you and fully completed. If this section is not completed, this will affect your rating.

You shouldn’t find any tax liens on your statement, such as property civil judgments, tax, income, and federal and state tax liens. If a tax lien appears on your statement, the appropriate bureaus should be notified of the error.

Who looks at your credit report?

Someone who wants to know about your credit history will probably check your report. Only those you permit can see your information. Protecting yourself starts with understanding who can see your file and how it affects you. Who can see your report? Here’s what you need to know.

Lenders and potential lenders

Lenders need to see your file when you apply for money to assess how well you have managed to repay the financing in the past. Based on your statement, they will decide whether to give you a loan and the amount and interest rate you’ll pay.

Banks

For instance, your file will be checked by a bank when you apply for a new account. It is also possible that they will want to see your financial behavior to assess the risks associated with having you as a customer.

Landlords and Utility companies

Your file will be checked as part of the mortgage application process. By doing this, they will be able to determine if you can repay your mortgage on time and if you are a reliable borrower. Utility companies typically charge in arrears, which means you’ll pay monthly or quarterly for what you’ve used. As a result, you will use a form of financing when registering with a utility company. A utility company is unlikely to refuse your service if you have bad borrowing history.

Insurance Companies

Insurance companies check your credit history before they decide if they will insure you and, if so, how much your premium will be. Your policy may require you to pay higher premiums if you have a history of late payments or significant debt.

Government Agencies

Some Government agencies have access to your file, such as when preventing crime, collecting taxes, or in legal proceedings. You might not see this access as a search on your file.

Collection Agencies

A lender checks your file when you first apply for a loan. Debt collectors are entitled to check your records to understand your financial situation and make appropriate decisions on how to collect your debt.

Employers or Prospective Employers

Employers don’t need to view your file before making you an offer of employment. In some instances, however, certain employers may need to see your report as part of the screening process if you’ve been offered a job at a financial institution (such as a bank or building society). A credit check may also be required if you’re applying for a career in which you’ll handle large sums of money or have high responsibility levels.

What to do if you find an error on your credit report

As a consumer, you have the right to dispute inaccurate or incomplete information under the Fair Credit Reporting Act (FCRA). If you notify the publishing company of an error, they are required to take specific steps. After you dispute the errors, FCRA requires the company to conduct a reinvestigation.

You should contact the issuing agency and the information provider if you believe your statement contains an error. The dispute should be explained in writing and copies of documents supporting your belief.

When mailing your dispute, be sure to include the following information:

- The first thing you should do is ask for a return receipt so that you will have proof that your letter has been received

- In your letter, request that the incorrect information be amended

- If you are disputing an account, identify the account number clearly

- If available, provide the document confirmation number

- Describe your reasons for disputing the information

- Identify the disputed items on your file by circling or highlighting them. Documents supporting your position should be included as copies (not originals)

- Make sure to include your complete contact information, including your name, address, and phone number

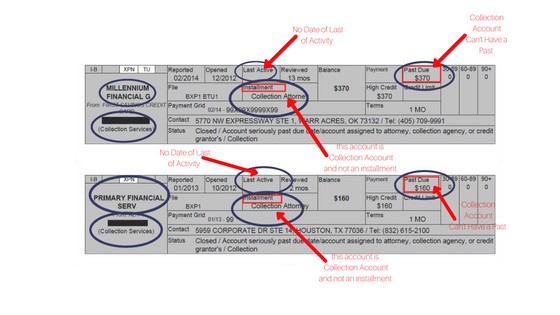

Common credit report errors you should look for on your credit report

Verify that your file only contains information about you when reviewing it. Check for inaccuracies or omissions in the information.

The following are some examples of credit report errors:

- Incorrect balances on accounts

- When multiple lenders are listed for the same account (especially if the account is past due or in the collection)

- Problems with data management

- The date of last payment, opening date, or first delinquency is incorrect

- Despite being just an authorized user, you are displayed as the account owner

- Account status is incorrectly reflected

- Mixed files contain information about two consumers with the same or similar names.

- Errors in identity

- Accounts that are closed are listed as open

- Multiple listings of the same debt

- Previously disputed information is reinstated

- Errors with balances

- Identity theft-related incorrect accounts

- The limit on an account is incorrect

- Your identity information has been incorrectly entered (wrong name, address, and contact information)

- The incorrect recording of late or delinquent accounts

Credit reporting companies

The U.S. has nearly 40 credit bureaus. TransUnion, Equifax, and Experian are the biggest ones. FICO Score and VantageScore are these agencies’ most prominent scoring models. The majority of lending decisions are based on FICO scores.

Under the FCRA law, data collection bureaus are highly regulated private companies. They dominate the financial reporting market in gathering, analyzing, and distributing information about consumers.

You can use companies to check your report, sometimes with a fee, or you can check it yourself with either of the big three companies.

- WalletHub (get daily updates)

- NerdWallet (easy sign-up)

- Credit Karma (for credit monitoring)

- CreditWise (for improving credit)

- Credit Sesame (for single bureau access)

- AnnualCreditReport.com (free credit report)