Get access to $255 payday loans online with same-day approval to cover urgent expenses, read on to discover instant loan options and how to apply quickly!

The area of finance is unpredictable. You may never know when to expect ups and downs, so it is generally recommended to tuck away some money in a so-called ‘nest egg’: that can be a solution for emergency expenses.

But what if this option isn’t available and the credit score makes you worry? Credit scores below 600 often stand in the way of obtaining loans from most conventional lenders. An urgent situation is still not a reason to jump to unreasonable choices such as secured loans or home equity loans.

Even with smaller sums of money and an instant approval guarantee, lenders of 255 payday loans online might offer unattractive conditions.

To help you see better versions of small and medium-size credits with instant approval guaranteed, we compiled a list of trustworthy california payday loan providers, so check them out.

Payday Loans Online Same Day: Best Offers

Since there is a considerable number of things to check before making instant credit card applications for same day loans and pitfalls to avoid at all costs, we compiled a list of services to find loan providers. These platforms boast good reviews, offer a wide choice of 255 payday loans online, and have become top choices in the last few years.

Here, we will review the benefits and drawbacks of online payday loans, question the common understanding of payday loans, and see when they’re okay to take out. We’ll also look at the key elements of loans – APR, repayment terms, fees, loan amounts, and documents needed – and see how affordable they are.

P.S. These are not direct lenders but platforms giving access to various creditors.

PayDaySay

General description

PayDaySay is a great short-term financial solution that doesn’t rely on your credit or history. Borrowers of 255 payday loans online can count on a gracious attitude to overdraft fees, quite loyal terms, and loans for 5 different purposes:

- Personal loans

- Installment loans

- Payday loan consolidation

- Emergency loans

- Business loans

The PayDaySay app is free. There’s no monthly subscription cost, and you can apply for online payday loans. That’s a rare thing to find for users with bad credit scores.

APR

59%-200% for personal payday loans (and 6%-36% for longer terms).

Terms

Short: until the next payday. Other long-term loans can be repaid in 3 months to 5 years.

Origination fee

Depends on the lending company.

Minimum credit requirement

500

Loan amount

$100 to $1.000 in payday loans.

Requirements

Personal data, such as name, address, and phone number, are the basics of what’s needed. Yet, different lenders can pose other requirements, and you shouldn’t agree to loans until you read all terms and conditions.

What documents are needed:

A passport is the only document many payday loans will need. No proof of income or bills is asked.

Pros and cons

|

Pros |

Cons |

|

|

|

|

|

|

Conclusion

As for emergency 255 payday loans online, providers tend to give loans freely, with no special requirements to score or credit history. Several loan types, including business loans, easy loan request making, and medium APR, make it a good option.

BadCreditLoans

BadCreditLoans is a platform that offers personal loans and aims at bad credit score borrowers.

Best for: borrowers with bad credit and poor spending history, young people with no credit history yet.

General description

At BadCreditLoans, there is a big database of authorized online lenders where users can find suitable offers and compare the best online personal loan.

APR

5.99% to 35.99%.

Terms

3 to 36 months.

Origination fee

Nearly 1%, depending on the creditor.

Minimum credit requirement

No (accepts scores of 500 and under).

Loan amount

$10.000 (for bigger purchase aimed loans – up to $35.000).

Requirements

Being a US resident 18 y.o. and older, having a valid bank account, contact info, etc.

What documents are needed

Social Security Number and other documents proving you’re a legal US resident.

Pros and cons

|

Pros |

Cons |

|

|

|

|

|

|

|

|

|

|

|

Conclusion

Like any other provider of online payday loans, BadCreditLoans is not a direct lender with fees and interest. Still, it’s a pearl for anyone seeking fast 300 cash now or debt relief and credit repair.

Cash Advance

This platform connects you to lenders who offer short-term online payday loans and guarantees a fast loan decision. The company has been in the lending industry since 1997 and complies with federal law.

Best for: borrowers who need a cash advance and payday loans.

General description

Cash Advance is a standard legal way to get cash quickly and without fuss.

APR

Up to 28% for payday loans and 10%-36% for other types.

Terms

Vary.

Origination fee

No.

Minimum credit requirement

No.

Loan amount

$100-$1.000.

Requirements

Verifying consistent employment for the past 3 months, having an active checking account, and earning at least $900 monthly, a credit check may be done, and they might want to see your credit report.

What documents are needed

Apart from proving your employment, you will also need to provide your ZIP code and Social Security Number.

Pros and cons

|

Pros |

Cons |

|

|

|

|

|

|

|

|

|

|

|

Conclusion

All in all, Cash Advance is not a direct lender but a lender network that provides an extensive database of lenders who can offer loyal and less merciful conditions without a credit check. It’s also not difficult to get a loan, but it depends on whether the payday loan lender will need a hard credit check.

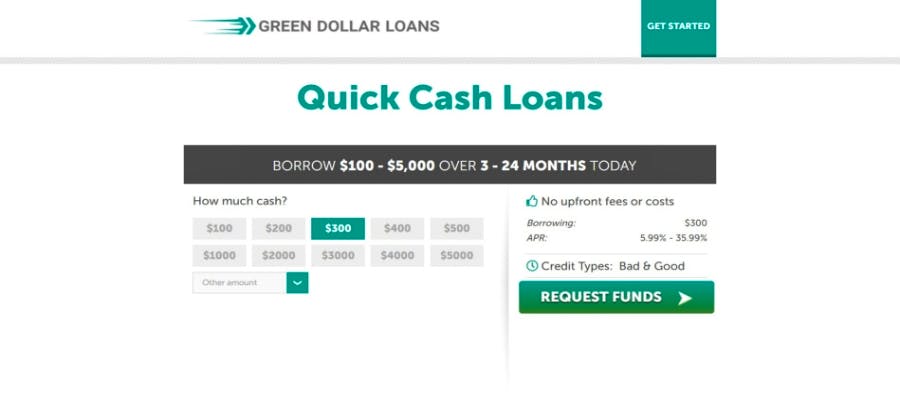

Green Dollar Loans

Being tight on finance may bring you to Green Dollar Loans as a convenient way to obtain cash on the same or the next business day.

Best for: borrowers seeking refinancing loans and installment loans.

General description

Green Dollar Loans has a lot of lenders to choose from and specializes in installment loans and auto title loans. Reviews say this lending partner a convenient way to borrow, and you’ll be contacted 15 minutes after applying. Still, Trustpilot and BBB have no info about it, so the partnership can be a surprise.

APR

From 200% to 1300% for short-term payday loans and 6% to 225% for installment loans.

Terms

Vary.

Origination fee

May be present, depending on the lender.

Minimum credit requirement

Varies.

Loan amount

$100-$5.000.

Requirements

Being at least 18 years old and a resident of the US.

What documents are needed

Being a citizen of the US or Canada, proof of ID, documents proving a steady source of income. Credit quality may be checked as well.

Pros and cons

|

Pros |

Cons |

|

|

|

|

|

|

|

|

|

|

|

Conclusion

Green Dollar Loans are an accessible way to borrow, thanks to the simple-to-use website and wide choice of lenders. Loans don’t limit the amount of borrowed money and its use.

What Are $255 Payday Loans Online Same Day

Payday loans online are loans given for short terms and fund you on the same business day. They are often classified as emergency loans. Borrowers may be checked for repayment eligibility, and soft credit checks are performed. Still, it’s not a rule, and it depends on the loan terms and conditions.

Applying for online payday loans in amounts from $100 to $500 and up these days is available online – usually through filling in forms and mentioning your personal information plus providing necessary documentation for same day approval.

Unlike personal loans, online payday loans are much easier to get. Loans online same day are given for less than 1 month and are expected to be returned at your next paycheck.

How Do Same Day Loans Online Work?

Same day payday loans are great short term loans for users with bad credit who need funds instantly but won’t qualify for other loans. After applying for online payday loans, the needed sum will be deposited to your bank account in nearly 24 hours. This is given if your loans online same day are described as an ‘instant approval loan.’

You will often get the finances in your credit card instead – the banks and accounts depend on the lender. In general, be prepared to wait more than stated. When the repayment date comes, the lender will expect you to pay 255 payday loans online in full or will use automatic withdrawal from your bank account.

Read More: Best Same Day Loans

How to Apply for $255 Payday Loans Online

To get payday loans online same day, follow these steps:

- Be careful examining loan repayment terms, policies, and fees.

- Submit an online loan application to make a loan request, filling out personal data and contacts (Some documents, such as proof of income, may be requested at this stage).

- Agree to fees and terms and make sure the loan date determined no (it’s called the pay date).

- See the approval status.

- When approved, go through identity and document verification.

- See if the verification is successful and the money is released.

Don’t neglect the step of researching a loan well – even if a provider of loans online same day is well known and trusted, you need to make sure that terms and fees are acceptable. If you don’t manage to pay an online payday loan in time, you jeopardize yourself by getting into a debt circle. This leads to larger financial needs.

Below, there’s more info on every step of getting loans online same day.

Select the Best $255 Online Payday Loan

Picking a worthy loan out of all options is a real challenge. If you are not attentive enough at the starting stage, you can suffer financial losses or agree to pay sky-high interest rates and fees for the same service you could have received elsewhere.

So, deciding on a certain loan offer out of all online loans needs advice, thorough thinking, and lots of comparisons. Here is a short guide to help you out.

- Check if the lender is registered and complies with the law.

Look into the affiliations section, terms and conditions to find it out. Moreover, check if payday loans are even legal in your state. They are currently illegal in 13 states of the US.

- See if the provider reports to credit bureaus.

This is super important as it determines if you’re able to improve your credit. If that’s your goal, choose those lenders of loans online same day that shares info with at least 2 major credit reporting bureaus: Experian, Equifax, and TransUnion.

- Look at amounts and charges.

While some providers of online payday loans may just charge fees for a late loan payment or missed payments, watch out for additional charges. Payday loans are generally more expensive than installment loans or cash advance.

If this type of loans online same day turns out too pricey, it’s not too late to use a credit union to get emergency money now instead (with a much lower APR). (*Credit unions are non-profit organizations that help users in need).

See also if there are any hidden fees in payday loans.

Complete the Form

Filling in the form with your info isn’t hard, but a correct sequence of steps can be helpful.

- Have your data at hand.

Prepare all papers that might be needed in advance.

- Give personal data.

This includes your birth date, address, residential status, and often Social Security Number.

- Fill in employment and contact data.

Email, phone number, and details about employment and income (how much and when you get paid) may be required to get loans online same day.

- Deposit data.

Give banking information, like in which account the money will arrive and if this bank account has a good standing. This may also require you to choose if you want to get the funds in direct deposit and if you can repay time loans online same day. Direct deposit (or same day direct deposit) is the most frequent option.

Get Feedback

Once the application process and lending process are over, be patient to wait for a loan without credit check approval from several hours to 24 hours or 1 more business day. This period in payday loans mustn’t take longer than that. Watch the status of your application online.

Read & Sign the Contract

Remember – the loan principal is that your loan is still invalid until you sign the loan agreement. If all is good with the feedback, you read and approve the loan request terms and conditions. Signing a loan agreement is the next step. These days online signatures are widely used for this purpose (with the help of e-signature services).

The contract signed by both sides proves that the lender and borrower complete their responsibilities. While the lender sends a stated sum of money, the borrower commits to use these funds from the loan online for a specified goal.

Factors You Should Consider Before Applying for the Best $255 Payday Loans Online Same Day

If you resort to online payday loans, you might be in a hurry. Yet, take some time to evaluate the real prospects of getting 255 payday loans online and their benefits. At the same time, learn the lender’s offers well to prevent dangerous situations.

First, find out if the payday loan service is registered and complies with state regulations. Read about who the online payday loans are designed for, study user reviews, and see how long the company has been in business. Must-view factors also include:

APR

The range of loan services and APRs in payday loans online is wide, but the law can determine upper limits for fees and interest (whereas lenders more often dictate the APR).

The APR of 400%-600% is common for American payday loans. This equals paying $10 to $30 for each §100 borrowed. A cash advance, in contrast, offers APRs of nearly 30%. As for a payday loan that lasts up to a month, an affordable APR is 300% to 400%.

Terms

Payday loan repayment period doesn’t last longer than 62 days, without an extension or renewal period. Most likely, you’ll have to repay in a matter of 2-3 weeks.

Origination Fee

Depending on the area, payday lenders may charge a 1-2% origination fee. It may include payday loan request processing, funding, and underwriting the loan and contain a share for administrative work. The origination fee is legal up to 10% for online payday loans and may be charged from new borrowers.

This upfront fee in payday loans can’t be equal to low-percent fees in mortgages: as a rule, you’ll see a 5% or 7% fee.

Required Credit Score

The good news is that for loans online same day, you don’t need a fair or good credit score to qualify. A borrower only requires proof of employment and income to demonstrate they can repay a short-term loan.

Payday loans also rarely report to credit bureaus, so there’s no impact on credit scores.

Loan Amount

Now, $255 is a mid-size loan amount for online payday loans. To generalize, the sum of such a payday loan varies from $50 to $1.000 (some up to $5.000). However, a more considerable payday loan amount is often not available for newbies and those whose score was determined low by the soft check.

How Fast Can I Get a $255 Payday Loan Same Day?

As we mentioned, applying for online payday loans takes up to 15 min. Funding happens in 24 hours or the next business day. Most lending company representatives make a loan decision related to lending in 20 minutes. The rest of the time goes for loan processing and funding in the account, which also depends on the preferred banking.

What Are Advantages and Disadvantages of $255 Payday Loans Same Day?

Payday loans are seen as a fast and easy way to get cash to cover urgent financial needs. They also feel less overwhelming since you don’t get into a long-term loan. For bad credit borrowers, payday loans online same day are near to perfect. But let’s summarize their benefits and drawbacks to see a complete picture.

Advantages

Easy access.

They’re a convenient way to get cash immediately – your issue can find a solution in just a few minutes. They’re good for those seeking instant approval.

Not as demanding.

Criteria for accepting borrowers are not as strict as in other loan types, and a poor credit score doesn’t make a problem. These short term loans are given to most borrowers without effort.

No collateral & less risk.

You don’t have to use a valuable asset or property as collateral because these are unsecured online payday loans. Hence, no property can be seized in case of failure to repay.

Disadvantages

Incredibly high APR.

The price for high speed of funding and fewer requirements is an outstanding APR. Interest rates in payday loans can reach 1.500%, and finding such loans with an APR lower than 700% in the US is a struggle.

Swirling borrowers in a debt cycle.

Now, it’s not a danger if you can repay in time, but for many, it results in spiraling down the debt cycle and putting themselves at greater risk. This ends up with even worse credit score for client with bad credit.

You may be a victim of harsh collecting methods.

Since the web of lenders is wide, it’s impossible to check every creditor’s trustworthiness. Some may turn to techniques like threatening letters or withdrawing payments and late fees from your account without user consent.

Paying not to direct lenders.

Direct lenders are preferable to non-direct because a third party can cause hardships and be unreliable. A direct lender is easier to communicate with, and there are only 2 sides to an agreement. If possible, choose direct lenders.

Read More: $2,500 Personal Loan: How It Works and Where to Apply?

Alternatives to $255 Payday Loans Same Day

Realizing that you’re not ready for online payday loans is okay – the key is staying on the safe side and choosing a fitting and stress-free loan. Good alternatives for borrowing money for bad credit owners are:

- Use a credit union;

- Ask for salary advance (an excellent way to get cash in advance without interest percent);

- Borrow money from friends / family;

- Use a guarantor loan;

- Turn to tribal lenders (those run by native Americans and indigenous tribes in reservation territories).

Sources Used in Research for the Article:

- Payday loans, Consumer Financial Protection Bureau,

https://www.consumerfinance.gov/open-government/information-quality-guidelines/ - Private (Non-federal) Loans, New York University

https://www.nyu.edu/admissions/financial-aid-and-scholarships/applying-and-planning-for-undergraduate-aid/private-loans.html - Payday lending, Federal Trade Commission,

https://www.ftc.gov/terms/payday-lending