Let’s imagine that you need to pay a bill or pay for car repairs in a hurry, and you’re $100 short. How do you solve this problem quickly and efficiently? Download one of the cash advance apps and get funds into your account within a few hours without a credit check.

There are many such offers on the internet, but some are fraudulent or require huge fees. So that you can save time and choose a $100 loan instant app without high interest rate, credit checks, and considerable requirements right away, we have compiled a list of the top 5 best loan apps. Read it and choose the option that works best for you.

Top $100 Loan Instant Apps

The best 100 loan instant earnin alternatives allow customers to close their urgent expenses. Such applications fall into several types, depending on the models on which they operate:

- The first apps are platforms that connect lender requests with investor opportunities. Their advantages include getting a loan, even if you have a low credit score. But the main drawback is high borrowing rates and short repayment terms. In addition, they can conduct thorough credit checks to ensure the safety of their financial activities.

- The second type works on a subscription model. The longer you use them, the more money you can borrow at 0% APR. This option looks the most profitable, but only if the subscription costs are less than $10 per month.

- The last type of $100 loan instant app partners with your employer so you can get your earnings a few days early at 0% APR. It’s an excellent substitute for instant loans, but it’s only available to those who qualify under strict requirements.

If you are wondering, “which app can I borrow money instantly with?” let’s compare the best offers.

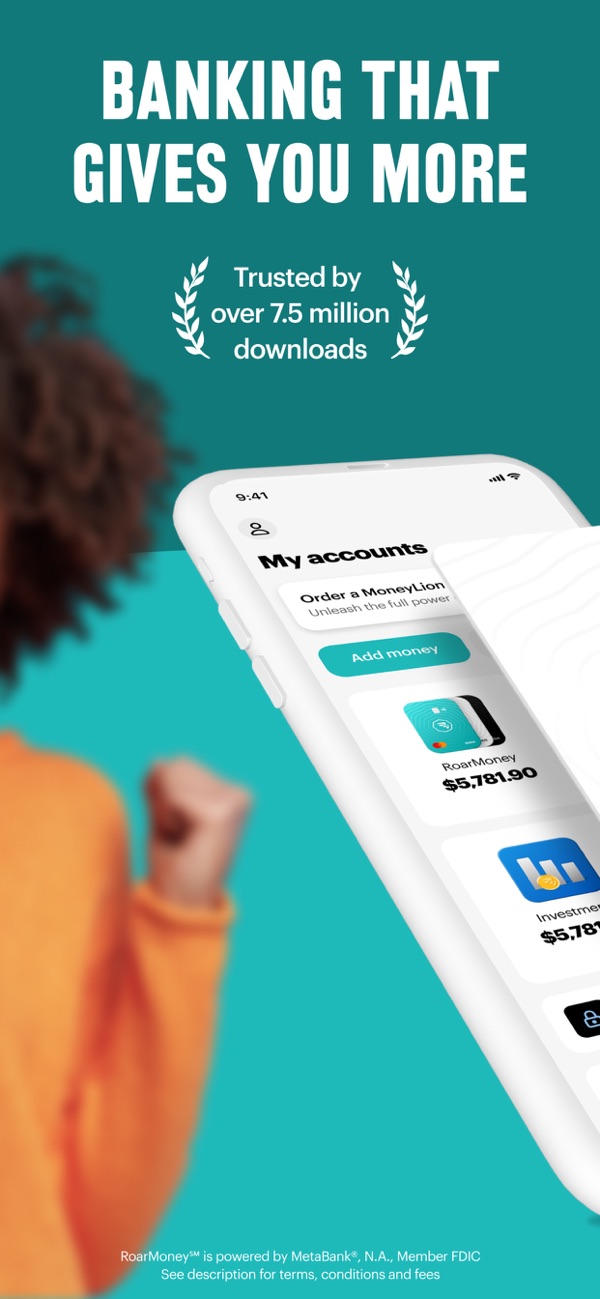

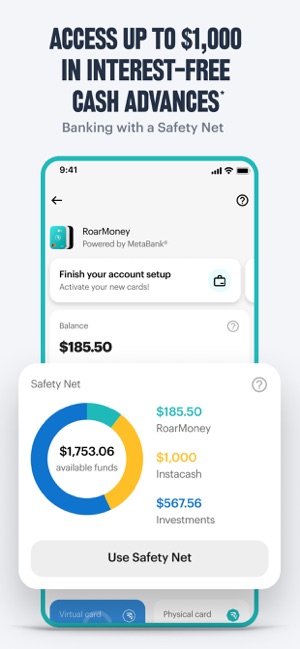

MoneyLion

This cash advance app works on a subscription business model and offers several financial products: small personal loans, online banking services, and credit-builder loans. Once you download the app and sign up, you open a zero-fee checking account and can borrow up to $250 per month at an interest rate as low as 0%.

The maximum subscription price is $19.99 monthly for those who want to use a credit-builder loan. However, if you only need small loans from time to time, you can get them for free, for a small tip of a few dollars.

How MoneyLion works?

This cash advance app doesn’t get credit checks of your financial history before lending you money, but does set meager amounts for first loans. For example, most users may only lend $50 after signing up, but that amount will increase over time.

MoneyLion often only allows you to withdraw part of the credit limit in one loan. In that case, you will need to borrow part of the amount on Monday, pay back at least 10% on Tuesday, and lend another part on Wednesday according to the loan agreement.

The standard period of full repayment of the loan is four days. This cash advance app can transfer money to any of your accounts, but it will only take a few days to arrive without a referral fee. If you need funds immediately, you can make a withdrawal to your MoneyLion debit card or pay a $4.99 fee.

How to borrow from MoneyLion

You need to download and register your account to get money from the app. To do this, enter your personal information, your Social Security number, and the details of a credit check at least 60 days old to which you regularly receive income.

The cash app will then show you how much credit is available to you right now. For example, If you want to borrow 100 dollars, click “Loan Request” and wait for the withdrawal. Remember to pay off your personal loan no credit on time right in the app.

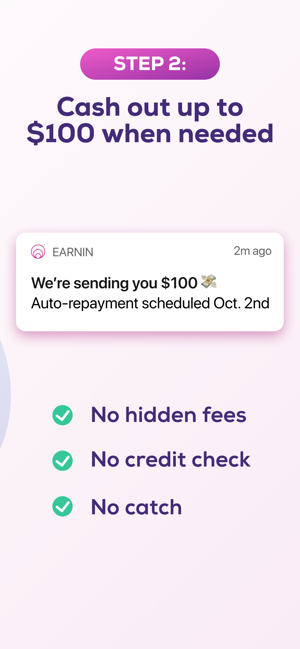

Earnin

This cash advance app is the best alternative to short term loans because it allows you to borrow money from yourself instead of the financial institution. It connects to your primary bank account and will enable you to get a cash advance at 0% APR a few days before your salary day. Note, you don’t have to pay this money back because it’s yours!

Like a Chime account, this app has no additional overdraft fees or monthly subscriptions, but it does offer a cash advance of up to $14. In addition, you can get your money the same business day without a credit check if you pay a fee for an express withdrawal.

How Earnin works?

When you download the app and create an account, you enter your primary bank account balance and give Earnin access. You can use this platform as a financial assistant to keep track of your income and expenses, and in case of an emergency, ask it to give you a small portion of your next paycheck a few days before your next paycheck. The only drawback to this option is the strict requirements. To get the money, you must:

- Be a U.S. citizen over 18 or have a visa allowing you to live and work there.

- Have official employment and proof of that.

- Have a fixed work location, an electronic timekeeping system, or PDF-style timesheets.

- Receive the next paycheck at least once a month. Other options are weekly, biweekly, and semi-monthly.

- Receive more than 50% of your direct deposit to a checking account.

How to borrow from Earnin

To use this app to get credit, you can use the following plan:

- Download the app on Android or iOS and create your account. Note that it can take up to 3 days to verify your information, so it’s best to do it before you need money in an emergency.

- Connect your checking account to the app and add your employment credit report information. This way, the app can keep track of your payment schedule.

- Add an electronic timesheet so the app has access to your earnings.

Next, you can request a cash advance by clicking on the “Cash Out” button. The exact amount of withdrawal depends on the number of hours worked and your income during that pay period. Usually, the funds come to your account within 1-3 days, but you can get them faster if you pay an express transfer fee according to the loan agreement.

Brigit

This app allows you to get a small paycheck advance of up to $250 at 0% APR for a $9.99 monthly referral fee. It also has many tools to help you learn how to manage your finances and educational articles.

How Brigit works?

Brigit doesn’t get a credit check of the financial history of its borrowers and doesn’t charge actual interest rates for using credit money. Instead, the app uses your income and employment information to determine how much up to $250 you can pay back in a few weeks. To qualify for a cash advance from Brigit, you must:

- Have a bank account that was opened more than two months ago.

- Have more than $0 in your account.

- You must have received more than three payments totaling $800 or more to this account in the past two months.

The app also has its “Brigit” score, a scale from 0 to 100, by which it rates your reliability as a borrower. The higher your score, the more money you can borrow. You can see the amount available on the app’s main screen.

How to borrow from Brigit

After you have downloaded the app, you must complete the following steps:

- Create an account and enter all the necessary information. Remember to upload essential documents such as proof of your employment, ID, and proof of address.

- Connect your existing checking account to your account. This is where the app will charge your monthly subscription and deposit cash advances.

- See what Brigit score you got and how much credit you can expect to get.

- Loan request an advance.

When you receive the money, the paycheck advance app will calculate your due date and remind you two days before you pay the loan. If you want to avoid paying overdraft fees, pay the money back on time.

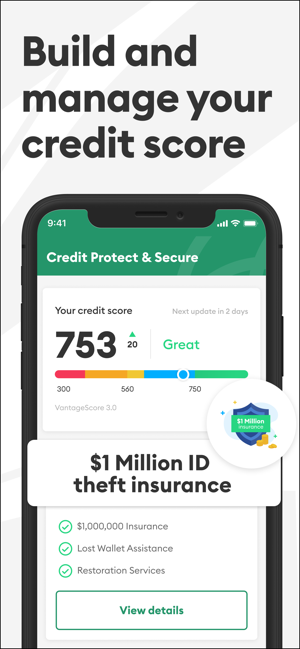

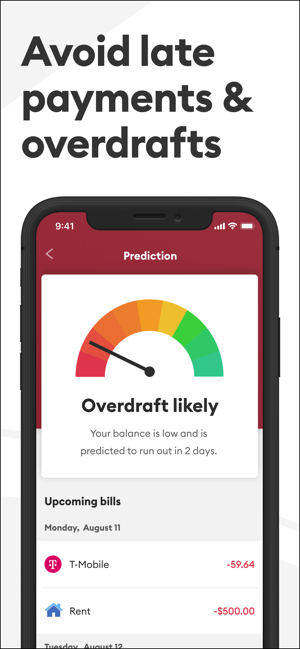

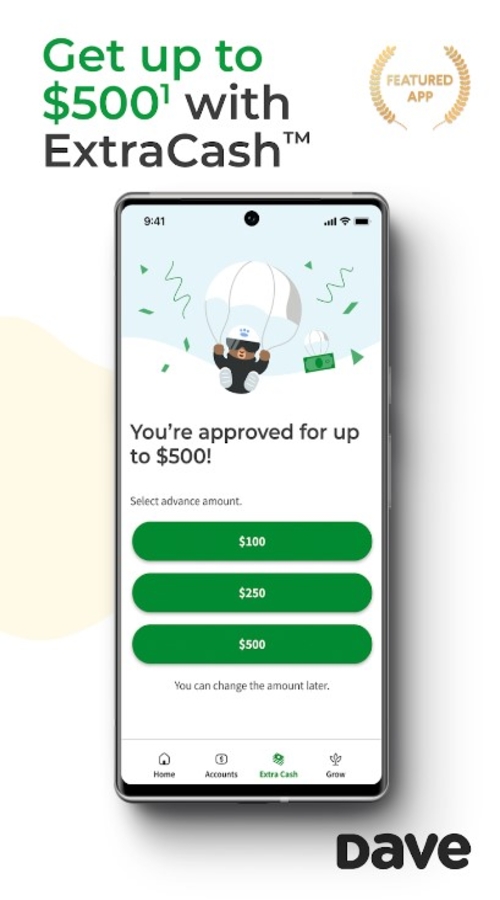

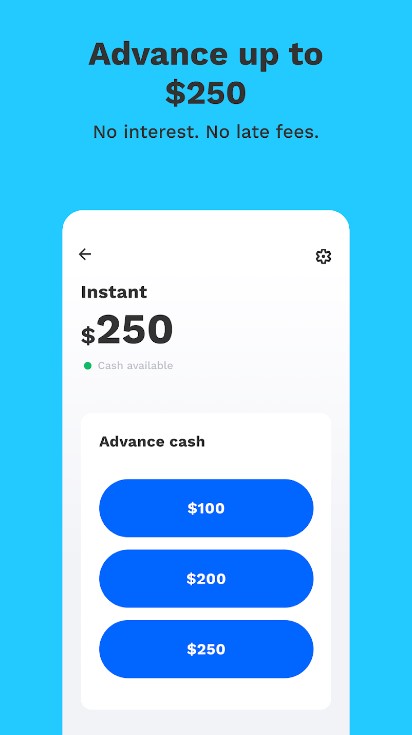

Dave

Another app that charges you a monthly subscription fee instead of APR is Dave. In it, you can get a small instant loan of up to $250 to avoid overdraft fees or cover small expenses. You can download the app to any phone, create an account, connect your bank account to it, and pay the $1 subscription fee to get a cash advance into your account in 1-3 days.

How Dave works

Dave doesn’t get a credit check of your financial history before granting you a loan. Instead, the key metric is how long you’ve been using the app and the transactions in your connected bank account information. The more money on your card, the more you can borrow through the app.

Loans from Dave come with 0% APR, but you can pay optional tips up to 20% of the amount borrowed. Also, it usually takes up to 3 days to withdraw, so you have to pay up to $5.99 more for instant withdrawal.

The pay period can be anywhere from one to four weeks, usually until your next paycheck. You don’t have to worry about missing the due date because you can set up an automatic credit payout. Dave also has some useful features:

- You can change your due date without a late fee.

- With tools inside the app, you can view your expenses and income to learn how to manage your finances better.

How to borrow from Dave

To get Dave best credit online, you must create an account with your first and last name, a cell phone number, and an invented password.

Next, you must connect your main bank account and pay for your subscription. From then on, you’ll borrow 100 dollars in the app and request an instant loan with one button. You’ll be able to borrow money on the app if you meet the following requirements:

- Be a U.S. citizen over the age of 18.

- Have a bank account older than 60 days that had at least two direct deposits.

- Provide proof of your identity, residency, and employment.

Since the app does not perform a credit check before lending money, you can use it even with a low FICO score.

Green Dollar Loans

Green Dollar Loans is one of the loan instant apps for those who need cash advances fast. Customers can receive loan amounts up to $1,500 with a debit card or direct deposit.

Green Dollar Loans is one of the loan instant apps for those who need cash advances fast. Customers can receive loan amounts up to $1,500 with a debit card or direct deposit.

The fees and APR vary depending on the state, but they can be quite high. Refund terms are typically due on the customer’s next paycheck, with interest rates and penalties for late payments.

Payment history can also impact the ability to receive future loans. Before committing to repay the loan, it is crucial to thoroughly read and comprehend the terms and conditions.

How Green Dollar Loans works

To apply for a loan, borrowers must have a regular source of income, a valid debit card, and an active checking account. Once approved, borrowers can receive the loan amount by direct deposit into their account. The loan amount and repayment terms are determined based on income and payment history.

Maturities are usually set to coincide with the borrower’s next paycheck, with the loan due in full on that date. To pay off the loan, borrowers can either allow Green Dollar Loans to automatically withdraw the loan amount plus interest from their checking account, or they can make the payment online or in person at one of the company’s offices.

How to borrow from Green Dollar Loans

To borrow money from Green Dollar Loans, follow these steps:

- Go to the company’s website and fill out an online loan application.

- Provide personal and financial information, including proof of income and an active checking account.

- Check the instant loan amount and repayment terms.

- Sign the loan agreement electronically.

- Receive the instant loan amount by direct deposit to your checking account.

- Repay your application on time by allowing automatic withdrawals or by making a payment online or in person.

Green Dollar Loans charges fees and interest rates that may vary based on your state of residence and the loan amount. The overdraft fees and interest rates for an instant cash loan are generally higher than traditional bank loans. Heart Paydays is a lender that offers short-term loans to individuals who need quick access to funds.

The lender’s fees and APRs vary depending on the amount borrowed and the borrower’s creditworthiness but typically range from $15 to $30 per $100borrowed, with an APR of 200% to 2,290%.

Loan amounts range from $100 to $1,000, and repayment terms are typically between 14 and 30 days. Heart Paydays takes pride in its speedy and effortless online application procedure and the capability to obtain funds promptly.

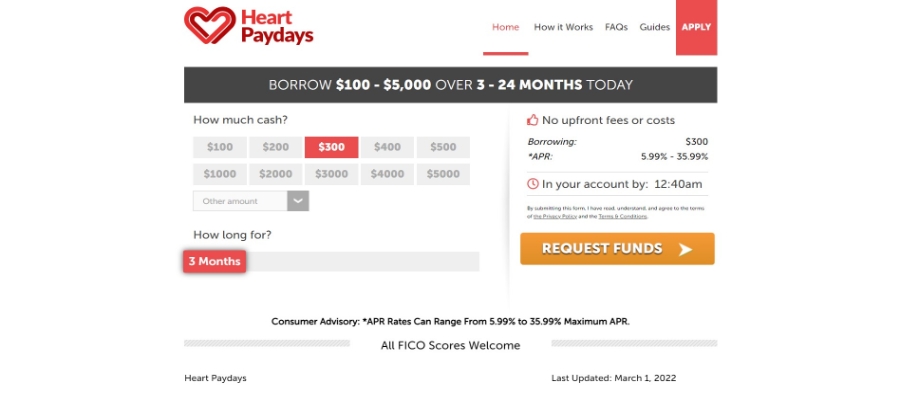

Heart Paydays

Heart Paydays is a lender that offers short-term loans to individuals who need quick access to funds. The lender’s fees and APRs vary depending on the amount borrowed and the borrower’s creditworthiness but typically range from $15 to $30 per $100borrowed, with an APR of 200% to 2,290%.

Heart Paydays is a lender that offers short-term loans to individuals who need quick access to funds. The lender’s fees and APRs vary depending on the amount borrowed and the borrower’s creditworthiness but typically range from $15 to $30 per $100borrowed, with an APR of 200% to 2,290%.

Loan amounts range from $100 to $1,000, and repayment terms are typically between 14 and 30 days. Heart Paydays takes pride in its speedy and effortless online application procedure and the capability to obtain funds promptly.

How Heart Paydays works

Heart Paydays is a lender that offers short-term loans to people who need quick access to funds. Here’s how the process usually works:

- Apply Online: The app typically asks for personal and financial information, including the borrower’s name, email address, employment status, income, and banking information. Subsequently, users will be requested to provide other fundamental details about themselves, like their income, employment status, and credit score.

- Get Approved: Once an application is submitted, Heart Paydays reviews the information provided and determines if the borrower meets its eligibility criteria. If the borrower is approved, he will receive a loan offer specifying the loan money amount, fees, and repayment terms.

- Receive Funds: If a borrower accepts an instant loan, Heart Paydays typically deposits funds into the borrower’s bank account, savings account or investment account within one to two business days.

- Refund the loan: The borrower is responsible for repaying the loan in accordance with the terms and conditions set out in the loan agreement. This usually involves making one payment on the borrower’s next salary or within a period of two to four weeks.

- Repeat: If the borrower needs another instant loan in the future, they can apply again by following the same process.

How to borrow from Heart Paydays

- To get a loan from Heart Paydays, you can follow these steps:

- Visit the Heart Paydays website

- Click on the button “Apply” on the main page.

- Complete the online application form with your personal information, including your name, address, contact information, and employment details.

- Submit an application and wait for a decision. Heart Paydays will review your application and notify you of its decision.

- If approved, review the loan agreement and sign it electronically.

- Get funds in your bank account the very next business day.

Viva Payday Loans

Viva Payday Loans is a lender that provides short-term loans to individuals in need of immediate financial assistance. The overdraft fees and APRs vary depending on the borrower’s creditworthiness and the loan amount but generally range from $15 to $45 per $100borrowed, with an APR of 200% to 2,290%.

Loan amounts range from $100 to $5,000, and payment terms are typically between 16 days and 1 year. Viva Payday Loans prides itself on its fast and easy online application process and the ability to receive funds quickly.

How Viva Payday Loans works

It s is a lender that provides short-term loans to individuals who need quick access to funds. Here’s how Viva Payday Loans works:

- Apply online: Visit the Viva Payday Loans website and fill out the online application form with your personal and financial information. You’ll be prompted to input certain essential information related to their personal details, such as their income, credit history, employment status, and credit score. If you have problems with your credit details, you can first contact the credit builder.

- Receive a decision: Once you submit your application, Viva Payday Loans will review it and let you know if you’re approved. If approved, you’ll receive a loan with the loan amount, fees, and repayment terms.

- Accept the loan: Before signing the loan agreement, make sure to carefully examine the terms and conditions if you choose to accept the loan instantly. Once you sign the agreement, the funds will be deposited into your bank account as soon as the next business day.

- Refund the loan: It offers flexible payment terms ranging from 16 days to 1 year. You can choose to repay the loan in one lump sum or in installments. Make sure to repay the loan on time to avoid overdraft fees or additional charges.

How to borrow from Viva Payday Loans

If you need to borrow 100 dollars from this app, follow these steps:

- Visit the Viva Payday Loans website

- Click on the “Apply Now” button on the homepage.

- Fill out the online application form with your personal and financial information, including proof of income, a valid ID, and a bank account.

- Submit the application and wait for a decision. The app will review your application and notify you of its decision.

- If approved, review the loan and sign the loan agreement electronically.

- Receive the funds in your bank account as soon as the next business day.

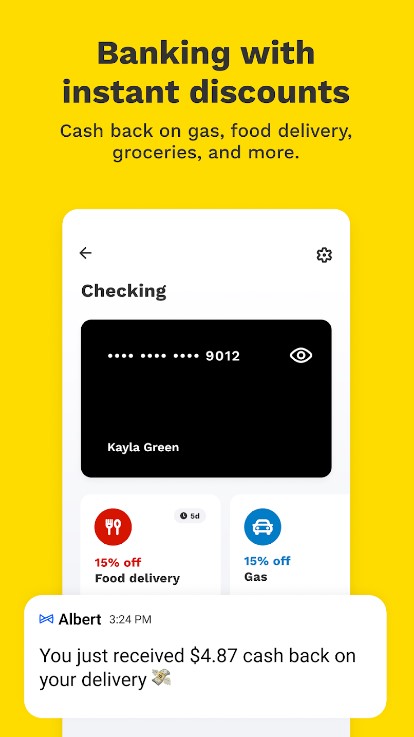

Albert

Albert is a financial app that helps users manage their finances and save money. The application provides several functionalities, such as generating a financial plan, keeping tabs on expenditures, and receiving customized monetary recommendations.

Albert does not charge any fees for its basic service, but there is a paid version called Albert Genius that costs $9 per month. The APR for any loans offered through Albert Genius varies depending on the lender and the borrower’s creditworthiness. Other highlights of the app include automatic savings, personalized investment advice, and a user-friendly interface.

How Albert works

To use the app, users need to connect their bank accounts, credit cards, and other financial accounts to Albert. The app uses this information to create a personalized budget for the user, taking into account their income, expenses, and financial goals.

One of the main features of Albert is its automatic savings feature. The app analyzes the user’s spending patterns and income to determine how much they can afford to save each week. It then automatically transfers this amount into a savings account or investment account.

Albert also offers a premium service called Albert Genius, which provides users with personalized financial advice from human experts. This service costs $9 per month and includes features such as bill negotiation, access to low-interest loans, and personalized investment advice.

How to borrow from Albert

To apply for a loan through Albert, users can select the “Borrow” option from the app’s main menu and then choose the type of loan they are interested in.

Users will then be prompted to enter some basic information about themselves, such as their income, employment status, and credit score. Based on this information, Albert will recommend a selection of loan options that are suitable for the user’s needs.

If the user decides to proceed with a loan, they will be redirected to the lender’s website or app to complete the application process. The lender will determine the loan’s conditions, such as repayment schedule, fees, and interest rates, which may differ depending on the borrower’s creditworthiness and other variables.

What to Look For In $100 Loan Apps

When selecting a $100 loan app, it’s important to consider several factors to ensure you get the best deal. Firstly, look for apps that offer a fast and easy application process.

Secondly, compare the interest rates and fees charged by different lenders to find the most affordable option.

Thirdly, make sure the app is legitimate and reputable by reading customer reviews and checking for any red flags. Finally, consider the payment terms and options to ensure you can comfortably repay the loan on time.

Fees

The fees charged by $100 loan apps typically include an origination fee, which is a percentage of the loan amount, and interest, which is the cost of borrowing the money.

The average fees charged by these apps can differ based on the lender and the borrower’s creditworthiness, but they can range from $10 to $30 for every $100 borrowed.

To compare fees, look for apps that disclose their fees upfront and calculate the total cost of the loan, including both the origination fee and interest. Consider choosing an app with the lowest overall cost and most affordable repayment terms.

It is also important to be aware of potential overdraft fees that your bank or financial institution may charge if the loan repayment exceeds the available balance. If you select to refund the loan manually, it is critical to make sure you have enough funds to cover the repayment amount and any potential overdraft fees that may be incurred.

APR

APR is the total cost of borrowing expressed as an annual rate. The average APRs for $100 instant loan apps range from 200% to 600%. To compare apps by their APRs, look for lenders that clearly disclose their rates upfront and calculate the total cost of the loan, including fees and interest. Select an app with the lowest APR to ensure you get the most affordable option.

Repayment Terms

Repayment terms are an essential factor to consider when comparing $100 instant loan apps. APR plays a big role. The average APRs for $100 instant loan apps range from 200% to 600%.

To compare apps by their APRs, look for lenders that clearly disclose their rates upfront and calculate the total cost of the loan, including fees and interest. Choose an app with the lowest APR to ensure you get the most affordable option. Longer repayment terms may result in lower monthly payments but may also mean paying more in interest or fees over time.

Reviews

Checking the reviews of $100instant loan apps is essential to ensure you select a legitimate and reputable lender. Reviews from other customers can provide insight into the quality of service, interest rates, fees, and overall customer satisfaction.

To check reviews properly, look for reputable websites such as Trustpilot or the Better Business Bureau, where you can find verified customer feedback. Read both positive and negative reviews to get a balanced view and look for patterns in the feedback. Avoid apps with a high number of negative reviews or unresolved complaints, as this may indicate a problematic lender.

Fees of $100 Loan Instant App

There are several types of loan instant applications, depending on what business model they are based on. For example:

- The first type of loan instant borrow $100 dollars app does not charge membership fees and provides services completely free of charge. However, keep in mind that in this case, payday lenders usually lend you money at a very high APR, up to 800%, and may charge origination and late fees.

- The second type of loan instant app works on a subscription basis, costing anywhere from $1 to $20 per month. Such get $100 instantly app usually gives loans at 0% APR, but they use express transfer fees, allowing you to get funds in several hours instead of several days.

- The third type of application allows you to get your money a few days before next payday and does not charge mandatory fees. However, you usually have to pay an express transfer fee of $2 to $6 and an optional tip of up to 20% of the loan amount borrowed.

If you want to take a loan, you will need a Сhime account or account on any other lending platform. Since the financial services market is vast, you can choose an application that will have pleasant repayment terms and even the ability to connect to the family member program.

How much money can I borrow?

The standard loan amount you can borrow from such applications is between $25 and $250. However, there are a few things you should consider. First, if you want to use a cash app that gives 0% cash advances, you should expect a first loan of about $50.

These platforms don’t get a credit check of your financial history but look more at how long you’ve been using the app itself, so they don’t allow you to borrow $250 right away. Second, if you need to borrow more money and be able to choose your loan amount, you’re better off using any app from our article or their counterpart. In that case, you can borrow up to $5,000, but you will have to pay a big APR.

Loan Apps vs. Cash Advance Apps

To understand the difference between these applications, you must understand the terms themselves. Usually, payday loan is short term loan from banks or other financial institutions at very high interest rates.

At the same time, a cash advance can be withdrawn from your credit card, or you can get your paycheck a few days early. Based on this, we can say that the instant money apps that offer these different types of loans have similarities:

- They allow you to get money without a credit check.

- More often than not, you get the funds until your next paycheck.

However, there are quite a few differences between them:

- You can get payday loans up to $500 in one payment, even if you’ve never used such an app. On the other hand, most cash advance apps do not allow you to borrow such a large loan amount at once; they usually allow you to get about $50 for your first loan.

- 1000 dollar loan bad credit apps don’t charge for subscriptions or services.

- Cash advance apps have a lower APR, sometimes as low as 0%.

- The first type of loan apps allows you to get money the same business day, even without express transfer fees.

- Cash advance loan apps have stricter requirements for borrowers.

These apps should not be your long-term financial solution, as they confirm your bad spending habits. Instead, try to avoid using them regularly and only turn to them in case of an emergency.

Pros and Cons of $100 Loan Instant Apps

Before deciding whether or not to use these best 100 loan instant apps, you should answer the question – can you do without these funds now? The problem is that despite all the advantages, such offers have a lot of disadvantages. Read more about them to make the right choice and avoid a debt trap.

Disadvantages of Instant Personal Loans

At first glance, such applications have many advantages:

- They allow you to get funds in an emergency in one day, albeit with a small fee for an emergency withdrawal.

- You don’t have to stand in line at the bank or go to the apps during business hours, as they can be used 24/7.

- You can get money without a credit check.

- You don’t have to worry about being unable to pay off that loan for years, like with installment loans, because you can pay back the entire loan amount in one payment on your payday.

Advantages of Instant Personal Loans

However, it is crucial to understand that despite this, they have so many significant drawbacks:

- Even a $100 loan instant app no direct deposit that offers 0% APR credit but for a subscription are costly. For example, paying a monthly subscription of $19.99 is the same as paying 240% APR for $100 credit.

- If you are constantly short of money and you use instant cash loan apps like these to close a hole in your finances, you may find yourself in a borrowing trap.

- There are a lot of scammers among cash advances apps that loan you money and are hard to recognize. This is bad because you have to give them your banking information and access to your bank account balance.

- You often have to pay an additional fee of up to $6 to get the money the same day.

- Borrowers with a good credit check score can access more favorable loan terms, such as lower interest rates and higher credit lines.

- Banks and credit unions are among the most popular places where there is money you need. Therefore, you can always find alternative options.

You should only use these loans if you are confident you can pay them back on time.

Borrow Responsibly

The most significant disadvantage of any loan is paying it back, usually with interest. Worst of all, you must remember to do it or ask to postpone it for another month because you have to pay a late or rollover fee for each decision, which doesn’t come cheap. That’s why you need to take this type of loan responsibly.

You should know that short-term loans are the most expensive precisely because lenders do not check your credit history. In addition, they foster lousy spending habits and allow you to buy more than you can afford.

If you can avoid instant cash advances loans, it’s best to take advantage of them. However, if you don’t have that option, you can approach the situation responsibly and create it in one of the following ways:

- Find a part-time job. You may only need to work a few hours to earn $100– this will have a much better impact on your budget and your life than a cash fast loan.

- Save money; this will help you deal with emergencies without credit and 1000 loan bad credit app.

- Pay off your old loans every time you get extra money instantly. This will help you improve your credit score and get better deals on loans and credit cards.

Overall, your priority should be to learn how to manage your finances so that you have savings account for emergencies and don’t have to risk borrowing money instantly from such apps. It’s worth remembering that payday loans often trap borrowers in debt and financial instability, making them a risky and expensive option for those in need of quick cash.