Find the top MoneyLion alternatives packed with budgeting tools, instant loans, and credit-building support—read on to pick the best app for your lifestyle!

There is a wide range of online money apps that are suitable for covering urgent money needs today. When you feel strapped for funds, you either need to restrict your expenses and regulate your spending activity or utilize apps like MoneyLion.

You are not alone if you urgently need to finance immediate needs or cover bachelor’s degree costs. Every person may experience temporary financial problems.

If you try your best to make ends meet and struggle to make the necessary payments, such apps can help you to get paid a quick cash advance.

Best Apps Like Moneylion

Many people ask about the best places to get additional cash. While there are a huge number of such apps that work with Chime these days, you need to find a reputable and certified service provider that you can trust.

Stop begging your friends and relatives to lend you some money. Be independent and choose a money borrowing app now! Here is a review of the top-rated loan apps to help you finance your short-term expenses.

1. Brigit

There are several instant cash apps that are worth your attention. Brigit is a cash advance app that would benefit your needs. This app helps people with cash advances to budget their needs and get direct deposits for their urgent money needs.

This online tool is one of the loan apps, instant cash can be obtained through a streamlined application process. You can also get card transactions up to $250 for different purposes here.

Cash is deposited directly to the client’s bank account balance or debit card within the same or the next day.

Rates and APR:

Brigit and sites like MoneyLion don’t charge late fees and have no hidden charges. Borrowers may also benefit from special prescription discounts, and bill alerts so that they don’t miss payments. Each client may withdraw up to $250 of cash advance.

2. DailyPay

DailyPay is another solution for people who want to receive some money till the next salary day. You can obtain the funds from the mobile app on your debit card, prepaid card, or any bank account you have.

Such apps like Dave and MoneyLion are suitable and affordable for all consumers who need to get cash advances to finance their near-term money goals.

Rates and APR:

Places like MoneyLion and DailyPay allow you to request up to 100% of your unpaid salary. The reason for this benefit is the belief of the app’s team that employees earn credits for daily hours.

Hence, clients can take out the whole sum of their net income if they want to. You may obtain up to $1,000 daily money without any fees and transfer cash up to five times per day.

You won’t see “looks like your request couldn’t be completed MoneyLion” if you choose a reliable loan app.

3. Albert

Albert is one of a few quality cash advance apps similar to MoneyLion that combines all-in-one. Customers can save, borrow, spend, and invest funds using their bank account, just like with the Ingo Money App. What’s more exciting, the Albert app offers a fee free credit builder loan with a bunch of useful budgeting tools. It’s a perfect solution when you require instant cash to get back on track with a solid cash flow.

Rates and APR:

The Albert app provides customers with several banking options. Usually, borrowers turn to lightning-speed advances. The app allows users to get paid up to $250 with no interest rates to cover their needs until the next paycheck. Although the app may charge you bank overdraft fees, there is no credit check required.

Another cash feature belongs to the Genius subscription plan. Smart Savings analyzes your spending, income, loan amount, and recurring bills automatically. Then, the app sets a fixed weekly sum that you can keep in your savings account. Albert pays a 0.25% bonus for the funds you’ve saved. However, to enjoy this feature, customers have to cover a membership fee.

4. Klover

Klover offers efficient and easy-to-navigate products and services. It is similar to MoneyLion app in providing a large variety of borrowing options. To start with the app, you need to download it from the App Store or Play Market, verify your data, and connect the app to your checking account. Klover would be a good option if you need a small loan amount to cover same-day expenses.

Rates and APR:

By using the Klover app, you can get free cash advances for a short term with no interest rate. It’s a beneficial feature compared to payday loans that require constantly growing extra charges. The app also offers two options for lending solo funds. You can either wait three business days to save up, or pay an express fee to receive the money instantly. The amount of charges depends on the borrowing sum.

The cash advance limits are applied as well. A client can borrow only up to $100 per session. Additionally, there’s a financial dashboard feature available at Klover. It helps to regulate spending habits and achieve savings goals.

5. Empower

Empower adds up the list of decent cash advance apps like MoneyLion. It’s a great budgeting app for improving financial health and keeping your bank account balance afloat. Empower cooperates with major credit bureaus to supply customers with quality mobile banking services. It would be just the solution when you need to cover another cash advance, financial gaps, or some urgent emergency expenses.

Rates and APR:

In comparison to other apps, Empower requires an $8 subscription fee but with a 14 business days free trial prior. It also charges transfer fees depending on the advance amount. On average, the sum varies from $2 to $8. Clients can also tip 20% of their loan amounts at their will.

Empower proceeds with repayment cash withdrawals, including the tips and membership fees you complied with, on the day of your next paycheck. In case you’re having problems and can’t cover the amount of your cash advance, contact customer service to negotiate the changes.

6. Chime

The app is a great financial solution for those who plan to improve their Chime checking account interest. Credit card holders usually receive money by direct deposit and rarely resort to borrowing. There are no overdraft fees or monthly fees required for those who set up a chime account.

Moreover, ATM transactions are fee-free at over 60,000 places. Although the chime debit card is offered only through third-party retailers, it’s a convenient way to keep track of your bank accounts.

Rates and APR:

By using direct deposit, customers can obtain granted funds two days early. Moreover, Chime SpotMe charges neither a membership fee nor a monthly fee. It’s also foreign transactions friendly and won’t require extra fees for paying abroad. However, separate banks may charge 1% to 3% of the amount of your debit card purchases.

Out-of-network ATM transactions cost around $2.50. To avoid extra expenses and get overdraft coverage, apply to the partner’s work location, like Walmart or 7-Eleven. Other retailer stores, but Walgreens, would cost you additional fees of up to $4.95. Last but not least, joint accounts are unavailable at Chime, so you won’t be able to share your bank balance with your pay friends.

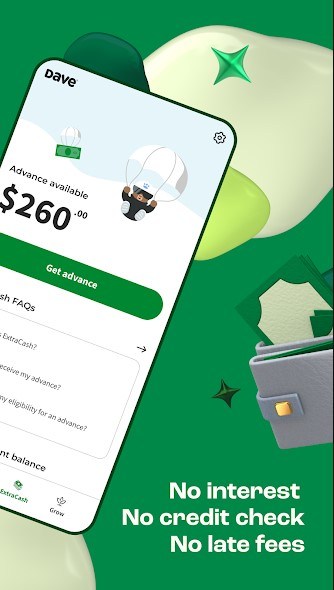

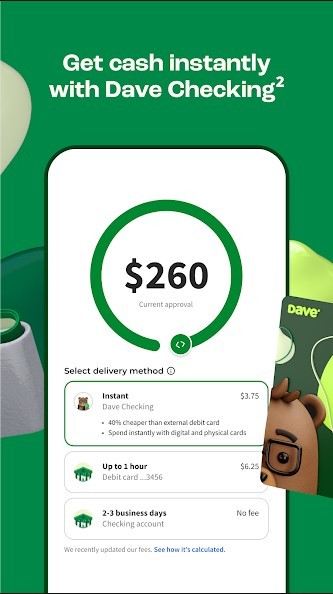

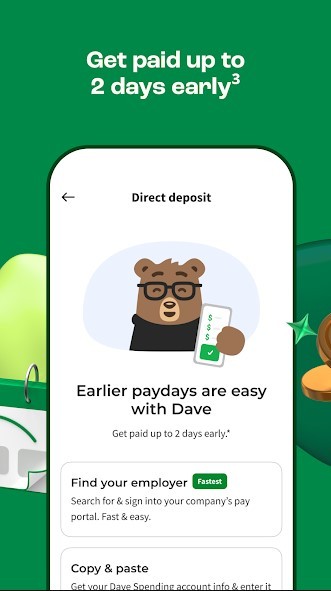

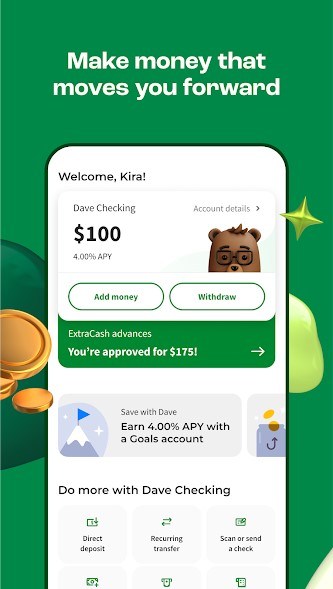

7. Dave

Dave best suits for covering rent payments, utility bills, transportation costs, groceries, etc. The bank account activity of the client is used to determine his creditworthiness and whether he’s meeting the eligibility requirements. Clients can receive the borrowing funds either on their Dave debit Mastercard or other valid credit cards.

Rates and APR:

While cash apps don’t have any fees, you will need to pay just $1 low fees a month to utilize Dave. This is a service fee, but this tool is helpful for covering any near-term goals, and it requires no paperwork at all. Pay attention to the cash advance limit and that you can’t finance long-term expenses with this app.

MoneyLion Short Review

Are you looking for installment loans? You can have a core membership or a plus membership. The first option costs nothing, while the second one costs $28 per month.

There is no credit check, so it’s a great advantage of such credit builder loans like MoneyLion. Borrowers with any credit rating can be accepted here.

While other apps like MoneyLion may charge some fees, this app is free of charge, but it allows you to withdraw only small amounts.

Also, clients from Nevada, Nebraska, Iowa, Montana, Vermont, and Indiana can’t apply. Yet, if you’re from New York, Oregon, Montana, or any other state except the stated ones, you’re free to apply.

Generally, you may withdraw up to 10% of the sum on your stride bank direct deposit.

Rates and APR:

This is another helpful app for people in need. Borrowers may request up to $250 through mobile banking. Still, they have to regulate the deposit frequency not to borrow more than affordable. MoneyLion offers two types of memberships. You may enjoy a free version or upgrade to a plus membership for $28 a month. Only borrowers who have plus membership can have APR cash advances of 5.99%.

Rates and APR:

This is another helpful app for people in need. Borrowers may request up to $250 through mobile banking. Still, they have to regulate the deposit frequency not to borrow more than affordable. MoneyLion offers two types of memberships. You may enjoy a free version or upgrade to a plus membership for $28 a month. Only borrowers who have plus membership can have APR cash advances of 5.99%.

How to Compare Apps Like MoneyLion

While selecting alternatives to MoneyLion, cash account holders should review several aspects to evaluate the app correctly. First of all, qualifying members have to check the trustworthiness and reliability of the lender.

Then, compare such figures as APR, fees, an available sum of paycheck advance, processing time, and conditions of repayment. Considering these factors is essential to avoid laundering, scamming, and personal information leaks.

We’ve prepared a detailed explanation of each factor to help you accurately review the chosen app like MoneyLion. You can also use this list for further cash advance apps evaluation.

Reliability of The Lender

Applying for a cash advance teaches you how to manage funds each pay cycle, take care of your credit score and go through credit checks. Yet, clients aren’t the only ones accountable for their cash advances. The lender shares this responsibility with you. Having a credible and experienced financial provider guarantees problem-free borrowing terms, overdraft protection, and essential guidelines.

It’s hard to distinguish a decent lander from a scammer, but there are a few tips that may help you:

- A true provider always keeps his documentation clear, representing a responsible approach to dealing with personal loans

- A good lender will be 24/7 in touch, stepping up to your struggles

- A decent provider will always be transparent about financial services and monetary questions. He’ll inform you about the necessary details, stress the important aspects, and clarify the charges.

Details Of The Loan

Clients have to take care of their cash advances, and apart from maintaining their credit scores and paying on time, there are a few more things to double-check. We’ll review them in the list below:

- Most cash advance apps exclude the monthly fee and any other expenses from their services. Those are the ones we recommend. Yet, some apps would ask to pay about $5 to $14 per pay period as subscription costs.

- APR shows the interest that you’d pay on fees over the year. The higher the APR, the more you damage your credit. For instance, look for a 12%-18% annual rate to maintain your scores. Rates over 24% would be considered higher than average.

- Processing time depends on several factors. Usually, a credit union reviews your score and debt history. They also proceed with additional checks when needed. On average, a loan can be processed in one day or max. one week

- The advance amount depends on how creditworthy you are, your sources of income, and your ability to repay a certain amount per pay period. A true creditor would evaluate all these factors and provide you with the most suitable option, while a scammer would ask you to pay more than you can afford.

- Loan repayment is considered a significant aspect of cash advance terms. The repayment includes a fixed sum, fees, and tips that you’ve complied with in your agreement. We would advise you to avoid tips and choose a cheaper cash feature.

Checking For Scamming

Unfortunately, customers often get in the tents of scammers. Those are extremely dangerous due to their side hustle of stealing your data or funds. Often, scammers may introduce themselves as lenders and try to make a deal with you. However, you have to be ready to define such a crime. Here are a few tips from us:

- A loan offer is always put into writing and has paper checks attached to it. With this feature, you can tell whether all rights reserved or not.

- A creditor has no site or suspicious webpage. A real provider always has a website with company services, different types of loans, and their details.

- A lender doesn’t ask about your credit history. Every reputable creditor would want to proceed with a background check to learn about your previous borrowing experience. Otherwise, it’s a sign to stop communicating with the lender.

Get Quick Funds with a Loan App Like MoneyLion

As you can see, there is a big variety of online apps that are available to applicants in many states today. Are they different from traditional crediting services?

Yes, these apps offer a flexible online application from any place. A client is connected with the creditors and gets access to additional money without delay.

An online loan money transfer procedure is quick and secure. You set up an account using the chosen technology company and undergo a short process with verification of your identity. You may receive a request for your resident license, NMLS ID, email address, or statements of your checking accounts.

Only basic personal and financial details are needed to transfer the funds to the client. You have the right to select a desirable sum according to the apps’ offers. The money will be transferred to your checking account.

Look through the features and rates of each app, compare money apps, and make your smart decision.

Sources Used in Research for the Article:

- Instant Cash, Brigit, https://www.hellobrigit.com/instant-cash

- Banking With No Monthly Fees, Chime, https://www.chime.com/no-fees/

- Cash, Albert, https://albert.com/cash