Discover the best apps like Earnin that offer instant access to your paycheck before payday—read on to find the perfect alternative for your financial needs!

Nowadays, life is unpredictable for consumers in many countries. Fast cash loans have become a common lending solution to suit the financial needs of many people. Cash advance apps are designed to give each person an opportunity to receive quick funding for the short term.

Apps like Earnin offer a cash advance for consumers who want to borrow money. If you want to obtain cash advances, you may choose instant transfers. Most cash loan apps give instant access to your paycheck and additional money without too much effort.

Keep in mind that such paycheck advances present a better alternative to payday loans, but they should be taken out with responsibility and can’t replace an emergency fund.

How Does Earnin Works?

Let’s start with the basics. How does this cash advance app work? Is it suitable for all borrowers, and does it even have student loans? Does it provide a credit report to any financial institution, like major credit bureaus? Earnin is one of the leading providers of quick personal loans issued to cover near-term financial disruptions. This app allows borrowers to get paid as they work. To ensure that this app is a reputable choice, borrowers can check its rating and reviews on the Better Business Bureau website.

To utilize credit builder loans from Earnin, you need to have a valid checking account, a steady source of monthly income, and a mobile phone. Apps like Earnin offer cash advance features and work with the community to help every applicant get extra funds to finance immediate needs and expenses.

To use this money advance app and build your credit, you need to connect your bank account and mention your employment data to help managers verify your pay schedule.

After that, you need to add your income to this cash advance app. You can easily do this by submitting a copy of your resident license, sending your electronic timesheet, adding your income automatically using the Automagic Earnings feature, or signing up with your recruiter-provided work email address.

Cash advance apps like Earnin are supported by the community. The applicant may support this online tool by paying a fair tip for this service. These tips can help more community members cash out with you by covering transaction fees.

It’s also crucial to keep an eye on your bank account balance fees, which may be charged by some cash payday advance apps. But if you have a fixed work location and a regular pay schedule, you can be eligible for a loan without overdraft fees and credit checks.

Apps like Earnin offer a cheaper alternative to regular payday loans. On the other hand, this best cash advance option should also be used carefully and not frequently, as it can’t replace your emergency fund. It’s critical to have an emergency fund with enough money to cover unpredicted costs or big-ticket purchases. Moreover, as Earnin does not affect your credit scores directly, it’s still essential to avoid over-relying on them as a long-term solution.

How to Get Cash Via Earnin?

Here is a step-by-step guide on how Earnin and other advance apps like it work, including eligibility requirements:

You should make a profile on this app. Give the app access to your bank account. Any individual who is strapped for deposit funds may download the Earnin app to obtain cash advances and have all rights reserved. A requirement is to receive your paycheck up to two days early via direct deposit.

- Earnin will track the hours you work before you get early access to your spending account. Depending on the job of each applicant, this process can be performed differently.

- Hourly workers may use location tracking or upload photos of their daily timesheets in apps like Earnin to profit from cash advances.

- Salaried workers can utilize location tracking on their mobile phones to prove that they attended the workplace. Consumers who work from home can qualify for a paycheck advance if they track the hours they work.

- On-demand workers may use advances if they upload photos of their task receipts. Uber ride receipts are uploaded by Earnin automatically.

- A client can get access to online loans only using earned wages. You can qualify for up to $100 the first time you use this tool.

- Receive your earned wages and pay online for your needs with an affordable loan. Your request will undergo a verification process to check the hours you’ve worked so far. It takes about 10 minutes for apps like Earnin to submit your loan request for a fast cash advance.

- You should select the sum. While any credit union offers financial advice features for a monthly membership, you can avoid overdraft fees and obtain a fast cash advance even in one business day. Borrowers may give a tip of up to $14.

- Possible finance will be issued within one or two business days. An early request on a weekday will give you a chance to obtain the money faster. If you apply over the weekend, the rainy day lending option will be issued on the next business day.

Top 13 Apps Like Earnin

When you are struggling to save funds to prepare for unexpected financial emergencies, credit builder loans can be a good solution. Apps like Earnin serve as a near-term comprehensive financial planning app only with a $9.99 monthly membership fee that gives you a loan amount of your earnings upfront.

Using Flexwage Flexwage, for example, you can get early access to direct deposit money to cover unexpected expenses and obtain automatic overdraft protection. The monthly cost for having extra funds instantly is absent, while users with premium accounts may be eligible for additional cash advances, bonuses, and features. Additionally, 7 Eleven provides this service, too.

The credit builder loan terms differ among apps and online tools, but they don’t have bank fees. Also, it’s a cheaper alternative to title loans and payday loans.

Whether you need to finance your future expenses for a vacation, cover cash flow problems, have a car repair, or obtain overall financial protection, apps like Earnin allow consumers to get financial counseling without hidden fees and a vicious debt cycle.

Here is a review of the top-rated apps like Earnin to help you fund your emergency expenses with the best apps that loan money.

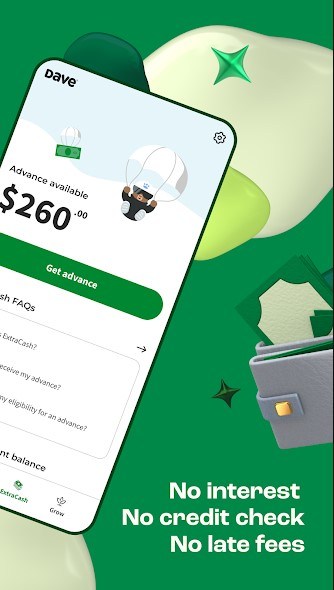

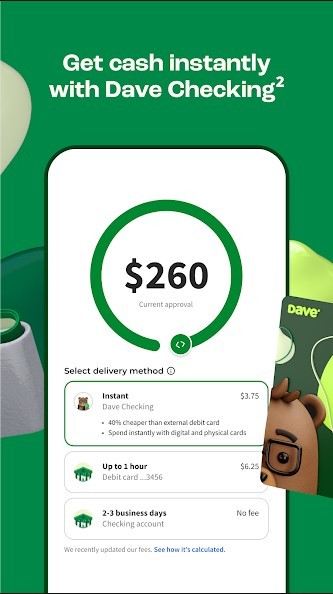

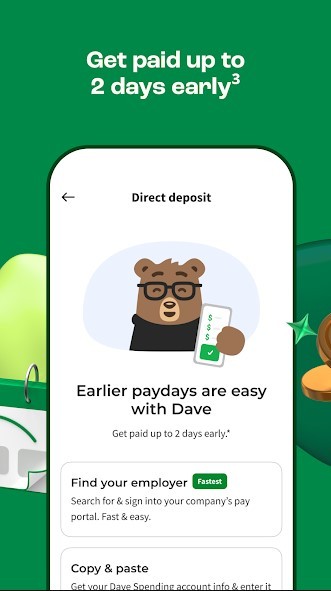

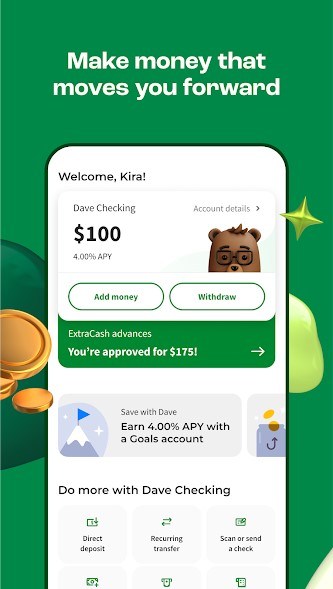

Dave

Are you willing to find budgeting tools and apps like Earnin? Dave app offers a structured process for getting a short-term loan. You may apply for a substantial chunk of your monthly income that you’ve already earned.

A free version of the Dave app is more than enough for covering paper checks and getting extra free cash without high-interest rates. Even bad credit holders can apply, as this app does not need your credit check.

What is the interest rate or fee? You only need to pay $1 per month to utilize this loan-based app. Hourly employees may also apply here and pay down the loan on the next salary day.

Benefits:

- Various Financing Options

- Reliable Budgeting App

- Pay for Various Needs And Expenses

- No Interest Charges

- Express Fee

- Flexible Repayment Terms

MoneyLion

The MoneyLion MoneyLion account, as well as the Chime checking account, offers payroll debit cards without a monthly fee, while savings accounts can serve different purposes for acquiring funds.

Financial products appear in these apps like Earnin, which can cover both regular expenses and different spending patterns. Individuals can get an advance on their pay by using them to meet their financial needs.

Benefits:

- Obtain From $25 to $250

- Cheaper Than an Overdraft Fee

- Credit Builder Plus Program

- Ability to Defer Payment by 14 Days

- Helps with Credit Building Process

- Without Paying an Interest Rate

Brigit

What are the other apps like Earnin? Personal loans can be issued by it if borrowers have valid bank accounts. In addition, installment loans can be issued through this app. Your checking account should also be active to obtain a loan through the Brigit app.

You may utilize the extra money per pay period for rent payments, utilities, groceries, etc. Paying with your Visa plus alliance debit card may be possible until the next paycheck comes.

As a credit builder option, Brigit allows qualifying direct deposits during the pay period. If you want to get lower fees instead of high-interest rates, you’ve come to the right place. Brigit Brigit allows consumers to get funded within eight hours and get paid at a maximum amount of $250.

Benefits:

- Quick Funding for $9.99 per Month

- No Interest Applies

- Money Comes Up to Three Days Early

- Pay for Various Financial Needs

- Any Credit Score Is Welcome

- Does Not Charge Interest

- Offers Bill Alerts to Make On-Time Payments

Chime

While traditional banks charge from $1 to $3 on every purchase, same-day money and monthly subscription for Chime’s ATM network allow you to access earned wages and cash advances without delay. You may obtain a more substantial chunk of money for the short loan term than your family member may lend you.

The Bancorp Bank powers Chime’s financial products and services, providing FDIC insurance up to $250,000. Individual investors from this online-only budgeting tool don’t have tax returns and don’t require the client’s credit check. If your credit score is less than stellar, you may still apply here.

Such cash advance apps like Earnin as Chime app or Vola Finance may help you cover prescription medications and unpredicted costs or give efficient alternative financing.

Benefits:

- No Overdraft Fees

- No Monthly Fees/ Low Fees

- Finance Extra Cost For Any Qualifying Purchases

- The Annual Percentage Yield Is Only 0.50%

- 60,000+ ATMs without ATM withdrawal fees For Flex Pay

- Free Plan Paycheck Hits Your Banking Accounts With Direct Deposit

- $2,000 Maximum Advance Per Pay Cycle

SoLo Funds

The SoLo program is designed to help consumers improve their monthly budgets by getting additional money and creating a unique opportunity for investors. This banking app is not intended for big profits, though.

It is fee free, a checking account is needed to apply. The amount of maximum cash advance differs among investors.

Beginner investors may see where their money goes while the app identifies upcoming bills. Strategies and research like equity trading are not required.

There is no 1 monthly membership fee or other fees. A small transfer fee is applicable, tips range from 3% to 10% of the loan amount. It also offers cash advances and identity theft protection. The maximum advance depends on your net income history and ability to set up direct deposits.

Benefits:

- No Minimum Loan Amount

- Offers Investment Opportunities

- Beginner Investors Can Invest As Little As They’d Like

- Transparency of Loan Apps like Earnin

- Credit Monitoring with Fixed Fees

- Lower Subscription Fees for Debit Card Purchases

- The Monthly Cost And Maximum Amounts Can Be Reached After an Internal Check

- Contributes to a Positive Balance on Your Direct Deposit Account

Zirtue

You won’t have more debt if you are careful and responsible with the loan. The interest for this credit option is quite low – it’s only 5%. When you can’t wait till the next paycheck, Zirtue is available to offer support. It can help you avoid financial difficulties and late payment fees and repay the loan.

The links posted show that this website allows clients to qualify for up to $1,000 and enjoy immediate cash advances. The credit can be returned within up to 36 months with low interest. A Zirtue or Roarmoney account has a rating system and doesn’t require collateral.

Benefits:

- No Collateral

- Turnaround Time As Soon As The Same Day

- Low Interest

- Additional Funds Till The Employer Sign the Next Paycheck

- A Quick Loan From Friends Or Family Members

- No Monthly Subscription Fee

Possible Financing

This platform offers quick funding and cash advances for underserved borrowers and those who were rejected at other crediting institutions.

The turnaround time is as soon as the same day, while there is no monthly membership fee. Possible Financing has a lot of positive feedback and reviews from the borrowers.

The only drawback is that it doesn’t operate in all states. It is only available in Ohio, Washington, Idaho, Texas, Florida, Utah, and California, but unfortunately, not in New York. If you earn at least $750 per month, you may obtain a quick loan of up to $500 for your needs.

Benefits:

- The Loan Term Is Up to 8 Weeks

- The Maximum Amount Is $500

- Licensed And Accredited Service Provider

- Small Loan for Debit Card Purchases and Other Purposes

- Easy Loan Application Process on the Web

Yotta

It is a label name that was founded in 2019, but it aims to make banking fun and offer credit builder solutions. This platform has created a lottery-style chance of winning cash prizes upon the client’s direct deposits.

A client gets a weekly ticket for every $25 in their deposit account.

Do you have an active debit card? The funds you’ve saved have a 0.20% APY, which is four times higher than the national average. Every Monday, the client can choose 7 numbers for each ticket from a table of contents or have the numbers chosen automatically.

Benefits:

- Accelerated Growth With A 0.20% APY

- No Maintenance Or Monthly Charges

- No Interest Rates / No Loans Paid

- No Monthly Membership

- Lottery-Style Prize System

- Quick Mobile Access with Cash Advances

Aspiration

Are you willing to get the maximum loan or obtain cash instantly for a small fee? If you are searching for overdraft protection, payday lenders won’t help you. You should apply for the Aspiration technology company.

The loan amount can vary based on the debit card you choose and eligibility criteria. Your credit history doesn’t play a significant role in the process.

As a credit builder program, Aspiration offers payroll debit cards for consumers who want to concentrate on making ethical choices with their funds.

Benefits:

- Impressive APY on Savings

- Cashback Bonuses on Any Debit Card Purchase

- “Pay What Is Fair” Policy Concerning Interchange Fees

- Possible Finance Options

- Direct Deposits Don’t Finance Fossil Fuel Production

Albert

This is your all-in-one personal finance assistant. It offers possible finance solutions for consumers across the country. Do you want to find a personal loan quickly?

While most cash advance apps like Earnin focus on one or two features, the Albert app comprises saving, banking, Albert cash advances, and investing.

Every finance-related feature and service (credit card, etc.) can be found in this app. Moreover, you may take advantage of automatic savings.

Benefits:

- All Finance-Related Banking Services In One App

- No Standard Cost For Usage

- Includes Banking, Saving, Investing, and Cash Borrowing Features

- Safe and Secure App

Varo

It can be a rather expensive way of borrowing supplemental funds for the short term. Borrowers may qualify for up to $100 using Varo. You may also open a checking or savings account here.

To qualify for the Varo Cash Advance program, a client needs to have an active account at this bank for at least 30 days.

This is an online-only bank available in the USA.

Benefits:

- Excellent Overall Customer Service

- Call Center 24/7

- Highly-Rated Mobile App

- Competitive Savings APY

- No Minimum Bank Account Balance Needed To Open A Savings Account

- A Large Number Of Moneypass ATMs

Empower

This is a financial app that can do everything. It’s a mobile tool that offers various personal finance features, including cash withdrawals and credit cards.

Empowerment might be a good idea for consumers who want to install one app to manage their finances and track spending habits while also being able to receive additional cash advances.

This app is secure and safe to use. It costs $8 a month after a 14-day free trial.

Benefits:

- Get Cashback Rewards of Up To 10%

- Obtain Between $25 And $250

- Get Paid Up To 2 Days Faster

- Track Your Monthly Spending Within Debit Card

- Monthly Membership Fee Free And No-Interest Cash Advance Options

How to Choose The Best App Like Earnin

When searching for a cash advance app like Earnin, it’s essential to consider various factors to choose the best option that suits your financial needs. To make an informed decision, users can compare different apps in the app store and evaluate the key banking features they offer. It’s also important to keep in mind the advertiser disclosure, which provides transparency about the relationship between the app and any financial institutions that it partners with. Below you can find an overview of the key banking features and a brief explanation of them.

Loan Limits

Some apps like Earnin that provide cash advances have restrictions on the amount of money that can be advanced to first-time users. They are used to reduce fraudulent activities and ensure responsible borrowing practices. Therefore, users have to evaluate whether the initial limit offered by the app will be enough to meet their financial requirements.

If the limit is insufficient, you have to consider alternative credit builder loan options or additional income sources to supplement your savings goals. Keep in mind that borrowing money should be done with caution and only for necessary expenses to avoid debt accumulation.

Turnaround Time

According to Stride Bank, it is crucial to take into account that not all cash advance apps are capable of providing quick funding through a credit card. Hence, if an individual requires funds urgently, they must verify whether the app offers this option. While some apps offer same-day or instant delivery of funds, they may have higher membership fees or interest rates.

Therefore, it is essential to assess the advantages and disadvantages of each alternative to ensure that the chosen app fulfills all immediate needs. Additionally, users should check the app’s NMLS ID, which provides information about the app’s licensing and regulatory compliance.

Requirements

Users must meet specific eligibility requirements to access the lending platform of cash advance apps. These usually include having a steady income, an active checking account, and being over 18 years old. Some apps like Earnin may also require proof of identity.

However, there may be additional criteria to be eligible for a loan, such as a minimum credit check or specific employment status. These extra requirements may restrict some users from accessing the app, so it is important to check the eligibility criteria beforehand. Meeting the minimum conditions does not guarantee loan approval, as each app has its own lending policies and underwriting standards.

Reviews

According to the Consumer Financial Protection Bureau, reading reviews can offer valuable information to users searching for cash advance apps like Earnin. Navigating through the red tape of finding a reliable cash advance app can be daunting, but it can help users evaluate an app’s dependability, user-friendliness, and customer support. You can search any online app store, social media platforms, and special websites to find reviews.

To ensure that they are authentic, users should look for comprehensive feedback, balanced opinions, and consistency across multiple reviews. It is also crucial to verify that the reviewer has genuinely used the app and is not a fake account. By examining and analyzing the experience of other people, everyone can make well-informed decisions when selecting a cash advance app to save money.

Customer Support

When choosing a loan app for managing personal finance, customer support is a vital aspect to consider, as it provides users with access to assistance when needed. Reliable customer service can help users solve issues, clarify doubts, and navigate through the app’s features to make money.

To evaluate the reliability of customer support, you should find out if the app offers multiple communication channels such as live chat, email, or phone. Users can also evaluate the response time and quality of customer support by sending queries or complaints. If customer support responds promptly and provides useful assistance, it can indicate that the app values its users and is dedicated to delivering excellent service to its clients.

Pros and Cons of Loan Apps

Loan apps like Earnin are a popular and convenient financial tool among many people. However, they come with both advantages and disadvantages.

Loan apps allow for easy and quick loan applications, providing access to credit for those who may not qualify for traditional bank loans, with fast funding and flexible repayment terms. Therefore, the advantages of loan apps include:

- convenience

- accessibility

- speed

- cash advances

- flexibility

- verification by credit bureaus

The disadvantages of loan apps are:

- high-interest rates: Payday loan apps like Earnin may charge higher interest rates than traditional banks.

- hidden high fees: They can increase the cost of borrowing.

- privacy concerns: The collected sensitive information can be vulnerable to hacking.

- potential to fall into a debt cycle: They lead to a cycle of debt and repayment if not used responsibly.

The bottom line is that it is crucial to review the terms and conditions carefully and weigh the potential benefits and risks before using a loan app. If you have any hesitation about any topic, even about what is the earned income tax credit, it is better to ask for help from specialists.