Discover the best same-day loans offering fast approvals and quick funding to cover urgent financial needs

Sometimes life can turn so that you will have some significant urgent expenses: need to fix something in the household, repair the vehicle, or pay for a medical emergency. It can cost a lot of money, and it is especially noticeable when you don’t have emergency cash, and then you decide to borrow money.

So, you begin looking for some same day payday loan with fast approval. But what are the best options; which ones are the most reliable? Let’s find out!

Same Day Loans: Best Offers

If you’re in New York or another US city and looking for same day loan applications, you’ve come to the right place. Here, we’ll share the best offers on same day loans we’ve found. These major credit bureaus offers are from reputable lenders and can provide you with the cash you need quickly and easily. However, keep in mind that state laws can vary.

With low-interest rates and flexible repayment terms, such best loans online can be a great way to get the money you need without putting a strain on your budget. Furthermore, some lenders may offer these loans without performing a hard credit inquiry, which can be beneficial for those who are concerned about their credit score.

Low Credit Finance

Low Credit Finance is a payday loan provider that accepts different credit types and offers quick credit loan decisions with an affordable repayment term.

Highlights

No hidden fees: You only need to fill out the form by providing all the necessary info and wait till the credit inquiry is approved.

A large pool of lenders: You can find loan lenders depending on your specific requirements.

Quick loan decision: Wait about 60 minutes to get the option approved and money transferred to your account.

APR

APR is from 5.99% to 35.99%.

Terms

- Be above 18

- A valid form of ID

- Must be a US citizen

- Earn at least $1000 in monthly payments

Origination fee

- No origination fee.

Minimum credit requirement

The minimum credit limit is $100.

Maximum loan amount

The maximum loan amount is $5,000.

Pros and Cons

Advantages:

- Quick loans;

- Poor credit scores are accepted;

- No additional fees;

Disadvantages:

- Impossible to get without a credit check;

- High interest rates.

Conclusion

Although getting a same day loan without a soft credit check is quite hard, the fast decision-making process and vast pool of lenders cover the cons.

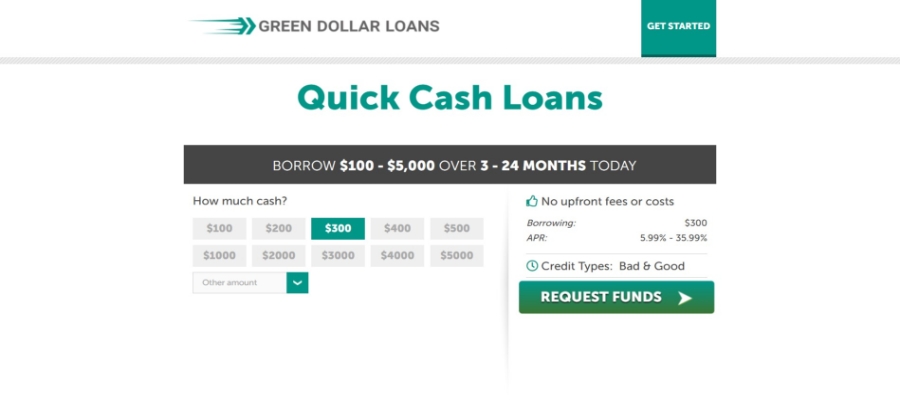

Green Dollar Loans

Green Dollar Loans is a peer-to-peer lending platform that provides loans to private persons and businesses.

Highlights

Security: Although this service connects users with potential lenders, the application information is not shared with other entities.

Rates and fees: The only expense is the interest rate – and it should be noted that this rate is higher than average.

Multiple loans: Green Dollar Loans provides reasonable interest rates and flexible repayment terms to fit your requirements.

APR

APR is between 5.99% – 35.99%.

Terms

- Be 18 or above

- Have a good credit history

- Have US citizenship

- Provide supporting documents

- Have an active bank account for further transactions

Origination fee

No upfront fees

Minimum credit amount

The minimum credit is $100.

Maximum loan amounts

The maximum credit is $5,000.

Pros and Cons

Pros:

- Support of all credit types

- Quick loans no credit check application approval

- 5.99% APR

Cons:

- Sometimes thorough credit checks are required

- Loans are not often approved

Conclusion

Green Dollar Loans provide stable and secured loan services that many users appreciate. They also allow getting credit for at least $100 within a day, making it a fast solution. Although, it is good to remember that they provide credit checks, so be sure to have it positive.

SoFi

SoFi (Social Finance) was founded in 2011 and is a digital lending company that offers financial solutions to enable individuals to accomplish their financial goals also through the app store.

Highlights

Different types of loans: It provides personal loans, student loans, and mortgages.

Repayment periods: In case of job loss, you can temporarily stop making payments for a period of up to 12 months.

Quick application: You have the chance to receive funding as early as the following business day.

APR

APR range is from 5.99% to 19.63%.

Terms

- Be 18+ years old

- Provide a valid form of ID

- A minimum credit score is 680

- Have a minimum annual income of $50,000

Origination fee

No fees

Minimum credit amount

The minimum possible credit is $5,000.

Maximum loan amounts

The loan amount offered is up to $100,000.

Pros and Cons

Pros:

- Low interest rates

- Flexible repayment term

- No membership fee and law finance charges

- Diverse customer service

- Access to financial planning services, exclusive events, and career coaching

- No credit reports

Cons:

- Strict eligibility criteria

- Limited availability

- Lack of branches

- No co-signer options

Conclusion

All in all, SoFi offers competitive interest rates, flexible repayment options, and no fees for their loan products. However, their eligibility requirements may be strict, and they have limited loan options and physical branches.

Upstart

Upstart is one of the lending companies that give personal loans to borrowers with a limited credit history, using advanced algorithms and machine learning to evaluate their potential for success.

Highlights

Quick approval times: typically within one business day. Credit borrowers can receive funds as soon as the next day.

A fully online application

Flexible repayment terms: they are usually up to five years.

APR

APR rates may vary from 7.8% to 35.99%. It depends on factors such as income, credit score, and loan amount.

Terms

- a minimum FICO credit score of 620

- a steady source of income and be currently employed or have a job offer starting within six months

- the maximum debt-to-income ratio allowed is 50%

- U.S. citizenship or permanent residence

- a valid Social Security number

- at least 18 years old

Origination fee

Up to 12% of the loan amount.

Minimum credit amount

The minimum credit is $1,000.

Maximum loan amounts

The loan amount can be a maximum of $50,000.

Pros and Cons

Pros:

Almost instant approval process

- Flexible repayment terms

- Uses advanced algorithms and machine learning to evaluate potential borrowers

- Loan offers for borrowers with a limited credit history

Cons:

- High down payment compared to some other lenders

- APRs can be high for borrowers with lower credit scores

- strict eligibility requirements

Conclusion

Upstart is a good option for borrowers who need quick access to funds and have a limited credit history. However, borrowers should be aware of the high processing fee and potential for high APRs. Overall, Upstart’s use of advanced technology and flexible repayment terms make it a competitive player in the personal loan market.

Avant

Avant refers to loan providers that offer personal loans to borrowers with fair to good credit. The company was founded in 2012 and has since provided loans to more than 600,000 customers.

Highlights

Instant loans approval process: Borrowers can complete an application and receive a loan decision within minutes.

Funds can be deposited as soon as the next business day: Such fast processing is useful for users who need to get the money quickly.

No prepayment penalty: Avant does not charge borrowers any prepayment fees for paying off their loans sooner than the agreed-upon term.

Flexible payment options: Borrowers can choose a repayment period (from 24 to 60 months) that fits their budget and financial situation.

APR

It ranges from 9.95% to 35.99%.

Terms

- a minimum credit score of 580

- a regular source of income

- a good credit profile

- U.S. citizenship or a permanent residence with a valid Social Security number

- at least 18 years old

Origination fee

The fee charged by Avant can go as high as 4.75% of the loan amount. This fee will be taken out of the loan proceeds.

Minimum credit amount

The minimum amount available through Avant is $2,000.

Maximum loan amounts

The maximum loan amount available through Avant is $35,000.

Pros and Cons

Pros:

- Fast funding process and flexible repayment terms

- Competitive interest rates for borrowers with fair to good credit

- No paying off penalties

Cons:

- Loan application fee can be costly

- Borrowers with lower credit scores may be subjected to higher interest rates

Conclusion

Avant is a solid option for borrowers with a credit card looking for a personal loan. While the processing fee can be high, the fast funding process and flexible payment options make Avant a convenient choice for those in need of quick cash.

LightStream

LightStream is an online lender that offers personal loans to borrowers with excellent credit. The company was founded in 2013 and is a subsidiary of SunTrust Bank. The platform offers flexible repayment options, competitive interest rates, and a simple application process with no fees or paying off penalties.

Highlights

Same-day funding available in some cases: It offers the possibility to receive funding on the same day that you apply.

No fees: It does not charge any early repayment fees, origination fees, or other. This makes it easier for borrowers to understand the true cost of their loan and avoid unexpected expenses.

Competitive interest rates for borrowers with excellent credit: Clients with good financial standing and excellent credit scores can secure better rates than they would with other lenders.

APR

The annual percentage rate for LightStream personal loans ranges from 2.49% to 19.99%.

Terms

- a minimum credit score of 660

- several years of credit history with a variety of account types

- sufficient income to repay the loan

- U.S. citizenship or a permanent residence with a valid Social Security number

Processing fee

No processing fees

Minimum credit amount

The minimum loan amount available through LightStream is $5,000.

Maximum loan amounts

The maximum loan amount available through LightStream is $100,000.

Pros and Cons

Pros:

- Same-day funding available in some cases

- Borrowers with excellent credit may be eligible for competitive interest rates

Cons:

- No option for co-signers

- Only available to borrowers with excellent credit

Strict eligibility requirements

Conclusion

LightStream is for borrowers with excellent credit looking for a personal loan with high dollar amounts. While the lender’s strict eligibility requirements may make it difficult for some borrowers to qualify, those who do will benefit from the lender’s competitive rates and lack of fees.

Alliant Personal Loan

Alliant Personal Loan is a personal loan option for members of Alliant Credit Union. The lender offers competitive interest rates and flexible payment terms.

Highlights

Competitive interest rates for members: They are lower than what other money lending apps offer.

No prepayment penalties: You can pay off your loan early without incurring any additional fees.

Fast online application: An application can be filled out in minutes, so you receive a loan decision shortly thereafter.

Flexible payment terms: Borrowers can select from various repayment plans, ranging from 12 to 60 months, and can also choose their payment due date.

APR

The APR for Alliant personal loans is from 6.24% to 10.24%.

Terms

- be a member of Alliant Credit Union

- a minimum credit score of 640

- a minimum income of $50,000 per year

Origination fees

Alliant does not charge any fee.

Minimum loan amounts

The minimum loan amount available through Alliant is $1,000.

Maximum loan amounts

The maximum loan amount available through Alliant is $50,000.

Pros and Cons

Pros:

- No paying off penalties

- Competitive interest rates for members

- Fast online loan application process

Cons:

- Minimum credit score requirement of 640

- Only available to Alliant Credit Union members

Conclusion

Alliant Personal Loan is a great option for members of Alliant Credit Union looking for a personal loan. The lender has competitive interest rates and flexible payment terms. Keep in mind that only Alliant Credit Union members are eligible for advance loans from this lender.

Rocket Loans

Rocket Loans is an online lender that offers personal loans to borrowers. Their loan application is fast, and funds can be deposited as soon as the next business day.

Highlights

Funds can be deposited as soon as the next business day: This is especially useful if you need to cover unforeseen expenses.

Transparency and clarity: Rocket Loans provides transparency, with clear terms and conditions and no hidden fees.

Quick application: You can enjoy convenient and fast online loan applications that can be completed in just a few minutes.

APR

The annual percentage rate for personal loans ranges from 7.161% to 29.99%.

Terms

- U.S. citizenship or a permanent residence with a valid Social Security number

- a minimum credit score of 580

- a regular source of income

- over 18 years old

Processing fee

Up to 6% of the credit amount. This fee is deducted from the loan proceeds.

Minimum credit amount

The minimum amount available through Rocket Loans is $2,000.

Maximum loan amounts

The maximum credit amount available through Rocket Loans is $45,000.

Pros and Cons

Pros:

- Competitive interest rate for borrowers with no credit check

- Fast funding process

- No paying off penalties and overdraft fees

Cons:

- Borrowers with lower credit scores may be subjected to higher interest rates

- Application fee can be costly

Conclusion

Rocket Loans is a solid option for borrowers with a credit card looking for a personal loan. It has a fast and easy application process, so Rocket Loans is a convenient choice for those in need of quick cash.

OneMain Financial

OneMain Financial also refers to loan providers that offer personal loans to borrowers with fair to poor credit. The company has been in operation since 1912 and has branches in over 1,500 locations across the United States.

Highlights

Funds can be deposited as soon as the same day: OneMain Financial offers the possibility of same-day funding for approved loan applicants.

Instant approval process: OneMain Financial saves borrowers time and reduces the hassle of waiting for a loan.

Personalized approach: OneMain Financial takes a personalized approach to lending, with loan officers available to help borrowers understand their options.

APR

It ranges from 18.00% to 35.99%.

Terms

- over 18 years old

- a minimum credit score of 600

- a regular source of income

- a U.S. citizenship or a permanent residence

- a valid Social Security number

Origination fee

Up to 10% of the loan amount

Minimum credit amount

The minimum credit amount available through OneMain Financial is $1,500.

Maximum loan amounts

The maximum loan amount available through OneMain Financial is $20,000.

Pros and Cons

Pros:

- Fast funding process

- Flexible payment options

- No prepayment penalties

Cons:

- Application fee can be high

- High interest rates

Conclusion

OneMain Financial was made for borrowers with a good credit score looking for a personal loan. While the interest rates can be high, the fast funding process and flexible payment options make OneMain Financial a convenient choice for those in need of quick money on a credit card.

Upgrade

Upgrade is an online lending company that provides personal loans to borrowers with a good credit score. Since its founding in 2017, Upgrade has serviced over 10 million customers.

Highlights

Fast loan approval process: A straightforward application can provide borrowers with loan approval instantaneously.

Flexible payment options: It is possible to choose a monthly payment due date and make extra payments or pay off a loan early with no early repayment fees.

Direct deposit as soon as the next business day.

APR

The personal loan APR range is from 6.94% to 35.97%.

Terms

- a credit report from financial institutions like credit bureaus

- a minimum credit score of 620

- a stable source of income

- to be a U.S. citizen or a permanent resident with a valid Social Security number

- 18+ years old

Origination fee

Up to 6% of the loan amount.

Minimum credit amount

- The minimum amount available through Upgrade is $1,000.

Maximum loan amounts

The maximum loan amount available through Upgrade is $50,000.

Pros and Cons

Pros:

- No prepayment penalties

- Competitive interest rates for borrowers with fair to good credit

- Fast funding process

Cons:

- High application fee

- Higher interest rates for borrowers with lower credit scores

Conclusion

For individuals with fair to good credit who are seeking a personal loan, Upgrade is a dependable choice. Though the processing fee may be steep, Upgrade’s swift funding process and adaptable payment choices render it a practical option for those who require fast access to funds.

Big Buck Loans

Big Buck Loans is a well-known loan provider of payday loans. One reason is that it accepts all FICO credit scores. As a result, you could have the funds from your successful application in about 15 minutes.

Highlights

High approval rate: Big Bucks Loans has a high approval rate of 97%, which means that most applicants can get loans with this company.

Fast funding: You may apply for a loan and expect to receive your money within 15 minutes.

Low interest rates: Big Bucks Loans also has low interest rates, which is convenient for customers looking to save money in the long run.

APR

APR is between 5.99% to 35.99%.

Terms

- Be 18 and above

- Have a good credit history

- Have US citizenship

- Earn $1,000 in monthly payments

- Have an active checking account for further transactions

Origination fee

No processing fee.

Minimum credit requirement

The minimum rate is $100.

Maximum loan amounts

The maximum rate is $5,000.

Pros and Cons

Pros:

- 15-minutes payout time

- From 2 to 24 months repayment time

- Funding range

- Availability of loans for bad credit and installment loans

Cons:

- Sometimes a credit check is required.

Conclusion

To conclude, people prefer Big Buck Loans because they can get the loan with no credit check but approved in about 15 minutes, making it an extremely fast solution in the market. It also provides FICO credit scores, although be sure to give a credit history as it is often required.

MoneyMutual

If you are interested in getting same day funding options from the best loan providers, you should try MoneyMutual credit services.

Highlights

Easy lending process: There are only three steps: answer general financial questions, attach a credit report from the credit bureau, and select the lender you need.

Wide range of advance loans: By furnishing the necessary information, you will be guaranteed approval for a loan for education or travel from MoneyMutual’s payday lenders and will be able to get installment loans.

Trustworthy website: The platform is safe as all the entered data stays on the platform and is not shared with a third party.

APR

APR is between 5.99% and 35.99%.

Terms

- Be 18 and above

- Have an active bank account

- Earn about $800 in monthly payments

Origination fee

No fee.

Minimum credit requirement

The minimum rate is $100.

Maximum loan amount

The maximum rate is $5,000.

Pros and Cons

Pros:

- Fast application process (one business day)

- Safe and trustworthy platform

- Quick approval platform

Cons:

- Not available for some states

- Should provide income proof of about $800

Conclusion

To conclude, the MoneyMutual is an excellent platform for those who seek options with no credit check, that have a quick same day approval process, and who want to be sure in the company. Although to get the loan, it is a must to show proof that your income is about $800 per month.

Funds Joy

Funds Joy are trustworthy loan matching services that allow users to get a loan of up to $5,000 with simple steps.

Highlights

No credit check: When users apply online to this financial platform, they can be sure they use a no credit check service.

Rates: The rates at this company are very reasonable as they range from 5.99% and 24.99%.

Security: Users have peace of mind when applying for a loan with this financial platform, as they offer secure transactions via TrustCommerce.

APR

APR is between 5.99% and 24.99%.

Terms

- A resident of the US

- Be 18 and above

- Have proof of your income

Origination fee

1% to 5%.

Minimum credit requirement

The minimum credit requirement is $100.

Maximum loan amount

The maximum credit requirement is $5,000.

Pros and Cons

Pros:

- Transparent and simple platform

- No credit check

- Installment loan ability

- Reasonable rates

Cons:

- Prove to have a stable income.

Conclusion

Funds Joy is an excellent option for those who want transparent services and get reasonable rates. Although, it may not be for everyone as this platform requires proving a stable income history that not everyone can have.

What Are Same Day Loans?

If you’re in a tight spot and need cash fast, the same day loan options could be the better solution than pawnshop loans. Same day payday loans may be high-interest, short term loans that can be approved and funded in as little as 24 hours. While they can be a lifesaver in a pinch, they come with a high price tag and should only be used as a last resort.

How Do Same Day Loans Work?

Same day loans are cash advance options intended for emergencies. These loans are typically shorter-term, high-interest payday loans that must be repaid without credit cards within a few days or weeks.

Online lenders offer loans quickly without a lengthy application process or extensive credit checks like in a pawn shop.

The process for getting same day loans is very straightforward. First, you select the amount you need. Then, you enter basic personal information into a simple online application form, such as your email address and phone number. Once the lender has verified your information, they will send you the money via electronic transfer.

Types Of Same Day Loans

There are many different types of same day loan agreements available to consumers. Some of the most popular include payday, title, and personal loans. Each type of personal loan has its own set of benefits and drawbacks, so it’s essential to understand the pros and cons of each before you make a lending decision.

Title Loans

A title loan can be a quicker way than credit cards to receive the cash loans you need with no credit check. To get auto title loans, you require a car and to sign the title over to the lender.

Title loans are outstanding because they’re quick and easy. The lender has a lien on your vehicle until the loan is repaid.

The cons of title loans are that they can be expensive. Some lenders charge extra fees for same day loan early or late loan payments.

Cash Advance Loans

Cash Advance Loan is a short term loan that the borrower typically repays within a given time frame. If the borrower doesn’t pay back this amount on time, they may take a fee and additional late prepayment fees.

Cash Advance Loans have benefits, including fast access to money for expenses like credit checks and car repairs.

There are also some cons of cash advance loans, such as paying a high interest rate on loans and being left with no other forms of credit.

Payday Alternative Loans

Payday Alternative Loans are usually a better choice than payday loans. The interest rates are lower, and you don’t need a cosigner. This personal loan is easier to qualify for because the borrower doesn’t need a checking account or good credit.

Payday Alternative Loans are a good option if you need an emergency loan of up to $1000 not on a long term basis but before your next paycheck or have bad credit.

Payday Alternative Loans don’t require a bank account or good credit, and the interest is much lower.

Some lenders may require a guarantor fee if you cannot supply collateral. These online loans are not available in all states.

Payday Loans

Online payday loans, also known as payday advances or cash advance loans, are typically small emergency loans that borrowers must pay back with their next paycheck. Although they may seem like a convenient option, payday lenders often charge exorbitant interest rates and fees for these loans. It can trap borrowers in a debt cycle.

If you fail to repay the loan on time, you will incur additional fees and a higher interest rate on future loans, leading to further financial struggles. Thus, payday loans are a risky and expensive financial option for those who need immediate cash. That’s why it is better to ask for help from a specialist who can answer all your questions, such as how do I consolidate my payday loans.

When Should I Take Same Day Loans?

In the event of an unforeseen financial burden, it may be a good time for the user to get the no credit check loan right away. You should also reach out to family members or other sources of support before deciding on a loan.

Same day personal loans can come in handy when the user has an urgent demand for emergency funds. If the user’s existing funds can’t cover the financial burden and the demand is essential, no credit check loans may be the best option. The payday loan company provides the user a way to get the funds they need now and worry about paying them back at the end of the month. It’s also important to be aware of state regulations. The Federal Trade Commission provides helpful resources and information and can be a valuable resource when considering a same day loan.

How to Choose the Direct Lenders for Same Day Loans?

It is crucial to conduct comprehensive research and carefully review the terms and conditions of any loan offer when evaluating online lenders for same day loans. The Consumer Financial Protection Bureau provides helpful information and resources for consumers on borrowing money and can be a useful tool when considering a same day loan from an online lender or different credit unions.

Here are five steps to finding the right direct lenders for the same day loan:

- Look for emergency cash immediately bad credit direct lender that has reviews and ratings on third-party review websites. You can find there a range of details, such as opinions and views from past clients, evaluations, and ratings. Don’t ignore them, as they can offer essential insights into the lender’s standing and trustworthiness.

- Check the lender’s website to see if they offer a no credit check loan. Not all lenders offer this service, so you need to check the information about same day loans.

- Carefully read the loan terms and conditions on the website of the direct lender. These may be details such as the loan amount, interest rate, repayment periods, and possible fees or penalties. It’s worth noting that not all lenders offering same day loans are equal.

- Contact the direct lender to see if they offer no credit check loans. You can also ask about the lender’s application and approval process etc.

- If you are satisfied with the lender’s offer, proceed to the next step and apply for a loan. Try to choose a reliable lender who offers favorable terms and conditions to avoid any trouble.

How to Get a Same Day Loan on My Bank Account?

The personal loan term and process can be tedious, requiring a long form and many documents. You may have to wait a while to hear back from the lender. Luckily, with the no credit check loan, you can get the cash you need without waiting and with any credit score.

Here’s how to get a loan today:

- Apply online

- Sign digitally

- In some cases, speak to a live loan officer over the phone

- Receive your funds in as little as one business day, with all rights reserved.

What Are the Requirements for the Same Day Loan?

Many people need money quickly, and with so many options for obtaining cash, it’s easy to get credit check loans. The credit check loan requirements are usually that you are 18 or older, have a job, and can prove your income.

Can I Get Online Loans with the same day Deposit and No Credit Check?

No credit check loans are comparatively easy to get if you have bad credit loans. There are loans for people with bad credit and payday loans online for people without credit. So, the answer to the question is “Yes”.

You can get same day quick same day loans online with bad credit history within minutes for urgent needs and emergencies. This means you can approve an application as soon as you fill it out and get your cash on the same day.

No soft credit check loans are available for people with poor credit scores or no credit score at all. If you have a bad credit history but still need a loan, this type of sponsored content offering loans may be the right fit for you.

Conclusion

To conclude, there are many types and options for same day credit check loans. Each of them has specific features that attract their users to get loans from them, such as low interest, the ability to reloan in some time, and a fast same day approval process.

But before going and getting same day credit loans online, it is essential to read about all the risks and situations where you can get each type. So, be sure to check everything connected with the selected financial assistance and be conscious of your decisions.