Life can be unpredictable, and when unexpected expenses pop up, finding a quick way to get cash can feel stressful. That’s where borrow money apps step in to make things easier.

When you need a small cash advance, having the right options can be helpful. Below is another service that offers quick access to funds.

Best cash advance services

These apps are a modern solution for accessing funds when you need them most, whether to cover emergency costs, handle bills, or get through a tight spot—all without the complications of traditional loans or credit cards.

Over 60% of Americans report living paycheck to paycheck, which makes having access to fast, reliable cash even more critical. These apps are designed to fill that gap, offering secure and hassle-free borrowing options to keep you on track between paydays. If you’re looking to get $50 instantly, these platforms provide the flexibility and speed you need to manage unexpected expenses.

In this guide, we’ll dive into the top borrow money apps of 2026, giving you a clear look at their features, fees, and benefits so you can pick the best one for your situation.

Borrow Money App: Cash Online Without Hassle

Thousands of people in the United States live from paycheck to paycheck and struggle to find ways to make money. This means they just have enough income to support their daily needs and other necessities, while even a small financial emergency to borrow $25 can easily unsettle them.

It may be rather time-consuming to travel from one lender to another and gather all the necessary information. When you require an emergency fund, and it’s difficult to become a credit union member or qualify for a personal loan, what’s the best solution?

The best apps to borrow money are a great alternative to bank and credit union loans. These apps lenders create allow consumers to get funded directly from their app store, straight from home or office, without any hassle.

You just need your smartphone or laptop to obtain the amount of cash you urgently need. Which app lets you borrow money? Loan apps like Earnin and Dave or Check n Go offer various financial products and services, including cash advances and loans without a credit check. It’s so easy and fast to make money using a $100 loan instant app that lends you money on the same day.

Apps That Loan You Money Instantly

What app lets you borrow money? The Internet is booming with a huge choice of alternative personal loan services and online cash advance apps. Is it possible to select the best one? Yes, we have conducted our unbiased analysis and are ready to present the list of the top-rated money apps to help you choose the best platform to borrow money today.

Below, you can find all the details about each borrow money app, including their pros and cons, the amount range, the fees and interest payments, and the APR, to help you make the right decision.

Our advertiser disclosure ensures that we provide unbiased and accurate information, enabling you to make informed decisions without falling prey to hidden fees and misleading terms.

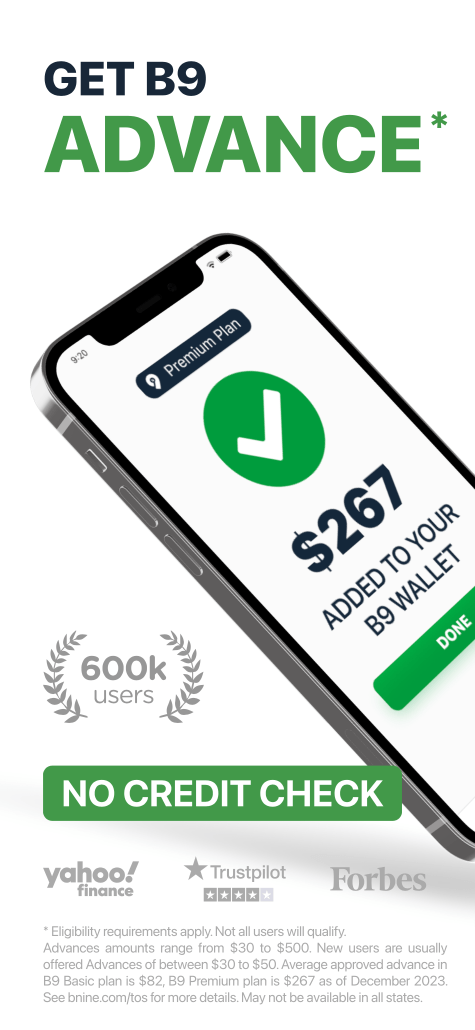

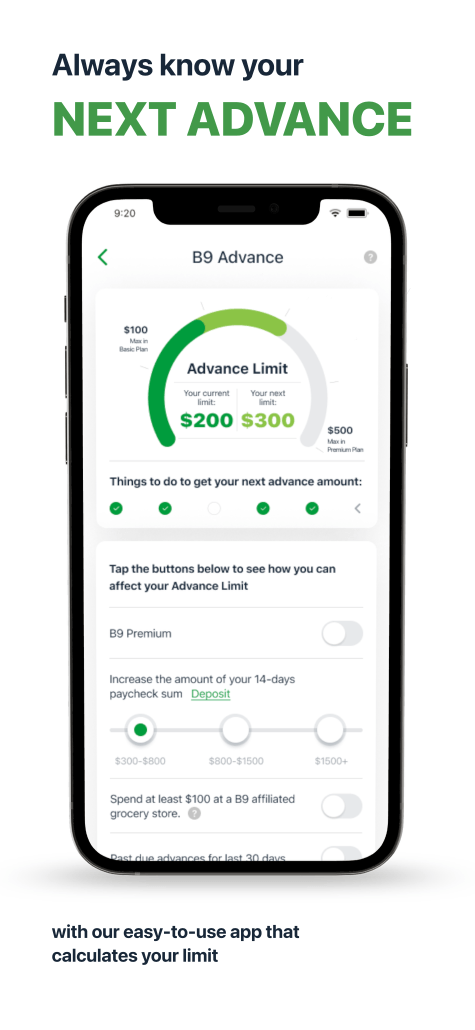

B9

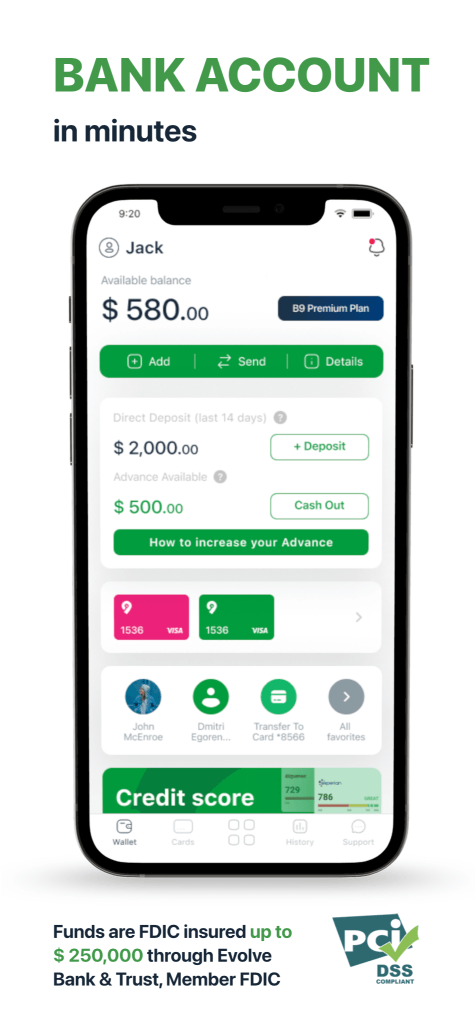

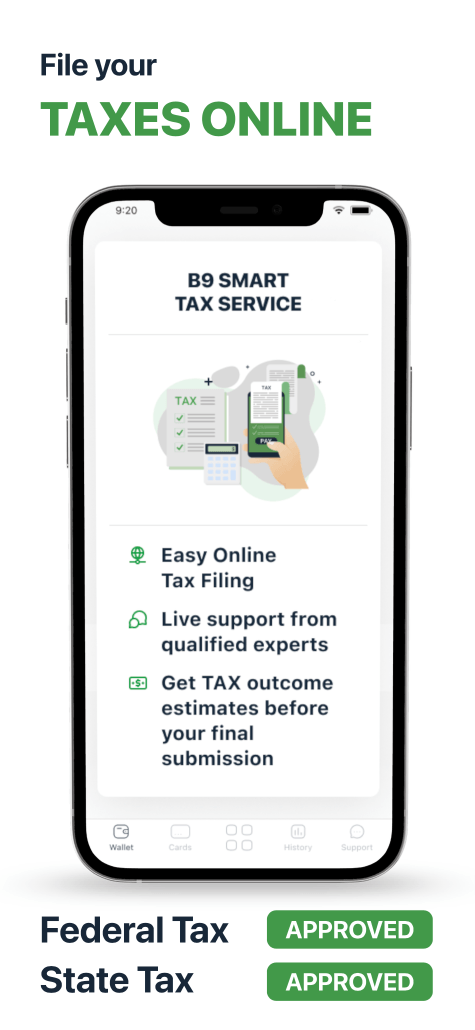

B9 Banking App is a popular mobile banking application that offers numerous features for its users. The app allows users to easily manage their accounts and make transactions with just a few taps on their mobile devices. With its user-friendly interface, the B9 Banking App is an excellent choice for individuals who prefer to handle their banking needs from the comfort of their homes or on the go.

Pros:

As far as pros go, the B9 Banking App has several strengths that make it an attractive choice for its users. One of its most notable features is its advanced security measures, which ensure that users’ transactions and information are kept safe from fraud attempts. Furthermore, B9 Banking offers excellent customer service, as it has a team of helpful and knowledgeable representatives who are available 24/7 to assist users.

Cons:

While the B9 Banking app offers numerous benefits, it also has a few downsides. One of the main drawbacks is that the app occasionally experiences glitches that can be frustrating for users. Furthermore, B9 Banking does have fees associated with some services, such as wire transfers and ATM usage.

Basic Requirements:

To use the B9 Banking App, you must have a B9 account. Additionally, you’ll need a compatible device (Android or iOS) with internet access to sign in and use the app.

Terms and Fees:

When it comes to borrowing money with the B9 Banking App, understanding the terms and fees is key to making the most of its features. Here’s a breakdown of what you need to know:

-

Advance Pay Amounts

New users can request cash advances starting from $30 to $50. As you use the app and build a repayment history, you may qualify for higher advances, with amounts ranging up to $500. -

Average Approved Advances

- For the B9 Basic Plan, the average approved advance is $82.

- For the B9 Premium Plan, users typically receive an average of $267.

- These averages were accurate as of December 2023, so results may vary based on your account activity.

-

Fees to Watch For:

- Advance Delivery Fees: Instant delivery of funds is free, a major plus for those who need cash immediately.

- ATM Fees: Using non-B9 ATMs incurs a $2.50 fee. To avoid this, stick to the in-network ATMs provided by B9.

- Foreign Transactions: If you’re using the card abroad, expect a 3% fee on international transactions.

- ACH Transfers: Good news—ACH transfers are completely free.

If you frequently need higher cash advances, consider upgrading to the Premium Plan to maximize your experience with B9. The added benefits can save you money in the long run and provide more flexibility.

Earnin

Earnin is one of the top-rated apps for borrowing money and getting cash in your account within one day. Their advertiser disclosure shows that you repay the debt per pay period from your next paycheck. It is quick financial assistance without any charges or fees.

This loan app is a quick and easy way to borrow money now. Once you fill in the amount you need, you will be issued the funds in your checking account. You can obtain money and return the cash automatically on your next salary – even with a QR code!

There is no monthly membership fee or other charges. The amount you withdraw will be taken from your bank account on the next paycheck.

Amount Rate

Borrowers can obtain loan amounts between $50 and $100. You will be able to cash out up to $750 a day after several months.

- There are no interest rates. This app is a great option for users who want to pay nothing more than the amount of cash they’ve borrowed. It doesn’t have any hidden charges. A borrower pays only $0-14 for one loan.

- Money advance. One of the greatest benefits of these loan apps you can borrow money from offers is the ability to cash out the money you’ve earned so far but haven’t been given by your recruiter yet. This is suitable only for full-time employees who will have to repay the loan per pay period through direct depositing.

- Automatic withdrawal. The funds will be issued and taken directly from your bank account on the next paycheck, provided that you have a steady source of income.

Cons:

- Not suitable for the unemployed. If you don’t have stable employment or a full-time position, you won’t be able to qualify for cash advances.

- A small amount of cash. A loan app is not a bank. Digital lending platforms approve only small loan amounts, which may not be enough to cover unexpected expenses.

EarnIn is a top pick among borrow money apps for its no-interest approach, fast funding, and user-friendly system. While it’s not suitable for those without a steady income, it’s a lifesaver for full-time employees needing small cash advances.

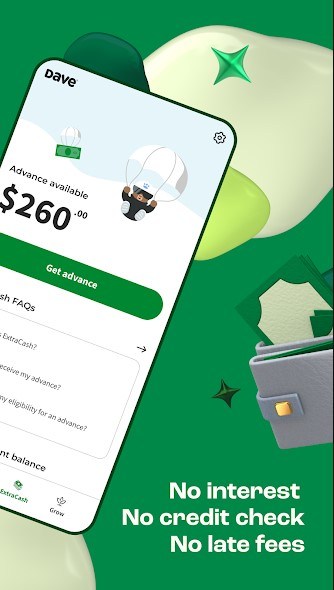

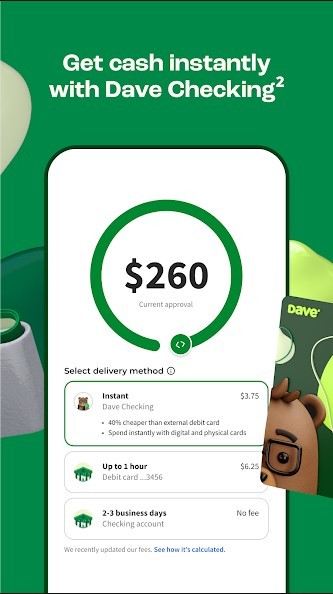

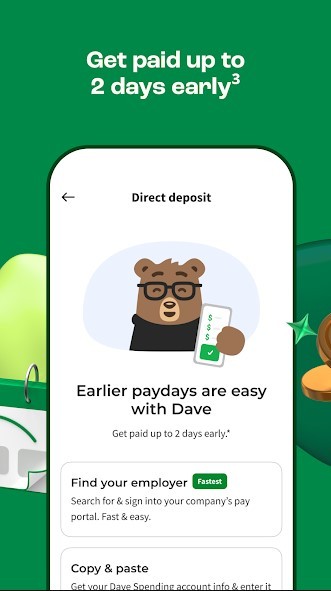

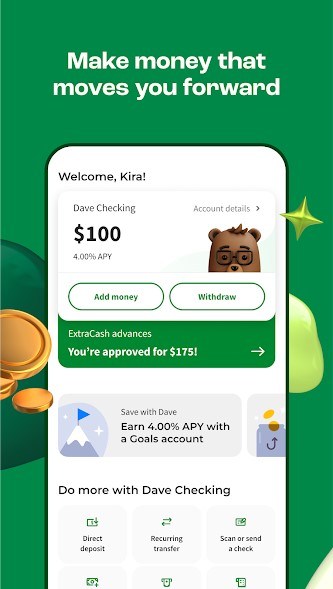

Dave

Dave is a financial services app that offers cash advances of up to $500 to help users manage short-term financial needs. It’s a flexible solution for anyone with a steady income and an active bank account who wants to avoid traditional loans or interest fees. Here’s what you need to know about Dave:

Loan Amounts and Features

- Borrowing Limits: New users can borrow up to $100 initially, while long-term users may qualify for advances up to $500, depending on account activity.

- Membership Fee: A $1 monthly subscription fee grants access to the app’s services, including budgeting tools and financial tips.

- Expedited Funding: Need your money right away? Same-day cash advances are available for a $4.99 express fee.

Pros

- No Credit Checks: Dave doesn’t perform credit pulls or report to credit bureaus, making it accessible for all credit scores.

- Transparent Fees: No interest rates or hidden charges. Optional tipping allows users to support the app based on their satisfaction.

- Helpful Features: Built-in budgeting tools and financial insights make it easier to manage your money.

Cons

- Doesn’t Build Credit: Since Dave doesn’t report to credit bureaus, it won’t help improve your credit score.

- Limited Initial Borrowing: New users are capped at $100–$200, which might not be enough for larger expenses.

- Standard Funding Delays: Regular funding can take up to three business days unless you opt for same-day funding for $4.99.

Dave is a reliable borrow money app for those who need quick cash without the stress of credit checks or high-interest loans. While it’s not ideal for large expenses or credit-building, it’s a great tool for managing small financial gaps. With its transparent fees and helpful features, Dave offers a simple, user-friendly solution to short-term cash needs.

Brigit

Brigit is a trusted cash advance app designed to help users manage their short-term financial needs. With tools to predict overdrafts, extend repayment dates, and monitor credit, Brigit offers more than just advances—it’s a full financial health platform.

Key Features

- Cash Advances. Borrow up to $250, deposited directly into your checking account.

- Identity Theft Protection. Premium members receive credit monitoring and identity theft insurance.

- Repayment Extensions. Extend your repayment date up to three times if needed.

- Overdraft Prediction. Get alerts when your account balance is low to avoid overdraft fees.

Fees

- Membership Fee. $9.99/month for premium services, including cash advances, financial tools, and identity theft protection.

- Optional Same-Day Funding Fee. Expedited transfers are available for an additional charge.

Pros

- Overdraft Notifications. Brigit predicts when your account might overdraft and sends timely alerts to help you avoid fees.

- Flexible Repayment Terms. Extend your due date up to three times if you need more time to repay.

- No Credit Checks. Brigit doesn’t perform credit pulls, making it accessible for users with low credit scores.

Cons

- Standard Transfer Delays. Regular funding can take up to three business days. However, same-day funding is available for emergencies.

- Membership Fee. The $9.99 monthly fee applies whether or not you use a cash advance.

Brigit is a practical borrow money app for users looking for small cash advances, financial planning tools, and overdraft protection. While the $9.99 membership fee might not suit everyone, its benefits—like repayment flexibility and identity theft insurance—make it a reliable option for managing short-term cash flow challenges.

Chime

Chime, a financial technology company founded in 2013 and based in San Francisco, partners with Bancorp Bank and Stride Bank to provide online banking services. With over 13 million customers as of 2026, Chime has become one of the fastest-growing fintech platforms in the United States.

Chime offers a fee-free Spending Account, a high-yield Savings Account, and a user-friendly mobile app to help clients manage their finances. Its innovative approach focuses on eliminating unnecessary fees while providing features like early direct deposits and overdraft protection.

Key Features

- Fee-Free Banking. No monthly maintenance fees, minimum balances, or international transaction fees.

- Early Direct Deposit. Receive your paycheck up to two days early, depending on your employer’s payment schedule.

- SpotMe Overdraft Protection. Users with $200+ in monthly direct deposits can overdraw up to $200 without fees.

- Surcharge-Free ATMs: Access over 60,000 fee-free ATMs through the MoneyPass and Visa Plus Alliance networks.

Pros

- Transparent Fee Structure. No recurring charges, no hidden fees, and no surprises.

- Extensive ATM Network. Use the mobile app to locate one of the 60,000+ surcharge-free ATMs near you.

- Early Paychecks. Get paid faster with Early Direct Deposit.

- Overdraft Protection. SpotMe lets eligible users avoid costly overdraft fees.

Cons

- Limited to USD Transactions. Accounts only support US funds, making Chime unsuitable for those needing multi-currency banking.

- Cash Deposit Fees. Deposits can only be made at Chime’s retail partners, like Walmart or Walgreens, and retailers may charge fees.

- No Physical Branches. Chime’s online-only model may not work for clients who prefer in-person banking.

Chime’s focus on fee-free, user-friendly services makes it a standout choice for individuals seeking a modern banking solution. While its lack of physical branches and cash deposit fees may deter some, its strong features—like overdraft protection and early direct deposits—make it a reliable and convenient financial tool for most users.

MoneyLion

MoneyLion is a financial technology platform that provides users with quick access to funds and tools for better financial management. With two membership options—Core (free) and Credit Builder Plus ($19.99/month)—MoneyLion is a versatile solution for short-term financial needs and credit building.

Membership Options

- Core Membership: Free of charge, offering access to Instacash advances up to $250 with no interest or fees (standard delivery).

- Credit Builder Plus Membership: $19.99/month, including access to credit-builder loans with a fixed 5.99% APR, financial tools, and credit monitoring.

Key Features

- Cash Advances: The Instacash feature allows you to borrow up to $250. Limits may increase based on account activity and membership.

- No Interest or Credit Checks: Enjoy interest-free advances without any impact on your credit score.

- Credit Builder Loans: Credit Builder Plus members can access loans designed to help improve their credit rating.

Pros

- No Credit Checks: Perfect for users with poor credit or no credit history.

- No Interest Rates: Core members can access cash advances with zero fees or interest unless opting for expedited delivery.

- Fast Approvals: Funds are typically approved and transferred within one business day.

Cons

- Monthly Fee for Credit Builder Plus: Membership costs $19.99/month, which may be steep for some users.

- No Credit Building for Core Members: Core membership does not report to credit bureaus or help improve your credit score.

- Limited Loan Amounts: Instacash advances are initially capped at $250, which may not meet larger financial needs.

MoneyLion is an excellent borrow money app for those seeking fee-free cash advances and flexible financial tools. While the Credit Builder Plus plan adds extra features, the free Core membership is a great option for users who need small, no-interest advances without a credit check.

Albert

Managing finances can feel overwhelming when you need to juggle multiple apps for saving, budgeting, and investing. Albert simplifies this by combining all these features into one seamless platform. From cash advances to financial guidance, Albert acts as your personal financial assistant, helping you take control of your money.

With no physical branches, Albert provides access to over 55,000 fee-free ATMs across the U.S., making it a convenient choice for modern banking. Boasting a 4.7-star rating in the Apple App Store and 4.1 stars on Google Play, it’s a trusted app for users seeking financial flexibility.

Key Features

- Cash Advances: Get up to $250 with Albert Instant, deposited into your checking account within three days—no interest, no credit checks.

- Seamless Account Management: Consolidate all your accounts for a 360-degree view of your financial life.

- Automated Savings: Albert’s smart technology helps you save money without effort.

- Personalized Financial Guidance: The Genius subscription provides expert financial advice tailored to your goals for as little as $8/month.

- Investing Made Simple: Guided investment options make it easy to start growing your wealth.

Pros

- Fee-Free Core Features: Albert’s essential tools, including cash advances and savings, are free to use. Optional tips are welcome but not required.

- Early Access to Cash: Borrow up to $250 instantly to cover emergencies, with repayment aligned to your next paycheck.

- Affordable Financial Support: The Genius platform offers one-on-one financial guidance starting at just $8/month, making expert advice accessible for most budgets.

- Extensive ATM Network: Use the app to find one of over 55,000 fee-free ATMs near you.

Cons

- Limited Financial Products: Albert does not offer long-term loans, credit cards, or mortgages, which could limit its appeal for users seeking these products.

- Genius Subscription Fee: While affordable, the $8/month fee for personalized financial advice may deter some users.

Albert is a powerful all-in-one personal finance app designed to simplify managing your money. Its ability to combine banking, saving, and investing features into one platform makes it a standout choice for anyone seeking financial clarity. While it doesn’t offer long-term credit products, its cash advance and Genius features provide excellent short-term solutions.

PossibleFinance

Possible Finance is a smartphone-based lending platform offering small personal loans of up to $500 to individuals with low or no credit. By considering more than just credit scores during the application process, Possible Finance caters to a broad range of borrowers who may otherwise struggle to qualify for traditional loans.

These loans are designed for short-term use, such as covering unexpected expenses, but come with high fees and APRs that borrowers should carefully evaluate.

Loan Features

- Loan Amounts. Borrow up to $500, even with bad or no credit history.

- Repayment Terms. Pay off the loan in four biweekly installments over two months.

- APR and Fees. Rates vary by state, typically translating to APRs of 91%–122%. Borrowers pay $15 to $20 for every $100 borrowed. In some cases, APRs can reach as high as 240%.

How It Works

- Download the Possible Finance app and apply for a loan.

- Receive funds quickly—often within a day—to your linked checking account.

- Repay the loan in four equal installments.

- Build credit with timely payments, as Possible Finance reports activity to all three major credit bureaus.

Pros

- Credit Bureau Reporting. Payments are reported to Equifax, Experian, and TransUnion, helping you establish or improve your credit score with on-time payments.

- Accessible for Low Credit Scores. Even borrowers with poor credit can qualify, as Possible Finance evaluates factors beyond traditional credit checks.

- Quick Cash Access. Borrowers can receive funds in as little as one business day, making it a practical solution for urgent expenses.

Cons

- High APRs. Borrowers face significantly higher costs compared to traditional loans, with APRs that can reach 240%. This makes repayment challenging for some users.

- Limited Customer Support. Possible Finance only offers email support, which may not meet the needs of borrowers seeking immediate assistance.

Possible Finance provides an alternative for those who need quick cash but lack access to traditional credit options. Its small loans and credit-building opportunities make it attractive for borrowers aiming to improve their credit scores. However, the high APRs and limited customer service options are significant drawbacks.

If you’re considering a Possible Finance loan, ensure you understand the total repayment costs and have a clear plan to make timely payments.

Cleo

Managing money can feel overwhelming, but Cleo makes it simpler with AI-driven budgeting and saving tools. With over 5 million users, this app provides a unique approach to understanding your finances, offering paycheck advances, budgeting insights, and spending analysis—all through a user-friendly chatbot interface.

Cleo’s witty and casual tone appeals to millennials and Gen-Zers looking for a modern, tech-driven financial assistant. Whether you want to track expenses, set goals, or prevent overdrafts, Cleo has the tools you need to stay on top of your finances.

Key Features

- Interest-Free Paycheck Advance. Cleo Spot offers up to $100 in cash advances to help prevent overdrafts. There’s no interest, no credit checks, and no impact on your credit score. Users have up to 28 days to repay.

- AI Budgeting Tools. Cleo’s chatbot analyzes your spending trends and suggests budgeting strategies. Ask questions like “Can I afford this?” for instant, data-driven insights.

- Savings Assistance. Cleo helps automate savings based on your spending habits, making it easier to reach your financial goals without even noticing the effort.

- Easy Registration. Sign up in just a few minutes by connecting your bank account and customizing your preferences.

Pros

- Advance on Paycheck. Get up to $100 when Cleo predicts you’ll overdraw—interest-free and hassle-free.

- Quick and Easy Setup. Cleo’s registration process is fast, allowing users to start managing their money in minutes.

- AI-Powered Insights. Save time by letting Cleo analyze your finances and offer personalized recommendations.

- Millennial and Gen-Z Friendly. With its relatable tone and modern interface, Cleo appeals to younger audiences seeking a tech-savvy financial assistant.

Cons

- Limited Customer Support. Cleo relies on chatbot-based assistance, which can lead to delayed email responses and frustration for users with urgent issues.

- Privacy Concerns. While Cleo uses bank-level encryption, some users may hesitate to share financial data with an AI-powered app.

Cleo is an excellent budgeting app for users looking for an AI-powered assistant to manage their finances. Its cash advance feature is a standout benefit, offering interest-free overdraft protection when you need it most. While the lack of direct customer support may be a drawback for some, Cleo’s innovative tools and user-friendly design make it a compelling choice for modern money management.

Loan Apps vs Personal Loans

Personal loans are more traditional forms of lending offered by banks and credit unions. Cheaper than loans from payday lenders, their main advantage is that they tend to have a low interest rate, making them a more affordable option in the long run. Plus, they’re perfect for paying off student loans or helping people invest in real estate.

Additionally, personal loan companies like Lendly offer more flexibility in terms of loan amount and repayment terms. However, the application process can be more time-consuming, and approval is only sometimes guaranteed.

So, which one should you choose? It ultimately depends on your individual circumstances. If you need money quickly, prefer an easy application process, want overdraft protection, and can afford to pay back the loan in full within a short period of time, then a loan app is the best option for you.

However, if the sum of money you need is large, and you’re looking for a more affordable long-term solution, then a personal loan is the way to go.

How Much Can I Borrow in Cash Advances App?

The maximum amount in most cash advance loan applications is $500 and, in some cases, $1,000. Your credit limit might vary between $50 and $1,000.

It is calculated by using the lesser of the three-month qualifying direct deposit average or the total qualified direct deposits over the previous 35 days. Your credit limit computation may be influenced by the length of time your loan has been open.

If your direct deposit activity changes, your limit may vary. In most cases, you can be 100% sure that you will get access to a smaller amount for which this lender won’t perform a credit check. You can even get the funds with a bad credit score.

Borrow Cash Advances Apps Feature: Choose the Best One

What apps will let me borrow money instantly? There is a wide choice of lend and borrow apps today. It may be tough to select the best option. However, if you review the mentioned features and compare all the benefits and drawbacks of each app, you will be ready to make a smart financial decision.

Depending on your immediate cash needs, your credit rating, as well as your steady income source, you may choose between these top 9 cash advance apps that let you borrow money on the same day. There is no one-size-fits-all app, as everything depends on your monetary stability and urgent needs.

Decide On The Goal

When it comes to selecting the best cash app for your needs, it’s a good idea to take a step back and decide why you need money in the first place.

- Do you require money for an emergency fund?

- Are you looking to manage your finances more effectively?

- Do you need to transfer funds to a friend or a family member quickly and securely?

- Do you need to repay any student loans?

- Are you looking for a fast way to make money?

- Or are you simply looking for a convenient way to make debit card purchases and pay bills on the go?

Whatever your reasons, consider the impact that money will have on your decision-making process. After all, not all loan apps are created equal, and some will be better suited to your specific needs than others. By evaluating your financial situation and goals, you can make an informed decision about which is right for you.

Compare Lenders

By comparing multiple lenders, you can find the one that offers the best terms for your needs. This will ultimately save you money and ensure that you don’t end up with a loan that’s too expensive or difficult to repay.

It’s also important to consider the lender’s reputation so that you can borrow from loan apps safely and securely. Look for reviews and ratings from other borrowers to see how they felt about their experience. Money-borrowing apps with a good reputation are more likely to provide a positive experience and be responsive if you have any issues.

Look for money-borrow apps that require an NMLS ID, which means they hold a resident license and are regulated by the National Mortgage Licensing System. This process needs to be done carefully, and this is why we’ve selected the following pros and cons factors to consider.

Cost

Many users tend to be attracted to the idea of a free service, but is it really a good idea to rely solely on free loan apps where you can borrow money? The answer is not as straightforward as you might think.

While free loan apps might seem like a good deal (they’re cheaper than payday loans), they often come with hidden costs that you might not be aware of. For example, some will charge overdraft fees or include hidden fees that add up quickly over time. Not only that, but a lot of lenders perform credit checks, which might adversely affect your financial report.

On the other hand, paying for an app provides a range of benefits. First, they usually have more robust features, better customer support, and a higher level of security.

Additionally, you can often get access to lower rates and more favorable loan terms when using a paid app. This is because they are often backed by reputable financial institutions that have a vested interest in ensuring that their customers are satisfied with their products and services

Speed

Simply put, the speed of the process refers to how quickly the direct deposit is sent from the money apps to your account. Ideally, this should be as fast as possible – within minutes even. After all, the whole point of using an instant app is to get money quickly and conveniently. Waiting around for days defeats the purpose.

If you’re in a rush and need money urgently, then waiting around isn’t ideal. But if you have a bit more time to spare and don’t mind waiting a few days, then it might be okay.

That being said, some may promise speedy processing times but fail to deliver. That’s why it’s important to choose a reputable app with a proven track record of fast direct deposit and reliable service. In general, a processing time of 24-48 hours is reasonable, but anything longer than that may be cause for concern.

Requirements

The average eligibility requirements for getting money with loan apps are relatively simple. To begin with, you need to be of legal age and have a valid ID. You also need to have a steady source of income, as well as an account that accepts electronic transfers.

However, some lenders might have extra requirements that need to be met. For instance, they might perform a credit check or need you to be in a particular type of employment. Others may require additional documentation, such as proof of income or residency.

But there are certain eligibility requirements that you shouldn’t be asked of. For example, it’s not reasonable for lenders to ask for collateral or for you to provide personal references. These practices are not only invasive but also unnecessary for the lending process.

As a borrower, it’s important to be aware of your rights and not to agree to any terms that may be unfair or unreasonable.

Find Reviews from Other Users

It’s always a good idea to be cautious before signing up for any cash app. That’s where checking reviews comes into play. Taking a few minutes to read customer feedback will give you a good idea of what to expect in terms of reliability and safety. Reviews provide valuable insight into:

- User experience

- Customer service

- Fees

- Their NMLS ID regulations

- Hidden fees or charges

- Approval process

- The credit check process

- Payment speed

- Find frequently asked questions

- Different online lenders personal loans for comparative purposes

- Unscrupulous lenders

As with any financial product, it’s important to look for advertiser disclosure that provides transparency about fees and interest as well.

Consider Your Time and Money Needs

Always ensure that the finance app you choose accomplishes what you need it to without requiring an unreasonable amount of time and financial commitment. First, consider your specific financial needs. Are you looking for an app to help you track your finances, manage unexpected expenses, make money, create a budget, or manage your investment accounts?

Once you have a clear idea of what you require, consider the time and money commitment required by the app. Some loan apps require a monthly subscription fee or funding fees. While others may charge a one-time fee for additional features. Make sure you understand the cost, the effect of credit checks, and commitment upfront, and determine whether it’s worth it for your specific financial situation.

The bottom line is that selecting the right app will make a huge difference in managing your finances effectively. By taking the time to consider your options, you can find one that allows you to make money by sending it to you within minutes without taking on side gigs or requiring an unreasonable amount of time and commitment.

Borrow Responsibly

If you are also unprepared for financial disruptions and every new additional monetary need makes you feel frustrated and stressed out, choosing the best money borrowing app may support your urgent needs without delay.

There are many benefits to choosing an app to borrow money quickly instead of applying for credit cards at the local bank, credit union, or pawnshop to get a 1500 dollar loan. What apps let you borrow money immediately? There is a wide variety of lending institutions in every city today. But you never know all the differences and nuances of each creditor.

Every potential borrower needs to understand that he or she takes full responsibility for the loan or instant cash advance they obtain. This emergency cash immediately no loans shouldn’t be taken for granted, as this sum is only borrowed for the short-term period.

Also, long-term goals can’t be covered with such small loan amounts as cash advances. Consider alternative ways to make money, such as finding funding fees for your long-term aims and needs or improving your earning potential.