When a sudden financial shortfall hits you, it may seem challenging to cope with unforeseen costs. Having a savings account can help, but too many consumers have to rely on their own means.

Are there any other good options? Yes, the risks will be minimized if you weigh your current choices and choose the most suitable option, for instance, cash lending apps. Keep on reading to find out more about how to get emergency cash immediately.

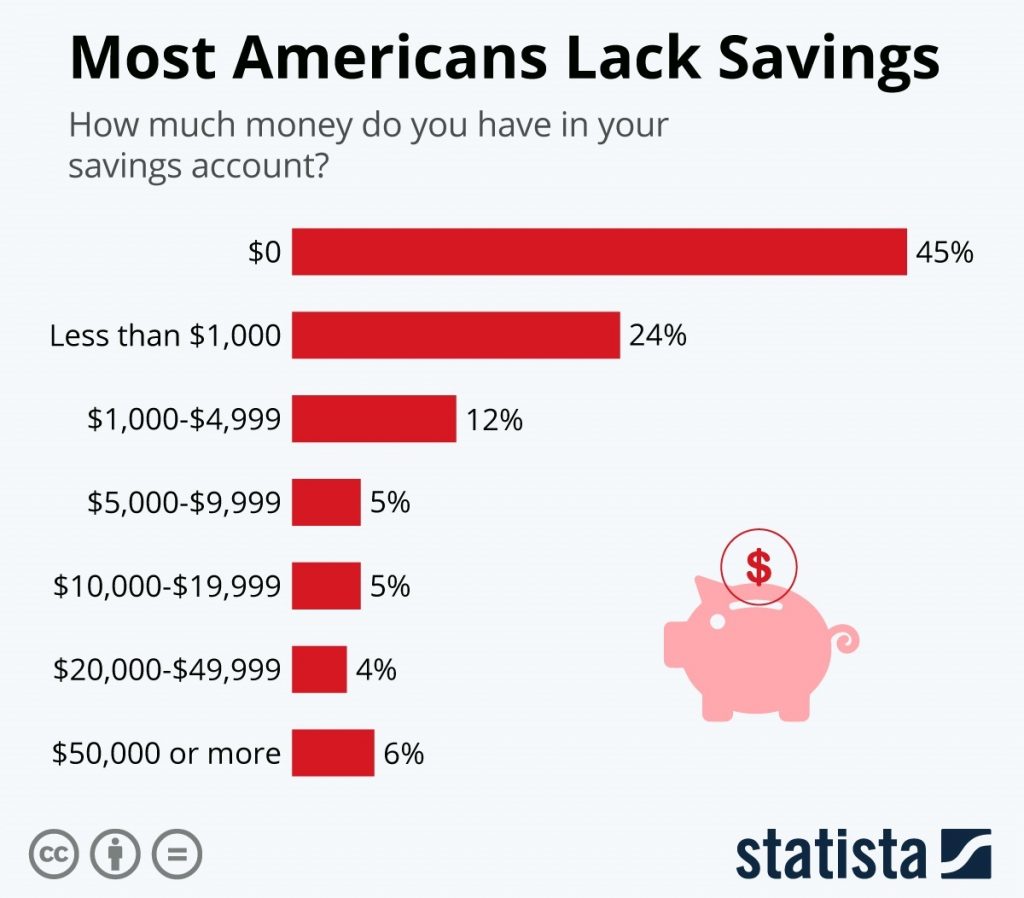

According to a recent report from Statista, almost half of Americans don’t have emergency expenses at all. For those who do have a buffer for unexpected expenses, the average amount is just over $1000.

This leaves a significant portion of the population vulnerable to financial ruin in the event of a job loss, medical emergency, or other major setbacks. Emergency loans and emergency payday loans are options for people who find themselves in a bind, but they can be very expensive and often cause more financial problems down the road.

For those without emergency funds, the best option is to start setting aside money each month so that you’ll have a cushion to fall back on in case of tough times.

Statista reports that almost half of Americans don’t have an emergency fund at all, and a quarter of them have less than $1000 for emergencies.

Statista reports that almost a half of Americans don’t have an emergency fund at all and a quarter of them have less than $1000 for emergencies.

You can’t protect yourself from sudden expenses and unpredicted costs. Sometimes the water pipe in your house starts leaking, the auto suddenly breaks down, or you need to cover an urgent medical or dental procedure. Not every consumer has enough funds in their pockets to support such urgent needs. When you require emergency cash immediately near me, the following options might bolster your situation and provide the necessary aid.

On the other hand, it pays to evaluate your existing debt and try to negotiate better terms. Do you already have some type of debt, whether it is a personal loan pre-approval, student loan, or short-term loan? Then talk to your creditors about the interest rates and conditions of your agreement.

Maybe they will agree to lower the rates or offer you a period of forbearance. Then you will be able to utilize this extra money to cover your needs. However, pay attention to possible penalties and charges for making a late monthly payment.

I Need Emergency Money Now: Where to Turn To?

When you are strapped for cash, you have several prospective loan options to choose from. Here are some of the most common solutions for people in financial need:

#1 Small Personal Loans

They are small emergency loans given to consumers for a short period of time. You can turn to conventional crediting companies or to alternative emergency loan lenders. Small personal loans can be a helpful option for covering unexpected expenses, such as travel expenses.

Banks and credit unions are among the most popular places for times when you need emergency cash today. A personal loan is an unsecured loan that can be used for a variety of purposes, such as a debt consolidation loan, home renovations, car repairs, or unexpected expenses.

Unlike secured loans, such as mortgage or auto title loans, personal loans do not require collateral. Personal loans typically have fixed interest rates and repayment terms, which can make them a good option for borrowers who want to budget their monthly payments.

Before you apply for a loan and hit enter, review the lender’s eligibility requirements to ensure you meet them. Once you have applied, the lender will review your application and make a decision regarding loan approval. If approved, you will receive the loan funds and will need to make payments according to the payment plan outlined in the loan agreement.

Your credit score plays a crucial role in determining the interest rate you’ll receive on small personal loans. The interest rates offered at traditional lending organizations can be lower compared to other bad credit direct lenders.

You can expect to have up to 35% in interest, while fast cash loan lenders charge much more. If you have a high credit score, you may qualify for a lower interest rate on small personal loans, which can save you money over time.

One of the disadvantages of turning to such companies is the lengthy loan application process. It won’t take you one hour or even one day to obtain the funds, even if you say, “I need emergency cash now!”

First of all, you will be required to fill in their loan request forms and provide all the necessary papers. The tedious paperwork and hassle make consumers want to opt for alternative ways of getting additional funds.

#2 Credit Card

When you are already credit cards with instant approval owner, you might want to tap some funds from it in the form of instant money now. Make certain you review the loan terms of using such a cash advance. Many cards have about 25% in interest rates.

In addition, banking institutions such as the Coastal Community Bank and Midland States Bank often have a high level of customer service and an autopay discount. The Consumer Financial Protection Bureau holds all rights reserved.

Furthermore, the majority of them don’t have a grace period (the period when the APR credit card is 0%), so the interest will start building up the day you withdraw the funds. Maintaining a good credit score is essential for obtaining low interest rates and favorable terms on credit cards.

An origination fee is a charge that some credit card companies apply when you first open a new account. This fee can range from a few dollars to a percentage of your credit limit.

A cash advance fee is a charge that a credit card issuer imposes when you use credit card cash advances cash from an ATM or get cash equivalents such as traveler’s checks. The fee is typically a percentage of the cash advance amount, and it can range from 2% to 8% of the total amount advanced.

In addition to the cash advance fee, credit card companies may also charge a higher interest rate on cash advances than on purchases.

Do you need money right now emergency? Bad credit holders may take advantage of the credit card cash advance option if they can’t qualify for other lending solutions.

#3 Pawn Shop Loans

Pawn shop loans, also known as pawn loans or collateral loans, are a type of secured loan where borrowers pledge personal items such as jewelry, electronics, or musical instruments as collateral in exchange for cash. The borrowing process is one of the fastest. The loan amount is typically a percentage of the item’s value and is usually lower than the market value.

If the borrower fails to repay the loan within the agreed-upon timeframe, the pawnshop keeps the item and may sell it to recoup the loan amount. Pawn shop loans can be a good option for those who need to get an emergency loan quickly but don’t qualify for a personal loan.

Pawn shop loans are often granted based on the value of the collateral rather than your credit score. However, borrowers should carefully consider the terms and interest rates before taking out a pawn loan and ensure they can pay the loan on time to avoid losing their collateral.

A nice distinguishing feature is that you do not need to provide personal information such as email address and last name. All rights reserved by the Consumer Financial Protection Bureau.

#4 Title Loans

Title loans are a type of short-term secured loan that allows borrowers to use their vehicle as collateral. In a title loan, the borrower pledges ownership of his vehicle in exchange for cash loans. The loan amount is often a percentage of the value of the vehicle, and the borrower is required to repay the loan amount plus interest within a certain period.

Title loans can be useful in emergency situations where the borrower needs quick access to cash. Compared to other types of emergency loans, such as emergency payday loans, auto title loans can be easier to get because they require less paperwork and credit checks. Because a low credit score can make it challenging to secure a title loan, as it indicates a higher risk to the lender.

Borrowers should make sure they can afford to repay the loan amount plus interest before taking out a title loan. Shop around and compare partner lenders to find the best emergency loans available.

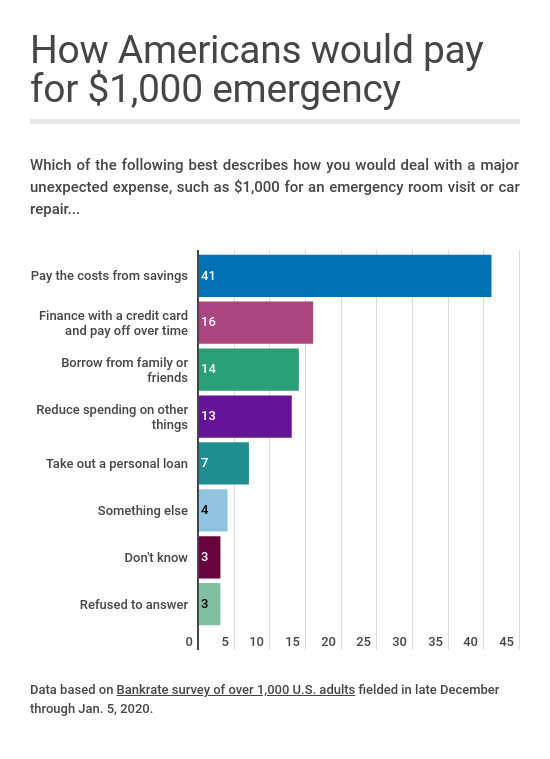

According to statistics, 16% of Americans prefer to cover their emergencies with credit cards and only 7% used to turn to personal loans.

What Is Emergency Cash Loan?

An emergency cash loan is a type of loan designed to help people get quick access to cash during emergency situations. These loans can be obtained without undergoing a traditional credit check, which makes them a suitable option for people with bad credit.

An emergency cash loan is also commonly known as a cash loan or personal loans. The loan amount for emergency loans is usually small and can be repaid in a short period of time. The best emergency loans offer flexible repayment options and low interest rates.

Unlike installment loans, emergency cash loans are typically short-term loans that are intended to provide immediate financial relief for unexpected expenses or emergencies. Emergency cash loans are often available to borrowers with lower credit scores and may be approved more quickly than other types of loans.

These loans typically come with high interest rates and fees. Therefore, it’s crucial to use these loans only for true emergencies and to have a repayment plan in place to pay them back quickly.

What Can I Use Emergency Cash Loans For?

An emergency cash loan can be used to cover unexpected expenses that arise during emergency situations. They are particularly useful for people with bad credit who may not be able to get an emergency loan through traditional means.

Common uses for emergency cash loan includes medical bills, utility payments, car repairs, and home repairs. These loans are designed to be obtained quickly, without undergoing a credit check, and the loan amount is typically small and can be repaid over a short period of time.

The best emergency loans offer flexible repayment terms and low interest rates, making them a more affordable option for those in need of quick cash. It’s important to use emergency cash loans responsibly and only for true emergencies.

Because borrowers who take out emergency payday loans can become stuck in a cycle of debt as they may require further loans to repay the initial one, leading to an unending pattern of borrowing and indebtedness.

Will Applying for Emergency Loans Affect My Credit?

Emergency payday loans themselves don’t necessarily hurt a user’s credit score, but the way they are managed can. If you apply for an emergency cash loan from different partner lenders in a short period of time, your credit score may suffer.

Additionally, if you fail to repay the loan on time, it can hurt your credit score even further. Some lenders may report late or a missed monthly payment to credit bureaus, which can remain on your credit report for up to seven years.

Therefore, it’s necessary to carefully consider the loan terms and only borrow what you can afford to repay. Users with bad histories may have more limited options when it comes to applying for emergency loans, but there are lending partners who specialize in providing a loan with bad credit.

Instant Emergency Money with Poor Credit

Do you need urgent money? Do you have a tough financial situation? Do you search for loans to affect your credit history? Many people experience emergencies connected with personal finances once in a while. An emergency cash loan immediately bad credit score is what thousands of borrowers are looking for when it comes to unforeseen expenses.

The main reason for this search is the lack of time to improve their repayment history and credit rating. When the next financial issue happens all of a sudden, an emergency loan with bad credit may save the day. But you need to be careful and seek the most affordable solution.

Not every lending institution is eager to deal with high-risk borrowers and issue emergency loans for bad credit. The reason is the possibility of default and non-payment.

It’s no surprise that creditors aren’t willing to give their funds as a present in case the borrower won’t be able to return the debt.

What is an emergency bad credit loan? This is a popular lending option for consumers in need who can’t qualify for regular personal loans due to a low credit score from lenders.

If you’ve had certain problems with debt repayment in the past, getting emergency cash bad credit from alternative crediting companies may help you out. Banks and other conventional lending organizations will definitely reject such an emergency loan application, as they only cooperate with borrowers who have a good credit rating.

So, you may need some time to look for other companies and online lenders if you need financial help immediately, bad credit won’t be a problem for many lending services. But you should remember that taking out an emergency payday loan can be dangerous because it typically comes with exorbitant interest rates, which can make it challenging to pay the loan on time.

So, you may need some time to look for other companies and online lenders if you need financial help immediately, bad credit won’t be a problem for many lending services.

Eligibility Criteria for Emergency Cash Loans

The eligibility requirements for taking out emergency cash loans vary depending on the lender. Most lenders require applicants to be at least 18 years of age, have a valid email address, social security number, phone number, driver’s license number, and have a bank account. Some online lenders may also require proof of income or employment.

A credit score is generally considered, but there are lenders who offer emergency cash loans with bad credit. Debt to income ratio is also taken into consideration to ensure the borrower is able to repay the loan.

A loan decision and interest rates are based on credit history, repayment term, and loan amount. Rates and fees can include an origination fee, late payment fees, and early repayment fees.

Taking out an emergency cash loan can affect your credit, especially if you fail to repay the loan on time. Before deciding to get emergency payday loans, borrowers should explore other options, such as using their emergency fund, getting a credit card cash advances, or applying for a bank loan. Having a savings account can help cover unexpected expenses and reduce the need for emergency loans.

How to Get Emergency Cash Today with Any Credit

What if you are searching for quick funds and want to find an emergency cash loan for the unemployed? Some potential borrowers don’t follow the basic requirements of the crediting institutions.

For instance, it is obligatory to have steady employment to qualify for personal loans or hardship loans. If not, you won’t be able to get emergency cash immediately no credit check from such loan providers.

The reason for that is their willingness to verify your creditworthiness. If a borrower doesn’t have enough means to repay the debt, he or she won’t get approved. How do i get emergency money now with bad credit?

- One of the easiest ways is to tap your friends or family members. It may be an awkward loan decision, as you might feel embarrassed to talk to your loved ones about your financial issues. However, when you need instant money now, you can discuss the conditions of such monetary assistance with your relatives or friends.

- Because to apply for a loan, the majority of lenders mandate that candidates possess a functional email address and phone number and own a bank account. You can’t remain anonymous. Build a repayment plan to make sure you can pay off your debt.

- Another one among emergency loan alternatives is to turn to nonprofit organizations in your area. Some of them help consumers with rent payments, utility bills, or paying for groceries. Search for companies like the Mission Asset Fund and compare reviews. This organization is created in the form of crediting circles, allowing people to borrow from one another in your community.

- Consumers take turns borrowing and lending their funds to other members. The drawback here is that getting some extra cash today through such companies is almost impossible, as you might be in the middle or at the end of the line. This is a decent option for the times when you can wait to get qualified for the lowest rates.

As you can see, there are many emergency cash loan options to obtain quick emergency money for rent as financial help with medical bills for any financial need. Shop around for the best quotes, compare various service providers, and choose the most affordable solution to fund your urgent expenditures.

If you improve your budgeting skills and learn how to manage your personal finances, you will be able to lower the risks of having such money disruptions in the future.

Also, building up your credit record can help you to get an emergency loan with better conditions when you urgently need extra funds.

Emergency Cash Loans for Unemployed

Are you having issues with employment these days and constantly thinking about “I need emergency cash today”? If you don’t have a steady source of monthly income, it may be rather challenging to get funded for urgent cash loans for unemployed.

Employment status, full-time position, having welfare or disability benefits – you should get some financial support that may be considered your monthly income. You want to find emergency cash loans unemployed with no more hassle, but it means you have no pay check or income at all.

Some creditors offer incentives such as lower interest rates to borrowers who have a checking account with them. But they also can give an autopay discount as an incentive for borrowers to set up automatic payments and ensure on-time payments.

Emergency cash loans for unemployed individuals can be a viable option when faced with financial difficulties. While unemployment benefits can provide some relief, they may not be enough to cover expenses such as mortgage payment or utility bills.

During public holidays, traditional banking services may not be available due to bank holidays. This makes it difficult for individuals to access cash through traditional means. This could lead to increased demand for emergency cash loans, which are typically offered by alternative financial service providers that operate outside bank hours and may have more flexible eligibility criteria.

However, be careful when getting an emergency cash loan because it can come with high interest rates and fees. In addition, payday lenders may require access to your bank account, which may expose you to overdraft fees or other charges. Taking out a payday loan can also negatively impact your credit score, making it harder to get a loan in the future.

Having a checking account can also be beneficial when negotiating with creditors, as it provides a way to track payments and demonstrate financial responsibility. Therefore, carefully consider all options before applying for an emergency payday loan as an unemployed person without any employment status.

Direct Express Emergency Cash

Quick emergency cash loan unemployed may be issued in case you still obtain some type of benefits of income – even if it’s welfare benefits or disability benefits. This way, the creditors will issue a direct express emergency money advance as they will see you have enough means to repay the debt on time.

Emergency cash loans unemployed often means you are temporarily out of a job, you may still have a side hustle, a part-time position, or even be self-employed with some steady monthly income source to pay the 1000 cash loan no credit check off.

If you need urgent money now and can’t afford to repay it at all, you should search for alternative options or ask your relatives to help you.

How to Choose Emergency Cash Loans Direct Lenders

Are you dreaming of much-needed financial assistance to cover the unpredicted expenses? Fast money lending service may help you fund any upcoming needs without delay.

You may see that there is a huge variety of best debt settlement companies and lending services around today. How can you select the best emergency cash loan direct lender?

You shouldn’t rush with your decision in the first place. Making smart financial moves may take some time, as you need to shop around for the best terms of use on the emergency advance.

Debt to income ratio is an important factor that reputable lenders consider when determining an individual’s creditworthiness for an emergency cash loan. The ratio compares a person’s total debt payments to their monthly income and helps lenders assess the borrower’s ability to repay the loan.

Individuals with a high debt to income ratio may find it difficult to qualify for emergency cash loans, as they may already have significant financial obligations. On the other hand, those with a low ratio may be more likely to be approved for emergency cash loans, as they have a higher capacity to repay the loan.

Are you satisfied with the repayment schedule and the amount they may issue? Can you afford to get money in the case of an emergency? Emergency cash immediately bad credit direct lender may sometimes ask for higher fees or extra charges.

Try to avoid prepayment and origination fees and look for the most suitable solution tailored to your needs.

How Can You Obtain Emergency Loan Now?

There are not so many ways you can receive the funds from the crediting companies if you constantly think about “I need emergency money right now.” Once you submit your loan application form and get approved for the direct express loan feature, you need to fill in your basic personal and banking details in the loan request form.

When applying for an instant emergency cash loan, you may be asked to provide your checking account information, including your account number and routing number, to enable the lender to deposit the loan funds and collect payments. Hence, the funds will be deposited into your bank account.

A Visa emergency loan may be obtained within the same or the next business day. The availability of a bank loan depends on your account characteristics and the timing, as certain banks may not operate on weekends.

If you want to obtain Mastercard urgent money, it won’t be a problem as well. Creditors accept accounts and cards from various banks, and you may utilize the loan proceeds for many purposes.