But even if we would, some debts can be inherited. Well, the last thing we plan when taking out a loan is to die. Either you think about who pays your debt after you die. But should. Your contract might not have the section that states what happens to your debt after you die.

Well, who must care about debts? Anyway, like it or not, but considering that 73 percent of Americans are more likely to die in debt, you can’t ignore this.

No one can guarantee you will pay off your debt before death. The number of Americans dying with unpaid mortgages, car loans, student loans, and credit cards is shocking. Chances are you’ll be upset to know that you’re going to leave a stack of unpaid bills when you pass on.

So, the question is, Does debt follow you after you die? If asking, then it’s safe to say that’s not the situation you want to leave behind for your loved ones. You want to ensure your family, friends, pets, or other beneficiaries will be taken care of.

The answer is, mostly, yes, your debt dies with you. Yet, there is always the But section that makes a difference. So here. Your debt can affect the people you leave behind.

And then comes the second question, Do family members pay debt after you die? The problem is, everybody’s situation is unique. And they’re a lot of things that can get messy. So, before you can get the answer to this question, there are other things to consider:

- the type of debt you have;

- where you live and the approximate value of your estate;

- the complexity of your situation.

Finally, what debt is passed on to your family after you die? Speaking of common types of debt, the following four can affect your heirs and estate:

- auto loans;

- credit cards;

- mortgages;

- student loans.

What Happens To Credit Card Debt When You Die

The debt from credit card balances is one of the most common kinds amongst those 73 percent who die in debt. To understand what happens to your cc debt after you die, it’s important to underline that this is a type of unsecured debt.

That means that you do not need to secure it with your house or car to open one. As a result, like with any other personal loan, credit debt after you die is not the responsibility of those left behind. Instead, credit card debt after you die becomes the responsibility of the deceased person’s estate.

Next, you have a cc account in your name only. Who pays of credit card debt after you die? It is the responsibility of your estate to take care of any remaining debt. The personal representative, executor, or administrator handles the estate’s finances.

Americans are dying with an average of $62,000 debt.

Can a credit card company collect debt after you die? The cc company can claim to get paid through your estate. That means that if the estate can’t pay the balance, the credit card company is at a disadvantage.

The only way to inherit credit card balances is to have a joint account. Thus, the co-owner will have to pay any balance on the account. If there’s an authorized user, there’s no responsibility.

Many parents make their children authorized users on their accounts, but this is not the same as a joint account holder. But spouses living in community property states may still be responsible as their debts are shared.

But what if there’s no estate, no will, or no asset that could satisfy these debts after death? What can happen with credit card debt after you die?

In this case, the debt dies with the debtor. Again, laws vary by state. Make sure to check the laws where you live or hire an attorney to help you understand your debt obligations.

Where Do Debts Go After You Die

What debts stay after you die? Generally, any debt that’s in your name only (that’s key) is not forgiven. Instead, in most cases, any unpaid debts get paid by your estate after you die. That includes the total assets owned at death.

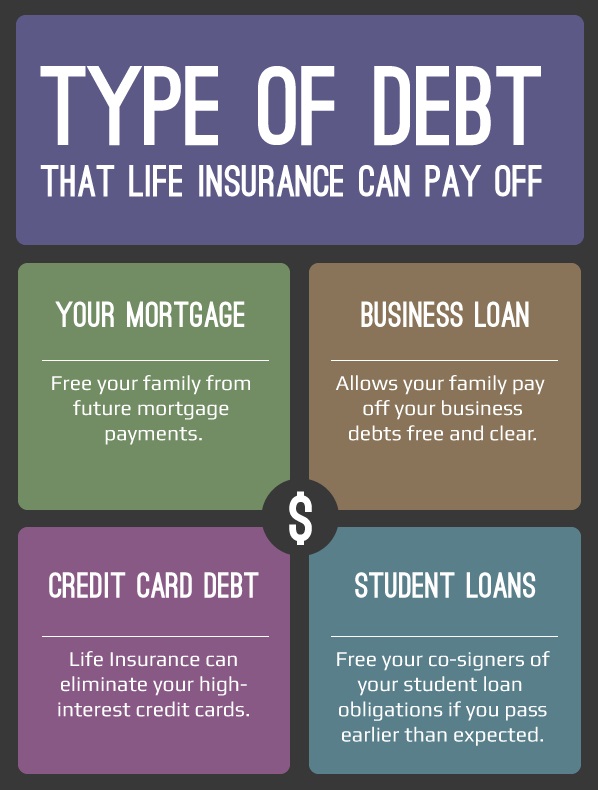

Source: Visually

When you die, all your debts are passed on to your estate. Then, the executor will compile a list of all outstanding debts and determine the order in which they legally should be paid. No matter whom you appoint as a personal representative, they will be responsible for paying any debts from the estate.

Can debts be inherited? In most cases, that debt isn’t something your family would be responsible for. Yet, there are exceptions. Relatives are not responsible for paying off debts that were not jointly owned at the time of the debtor’s death.

What about student loan debts after you die? What happens to your student loan debt after you die? Picture this: there are over 2.4 million borrowers who have private student loans. Now think, could they be forgiven?

Well, unlike Federal student loans, private ones have to be covered by the deceased’s estate. If it’s not enough in the estate to cover the debt, they are more likely to go unpaid.

Does Your Insurance Pay for Debt After Death

Got any form of debt? Then chances are you want to protect your family from that headache. A life insurance policy could help.

Remember — responsibility for mortgages, credit cards, student loans, and other joint debts automatically pass to the surviving account holder.

If you have life insurance, and after you die, who does your debt go to? Your relatives are not responsible for their deceased ones.

By way of example, you are the beneficiary of the dead person’s life insurance policy. Thus, you are not liable for their debts. If you are the beneficiary on a life insurance policy, that money belongs to you.

The deceased person’s creditors cannot force you to use it to pay their debts. So, if you obtain life insurance proceeds that are payable directly to you, you don’t have to use them to pay the debts of your relative.

Speaking of medical debt, What happens to medical debt after you die? Medical debt is somewhat more complex and doesn’t go away when you die. So, who is responsible for your debt after you die? The patient is responsible, except you are a child.

Then the parent will be responsible for the bill. In case you owe a small amount, the collector might declare the bill uncollectible and close the account. If you owe a lot, the provider might try to get debt from your estate.

Who need insurance?

Can Debt Be Put on Others After You Die

Are you responsible for your parents’ debt after they die? You are never responsible for the debts of others, including your parents, spouse, or children, unless the debt is also in your name or you cosigned for the debt. If there was no joint account, co-signer, or other exception, only the estate of the deceased person owes the debt.

The community property states are the exception. Yet, there is a trick. Just because you are not responsible for paying the debt does not mean that creditors will not try to coerce you into doing so. But, even then, collectors can’t discuss the debt.

Does Becoming Someone’s Executor of an Estate Make You Responsible for Debt After They Die

When a person dies, the role of an estate executor begins. If you are an executor, you have a legal obligation to handle all the estate’s probate process, including:

- paying debts using estate assets;

- selling estate property;

- distributing assets to heirs and beneficiaries.

When the property is distributed to the beneficiaries, who are legally entitled to receive those assets, your role ends. That can take between 5 months to 18 months. Finally, you are not personally responsible for the debts of the deceased person. Moreover, don’t let the collector pressure you into taking on this debt.

The role of an executor is not easy and comes with a degree of risk. Make sure you are comfortable taking on the responsibility. If you’re confused and need advice, contact an attorney.

Is It Legal for Creditors To Collect Debt After You Die

Is it legal for creditors to collect debt after you die? Generally speaking, creditors can collect what is owed from your estate. When you die, the process called probate begins.

It can take anywhere from three months to nine months. Therefore, you have time to get familiar with your state’s estate laws. Otherwise, you won’t be able to deal with rules that apply to you.

Can debt collector go after you after you die? Don’t let debt collectors harass your family members. Instead, they should contact the estate’s executor, who is responsible for that.

It’s a common practice when a collector agency suggests that your family is responsible for the deceased’s debts. Then you have the right to file a complaint.

Debts That Can Be Inherited (Types Of Debts)

Speaking of what debts can be inherited, your family could be responsible in these situations:

- Joint and cosigned debt – got a joint credit card with somebody? That means if one account holder dies, you’re responsible for paying the debt and vice versa. At the same time, authorized users are not accountable for cc debt.

- Debt in community property states – some states follow specific community property laws. Then if you die, a surviving spouse pays off their deceased spouse’s debt with community assets.

- Home equity loans on inherited homes – everything looks as straightforward as possible. You inherit a house from your loved one after they die, and they had a home equity loan on that property. The bad news is you inherit that debt.

- If state law requires a spouse to pay a particular type of debt.