Big purchases ask for big investments, but it’s not always easy to find the money to cover another expense. What’s then? In this case, a loan comes to the fore. You must be familiar with the way loans work.

You send an application to the lender, provide all the information about your income, and get approved for bad credit loans Florida. Or you can be rejected, which happens quite often. Is it a coincidence, bad lack, or insufficient research? The most frequent case why applicants are rejected is a bad score.

It’s a challenge to earn those precious points and reach at least the “good” bar in the game. What if you don’t have to work hard to reach the desired score? Bad credit can narrow down your chances of borrowing.

However, with the right approach, you can find the best lenders for loans for bad credit Florida. And this article will tell you more about the opportunities even for borrowers with bad credit.

Bad Credit Loans in Florida: Best Lenders

What is a bad score? Anything lower than 669 is considered to be fair or poor for a loan application. Have you been in the same situation when the score isn’t excellent for a big loan application? It’s not an issue anymore.

We’ve carefully researched the market to provide you with the top lenders for bad credit. Your big purchase dreams can come true with almost no effort if you check the following options. These are the granters with the minimum score needed yet reliable services and nice reviews from the clients.

Payoff

With PayOff, a reliable peer-to-peer lender, you can expect a $5,000 to $50,000 loan for debt consolidation. Why do you need to consider PayOff loans for bad credit Florida? Here are a couple of reasons why it could work out for your case. The first reason is a competitive APR. You won’t also hurt your score even more because the service offers a soft pre-check procedure.

- 5.99% to 22.59% APR

- 0% and 5% origination fee

- 24 to 60 months repayment conditions

- minimum 640 score

What are some other reasons to try this lender? As a borrower, you may be packed with questions no one can answer. However, it’s not the case for the PayOff service. There are many agents ready to answer your call and help with the process.

Who is it best for? You don’t need an excellent score because 640 is already enough to apply. Furthermore, there is a prequalification option on the website, so you 100% know whether you fit in. However, there’s no option to use a co-signer, so make sure to keep that in mind.

OppLoans

What can be better than a short-term loan for bad credit? OppLoans is a service with truly beneficial offers for poor credit owners in Florida. The best part about this loan is the absence of a check. Borrowers don’t have to qualify with a specific score number. It’s an excellent opportunity for those who need cash but are still working on their payment history and status.

- 59% – 160% APR

- no origination, prepayment, or late fees

- 9 to 18 months terms

- no minimum score required

It’s an affordable loan, but it can stagger you with the interest rate. For this reason, make sure you calculate the amount of your future loan and don’t request more than you can pay off. It’s a lifesaver for those whose borrowing alternatives have already been exhausted.

What do you need to qualify? Make sure your stable income is higher than $1,500 and you have been using a bank account for the past 40-day period minimum. If you can find a branch in your state, you’re good to go and borrow money.

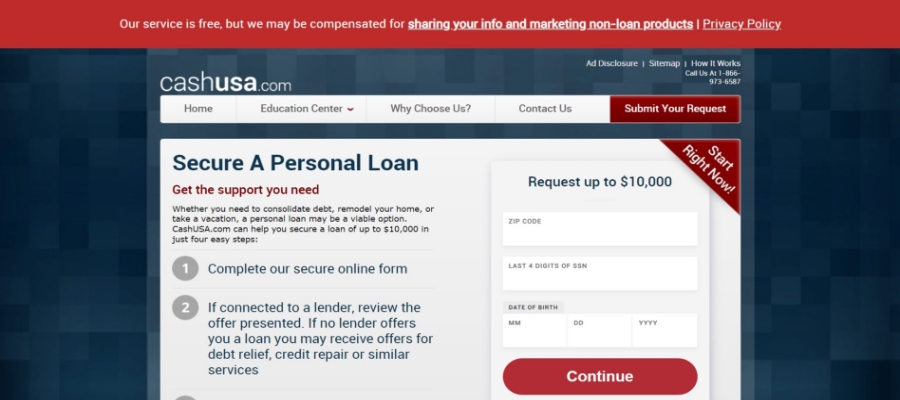

CashUSA

This is an online platform where money lenders are linked to credit borrowers for loans up to $10,000. You can get virtually all kinds of loan offers with CashUSA, from a personal loan to a debt consolidation loan. To qualify for a loan on the platform, you must be 18 years and above and reside in any of the states in the USA.

The platform is best for users with checking accounts and a minimum monthly income of at least $1000. The minimum loan amount available on CashUSA is $500, and there’s a repayment term of up to 6 years (72 months). CashUSA has an interest rate of 5.99% – 35.99%, and you can access the funds 24/7. To apply for a loan, you may need a minimum credit score of 579.

Advantages:

- Low minimum annual percentage rate of 5.99%.

- Repayment terms range from 90 days to 72 months.

- Loan payment to your designated account by the next business day.

- Fast and easy registration process.

- Customer service is available 24/7

Disadvantages

- Maximum loan amount is low.

- High maximum APR.

- CashUSA is not one of the direct lending companies.

- A credit check may apply, depending on the lender you’re linked with.

Tropical FCU

If you have experience with online lenders or banks in Florida, you may also want to try working with a union. Why? As a union member, you will benefit from the handy loan management options.

There’s an online application version, a handy website, and other contact details to reach out to the experts and seek help. But you can also grab a coffee and come by the nearest physical branch in your county.

- 2.55% to 16.99% APR

- no origination or prepayment fees

- 24 to 60 months repayment terms

- no minimum score required

The union is secured from common fraud tactics, meaning your investments and income will be safely protected in one place. Fraud prevention and reports make this union a good place to trust your cash.

One more great advantage is the terms the union features. Among the wide range of loan options, you can choose the one that appeals to you the most and checks. They are competitive and will make you have the final decision fast.

Happy Money

If you ever find yourself in credit card debt and in need of debt consolidation, Happy Money is your best option. The loan application process is only viable for individuals with credit cards and a credit score of at least 640. With Happy money, you get your funds approved within 24 – 48 hours into your credit account.

However, this loan isn’t available for residents of Massachusetts and Nevada. Happy Money has a low APR rate, broad amounts, an originating fee, and long repayment terms. As the loan is only for consolidation, it’s prohibited for large purchases, home expenses, and emergency funds. The lender also takes into account your debt to income ratio, credit history, and owed payments to other lenders.

Advantages:

- Your credit card providers can be paid directly by Happy Money.

- Low interest rates of 10.50% – 29.99%.

- No application or late payment fee.

- No prepayment penalties.

- Great customer experience, with the support service available 24/7.

Disadvantages

- Credit score requirements apply.

- Loan is restricted to consolidation on your credit card only.

- A loan origination fee of up to 5% applies.

- Joint application isn’t allowed.

- High minimum loan amount of $5,000.

- Low minimum loan amount of $40,000.

LendingClub

Do you want to save on the rates and lower them to win from the loan deal in the end? LendingClub is a trustworthy partner. However, it can have rather high rates. With all the benefits provided by the service, its rate can sometimes be over expectations. In this case, you can easily find a co-borrower and lower the rate to make the terms acceptable for both parties.

- 8.30% – 36.00% APR

- 1% to 6% origination fee and 5% late fee

- 36 to 60 months repayment terms

- minimum 600 score

What are the benefits of using LendingClub? The joint option is the main perk. You can ask a friend or colleague to get in with you and work out together. It’s going to be safer, faster, and easier.

The loan lender ensures you can have direct payments to creditors and pre-qualify with a soft check to keep your score safe and almost untouched. By the way, the required score is rather low, meaning bad credit application candidates have all the chances to qualify.

Upgrade

You can get the best personal loans for a variety of purposes with Upgrade. Whether it’s home improvement loans, auto loans, or installment loans, Upgrade has a wide range of loan offers for you. The personal loan provider gives offers its services to all citizens of the United States of America, except residents of Washington D.C., Iowa, and West Virginia.

You can get the best personal loans for a variety of purposes with Upgrade. Whether it’s home improvement loans, auto loans, or installment loans, Upgrade has a wide range of loan offers for you. The personal loan provider gives offers its services to all citizens of the United States of America, except residents of Washington D.C., Iowa, and West Virginia.

You can also use the loans for consolidation of debts as you can borrow a minimum of $1000 and a maximum of $50,000 with the provider. Upgrade is one of the top lending companies that will accept your loan requests with a minimum credit of 560. The provider has a mobile app for you to track your loan request process, payments, and rate discounts.

Advantages

- Low minimum amount of $1000.

- Fair score required to apply for a loan.

- For consolidation of debts, monthly payments can be made to your creditors.

- Secured and joint loans are available.

- No prepayment penalties.

- Loan terms range from 2 to 7 years.

Disadvantages:

- Origination fees apply. This can range between 1.85% – 8.99%.

- High minimum and maximum interest rates at 8.24% – 35.97%.

- There’s a late payment fee of $10.

Upstart

Similar to CashUSA, this is a platform that links lenders with borrowers. However, it stands out from the rest with the use of artificial intelligence to better ease the lending process. Upstart gives a great amount range of $1000 – 50,000 and a long repayment period.

It’s the best option for people with fair credit scores in need of cash advances. Whether it’s an installment loan, personal loan, title loan, student loan, auto loan, or even a mortgage, you can get your request approved and disbursed by the next business day.

It’s one of the best personal loans in Florida, with a $1000 minimum amount available. This is in comparison to the minimum offered in Massachusetts, New Mexico, and Ohio at $7,000, $5100, and $6,000, respectively. The lending network requires no credit history before your loan process is approved and fast-tracked.

Advantages

- Loan term ranges of 3 or 5 years.

- Loan amounts range from a minimum of $1000 to a maximum of $50,000.

- No credit checks are required.

- Get your personal loan approved and ready by the next day.

Disadvantages

- Origination fees apply.

- High APR at 35.99%.

- No secured, joint, or co-signed loans.

- Mobile app is unavailable to track your personal loan.

LendingPoint

LendingPoint is the best personal loan for you if you need loans for home improvement or medium-scale expenses. The personal loan demands a relatively bad score of 590, and its soft credit check does not impact your score in any bit. This loan is best for wedding expenses, buying a car, vacations, and health expenses.

The loan ranges from $2000 – $36,500. This comes with an APR ranging from 7.99% – 35.99%. Unfortunately, LendingPoint does not render its services to residents of Nevada, Wyoming, and West Virginia.

The lender has a mobile application for managing your loan activities, and the criteria you must meet to qualify for the best personal loan include a social security number, a minimum annual income of $35000, a verified bank account, and a photo ID issued by the government.

Advantages

- Loan applications are approved fast on qualification.

- No prepayment penalties.

- Loan repayment period of 24 – 72 months.

- Autopay discount and interest rates can reduce after six months.

- Availability of a mobile application to track your loan payments.

Disadvantages

- High maximum APR at 35.99%.

- Credit check is required.

- Joint application for a loan is not allowed.

- Origination fees can go as high as 8%, depending on the amount borrowed.

PersonalLoans

From rent to auto repairs, PersonalLoans is the vendor for you to take the best personal loan in Florida and 49 other states. The loan provider makes its loan options available for people with zero to poor credit. It offers an amount range of $1,000 – $35,000, and there are no payment fees that apply to getting or repaying the loan.

The repayment terms are from 90 days to 72 months, and you can make the monthly payment once or twice, depending on the lender. This lending network has an interest rate ranging from 5.99% to 35.99%. Although there’s no late payment or prepayment fee, you will need to settle an origination charge of 1- 5%. The requirements that apply to this lender include a score of 580, a valid ID, a checking account, and a US residency.

Advantages

- Fast approval and loan disbursement.

- Long repayment period of 90 days to 72 months, depending on the amount borrowed.

- Quick and easy registration process.

- Personal loans can be used for various purposes, including wedding expenses, home repairs, car repairs, and consolidation of debt.

Disadvantages

- High maximum APR of 35.99%

- Low maximum amount at $35,000

- High origination charge of up to 5%.

Vystar Credit Union

If you’re on a journey to find a low-cost banking offer, it’s high time to dive in and learn more about Vystar Credit Union. What perks does this institution have? Low fees, income, and low minimum deposits are the catchy characteristics for the borrowers. As an application candidate and member, you won’t be charged monthly fees and won’t get hurt by the overall balance requirement.

- 8.75% to 15.24% APR

- no fees

- 36 to 84 months to repay

- minimum 550 to 720 score

Union members can use a mobile app to manage all their tasks without leaving the house. It’s a handy app with alerts to notify users about current options happening with their accounts.

This feature makes the membership worth it. One more important detail is about the minimum score. Have you caught yourself in a position where your score doesn’t cross the minimum bar? It’s not the case for the Vystar Credit Union, meaning the service accepts 550 to 720 scores.

Read More: How to Get a Loan with Bad Credit

Compare Lenders Of Bad Credit Loans In Florida

| APR | Credit Score Required | Loan Amount | Repayment Terms | Fees | |

| PayOff | 5.99% to 22.59% | minimum 640 | $5,000 to $50,000 | 24 to 60 months | 0% and 5% origination charge |

| Upstart | 6.50% to 35.99% | None | $1000 – $50000 | 36 months – 60 months | 0 – 10% origination charge, 5% late payment fee, and $15 returned check fee. |

| Upgrade | 8.49% to 35.97% | 580 | $1000 – $50000 | 24 months – 84 months | 1.85% – 8.99% origination charge, $10 late payment fee |

| LendingPoint | 7.99% – 35.99% | 590 | $2000 – $36500 | 12 – 72 months years | 8% origination charge. |

| Cash USA | 5.99% – 35.99% | 579 | $500 – $10000 | 90 days – 72 months. | As agreed by lender |

| PersonalLoans | 5.99% – 35.99% | 580 | $1000 – $35000 | 90 days – 72 months | 1 – 5% origination fee |

| OppLoans | 59% – 160% | no minimum | $500 to $4,000 | 9 to 18 months | no origination, prepayment or late fees |

| Tropical FCU | 2.55% to 16.99% | no minimum credit score required | $5,000 to $50,000 | 24 to 60 months | no origination or prepayment fees |

| Lending Club | 8.30% – 36.00% | minimum 600 | $5,000 – $300,000 | 36 to 60 months | 1% to 6% origination fee and 5% late fee |

| Vystar Credit Union | 8.75% to 15.24% | minimum 550 to 720 | $2,000 – $20,000 | 36 to 84 months repayment period | no fees |

Types of Bad Credit Loans in Florida

Now that you know the top lenders to trust, there’s another question. What type of loan should you pursue? Is it a home renovation or auto credit? The answer is yours because the goal defines the means to get the budget. Some people need to renovate their house or buy a property with a mortgage, while others need as much as $500 to cover their urgent needs.

Your goal will define the type of loan to seek in lending services. You’ll find the top 3 most common loan types in Florida. Applicants request them the most, and they are relatively easy to get, even with a bad score. Let’s see what specific features each of these personal loans has.

Title Loans in Florida

A title loan is a type of short-term loan featuring high interest for the borrowers and collateral. In this case, it will be a car that you’ll have to give in to get cash.

Who is the title loan good for? If you struggle with a poor score or questionable history, a title loan is a chance for you. Lenders won’t pay much attention to your payment history. You need to overcome the following steps to get approved for the title loan:

- First of all, the lender will request to take a look at your vehicle.

- Second, you will need to prove you’re the car’s owner.

- The final step is to show the license.

Not too many steps, so it’s a nice way for bad borrowers to get their money fast. However, you should beware of the risks related to secured loans. Your collateral can be repossessed by the lender unless you pay off the loan on time.

Payday Loans in Florida

A payday loan is a cash advance that should rarely be considered by anybody in a financial crisis. These loans are notorious for exorbitant rates and fees. Asides from the fact that you must meet your payment by the next payday, you must also make an additional payment at interest rates that can go up to 300%.

These loans are short-term and typically for people with bad credit scores and low gross income with no other means of securing a loan. It’s another short-term loan that one can easily obtain without an excellent score or income. The characteristic feature of the loan is its amount. These types of loans don’t usually exceed $500.

And they are expected to be repaid with the following paycheck. What’s so compelling about these loans that people keep requesting them so often? A couple of features make this offer a great deal for many. Let’s get down to the details and see what real advantage the borrowers can get.

- You shouldn’t be bothered by the score. Loan lenders don’t usually pay attention to the status of your report, meaning even applicants with a poor history are still eligible to get their money.

- It’s not a secured loan. Hence, there’s no collateral to be worried about.

- You can request two or three loans per time, depending on your history. If you don’t have massive issues in the past, you have a chance to get up to three loans at a time.

Are there any disadvantages? You will face a high interest and some additional fees certain lenders request. However, it’s still a compelling bargain for those seeking quick money.

Personal Loans in Florida

A personal loan is a general concept that refers to different types of loans obtained from a number of income sources, such as a bank, union, or online lender. For starters, there’re a couple of ways you can spend the cash borrowed from the granter.

People use it to consolidate debt, cover expensive events, invest for personal purposes, spend on house renovation, or use it in emergencies. The cases are wide, so you can find personal loans in Florida quite helpful. What is a personal loan good for in Florida? It’s a versatile way to request money and get approved easily. If you find a reliable lender who accepts bad or fair credit, it’s an easy task to get the money fast.

HELOC Loans

HELOC, fully known as the Home Equity Line of Credit, is a loan given using the equity built in your home in Florida. The loans from this can be used for home repairs & expenses, large purchases, and consolidation of debts when you have bad credit. This loan is best for residents of Florida who want lower rates on cash advances, offering an APR range of 8.00% to 12.50%. The loan has a repayment period of up to 20 years, with a 10-year draw period.

Student Loans

In conjunction with Sallie Mae, the Florida credit union offers loans to graduates and undergraduates. There are loans for graduate school, MBA, medical school, dental school, graduate school for health professions, and law school.

The interest on these loans will vary according to the student loan you take from the credit union. There are also online lenders you can access to get any of these loans, even with bad credit. The rates will be different from the credit unions and will be available for undergraduates and graduates.

Installment Loans

These installment loans come in different forms, including mortgages, secured loans, student loans, auto loans, and many more. The primary aim is that you can repay these loans according to an agreed schedule with the lender.

These loans usually draw for a long period, up to years, and come with considerable interest rates. If you have bad credit, you can register with platforms like Upstart and Upgrade to apply for these loans. You’d be sure to meet a direct lender that’ll grant you the loan.

Cash Advances in Florida

If you find yourself in need of emergency loans, there are several lenders you can register with within Florida for quick cash. Some of the online lenders you can meet for cash advances in Florida include Upgrade, PersonalLoans, Upstart, LendingPoint, and LendingClub. These loans are best for people in a hitch with their finances and who have poor credit. Although this loan gives you a fast solution, it comes with high-interest rates and several finance charges.

Read More: What Is Considered a Bad Credit Score?

How To Choose The Best Bad Credit Loan In Florida

A bad credit loan is one that’s given to individuals with poor credit history and scores. In fact, it’s quite hard to get a loan or cash advance when your credit profile reflects poor financial decisions. Very few lenders are willing to take on that risk and grant a loan to such people.

Fortunately, these few reputable lenders will not only grant you loans but help improve your credit. So, if you want to pick a lender that’ll grant you a loan on bad credit, these are the features you must use to compare them.

APR: This is the interest rate that applies to the amount you borrow.

Fees: Check for application fees, originating, late payment, and administration fees.

Loan amount: Compare the minimum and maximum loan amounts offered.

Requirements: See the criteria that’ll qualify you for the loan, from the credit score to your social security number.

Useful Tips to Get Bad Credit Loan in Florida

How to catch on the right loan and not waste your time with the wrong lender? People are always concerned about the way loans work because it’s not always a transparent process. If you’re a newbie and need guidance, here are some useful tips for starters. You can find them easy to implement, and some can even help you save money. There are many ways to ease the whole application process and get approved. The better you research, the more results you can see.

How to Get Bad Credit Loans Like Fig Loans

You can get bad credit loans like Fig loans by following a simple process. The first and most important step is getting an online lender like Fig Loan to register with.

Once you get a lender with quality services like that of Fig Loans, you’ll need to consider factors how much score you need to apply for the loan. If you pass the stage, you can then move on to planning how much you need and meeting the requirements as detailed below

Check Your Credit Score

One of the most important factors about getting a loan is checking your credit rating and worthiness. Some providers demand on their loan agreement that you have a fair to average score before you can get any form of cash advance or loan. This score generally ranges from 579 – 660.

However, some providers can go lower, hence offering services to people with a poor credit report. You can make a credit inquiry with many platforms that offer the service for free. On the other hand, you can request your score from one of the credit bureaus. Once you know your credit score, you can check if it matches the minimum required by the online lender.

Plan How Much You Need

If your score matches the minimum required by the loan provider, you then need to decide the amount to loan. This is why loan companies attach the amounts they give in their description.

If the amount you need for your home expenses, auto repairs, large purchases, or title loans falls in the range, then you can proceed with the online lender. Fill this amount in the request form and wait for the company’s approval. If you meet the criteria, the funds will be disbursed to your account.

Check the Requirements And Details

This is probably the most important part of getting a loan similar to Fig. The eligibility criteria for each vendor differ, and you must take note of the details attached to getting a loan with them. These details include the APRs, repayment periods, the installment payment plan, repayment plans, and fees.

All of these must be considered to ensure you’re getting the most favorable deal from your chosen provider. General requirements for online lenders in the United States are an SSN, a valid photo ID issued by the government, proof of residence with a registered phone number, a verifiable bank account, and being at least 18 years.

Special requirements that lenders may ask for are a credit score, as mentioned above, a soft credit check for pre-qualification, a specified annual income, and a history of past or concurrent loans. Once you meet the requirements of two or more lenders, proceed to the next step.

Choose The Best Lender

If you’ve gotten your credit score, planned the amount needed, and met the requirements of your preferred lenders, it’s time to make a choice. Sifting through the above points helps you make the best decision for yourself, and you won’t go wrong with the few options that end up on your list.

If you want to be sure about your choice, look for additional features such as autopay discounts, quality customer service, and a mobile application. A lending company with these extra features implies their services are streamlined and automated to make your loan application and repayment easy. Once you have these extra perks at hand, proceed to the next step of applying.

Apply

Applying with an online vendor is the easiest part of picking a loan. With the many online lenders in Fort Lauderdale, Fort Myers, and beyond, you can easily log on to a registered provider’s website and take the following steps.

- Once you find the best company for you, visit the official website from your mobile device or desktop.

- Fill out the form for your loan request, specifying the personal details, bank account, and loan amounts.

- Upload the necessary documents, including photo ID, SSN, and proof of annual income & residency.

- Submit the form and wait for the loan to be approved if you meet the criteria.

- Expect your funds to be disbursed in the account you filled out in the form.

- Spend on the situation it’s meant for.

Plan Your Payments

The last and most important step is repaying your loans with the provider you picked. Remember, you won’t be paying the exact amount you borrowed as APRs, and certain fees now apply. Depending on your monthly income, you should create a plan on how you’ll make payments in installments to ensure you do not default on the agreed dates.

In the case of a default, you should have extra cash set aside to pay fees, such as late payment fees. Before repaying, you must have already agreed to a repayment plan by the provider that you should adhere to. This is because some will penalize you with a “prepayment fee” if you pay too early.

Read More: Emergency Cash Immediately: Urgent Loans for Bad Credit

What Do I Need to Get Bad Credit Loan in Florida?

Can I get approved for a loan if I have a bad score? It’s possible and even easy in today’s reality. Some quick research and preparation will make you the best candidate for the money. What to consider when you request a bad loan? Here are a couple of things to keep in mind.

First off, check the score requirements. It has to be a priority for applicants with poor score status. You don’t want to endanger and lower your score even more with a hard check. So, make sure you know your points to play it safe.

The major criteria are your age and citizenship. The majority of loans only accept U.S. citizens over the age of 18. Furthermore, a set of papers should be provided to the lender to have you accepted. What documents do you need? Income verification, Social Security number, address details, and some other papers to prove your creditworthiness.

Advantages And Disadvantages Of Bad Credit Loans In Florida

In this section, we’ll detail the advantages and disadvantages of securing a bad credit loan. The most obvious advantage of all is that you get funds from a lender willing to overlook your poor FICO score or history. In all the states, bad credit is considered a sign of poor financial decisions and funds mismanagement. As a rule, registered lenders avoid people with bad credit, as they may never get to pay back the loan.

However, with loans dedicated just for people with bad credit, they can get loans to get them out of a fix without worrying about exorbitant APRs. Another advantage is the stretched-out repayment time that can go on for years. This way, you get to pay your loans at your convenience. However, as these loans have upsides, so do they have downsides.

A major disadvantage is that APRs can get quite high, which might make the loan quite strenuous to pay back. Also, you may not be able to apply for other loans while you’re still paying one. Another disadvantage is the many fees you have to pay from applying to repaying the loans.

Read More: Best Credit Cards For Bad Credit 2024

The Bottom Line

With all rights reserved by us in this article, loans for bad credit Florida have been broken down for anyone who wants to consider them. You now know the first step you must take in applying for these loans, which is looking out for a reputable lender, and we’ve given examples plus alternatives to consider. Ensure to always go through features, including interest rates, fees, and terms attached to repayment.

A good practice to inculcate in your financial habits is repaying loans you get. This helps you build credit, as many of these loan providers report to credit bureaus. When you meet your payments as agreed, you build credibility for yourself also and will be able to qualify for better loans that’ll pull you out of bad credit.

Loans are a good way out if you need cash fast but don’t want to bother a family member or a friend. But never compromise on the legality of the lender, so you don’t fall for scams and exploitation from unverified users.

Sources Used in Research for the Article:

- Understanding Your Credit, Federal Trade Commission,

https://consumer.ftc.gov/articles/understanding-your-credit - What You Should Know About Home Equity Lines of Credit (HELOC), Consumer Financial

Protection Bureau,

https://files.consumerfinance.gov/f/documents/cfpb_heloc-brochure_print.pdf - Getting Approved, Happy Money, https://happymoney.com/getting-approved