Stuck with a bad score? Contrary to popular belief, bad credit doesn’t mean you must be bad at managing money. The good news is that this isn’t always the case. A bad credit score scale is not a verdict. Instead, it is an indicator you might have a hard time repaying a loan.

A bad score is a credit score range between 580 and 669 that indicates the probability that a borrower will repay a loan. Also, it’s worth mentioning that a credit score is the least relevant indicator of financial health for a borrower. What really matters is income.

What Is a Bad Credit Score?

Well, let’s focus on what’s a bad credit score. What is the credit score range? For a lender, this number indicates how likely you are to become accepted for a loan. Also, that means you’ll get a higher interest rate because you’re a high-risk borrower.

So, what do lenders see when they review your credit score? Your financial history and ability to repay the money lent to you. Thus, if you want to get the best credit cards, mortgages, and competitive loan rates, make improvements to your key spending habits, and expect your credit score to improve.

For you, knowing your credit score means having more access to new and cheaper loans. Say, if you have a fair credit score range between 580 and 669, which is considered a bad credit score, you understand that you’re limited in options. But you’re not alone, many US citizens struggle to maintain good credit scores ranges. And the best thing is that you can get a loan with bad credit too.

How Is a Bad Credit Score Calculated?

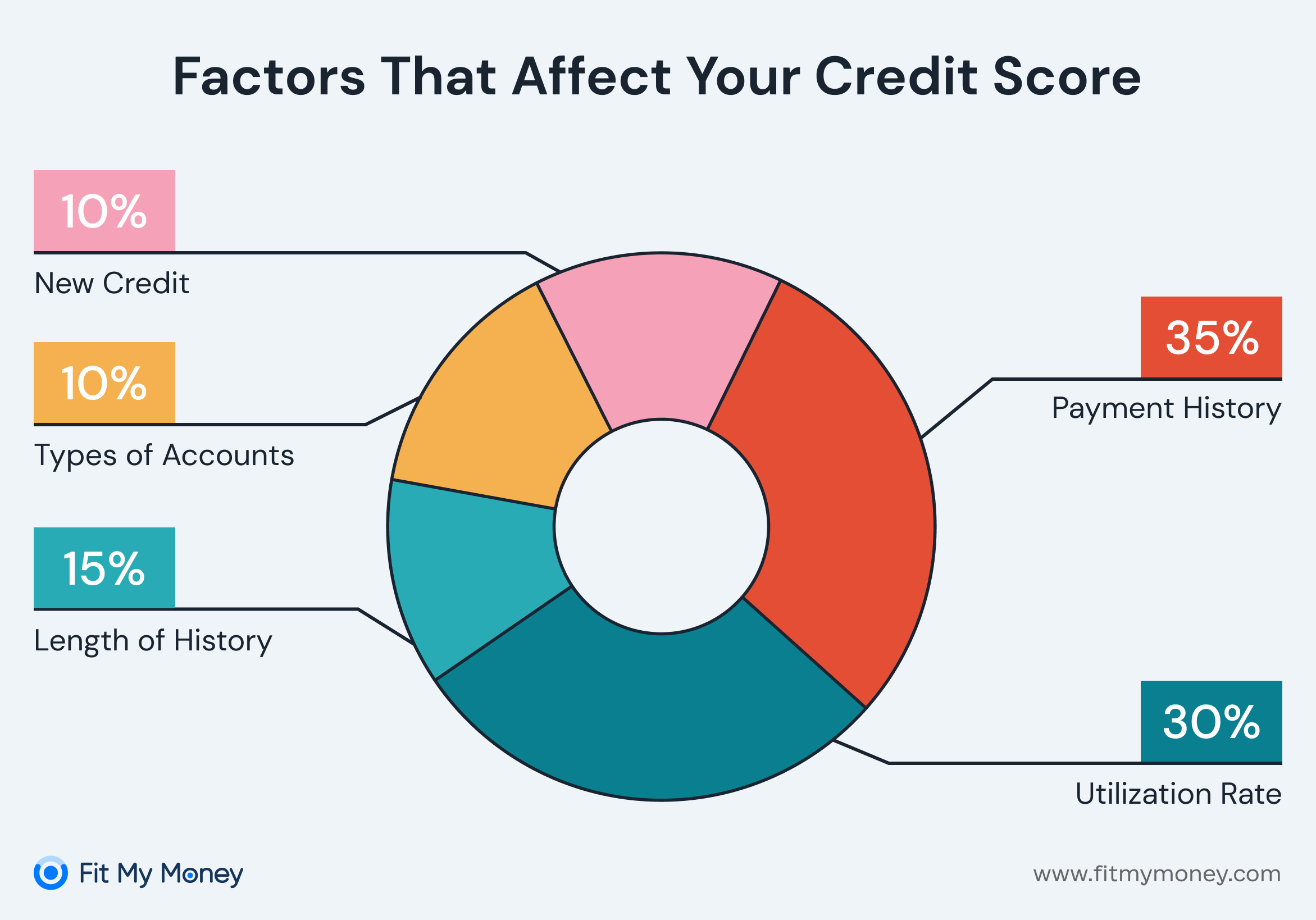

To get an idea of what a bad credit score is, let’s find out how it’s calculated. To do it, major credit bureaus use five factors. However, each of those values is different but could be a reason for a bad credit score chart. Each credit reporting agency gets information from lenders about the credit you have and how you manage it. With the data gathered, they generate your credit report and calculate your credit score.

- Payment history makes 35 percent of your score. It includes delinquent debts, not paid off credit cards, and the like.

- Amounts owed account for 30 percent and represent your debt-to-credit ratio. A good rule of thumb is to use between 10 and 30 percent of your credit available.

- Length of credit history amounts to 15 percent and shows how long you have maintained your open credit amounts. The more successful, the higher the percentage. Opened old credit cards would also be a benefit.

- Credit mix makes 10 percent of your score and shows how smart you can manage multiple types of credit.

- Finally, the new credit factor accounts for 10 percent and shows how often you’re shopping for new credit. Each time you apply for a loan, expect to have a hard pull on your credit report. The fewer credit inquiries you have, the higher the chance that you can pay off your debt.

The coolest thing is that even if you are weak in one of the key factors, a high credit score is still possible. Also, you can learn whether you have a bad score with no need to make a check. Things like a loan application, credit card, or apartment denial are a red flag for you.

Have you noticed interest rate increases or unexpected credit limit cuts? Those are also signs of damaged credit. Yet, the good news is that you can work on your score to improve your chance of a deal you are happy with.

What Affects Your Credit Score

Below, you will find several factors that can cause a poor credit score. Keep them in mind if you want to be considered a reliable borrower.

- Repeatedly missing or making late payments means that you’re most likely to miss payments in the future.

- Defaults, court judgments, bankruptcy suggest you can’t afford the debt you’ve taken on.

- Applying for lots of credit in a short time indicates that your financial health is in poor standing, and therefore, you may appear high risk.

- Having an extensive amount of credit available to use is a red flag for lenders, as you have the potential to run up high debts.

- Frequent change of address suggests that you are less stable.

- Mistakes on your report don’t reflect the actual picture of how you manage credit.

If you know you are over 30 days late on your loan payment or credit card, your score hits. Any communication from a debt collector is also a way to hurt your credit score. Whats the lowest credit score? The lowest credit score is 580. Even with a 580 credit score, you can inculcate certain good credit habits and go a long way in maintaining a good credit score.

Finally, filing for bankruptcy relief also can hurt your credit. So, if you know that your credit history includes one of the above-mentioned events, don’t expect your score to be good.

How a Bad or Poor Credit Score Can Hurt You

Before we go further into the poor credit score circumstances, let’s find out what is a poor credit score first and what are the credit score ranges. The most popular scoring systems (FICO Score and VantageScore) generate a three-digit number in the credit scores range of 300 to 850.

So, what is considered a poor or bad credit score? An excellent credit score range is from 800 to 850. The credit ranges from 740 to 799 is deemed a good credit score range. Meanwhile, a 701 FICO Score is the average score for Americans.

Now, what about a 670 credit score? Wonder whether the 690-700 credit score is good or bad? A good range starts somewhere at 670. Even with a 739 credit score, your rating is good enough to qualify for a loan or mortgage.

How bad is a 600 credit score? Taken into account that a bad credit score ranges from 580 to 669, 600 is considered bad. The best thing about a bad rating is that it’s not forever. Sure, it reflects you have difficulties at this moment, but nothing stops you from improving your score.

Is 650 a bad credit score? It depends.

If you make smart financial decisions today, you can see your credit improvement in the future.

The problem is that a bad score hurts. The lower your credit score, the more likely you pay higher interest rates. Sure, there’s no guarantee you won’t be rejected for loans or credit cards. For a lender, your poor credit score is a red flag. But a better indicator of your financial success is income.

Final Note

It’s always smart to focus on ways to increase your income and don’t get to such situations as finding out how often do debt collectors sue. Indeed, that doesn’t happen overnight; nothing happens overnight. Work on your career, invest in your future, and you can find the easiest way to financial freedom.