Not everyone has a solid savings account that may help in case of urgent monetary disruptions or during the crisis.

The total consumer debt in the USA was over 4 billion in February 2020, according to the Federal Reserve.

Many people live paycheck to paycheck, thus any temporary emergency may lead to serious hardship and financial loss. As a result, so-called hardship loans have become widespread.

Here are the ways to acquire the necessary monetary aid in times of hardship. You have multiple options to choose from. Check the details of each method before you make the final decision.

What Is a Hardship Loan?

In times of financial distress, hardship loans can be a valuable resource for individuals and families facing unexpected challenges. If you are in the same boat and want to fulfill your immediate cash need, it may seem a perfect solution for any trouble. But! There is no special lending option named ‘hardship loans’.

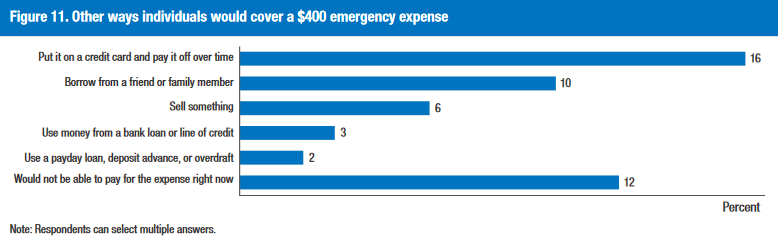

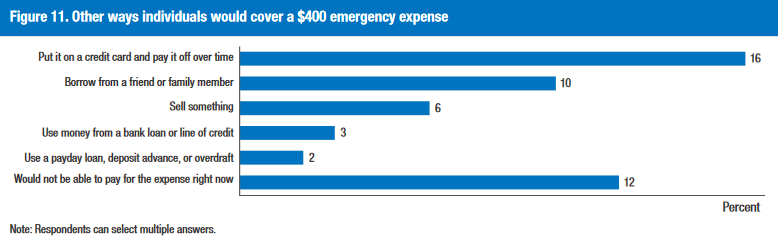

The notion occurred due to cases when people face unforeseen expenses and need to cover them straight away. Some people decide to sell their items, others turn to friends or family members while a certain percentage of consumers has nowhere to go. Thus, they search for financial hardship loans as the only way out. It may seem like an obvious solution, although, it’s not the easiest one.

While such loans can help to improve the current situation for the short term, they may not be that useful in the end because of the high interest rates.

How Does a Hardship Loan Work?

This lending option doesn’t differ from any short-term loan that can be taken for various purposes. Borrowers apply for a certain amount for two or three weeks to fund their needs. If they are eligible and confirm their ability to pay the debt off, the request will be approved.

There are several types of such solutions:

- Short term loans are very common options when consumers feel strapped for cash or need to improve their earning potential by borrowing a small amount for several weeks. The name speaks for itself as this money serves as a cash advance and doesn’t work for long-term solutions. Generally, such hardship personal loans should be repaid the next month or within a few weeks.

- Installment loans work a bit differently. A consumer obtains quick cash that should be returned within a stated time. The payback period may take from a few weeks to years. Installment loans can be beneficial for people with a steady income or full-time employment as they can better allocate a certain sum towards loan repayment. Monthly payments are called installments as they are the parts of the total sum that are paid off. A mortgage is considered to be a type of installment loan.

- Emergency loans are helpful for immediate needs to cover certain expenses or finance big-picture goals. They are most suitable for temporary emergencies and unforeseen events when you don’t have enough cash in savings. Such hardship loans work similarly to small cash advances when the funds should be paid off in one lump sum at the end of the payback term.

Hardship Loans for Bad Credit

Potential borrowers should bear in mind that every lender has its requirements and eligibility criteria. The above-mentioned types may not be suitable for low credit holders as such consumers are considered high-risk. Some companies may offer special hardship loans for poor credit holders, but the terms are typically less beneficial and flexible.

How to Choose The Best Hardship Loan

Are you weathering financial turbulence and seeking the perfect lifeline? Fear not, for we’re here to help you navigate the sea of hardship loan options! With countless choices at your fingertips, it’s crucial to pinpoint the best one for your unique situation.

As your trusty financial compass, we’ll guide you through the critical factors to consider. They include interest rates, repayment terms, and eligibility criteria.

So, buckle up and join us on this captivating journey as we unveil the secrets to selecting the ultimate hardship loan. We are sure that this will put you back on the road to financial stability!

Rates

Embarking on the quest for a hardship loan can feel like navigating a labyrinth of numbers. But fear not, for we’ll help you master the art of rate comparison! In the realm of hardship loans, rates are the lifeblood, determining how much you’ll ultimately repay. With both fixed and variable rates lurking around every corner, it’s essential to be vigilant and discerning.

Keep your eyes peeled for low rates, as they signify a more affordable loan. But beware, the temptation of seemingly attractive rates can be deceptive. Always ensure they are accompanied by favorable repayment terms and conditions.

Arm yourself with knowledge, evaluate various offers, and navigate the rate labyrinth to obtain a hardship loan that aligns with your financial aspirations, paving your way to success!

Loan Amounts

Loan amounts are the essential puzzle piece in your hardship loan adventure. Picking the right amount is crucial, and striking the perfect balance is key. Too little, and you’ll struggle to stay afloat.

Too much, and you risk drowning in debt. Start by assessing your needs. Calculate your required funds to overcome your financial hardship. Now, it’s time to scrutinize loan offers. Remember, bigger isn’t always better.

Borrow only what you need, but be cautious not to undershoot. When comparing loan amounts, don’t forget the bigger picture. Combine this knowledge with rates, terms, and eligibility to make an informed decision. Embrace the power of balance, and let the ideal loan amount guide you toward financial stability and success!

Repayment Terms

Repayment terms are the unsung hero of hardship loan decisions. Like a tightrope walker, you must find the sweet spot between too short and too long. Straying from this balance may lead to a financial tumble. Begin by understanding your budget.

Determine your capacity for monthly payments without straining your finances. Next, explore the loan landscape, keeping your eyes peeled for flexible repayment terms.

Shorter terms mean faster debt freedom but carry heavier monthly burdens. Lengthier terms lighten your monthly load but extend your debt journey.

Weigh your options, and remember: one size doesn’t fit all. By carefully selecting the right repayment term, you’ll gracefully traverse the financial tightrope and step into a safe future.

Reputation Of The Lender

The reputation of the lender is a vital yet often overlooked factor in the hardship loan saga. A trustworthy lender can be your guiding star, leading you to financial solace; a shady one, a treacherous path to ruin.

So, how to separate the wheat from the chaff? Begin your detective work by investigating online reviews. Genuine feedback from fellow borrowers can illuminate the lender’s true colors. Watch out for red flags, like hidden fees or poor customer service.

Don’t stop there, verify their credentials. Are they accredited? Do they have a solid history? Remember, knowledge is power. By diligently scrutinizing a lender’s reputation, you’ll forge a reliable partnership and sail confidently toward the shores of financial recovery.

Should I Use Emergency Hardship Loan?

To use or not to use an emergency hardship loan? That is the question we must unravel in this thrilling tale of financial conundrums. Like a rare elixir, a hardship loan can offer potent relief in times of distress. But beware, for it may not be the panacea for all!

Should you find yourself amidst a tempest of unexpected medical expenses, job loss, or natural disasters, this financial potion can help steady your ship.

However, prudence is your ally. Exhaust all alternatives before uncorking this vial. Government assistance, personal savings, and assistance from friends or family may prove to be safer routes.

Tread lightly, for hardship loans can be a double-edged sword. Unsuitable for chronic financial woes or frivolous pursuits, they may deepen your fiscal quagmire if misused.

By heeding the whispers of wisdom, you’ll discern when to embrace the elixir and when to leave it corked, steering you toward a safe and sound future.

How To Get Hardship Loan

Gather ’round, intrepid explorers, for we are about to embark on an exhilarating quest to unravel the mysteries of acquiring a hardship loan! This step-by-step guide will help you through the twists and turns of this financial expedition. It will equip you with the tools needed to emerge victorious.

Step 1: Assess your needs. Delve deep into the heart of your financial troubles and determine the amount you require to overcome adversity.

Step 2: Research, research, research! Like a cartographer mapping uncharted lands, explore the vast landscape of hardship loan options. Consider interest rates, loan amounts, repayment terms, and lender reputations.

Step 3: Prepare the parchment. Assemble the necessary documents—proof of income, credit reports, and a letter detailing your hardship. Leave no stone unturned, for a well-prepared application is a formidable weapon.

Step 4: Approach the lender’s lair. With your knowledge arsenal, engage your chosen lender and submit your application. Be prepared to negotiate terms, as flexibility is the key to success.

Step 5: Await your fate. The lender will evaluate your application, and if the stars align, you’ll be granted the coveted hardship loan.

Step 6: Tread wisely. Once the loan is disbursed, ensure timely repayments to avoid spiraling into a financial abyss.

How Can I Get a Hardship Loan with Bad Credit?

Such a question is widespread these days as many consumers have little or no savings and can hardly make it through urgent monetary disruptions. There are a few solutions available for low credit holders but you may need to do some research to find a reputable creditor willing to issue the cash to you.

Keep in mind that the interest rates and APRs for such options can often be much higher as creditors take higher risks in case of default or non-payment. Do your research for a trusted creditor or agency with real positive feedback. Review the rates and make certain the company has solid customer support to resolve any issues.

- Government hardship loans. The U.S. government may provide certain monetary aid. It is necessary to review the requirements and eligibility criteria. Generally, low-income households and single mothers may acquire financial support from the government. When you have no steady job or are unemployed and face emergency medical expenses, for example, you may qualify for governmental assistance.

- 401(k) hardship withdrawals. You may have a 401(k) plan used for saving towards retirement. And you may know that you can’t take out this cash to use it whenever you want. Your plan consultant or administrator may explain the details of when such withdrawal is possible. Typically, hardship loan on 401k may be possible for such purposes as medical costs, tuition fees, funeral expenditures, home repair costs, and/or loss of main income.

Moreover, you will need to provide special papers to prove that you experience a shortfall and have no other choice except to withdraw cash from your retirement savings.

Experts suggest thinking twice before deciding to take out this money. You may resolve present issues but end up having more trouble in the future when you don’t have enough funds saved for a comfortable retirement. It pays to be careful and look through your 401k hardship loan rules to check if you can qualify and don’t lose much opting for this solution.

Forbes reports that the average student loan debt in the USA equals $32,731 in 2020, while the total amount of debt for 44,7 million students is over $1,5 trillion.

- Home equity loans are another widespread way to fund small-ticket expenses such as educational fees, medical costs, or credit card debt. It is not used for large expenses though it might also be a solution suitable for homeowners in need of the cash amount that is equivalent to their house equity. Lenders usually give out a full amount at once that should be paid off over a certain time frame.

Hardship Loan Alternatives

While not everyone is eager to apply for the above-mentioned options due to higher rates, extra charges, and other pitfalls, there are several alternative methods for getting immediate cash.

- Credit cards may be a great alternative provided that they are used by accountable and serious holders. They might come with high rates as well so it is recommended to repay the balance in full every month. Otherwise, this alternative won’t differ much from the above-mentioned solutions.

- Peer-to-peer lending is a type of financing fulfilled by separate investors and individuals willing to fund the loan for the short or medium term. This method is quite popular among consumers as it offers lower rates compared to traditional finance-related service providers and often comes with more suitable terms. You can find various platforms for P2P lending and try this solution.

- Borrowing from family and friends is one of the most comfortable and cheapest hardship solutions. It often comes with lower or no interest. However, this method may put your relationship at risk in case of non-payment. Always sign an agreement between you and the person giving you the cash so that both sides are protected and your relationship isn’t ruined because of money matters.

- Secured loan is also a widespread alternative that offers better conditions but stricter demands compared to other methods. It comes with lower interest but requires collateral to secure the loan. Also, you need a steady income and a decent credit rating. Otherwise, you may waste your time and get denied.

- Loan or mortgage modifications. If you suddenly face a job loss or other immediate hardship, you may resort to this alternative as a way to lower your loan/mortgage payments. The monthly interest or regular payments might be reduced. But you need to review the terms of your contract to find out how this option may affect the longevity and other features of the loan.

Hardship Loans for Veterans & Active-Duty Military

Are you an active-duty service member or a veteran? There is a suitable alternative from traditional lending institutions available for you.

Personal lending options are provided by Navy Federal Credit Union for up to $50,000 and a period of up to 60 months. Moreover, members of the USAA Bank may qualify for loans with 6.99% APR and acquire up to $50,000 for various purposes. Pay attention that such an alternative method requires a good credit rating as it is offered by a traditional bank. In case the score is below average, the request may be rejected or accepted with a higher APR.

Here are the ways to acquire the necessary monetary aid in times of hardship. You have multiple options to choose from. Check the details of each method before you make the final decision.

What Is a Hardship Loan?

In times of financial distress, hardship loans can be a valuable resource for individuals and families facing unexpected challenges. If you are in the same boat and want to fulfill your immediate cash need, it may seem a perfect solution for any trouble. But! There is no special lending option named ‘hardship loans’.

The notion occurred due to cases when people face unforeseen expenses and need to cover them straight away. Some people decide to sell their items, others turn to friends or family members while a certain percentage of consumers has nowhere to go. Thus, they search for financial hardship loans as the only way out. It may seem like an obvious solution, although, it’s not the easiest one.

While such loans can help to improve the current situation for the short term, they may not be that useful in the end because of the high interest rates.

How Does a Hardship Loan Work?

This lending option doesn’t differ from any short-term loan that can be taken for various purposes. Borrowers apply for a certain amount for two or three weeks to fund their needs. If they are eligible and confirm their ability to pay the debt off, the request will be approved.

There are several types of such solutions:

- Short term loans are very common options when consumers feel strapped for cash or need to improve their earning potential by borrowing a small amount for several weeks. The name speaks for itself as this money serves as a cash advance and doesn’t work for long-term solutions. Generally, such hardship personal loans should be repaid the next month or within a few weeks.

- Installment loans work a bit differently. A consumer obtains quick cash that should be returned within a stated time. The payback period may take from a few weeks to years. Installment loans can be beneficial for people with a steady income or full-time employment as they can better allocate a certain sum towards loan repayment. Monthly payments are called installments as they are the parts of the total sum that are paid off. A mortgage is considered to be a type of installment loan.

- Emergency loans are helpful for immediate needs to cover certain expenses or finance big-picture goals. They are most suitable for temporary emergencies and unforeseen events when you don’t have enough cash in savings. Such hardship loans work similarly to small cash advances when the funds should be paid off in one lump sum at the end of the payback term.

Hardship Loans for Bad Credit

Potential borrowers should bear in mind that every lender has its requirements and eligibility criteria. The above-mentioned types may not be suitable for low credit holders as such consumers are considered high-risk. Some companies may offer special hardship loans for poor credit holders, but the terms are typically less beneficial and flexible.

How to Choose The Best Hardship Loan

Are you weathering financial turbulence and seeking the perfect lifeline? Fear not, for we’re here to help you navigate the sea of hardship loan options! With countless choices at your fingertips, it’s crucial to pinpoint the best one for your unique situation.

As your trusty financial compass, we’ll guide you through the critical factors to consider. They include interest rates, repayment terms, and eligibility criteria.

So, buckle up and join us on this captivating journey as we unveil the secrets to selecting the ultimate hardship loan. We are sure that this will put you back on the road to financial stability!

Rates

Embarking on the quest for a hardship loan can feel like navigating a labyrinth of numbers. But fear not, for we’ll help you master the art of rate comparison! In the realm of hardship loans, rates are the lifeblood, determining how much you’ll ultimately repay. With both fixed and variable rates lurking around every corner, it’s essential to be vigilant and discerning.

Keep your eyes peeled for low rates, as they signify a more affordable loan. But beware, the temptation of seemingly attractive rates can be deceptive. Always ensure they are accompanied by favorable repayment terms and conditions.

Arm yourself with knowledge, evaluate various offers, and navigate the rate labyrinth to obtain a hardship loan that aligns with your financial aspirations, paving your way to success!

Loan Amounts

Loan amounts are the essential puzzle piece in your hardship loan adventure. Picking the right amount is crucial, and striking the perfect balance is key. Too little, and you’ll struggle to stay afloat.

Too much, and you risk drowning in debt. Start by assessing your needs. Calculate your required funds to overcome your financial hardship. Now, it’s time to scrutinize loan offers. Remember, bigger isn’t always better.

Borrow only what you need, but be cautious not to undershoot. When comparing loan amounts, don’t forget the bigger picture. Combine this knowledge with rates, terms, and eligibility to make an informed decision. Embrace the power of balance, and let the ideal loan amount guide you toward financial stability and success!

Repayment Terms

Repayment terms are the unsung hero of hardship loan decisions. Like a tightrope walker, you must find the sweet spot between too short and too long. Straying from this balance may lead to a financial tumble. Begin by understanding your budget.

Determine your capacity for monthly payments without straining your finances. Next, explore the loan landscape, keeping your eyes peeled for flexible repayment terms.

Shorter terms mean faster debt freedom but carry heavier monthly burdens. Lengthier terms lighten your monthly load but extend your debt journey.

Weigh your options, and remember: one size doesn’t fit all. By carefully selecting the right repayment term, you’ll gracefully traverse the financial tightrope and step into a safe future.

Reputation Of The Lender

The reputation of the lender is a vital yet often overlooked factor in the hardship loan saga. A trustworthy lender can be your guiding star, leading you to financial solace; a shady one, a treacherous path to ruin.

So, how to separate the wheat from the chaff? Begin your detective work by investigating online reviews. Genuine feedback from fellow borrowers can illuminate the lender’s true colors. Watch out for red flags, like hidden fees or poor customer service.

Don’t stop there, verify their credentials. Are they accredited? Do they have a solid history? Remember, knowledge is power. By diligently scrutinizing a lender’s reputation, you’ll forge a reliable partnership and sail confidently toward the shores of financial recovery.

Should I Use Emergency Hardship Loan?

To use or not to use an emergency hardship loan? That is the question we must unravel in this thrilling tale of financial conundrums. Like a rare elixir, a hardship loan can offer potent relief in times of distress. But beware, for it may not be the panacea for all!

Should you find yourself amidst a tempest of unexpected medical expenses, job loss, or natural disasters, this financial potion can help steady your ship.

However, prudence is your ally. Exhaust all alternatives before uncorking this vial. Government assistance, personal savings, and assistance from friends or family may prove to be safer routes.

Tread lightly, for hardship loans can be a double-edged sword. Unsuitable for chronic financial woes or frivolous pursuits, they may deepen your fiscal quagmire if misused.

By heeding the whispers of wisdom, you’ll discern when to embrace the elixir and when to leave it corked, steering you toward a safe and sound future.

How To Get Hardship Loan

Gather ’round, intrepid explorers, for we are about to embark on an exhilarating quest to unravel the mysteries of acquiring a hardship loan! This step-by-step guide will help you through the twists and turns of this financial expedition. It will equip you with the tools needed to emerge victorious.

Step 1: Assess your needs. Delve deep into the heart of your financial troubles and determine the amount you require to overcome adversity.

Step 2: Research, research, research! Like a cartographer mapping uncharted lands, explore the vast landscape of hardship loan options. Consider interest rates, loan amounts, repayment terms, and lender reputations.

Step 3: Prepare the parchment. Assemble the necessary documents—proof of income, credit reports, and a letter detailing your hardship. Leave no stone unturned, for a well-prepared application is a formidable weapon.

Step 4: Approach the lender’s lair. With your knowledge arsenal, engage your chosen lender and submit your application. Be prepared to negotiate terms, as flexibility is the key to success.

Step 5: Await your fate. The lender will evaluate your application, and if the stars align, you’ll be granted the coveted hardship loan.

Step 6: Tread wisely. Once the loan is disbursed, ensure timely repayments to avoid spiraling into a financial abyss.

How Can I Get a Hardship Loan with Bad Credit?

Such a question is widespread these days as many consumers have little or no savings and can hardly make it through urgent monetary disruptions. There are a few solutions available for low credit holders but you may need to do some research to find a reputable creditor willing to issue the cash to you.

Keep in mind that the interest rates and APRs for such options can often be much higher as creditors take higher risks in case of default or non-payment. Do your research for a trusted creditor or agency with real positive feedback. Review the rates and make certain the company has solid customer support to resolve any issues.

- Government hardship loans. The U.S. government may provide certain monetary aid. It is necessary to review the requirements and eligibility criteria. Generally, low-income households and single mothers may acquire financial support from the government. When you have no steady job or are unemployed and face emergency medical expenses, for example, you may qualify for governmental assistance.

- 401(k) hardship withdrawals. You may have a 401(k) plan used for saving towards retirement. And you may know that you can’t take out this cash to use it whenever you want. Your plan consultant or administrator may explain the details of when such withdrawal is possible. Typically, hardship loan on 401k may be possible for such purposes as medical costs, tuition fees, funeral expenditures, home repair costs, and/or loss of main income.

Moreover, you will need to provide special papers to prove that you experience a shortfall and have no other choice except to withdraw cash from your retirement savings.

Experts suggest thinking twice before deciding to take out this money. You may resolve present issues but end up having more trouble in the future when you don’t have enough funds saved for a comfortable retirement. It pays to be careful and look through your 401k hardship loan rules to check if you can qualify and don’t lose much opting for this solution.

Forbes reports that the average student loan debt in the USA equals $32,731 in 2020, while the total amount of debt for 44,7 million students is over $1,5 trillion.

- Home equity loans are another widespread way to fund small-ticket expenses such as educational fees, medical costs, or credit card debt. It is not used for large expenses though it might also be a solution suitable for homeowners in need of the cash amount that is equivalent to their house equity. Lenders usually give out a full amount at once that should be paid off over a certain time frame.

Hardship Loan Alternatives

While not everyone is eager to apply for the above-mentioned options due to higher rates, extra charges, and other pitfalls, there are several alternative methods for getting immediate cash.

- Credit cards may be a great alternative provided that they are used by accountable and serious holders. They might come with high rates as well so it is recommended to repay the balance in full every month. Otherwise, this alternative won’t differ much from the above-mentioned solutions.

- Peer-to-peer lending is a type of financing fulfilled by separate investors and individuals willing to fund the loan for the short or medium term. This method is quite popular among consumers as it offers lower rates compared to traditional finance-related service providers and often comes with more suitable terms. You can find various platforms for P2P lending and try this solution.

- Borrowing from family and friends is one of the most comfortable and cheapest hardship solutions. It often comes with lower or no interest. However, this method may put your relationship at risk in case of non-payment. Always sign an agreement between you and the person giving you the cash so that both sides are protected and your relationship isn’t ruined because of money matters.

- Secured loan is also a widespread alternative that offers better conditions but stricter demands compared to other methods. It comes with lower interest but requires collateral to secure the loan. Also, you need a steady income and a decent credit rating. Otherwise, you may waste your time and get denied.

- Loan or mortgage modifications. If you suddenly face a job loss or other immediate hardship, you may resort to this alternative as a way to lower your loan/mortgage payments. The monthly interest or regular payments might be reduced. But you need to review the terms of your contract to find out how this option may affect the longevity and other features of the loan.

Hardship Loans for Veterans & Active-Duty Military

Are you an active-duty service member or a veteran? There is a suitable alternative from traditional lending institutions available for you.

Personal lending options are provided by Navy Federal Credit Union for up to $50,000 and a period of up to 60 months. Moreover, members of the USAA Bank may qualify for loans with 6.99% APR and acquire up to $50,000 for various purposes. Pay attention that such an alternative method requires a good credit rating as it is offered by a traditional bank. In case the score is below average, the request may be rejected or accepted with a higher APR.

Here are the ways to acquire the necessary monetary aid in times of hardship. You have multiple options to choose from. Check the details of each method before you make the final decision.