Explore the best unemployment cash advance apps that offer quick financial support and flexible options—read on to find the right app to help you during tough times.

Best cash advance services

If you urgently need to borrow a small amount of money, you can always go to a bank or financial institution and get the funds into your account within 1-3 days. However, is it possible if you do not have official employment? Yes, but the process of getting a loan can be more complicated.

No lender would want to risk their money and lend it to someone who does not have a stable job. However, some do so if they find proof that the borrower can repay the money on time.

One option to get a loan if you are unemployed is to use emergency cash advance apps. Many of them do not require you to prove official employment but give loans only to a bank account, which receives at least 2-3 payments per month.

Understanding financial management better can also make a difference—whether through practical experience or simply picking up insights from personal finance podcasts that break down smart money habits.

In this article, we have described several such applications so that you can choose the best and most affordable option for you. They provide loans for the unemployed, but each has different requirements for borrowers, so pay close attention to them.

Cash Advance Apps For Unemployed: Best Offers

Unemployment cash advance apps allow you to borrow a small amount for 2-4 weeks. To take advantage of these offers, you must be older than the US, have a government-issued ID, and meet other company requirements.

In this article, we’ve gathered the apps to borrow money with the best terms so that you can choose the best option for you. They all have different requirements and operating models, so read the description of each company and choose the one that best meets your needs.

PayDaySay

Payday loans are one of the most affordable types for the unemployed. You can quickly get them on the PayDaySay app because it has a vast database of lenders and can find the right fit for any borrower.

Here are five facts that will give you a better understanding of this app:

- PayDaySay is a platform that pairs borrower applications with lender offers, which is why about 98% of those want to get a loan even without employment.

- With it, you can borrow from $100 to $5,000 for 2 to 4 weeks.

- To get a loan, you only need to provide your passport, address, phone number, and Social Security number. The company does not require proof of your income or other documents.

- PayDaySay transfers funds to your account within one business day after your application is approved.

- The app is free and does not charge a monthly subscription; you can download it on Android or iOS.

The main drawback of PayDaySay is the high APR, which can reach 2.290%. However, this is the best option if you need more than $500.

Read More: PayDaySay Review

SoFi

Sofi is an application where you can get a loan of $5,000 or more if you have a job offer that starts within the next three months. When applying, you must provide your contract with your employer to show that you will have future income and are creditworthy.

The conditions for obtaining credit in this application are as follows:

- SoFi provides personal loans for 2 to 7 years in all states except Mississippi.

- The APR range for its loans is from 7.99% to 23.43.

- The app transfers funds to your account within one business day.

- You can download Sofi to your Android or iOS device or apply online at the company’s website.

The main disadvantage of this option is that you need a job offer and a high credit score of at least 680 points. If you meet these requirements, Sofi is your best option, with the lowest APR possible.

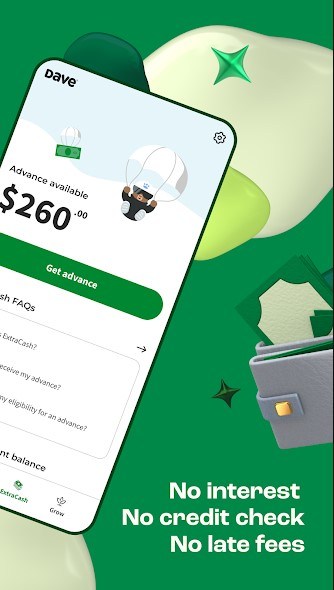

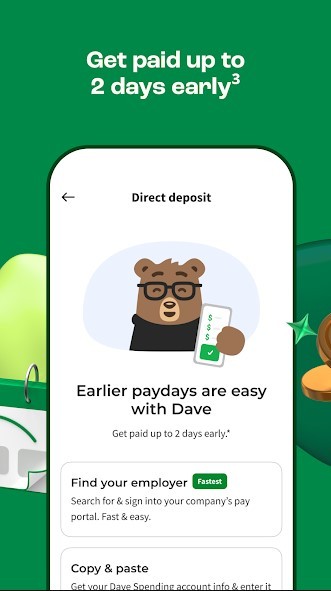

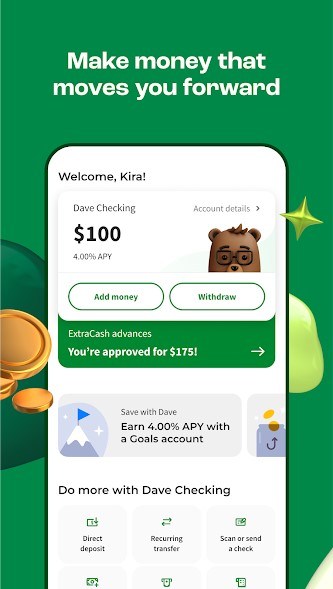

Dave

Dave is an app for those needing $100-$200 to get out of a difficult financial situation. To access unemployment cash advances, you must provide the app with your ID and bank account information where you have received more than two deposits of $200 each.

Here’s how it works:

- Initially, you download the app to your phone or tablet (available on Android and iOS).

- Next, you register a new account by providing personal information and ID.

- The next step is to connect your bank account. You can choose to have your existing bank account or open a Dave banking account with its debit card. The app charges you $1 for a monthly subscription and completes your registration.

- After this step, Dave checks your expenses and income on your connected account and shows you how much you can receive as a cash advance. Once this feature is available, you can request a cash advance and pay it back when you receive your next paycheck.

The main advantage of this option is the absence of any APR and additional fees. You can pay a small tip, but these are voluntary.

However, Dave does have disadvantages. You will have to wait one to three days to have funds deposited into your account. Also, the app has a low maximum amount you can borrow ($250).

If you need a small amount of money to borrow for a few days or a week, Dave would be the best option because of the lack of high fees and APR. Also, for those looking for work, Dave provides opportunities, but it’s only about remote work.

Read More: Dave Review

SoLo

SoLo Funds allows all new users to borrow from $20 to $100 for up to 35 days with no fees or interest. If you use the app longer, you can get up to $575 for the same term.

The goal of the founders of this company was to provide people who are not eligible for personal loans with an alternative option cheaper than a payday loan. As a result, they were able to create a platform that lends money to almost anyone who fits the following criteria:

- To be a major U.S. citizen or permanent resident.

- Have a bank account with a debit card that SoLo Funds supports.

When you create an account with the app, it runs a soft credit check to determine exactly how much credit you can afford. The main advantage of this option is that the only charge for an unemployment cash advance is the optional tip and donation to the lender. Of course, you can choose not to give them if you do not have that option, but in that case, it may be more difficult for you to find a lender. The only downside that app users note is the low amount of the first loan, only up to $100.

SoLo Funds is available on Android and iOS. It is the best option for those who want a free cash advance.

Brigit

Brigit is another app that gives unemployment cash advances without a credit score check to borrowers who don’t have formal employment. It works the same way as Dave and allows you to borrow up to $250 before your next paycheck.

Brigit has the following advantages:

- It is available on both iOS and Android.

- Brigit allows you to connect automatic protection against overdraft fees.

- In the app, you can check your credit score for free.

- Brigit will enable you to extend the repayment period if you do not pay your loan on time.

- Any cash advance you get with this app has 0% APR, with no late fees or penalties.

The main disadvantage of this option is a relatively expensive monthly subscription of $9.99 per month and a long time to withdraw money (up to 3 days). In addition, when registering, you will need to connect a checking account that meets the following requirements:

- It is over 60 days old.

- You were actively using it for 2-3 weeks before registering.

- You get at least 2-3 payments a month from the same source to this account.

- Your balance in this account exceeds $0.

Brigit is an excellent option if you don’t like the cheaper Dave app.

Read More: Brigit Review

FloatMe

FloatMe is an app designed specifically for unemployed people to “float” them up to $50 in an emergency. It costs only $1.99 monthly and allows you to get a small cash advance into your account within three days or 8 hours (for an additional $4 rush fee).

FloatMe has the following advantages:

- The app is available in all 50 states.

- It has a 30-day free trial, so you can try it out and see if it’s right for you.

- It offers 0% APR and no tips or fees for services.

- You can get a loan from FloatMe even with a low credit score.

As with similar apps, you need to connect your bank account to FloatMe to take advantage of its cash advances. To do this, you must receive at least three payments of $200 a month to this account, have a positive balance, and not be self-employed.

The main disadvantage of this option is the tiny amount of money you can borrow (up to $50), while new users can get from $10 to $30. FloatMe may be the best option if you are not eligible for Brigit or Dave apps.

MoneyLion

MoneyLion is another app that allows unemployed people to borrow from $25 to $250 if they have a checking account that’s at least 60 days old and gets at least 2-3 deposits a month.

Its main advantage is the absence of donations or tips, and the main drawback is a high withdrawal fee of $19.99 and an expensive instant withdrawal of up to $7.99 (without it, the funds arrive in your account after 3-5 days).

This app was created to help you learn how to save and invest money, so its cash advances are less lucrative than Dave’s or Brigit’s. Therefore, we don’t recommend using this app as your primary option, but if you need an extra $50 that you can’t borrow elsewhere, MoneyLion can bail you out.

What Are Cash Advance Apps For the Unemployed?

Cash advances are small loans, usually up to $250, that anyone can get without a credit check. However, lenders typically ask for proof of income or formal employment from their borrowers to whom they are willing to lend money.

To avoid leaving the category of the unemployed without the opportunity to get a small cash advance, some loan applications have removed the income requirements and started lending money even to those who do not have official employment. The standard requirement of such platforms is to have a checking account to which you receive at least 2-3 deposits each month, preferably from the same source.

Are Cash Advance Apps a Good Idea for the Unemployed?

You should understand that every loan has one significant disadvantage – over time, you will have to pay back all the borrowed money and its interest. But will you be able to do it in time? The answer to this question determines whether this option is good for you.

Cash advances are a profitable and affordable alternative compared to payday loans, which have huge interest rates of sometimes up to 2,300%. However, before you take out such a loan, you need to answer the following three questions:

- Will you be able to pay off this loan on time?

Many of the apps we talk about in this article report to the credit bureau, so even one late payment on the loans you get from them can ruin your credit history.

- Do you understand all the terms of the loan?

Sometimes cash advances have 0% APR, but many additional fees that borrowers don’t know about. So before getting a loan, ensure you have thoroughly researched its terms and conditions and they are suitable for you.

- Are you aware of the risks you take by taking out such a loan?

Imagine what will happen if you don’t pay the loan on time. How would you get out of such a situation? What would it affect?

If you have answered all these questions and understand that you can quickly pay off your loan on time, this option may be a good idea and a way out of a difficult financial situation. However, if you are not confident that you can handle the commitment, it is better to use alternatives with a more extended repayment period or lower fees.

Read More: Cash Advance Apps

What Types Of Loans Are Available For the Unemployed?

If you don’t have a permanent job, you can still get one of the following types of loans:

- Secured loans.

You can give the lender collateral to agree to provide you with a weekend loan. The most common collateral is a house, a car, or an investment account.

However, it is essential to remember that this type of loan comes with high risks. For example, if you don’t pay it off on time, the lender can take your property to cover its costs on your loan and recoup the money you borrowed.

- Payday Loans.

This name describes short-term loans that do not require credit checks or formal employment. However, it is essential to note that they have high interest rates, which makes them illegal in some states.

- Credit card cash advances.

If you have a credit card with this feature, you can instantly borrow a small amount of money without a credit check and regardless of your employment. This option has a lower APR than payday loans, but you can only borrow a small amount.

Tips for Comparing the Best Cash Advance Apps

Choosing a lender is the most important thing you must do to make it easier to pay back your loan. So how do you do it quickly and ensure you’ve considered all the essential points? Just follow our plan and move through the following points.

Consider the Fees

You can often find a cash advance app that does not charge interest rates but has various fees, such as membership fees. All of them are included in the final price of your loan, so it is vital to take them into account.

You’ll never know how good an offer is until you count its price. So, for example, if one app offers to lend you $100 at 200% APR for three weeks, but no fees and another app promises 0% APR but asks for a $19.99 membership fee, which one will you choose?

Most people answer the second because 200% APR is a lot. First, however, let’s calculate the total amount of credit in the first and second cases:

- For three weeks of using the credit funds of the first application, you will pay only 200%: for 365 days * 21 days = 11.5% (0.115). If we convert that amount to dollars, we have 0.115 * $100 = $11.5. The total price of the loan is $11.5.

- The second app asks us to lend $100 for three weeks and pay a $19.99 membership fee, which means the total price of the loan will equal that $19.99.

It turns out that the first offer is more profitable.

Never make a final decision without calculating the total price of the loan and reading the contract with the lender charmingly to determine what the membership, prepayment, late, rollover, express transfer, and other fees are equal.

Calculate Interest Rates

APR is the annual percentage rate, the fee you must pay for using credit funds. For example, many cash advance apps offer loans at 0% APR, but some ask you to pay 800% APR. So how do you figure out which option to choose?

First, always calculate the total loan amount in dollars. It should include all interest and additional fees.

Second, try to choose offers with the lowest APR, but pay attention to the fees, which may be more expensive than the interest.

The average APR for cash advances is up to 200%. However, since you are borrowing a small amount for 2-3 weeks when you convert that interest into dollars, we realize that it is only $10-$30, depending on the amount.

Consider Repayment Terms

The repayment period is another important indicator to consider when choosing a lender. Again, there is a strict rule – the less you use credit funds, the lower your cost of credit will be. Therefore, many financial experts recommend choosing options with the shortest possible repayment period.

However, this rule does not apply to short-term cash advances. On the one hand, it is essential to pay off this loan as quickly as possible so that you pay less interest. On the other hand, the shortest possible repayment period can be a problem because if you are in a difficult financial situation, it may not get better in 2 weeks, and you won’t have the funds to pay off the loan.

To avoid overpaying and ending up in a situation where you are physically unable to repay the borrowed funds, try to choose apps with flexible repayment terms. This way, you can select a repayment schedule that is convenient for you and avoid falling into a debt trap.

Read the Reviews

There are things that a company’s website will never tell you. For example, whether the support service works well, whether the financial institution has no hidden penalties, and whether it closes its users’ accounts without explanation.

Always try to read reviews on the websites of independent companies, such as BBB.org. In addition, pay attention to whether the thoughts are varied because financial institutions often buy reviews similar to a standard template.

Alternatives Of Cash Advance Apps For the Unemployed

If you need a large amount of credit or, for some other reason, do not want to use cash advance apps, you can try one of the alternatives listed below.

Credit Card Cash Advance Loan

Credit card cash advance is the same small loan you can get on your credit card. Read your contract with your bank to see if you can use this feature and the terms.

You can usually get these cash advances at any ATM, bank branch, company app, or phone. The loan amount will be small, usually up to $100 at a time and up to $250 during the payment period.

This alternative is best for those who want to get cash offline in a few minutes.

Credit Cards

If you have a credit card, you can use it to cover expenses that arise while you are out of work. It is best to use this option to pay for everyday purchases, such as groceries, until you regain your average income level.

Avoid carrying balances for extended periods because you may find it challenging to pay off credit card debt later. However, this option is better than cash advances because it allows you to borrow more money at a lower APR.

Bank Loans

Many banks have loans designed for unemployed people. In that case, all you need to qualify is proof of any other income besides your salary. For example, you can state that you receive cash advance apps with unemployment benefits, have an investment account, rent your home, receive child support, or have an inheritance.

If you have no verified and stable income, you can ask the bank to give you a secured loan. In this case, you will need to provide some of your property as collateral so that the lender can reduce his risks and make sure you return the money he gave you.

Credit Union Loans

Credit unions are a great alternative to banks or online lenders because they usually offer better loan terms and have lenient requirements for borrowers. Often, credit unions don’t just look at your credit score or formal employment when deciding whether to give you a loan.

These financial institutions operate on a community model, so they must ensure all their members have access to credit, regardless of their employment situation. They often have programs for unemployed members, including Growth Loans, Child Benefit Loans, and Saver Loans.

You can contact your credit union or join one to find out what programs and credit terms are available.

Sources Used in Research for the Article:

- Cash Advances, The Board of Trustees of the University of Illinois,

https://www.obfs.uillinois.edu/payments/cash-advances - Cash Advance America – Possible Collection and Advance Fee Loan Scams

https://dfi.wa.gov/consumer/alerts/cash-advance-america-possible-collection-and-advance-fee-loan-scams - No hidden fees, Dave, https://dave.com/no-hidden-fees