Discover the best $25 loan instant apps that provide quick and easy access to small cash advances—read on to find the right app for your needs!

Finding the right cash advance option can make all the difference in urgent situations. Here’s another service that might help when you need funds quickly.

Best cash advance services

In today’s fast-paced world, unexpected financial needs can arise at any moment, leaving us scrambling to find quick solutions. Enter 25 dollar loan instant apps, game-changing tools designed to ease your financial stress and provide small cash advances for a seamless borrowing experience.

These innovative cash advance apps empower users by granting swift access to small, manageable, and short-term loans at the touch of a button. No more waiting in long queues, filling out extensive paperwork, or feeling overwhelmed by high interest rates.

With a $50 instant app, you can get a cash advance and address minor financial emergencies or bridge those annoying gaps between paychecks, all while maintaining control over your finances.

Join us as we delve into the world of instant loans and discover the reasons behind the growing popularity of apps like these, taking you one step closer to financial freedom and peace of mind.

Best $25 Instant Loan Apps

We understand the urgency of needing quick and small cash advances in your bank account. This is why we’ve done the heavy lifting for you by carefully handpicking the best $25 instant cash advance loan apps that you can borrow money from.

Even if you have bad credit, our expert selection covers a range of trustworthy and user-friendly loan apps that let you borrow money and address your financial needs without a credit check. You don’t even need to worry about qualifying for direct deposits offered by other lenders. So, whether you need 25 dollar cash advance for urgent bill payments, sudden car repairs, or a last-minute gift, these top-notch apps have got you covered.

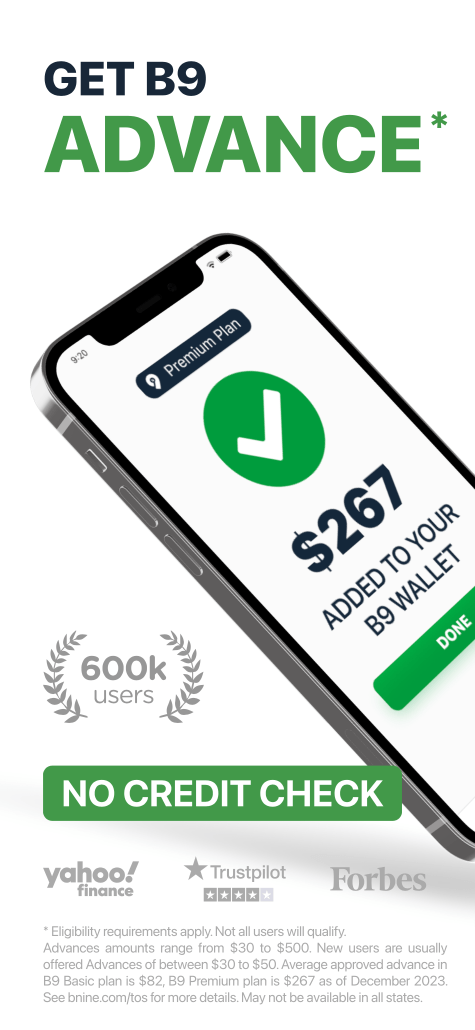

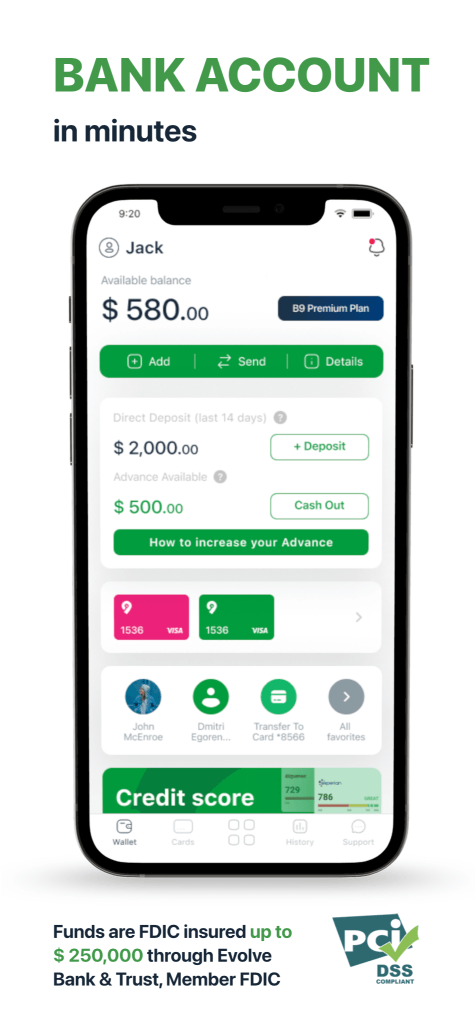

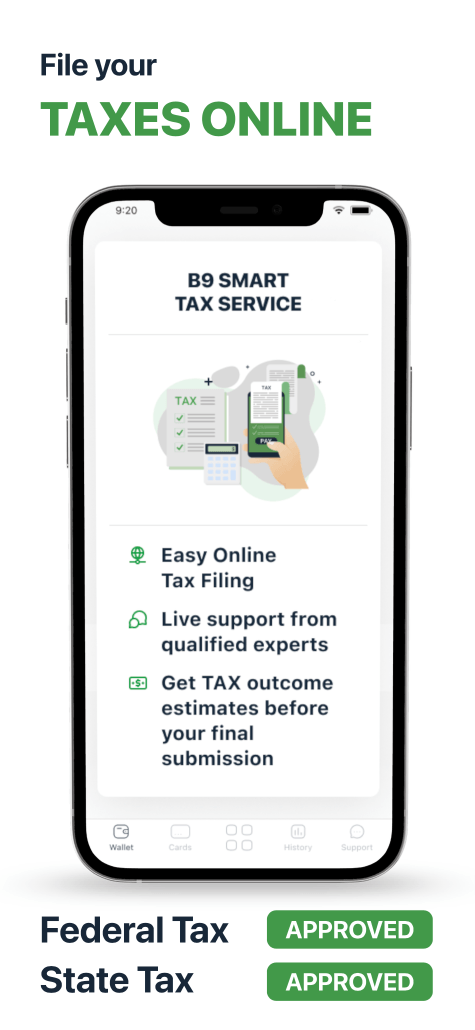

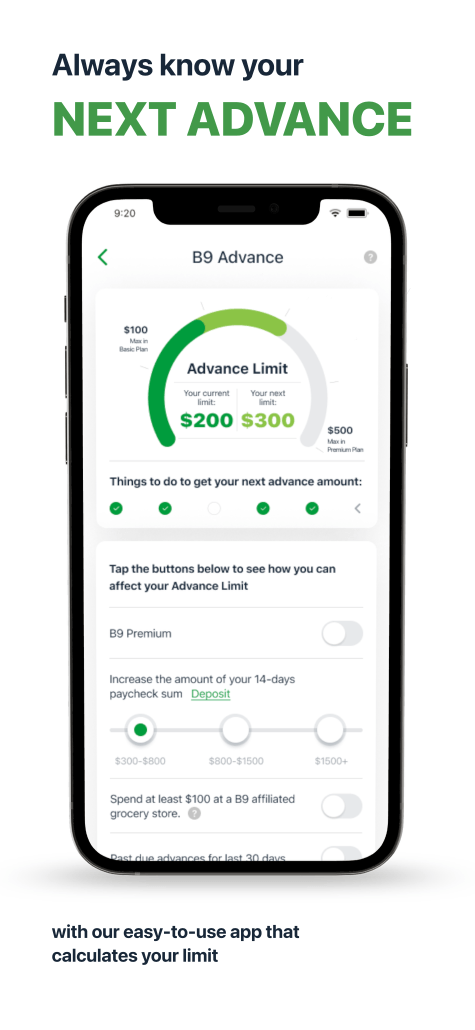

B9

The B9 Banking App is a commendable entrant in the digital banking space. Packed with a variety of features, it offers a solid user experience, serving as a one-stop solution for your banking needs.

Features

- User-friendly Interface: The app offers a clean, intuitive user interface that makes navigation simple, even for first-time users.

- Broad Spectrum of Features: From funds transfer to loan applications, the app consolidates a range of banking services in one platform.

- Security: With strong encryption protocols, the app ensures your financial information stays safe.

Basic Requirements

B9 Accounts can be opened with either an SSN or an ITIN. You must have an active account with B9 to utilize the B9 app, which is compatible with iOS and Android devices.

Terms and Fees

Within the B9 Banking App, users encounter a range of basic fees, such as advance payments between $30 and $500. For newcomers, advances typically range from $30 to $50. The standard advance under the B9 Basic plan is $82, whereas the B9 Premium plan offers an average of $267 as of December 2024. For those seeking smaller amounts, a $100 loan instant app like B9 provides quick and flexible access to funds.

There are no fees for immediate advance delivery, but transactions at non-B9 ATMs incur a $2.50 charge, and international transactions attract a 3% fee. ACH transfers, however, are free of charge. Depending on the service utilized, various other fees might be applicable, so it is advisable to consult the latest B9 Banking fee schedule for accurate information.

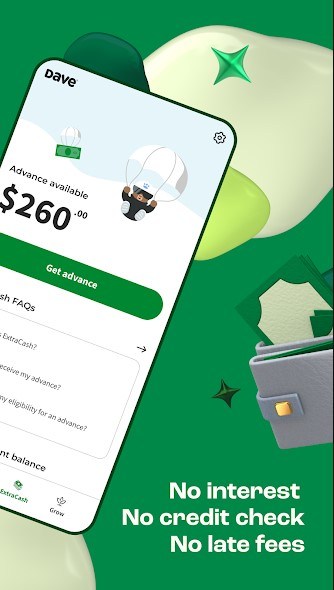

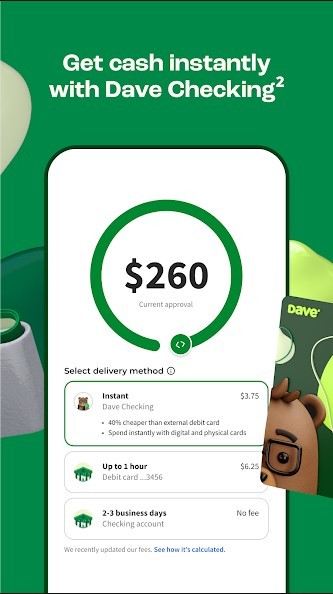

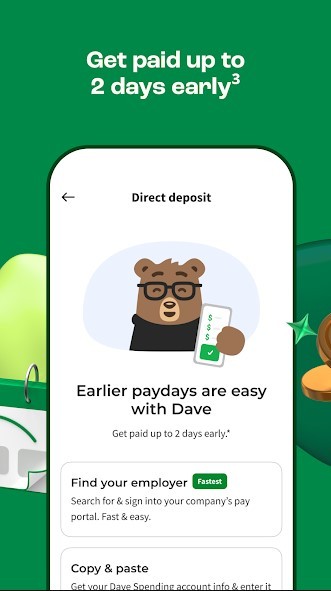

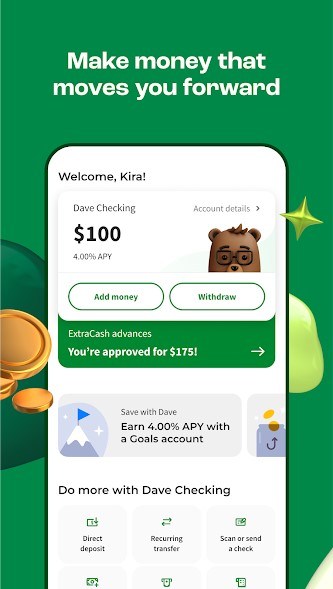

Dave

Dave is a cutting-edge cash advance instant loan service designed to provide overdraft protection offering short term, interest rate free cash advances. With a simple and user-friendly interface, Dave provides valuable financial budgeting tools to help users better manage their expenses and improve their overall financial health. For those looking to strengthen their financial knowledge, combining these tools with insights from financial podcasts can offer a well-rounded approach to smarter money management.

By combining these features with an intuitive user experience, Dave has positioned itself as a leading player in the instant loan app market. The benefits of using Dave are numerous.

- This cash advance app offers instant cash advances, without a credit check, of up to $500 without any interest or hidden fees via qualifying direct deposit.

- Dave’s predictive artificial intelligence technology analyzes your spending habits and provides real-time alerts to help you avoid overdraft fees (overdraft protection).

- There are no fees to pay, but there is a $1 monthly subscription fee.

This proactive approach to financial management is a game-changer for users who struggle to stay on top of their expenses. Furthermore, Dave offers a convenient repayment system, allowing users to pay back their small cash advances automatically from their next paycheck, eliminating the stress of traditional loan repayment processes.

Brigit

At their core, apps like Brigit grant users access to short-term loans of up to $250 without the need for a credit check or steep interest rates. With a primary focus on transparency and user-friendliness, Brigit provides instant financial relief via direct deposit without the burden of hidden fees or long waiting periods.

- The app utilizes smart algorithms that analyze your spending habits, direct deposits, and predict upcoming expenses, ensuring you have the necessary funds to cover them to prevent overdraft fees on your debit card or credit card

One of Brigit’s standout features is its seamless integration with your existing bank account, debit card, or checking account. This enables real-time credit monitoring of your financial status. The app also sends timely notifications, alerting you when your bank account balance is running low or when a payment is due.

Additionally, Brigit offers budgeting tools and personalized financial insights, helping users make informed decisions about their money management. Their $9.99 monthly membership fee is above average, but this cost covers a lot of helpful financial features.

MoneyLion

MoneyLion is a versatile credit builder loan and cash advance app that is a one-stop shop for managing personal finances. They offer a range of services, including:

- $250 cash advances

- Credit builder loans

- Reporting to the three major credit bureaus

- Budgeting tools

The app’s cash advance feature stands out with instant approval, without a credit check, and zero % APR. Through direct deposit, MoneyLion offers cash advances designed to assist users in times of financial emergencies

MoneyLion’s robust security measures ensure that users’ personal and financial data is well-protected, enhancing the app’s credibility. However, this cash advance app charges a monthly $19.99 subscription fee and transfers to a third-party checking account can take up to one business day. With this in mind, MoneyLion is best for those who want to take advantage of credit builder loans to improve their credit scores.

Earnin

The concept behind Earnin is simple yet revolutionary. Users securely link their bank accounts and employment information to the app, which then tracks their working hours, calculates their earnings, and sends a small amount of money through direct deposit.

Users can request a cash advance of up to $100 per day, with maximum loan amounts of up to $700 per pay period – all without a credit check. The borrowed amount is then automatically deducted from the user’s bank account or debit card on their next paycheck, ensuring a hassle-free repayment process.

Unlike traditional payday loans that charge exorbitant fees, apps like Earnin operate on a voluntary “tip” system, allowing users to contribute what they feel is fair for the service with no fees involved

Moreover, the Earnin app is designed to be user-friendly and accessible, with features such as “Balance Shield” to prevent overdraft fees (overdraft protection) and “Cash Back Rewards” to help users save on everyday purchases.

This cash advance app is perfect for anyone wanting to borrow money in a larger sum than other lending platforms offer. The funds can only be requested two business days before your next paycheck is due, and they must be sent to the same bank account, debit card, or checking account where your wages are deposited.

Chime

As a leading financial technology company (The Bancorp Bank and FDIC provide banking services), Chime has gained immense popularity among consumers. They provide small cash advances without a credit check. Through its user-friendly interface and interest-free banking services, users can access short-term loans via direct deposit.

Chime distinguishes itself from traditional providers and even other loan apps by ensuring a seamless application process and instant access to funds once approved. Users can borrow 25 dollars with a short-term loan directly from the app, and with a fast application process, most receive a decision within minutes.

Chime doesn’t rely solely on credit scores to determine eligibility to get cash advances, making their loans accessible to a broader range of consumers, including those with less-than-perfect credit

Another key feature of the Chime loan app is the integration with the user’s Chime account (similar to a savings account), which allows for automatic loan repayments and easy management of the bank account balance. This eliminates the need for manual transfers or the risk of incurring fees from missing a payment.

Additionally, Chime offers various loan repayment options, including the ability to split payments between multiple paychecks, giving users the flexibility to manage their finances according to their specific needs.

Cleo

The Cleo loan app is a revolutionary digital platform that marries cutting-edge technology with user-friendly features to provide small cash advances and guidance to its users. The app’s primary function (fee-free) is to serve as a personal finance assistant, helping users budget, save, and track their spending.

However, what sets Cleo apart from other budgeting apps is its ability to offer instant loans to users who meet specific criteria.

Known as Cleo Plus ($5.99 monthly membership fee), eligible users can access short term loans of up to $100 per pay period.

Cleo’s AI-driven system evaluates your financial situation and determines your eligibility requirements in real time. The app also offers flexible repayment options and 0% APR, ensuring that users can pay back the borrowed amount without straining their finances. To create an account with Cleo:

- Download the app from your app store.

- Sign up with your email address, etc

- Enter your bank account information and debit card details.

Albert

A short-term cash advance provided by Sutton Bank, Member FDIC, Albert simplifies the process of getting money by eliminating the need for lengthy applications, credit checks, and waiting periods. By connecting directly to your bank account or debit card, the app can quickly assess your financial situation and calculate an appropriate amount – typically up to $250.

Once approved, you will get money in your account within minutes. Then you can get cash advances up to three times per pay period, which are repaid through your next paycheck.

One standout feature of the Albert cash advance app is its transparency when it comes to fees. Unlike traditional payday loan services, there are no interest charges on their small cash advances. Instead, users are encouraged to pay a voluntary “tip” for the service, allowing them to choose their own level of support.

For a monthly subscription fee between $8.00-$16.00, users have access to more budgeting tools, including access to ATM withdrawals for a $2.50 fee.

Top Questions To Ask While Choosing The Best $25 Loan App

The search for the perfect $25 loan app can be overwhelming, which is why you need to ask yourself the following questions to ensure you make the right choice. Knowing what to look for will save you time, money, and potential frustration. Only then can you confidently select a $25 loan app that best fits your needs and expectations.

What Are Fees?

When considering instant cash apps like Earnin or OppLoans, it’s essential to understand the various types of fees involved and their average amounts. Although not as high as payday loans, typically, these money apps charge:

- Origination fees

- Late payment fees

- Transaction fees

The average fees vary depending on the app, loan amount, and your credit score, but origination fees usually range from 0.5% to 1% of the loan amount, while late payment fees can be around $15 to $30 per missed payment.

To determine whether the fees of an instant cash app are normal, compare them with other similar apps on the market. Research and compare the fees charged by different instant cash apps to get a clear understanding of the industry standards and check that they’re in line with the banking services provided.

How Much is the Loan Limit?

Loan limits refer to the maximum amount of money that you can request from a lending institution or app. These limits are typically calculated based on credit score, income, and repayment history.

So, when choosing an instant cash app, you first need to determine the amount of money you need. This will help you gauge whether the app’s loan limit is suitable for you. Keep in mind that loan limits vary among different instant cash apps. While some offer higher loan limits, they may also have stricter eligibility requirements or a higher interest rate.

What Is Turnaround Time?

While there are several instant cash apps that claim to provide users with quick access to funds, not every app is designed to deliver money at lightning speed. The turnaround time, or the time it takes for funds to be transferred and available for use, can vary significantly between different money apps like Dave and MoneyLion.

In situations where every minute counts, relying on an app that takes hours or even a few business days to process transactions can lead to financial strain. In these cases, it’s best to select an instant cash app that is specifically geared toward rapid fund transfers.

On the other hand, if your financial needs are not time-sensitive, the turnaround time of various cash apps might not be a significant concern. In such cases, users can focus on other factors, such as convenience, ease of use, and security.

Are Requirements Affordable?

The general requirements of instant cash apps, such as OppLoans, are designed to cater to a wide range of users and provide swift financial assistance in times of need. These money apps typically require users:

- To be of legal age.

- Possess a valid government-issued ID.

- Have a stable source of income.

- Hold an active bank account or checking account.

However, to stand out in the competitive market, some instant cash apps may incorporate additional requirements or features to enhance the user experience. These extra requirements could include:

- A comprehensive credit check to ensure responsible lending.

- Flexible repayment options to accommodate different credit history circumstances.

- A robust customer support system to address any concerns or queries promptly.

Furthermore, these apps might offer incentives like a lower interest rate for users with good credit scores, referral bonuses, or cashback rewards for timely repayments.

Does Customer Service Work Properly?

The role of customer support in these loan apps ensures that the users have a seamless experience but also instills confidence and trust in the brand they borrow $25 instantly.

When choosing an instant cash app, it’s a good idea to check reviews from other users on customer support. This helps potential users gauge the quality of the app’s customer support and how well they address issues and concerns.

A well-functioning customer service system helps users troubleshoot issues and provides valuable insights into the app’s features, making it more user-friendly and efficient.

What are Instant Loan Apps?

At their core, cash advance instant loan apps are designed to streamline the lending process by leveraging advanced algorithms, data analytics, and cutting-edge technology. They allow users to apply for loans with just a few taps on their smartphones, eliminating the need for tedious paperwork, long waiting periods, and complicated procedures associated with a personal loan application, for example.

Upon submitting the necessary personal and financial information, the lender assesses the applicant’s creditworthiness and repayment capacity in real-time, generating an instant decision on loan approval.

Once approved, the funds are disbursed directly into the borrower’s bank account or checking account, often within minutes, providing them with immediate financial relief. The entire process, from the application form to disbursement, is carried out seamlessly and securely, ensuring the utmost privacy and data protection.

Pros and Cons of Instant Loan Applications

When it comes to financial decisions, it is essential to weigh all aspects before making a choice. This is precisely why it is crucial to look at the pros and cons of $25 advance instant loan applications before opting for one.

Advantages:

- Convenience: With just a few taps on your smartphone, you can borrow $25 without the hassle of visiting a physical branch or applying for credit cards.

- Lightning speed approval process: Traditional financial institutions that offer personal loans, for example, often take days or even weeks to approve loan applications, but with instant loan apps, you can expect a quick response.

- Personalized experience: They use advanced algorithms and artificial intelligence to analyze your credit history and credit score, resulting in tailored loan offers that cater to your specific needs.

- Low overhead costs: This affordability factor is especially beneficial for those who struggle to get the money they need with other lenders due to poor credit.

Disadvantages:

- High rates and membership fees: This can lead to significant debt accumulation in the long run.

- Lack of proper credit assessment: Many instant loan apps do not carry out a thorough credit check, leading people to borrow money beyond their repayment capacity. And not all of them report to the major credit bureaus.

- Impulsive borrowing: Users may fall into the habit of relying on cash advance apps for frivolous expenses, leading to a vicious cycle of debt and the chance to borrow money from credit builder loans impossible.

- Fraud: Scams and fake apps can trap unsuspecting users, leaving them with mounting debt and a tarnished credit score.

Alternatives to Apps for Instant Money

Having instant access to the money they need has become a necessity for many people. While numerous cash advance apps have emerged to cater to this need, it’s also worth exploring some alternative safe loan online options that offer similar benefits.

This list presents a few tried and tested alternatives to cash advance apps for instant money, ensuring you never find yourself in a financial bind.

- Peer-to-peer lending platforms connect borrowers with investors who are willing to lend money and offer short-term or long-term personal loans. With competitive interest rates and a streamlined online process, these platforms offer a convenient way to access funds quickly.

- A credit builder loan or personal loans from banks or credit unions. Although a personal loan requires a more extensive application process and better credit scores, these loans generally have a lower interest rate and more flexible repayment terms than app-based loans.

- If you borrow 25 dollars from friends and family, it can provide a quick boost to the balance of credit cards without the need for app downloads or credit checks.

- Selling items of value, such as electronics or jewelry, can generate immediate funds.

Summary

In today’s digital world, $25 loan instant apps have become a money game changer for individuals with bad credit scores seeking quick financial assistance. These innovative platforms offer a simple solution to access small, short-term loans within minutes, ensuring that your urgent needs are met without any delay.

This comprehensive list of cash advance apps includes reputable names that prioritize user convenience and security. With their easy-to-use interfaces and streamlined processes, obtaining a short-term loan has never been simpler.

So, don’t let financial hiccups hold you back; explore the fantastic world of $25 loan instant apps and experience the future of borrowing today. But remember to keep in mind that these cash advance apps are not the best long-term solution and should be used sensibly.