It’s only Monday morning but you already find yourself counting down to Friday each week? Well, you are not alone. Just because we are all in different colors, shapes, and sizes, it doesn’t mean we don’t have common wishes. And one of those is about early retirement.

In times where many earn generous incomes, some choose to earn less. Thing is, some can’t wait to retire ASAP, and others hope to attain financial independence and never stop working.

Dreaming of retiring early? Well, it’s a struggle for many. Unless you live on a desert island somewhere, it’s likely you’ve heard of the FIRE Movement.

According to the United Income finding, the share of retirement-age Americans in the labor force has doubled since 1985. In times where early retirement is a choice for some, it becomes a necessity for others.

Over 20 percent of 65-aged Americans or older are working or looking or work.

The dream of retiring early seems unattainable for many Americans.

Retiring early won’t just happen. It requires discipline, rigorous planning and budgeting, smart investing, and living frugally.

The trick here is to understand what age ‘early’ does mean to you.

Do you know what you want to do in retirement? Financial gurus promote numerous paths to early retirement but which one to take depends on your plan.

So, whatever drives you, you need a serious plan.

What Is the FIRE Movement?

Different things make us tick and we plan different budgets to become financially free.

Is your goal to retire at 30, 35, or whatever? Wrong goal.

Instead, the focus should be on financial freedom, that could help you retire early. Key difference.

In a nutshell, the FIRE (Financial Independence, Retire Early) movement sounds nothing like a retirement planning strategy but a movement where people target to save their cash to retire earlier.

Simply put, fans of the fire lifestyle have to maximize their income and reduce their spending while at work. The result? They’ll be able to retire early – by 45 (often the target age).

So, what is financial independence?

While the financial independence definition might mean different things to different people, typically it means that you no longer have to rely on a job to cover your expenses.

So, once your investments start paying more than your expenses, congrats, you’re financially independent.

If you are a proponent of the F.I.R.E. community, then you know how the FIRE movement started. Launched as a pure personal finance project, FIRE philosophy got in weight and followers over time.

The year 1992, Vicky Robins and Joe Domingues released the book ‘Your Money or Your Life’. The idea behind it is simple – people might be better off consuming less and saving a lot more.

In the 2010s, Pete Adeney who retired at the age of 30, got the premiere of his blog named Mr.Money Mustache or MMM for short. The initial aim is to help people think that real quality of life doesn’t stem from spending more money.

Sounds great right?

Ultimately, the Financial Independence Retire Early movement is not about wealth. Instead, it’s more about reaching financial independence that gives you control to manage your working years. Once you’ve identified the number that means ‘enough’ to reach financial independence, it’s easier to decide whether to stop working or not.

Who Is FIRE for?

In general, anyone can strive for FIRE retirement. Just because a FIRE retirement plan is more about controlling what you spend, the first question to ask is how much?

Let’s say, you’re spending 100 percent or even more of your income. The result? Well, nothing good. You’ll never be prepared to retire. Unless of course someone else (parents, social security, pension fund, etc.) is doing the saving for you. And lastly, your work career will have no end in sight.

Okay, what if you’re spending zero percent of your income? We won’t dive deeper into how you can manage to live for free but focus on retirement goals. The effect? You can end up with a zero-working career.

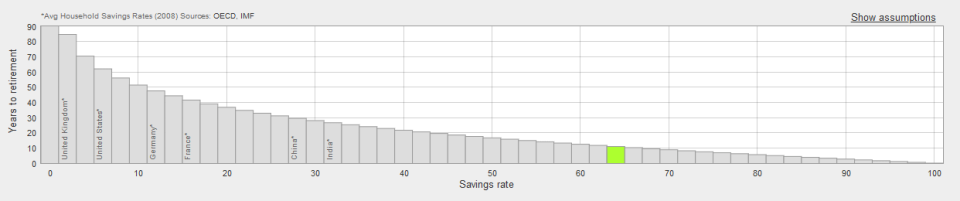

As you can see, both paths can’t be considered as used by many. And when it comes to numbers that are in between, the picture looks much more realistic. Take a look for yourself. The graph below can help make a long story short: the higher your savings rate, the fewer working years you get until retirement.

Want to retire in 10 years? Great, get ready to spend only 35 percent of your income. Find it rather tough? Start by spending 50 percent of your income. The average time you’ll have for retirement is 16 years. Anyway, it’s up to you to decide the ‘enough’ number that can help you speed up your FIRE retirement plan.

What is the best way to learn that you are on track to reach financial independence or retire early?

Indeed, the solution is right in front of you – use the Financial Independence Retire Early calculator. There are numerous options you can choose from. But it makes sense to start with the simple one that will require 3-5 inputs to give you the number.

Why the F.I.R.E. Movement May Not Be for Everyone?

Before you decide to join the FIRE finance community, let’s dive deeper and learn what it’s all about. Those who decide to achieve financial independence by their early 30s are sure they have a stable income.

Okay, after your debt is destroyed, it’s easy to save every last coin available and get that stable income. And that’s great. There is nothing wrong with that. Yet, the sad truth is that many FIRE lifestyle proponents go beyond that.

If you haven’t heard stories about those who live uncomfortably in shack sized apartments or those who ignore their friends because they are too focused on retire early lifestyle, it doesn’t mean they don’t exist. Quite the contrary.

With the initial goal to become financially independent early in life, FIRE proponents accept to save from ten to fifteen years to become financially independent and retire early. In general, the whole idea to achieve full financial freedom early in life is great but the truth is it has its price.

Forget About Fire Method If:

- You are married

If your partner is head to toes in the FIRE method with you, it may work. It way also work if you plan to live a selfish single life with no kids. Otherwise, FIRE planning won’t work for you either.

- Your future is more expensive than you think

“Retirement is like a long vacation in Las Vegas. The goal is to enjoy it the fullest, but not so fully that you run out of money.” – Jonathan Clements

Don’t you think that putting your entire life in the hands of the Federal Government is safe? In fact, get ready to live dangerously understanding that you’re not financially independent.

Think this way. What if the economy will take a huge hit tomorrow? What about inflation that will rise rapidly and your money is worth 85 percent of what it was yesterday? Are you ready for that?

Your answer? Will you just go back to work the next day? Fat chance.

- Your societal relevance can collapse

Imagine you’re a young woman who stayed at home with her children for several years. In fact, it can be a reality for many.

Now, you have a large employment gap on your resume. Also, you are missing some skills necessary to apply to modern jobs. Indeed, if you haven’t worked for all these years from home as a freelancer or used to learn new skills on your own.

But if you’re financially independent, with a couple of million dollars and absolutely no debt – does it really matter to you?

All these things sound great until you realize that your funds are not limited and one day you can end up living below your means with no money. What if you want to have kids? What if you feel unfulfilled in life? Well, chances are high you’ll not be able to live a lucrative life without giving back to the world.

- You are not ready to sacrifice your early years and live in poverty for the sake of ‘the perfect life’

As an old saying goes, all in good time, you know. Are you ready to sacrifice a tremendous amount of comfortability? What about time with friends and family? There are great experiences to be had living while you are young. So, it all boils down to want matters to you.

What We Can Learn from the F.I.R.E. Movement

When on the hunt for solutions on how to retire early, don’t forget that early retirement movement is not for everyone. In fact, it’s possible but it requires planning, sacrifices, and focus on long term goals. Recognize that frugality is one of the main tools in the toolbox of FIRE proponents. Everyone away from it has almost zero chance to benefit from it.

Without a doubt, being financially independent is great but when it comes to vacation time, health insurance or sick time, will you replace them? If yes, then how?

Ready to join the retire early community? Great, then here are several things to start doing right now.

5 Rules Behind FIRE

- Embrace a frugal lifestyle.

- Save like crazy – min 75 percent of your income and more.

- Once you have enough support to live that frugal lifestyle – consider yourself free to retire.

- Know your risks.

- Find the true FIRE walkers who are well on their way to financial freedom.

It goes without saying that FIRE investing can bring great results. There are a half-dozen families that are already reaping the benefits in the early retirement of their own. These people don’t appear top in the search engine results, yet, they exist and encourage others to live a debt-free life.

So, if you’re really interested in FIRE savings, do a bit of exploring.

10 Steps to Financial Independence Retire Early

To retire as early as possible, your saving and investing have to be quite aggressive. So, if you decide that fire terms suit you right off the bat, there are several steps to help get you started.

- Cut housing costs

Without a doubt, housing costs are one of the biggest outgoings every month. So, get ready to cut housing costs as the first step to your financial independence.

- Spend less on food

Forget about healthy & various food, eating out with friends and family. Say hello to packed lunches and batch cooking. Get ready to spend less on food & drinking. Think of it as a necessity, no more.

- Set realistic goals

First, define FIRE goals for yourself. Remember these need to be realistic and attainable goals, not a yacht or a penthouse suite. Think of what matters to you and set a plan.

- Embrace the minimalist style

Forget about brand-new clothes or luxury things. From now on, your experiences and memories are on the rate of gold.

- Eliminate debt

Paying off your debt is the other key step when it comes to getting started with a FIRE lifestyle. Closing debts from the high-interest credit cards to lower-interest loans would be your smart approach.

- Crunch the numbers

How early do you plan to retire? In your 30s, 40s, or 50s? Make calculations to learn how much you need to accumulate before you give up work.

- Start early

In fact, the earlier you start investing, the bigger the number of how much you save. So, you’d better start today or better yesterday to achieve a better result in the future.

- Start a side hustle, get a raise, and build new skills

At last count, most of the jobs that will exist in 20 years haven’t been created yet. Today, being an expert in one thing is a bad idea. Much better if you have a broad range of complementary skill sets.

- Track your net worth and investment performance

Keeping track of where you are on your journey to financial freedom is always smart. Calculate your net worth and check it over time to see how well you’re doing.

- Make a habit of buying used cars, reduce your monthly phone bill or simply cut the cord

4 Myths About FIRE And Early Retirement

Now when you know FIRE definition and the main idea behind it, why not learn some myths about it?

- You need to live an extremely frugal life

The truth is, frugality means here living a more moderate lifestyle. It doesn’t mean that you need to steal toiletries from fast-food restaurants to save a few bucks. Instead, it’s more about directing your efforts towards what’s important.

- Healthcare will cost you an arm and a leg

Difficult to argue. But you can still take advantage of medical services with more careful planning. Think on our feet and join health share ministries, enjoy medical tourism, and the like.

- People stop working completely

It’s not always true. Early retirement doesn’t always mean the end of employment. Who said that hobbies can’t produce income? Why not start a side hustle that brings profit?

- You’re gonna be bored in a few years

Just because someone gets bored without a boss telling what to do every day doesn’t mean you would be bored, too. We are all unique and have many interests. With the right life list right at your fingertips, no need to worry about being bored in early retirement.

Summing Up

It’s easy to find even more myths related to FIRE movement like the higher chance of death after retirement, or having no identity without work. The key thing here is understanding that the FIRE lifestyle has both its pros and cons anyway. So, there will always be those who accept this conception and those who stand tall against it. Yet, never say you did it without even tried it.

If you’re serious about early retirement, consider all the pros and cons, challenges and benefits from every angle. Then, start planning. Building financial freedom is about controlling how much you can save and spend. So what’s your choice?