In today’s fast-paced world, everything is just a click away from your bank account, including your finances. With the advent of free cash advance apps, you can now easily access quick and hassle-free advance loans at your fingertips.

A cash advance app offers a convenient way to borrow and loan you money without the need for lengthy paperwork or credit checks. Whether you need an advance app for an emergency expense or to cover unexpected expenses, cash advance apps have become a popular choice for many who want to avoid the high interest rates of payday loans.

But, like any financial service, a lack of knowledge may influence which products and services are the best choice. So, in this article, we’ll explore the world of cash advance apps, their benefits, drawbacks, and everything in between.

So, buckle up and get ready to learn all about the ins and outs of these innovative advance budgeting tools.

What Are Cash Advance Apps

Cash advances have become increasingly popular in recent years, and with the rise of technology, free cash advance apps have emerged as a convenient option for those in need of quick cash and who don’t have a savings account. But how do they work?

Essentially, these cash advance apps allow you to borrow money against your upcoming paycheck. You simply download one from your app store, request a cash advance, and once approved, the funds are sent via direct deposit straight into your bank account balance.

Cash advance apps that let u borrow money are a great option for those who need to save money urgently but don’t want to go through the hassle of traditional lending institutions. They’re also great for:

- A bad credit score

- Avoiding hidden fees

- College students

- Low fees

- Lower annual percentage rate (APR)

- Overdraft protection

- Debit card purchases

- Interest free options

- Savings accounts

- Avoiding an origination fee

- Budgeting tools

- Credit monitoring

- Avoiding late fees, overdraft fees, or interest

However, it’s important to use cash advance apps responsibly and only borrow what you can afford to repay. They rarely offer a cashback program, and the cash loan amount you can borrow from these lenders varies depending on the app.

And what’s great about them is that they’re cheaper than installment loans, payday loans, or other traditional personal loans. They don’t charge high interest, sometimes come with a monthly subscription fee free, and don’t apply overdraft fees.

Best Cash Advance Apps in 2024

Are you in a need of immediate cash because you’re in a financial pinch? Don’t worry, we’ve got you covered! We have selected the best cash advance apps that will see you through your financial woes in 2024.

Instead of risking a credit check that comes with payday loans, overdraft fees, or interest that come with credit cards, these cash advance apps are designed to offer quick and interest free cash advances. Similar to a Varo advance, they offer up to 250 at the click of a button- via direct deposit, straight to your bank account balance.

Our top picks for the best cash advance apps in 2024 include some of the most user-friendly, safe (bank member FDIC verified by the department of financial protection), and convenient advance app options available on the market. These cash advance apps offer a range of features, including those specific to money management needs – even for rent payments.

Whether you need a small loan with no credit check to cover unexpected emergencies or want to increase your personal finance debit card or credit card purchases, the following cash advance apps have covered you.

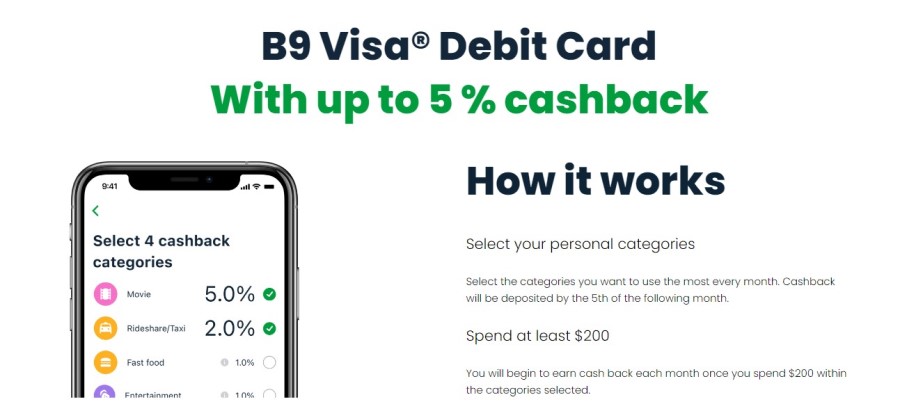

#1 B9

B9 is a banking app that offers no-fee advances ranging from $30 to $500, a Visa debit card with up to 5% cashback, and money transfer services. It is an excellent option for individuals looking to navigate the demands of the day-to-day.

Pros:

The app-based offering makes it easy for individuals to download and open a B9 account. The payroll direct deposit feature allows for quick and seamless funding of accounts. Additionally, B9 offers up to $500 in zero-fee advances and a Visa debit card that rewards users with up to 5% cashback on purchases. The app also allows for no-fee ACH transfers and instant transfers between B9 members.

Cons:

Though there are many benefits to the B9 app, it does require a monthly membership fee. The basic plan costs $9.99 per month, while the premium plan, which includes features such as a credit report, credit score, and credit score simulator, costs $19.99 per month. Also, to qualify for a B9 advance, users need to meet specific requirements, including having income and a government-issued photo ID.

Terms, and Fees:

The B9 Banking App charges basic fees including advance payments ranging from $30 to $500, with new members typically eligible for $30 to $50 advances. The average advance amounts are $82 for the B9 Basic plan and $267 for the B9 Premium plan as of December 2023. Advances are delivered instantly without fees, but using non-B9 ATMs incurs a $2.50 charge, and foreign transactions have a 3% fee. ACH transfers are free. Other fees vary by service, and users should consult B9 Banking’s fee schedule for current details.

Basic Requirements:

To qualify for a B9 pay advance, users must have income, a Social Security Number or Individual Tax Identification Number. Users can set up their payroll direct deposit to their B9 account to receive funds quickly and efficiently.

In conclusion, B9 is an excellent app-based banking option for individuals looking for flexibility in managing their finances. While the membership fee and specific requirements to qualify for a pay advance may be a downside, the app’s benefits, including zero-fee advances and cashback rewards, make it a valuable tool for navigating day-to-day demands.

#2 Chime

The Chime spending account is a popular online bank accounts platform that prides itself on being user-friendly and accessible to everyone with a checking account. So, what exactly is a Chime cash advance? Simply put, it’s advertised as SpotMe, which is essentially a short-term loan (up to $200) that you can take out against your next paycheck.

One of the best things about Chime’s SpotMe is that it’s incredibly easy to apply for. You don’t need to fill out any complicated forms or go through a lengthy approval process.

As long as you meet the basic eligibility requirements (which include having a Chime bank account and a regular source of income deposits – at least $200 per month), you can apply for a cash advance right from your Chime app. This is then deposited via direct deposit.

Another great thing about Chime is that there are no bank fees or interest rate applied. Instead, you’ll be asked to pay the loan amount you borrowed (plus a small optional tip) when you get paid. This makes it a much more affordable option than traditional payday loans and banking options like a credit union or Sutton bank, which can come with sky-high rates and hidden fees.

Of course, like all banking products featured here, Chime cash advance isn’t perfect. You’ll have to sign up for a bank account with them, and the borrowing limit begins at only $20.

But on the plus side, there are no credit checks required. And if you borrow responsibly, you’ll get an increase in the loan amount you can borrow in the future. Which means you might be able to put that side hustle you were planning on hold.

Chime App Advantages

- No monthly membership charges. The platform doesn’t impose any minimum balance fees, special service fees, or maintenance per pay period fees. These kinds of charges are also not applied to international transactions. This means you’ll have to pay transaction fees.

- No Fees charged at ATMs. More than 60,000 surcharge-free ATMs are available on the market to account holders globally. This means no ATM fees.

- Automatic savings account features. Borrowers can give Chime permission to “round up” money for you and transfer it into your savings bank account via a direct deposit- perfect for your savings goals. They do this through a banking partner.

- No credit check. If a bad credit score prevents you from being approved for another bank account, the Chime checking account users application process doesn’t require a credit check.

Chime App Disadvantages

- They don’t offer a multiple-currency bank account. Your card might incur extra fees when used outside of the US.

- There are no physical bank branches. Although these days, most banking services can be done online with your email address and phone number, some might still prefer a personal touch to their service.

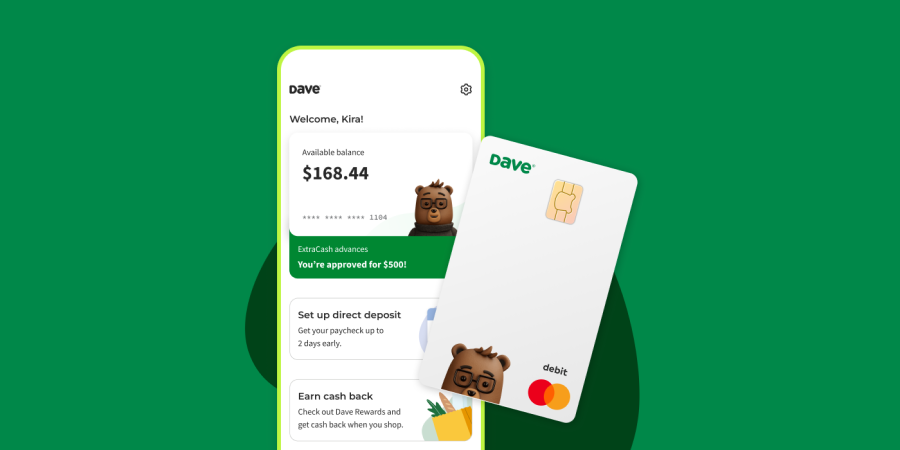

#3 Dave App

With Dave, you’re not just using a cash advance app, you’re using an all-in-one artificial intelligence financial tool that offers its users a plethora of benefits. With its paycheck advance feature, you can get an advance with a borrowing limit of up to $500 without any high interest rates or credit check. All you have to do is connect your checking account credit or debit card via your preferred payment method.

And the best part is that the repayments are automatically deducted from your next paycheck, making it an interest free experience. But the Dave cash advance app doesn’t stop there. It also offers a credit builder feature that helps you improve your credit score by reporting your on-time payments to the major credit bureaus.

And although Dave doesn’t charge any high interest rates when borrowing from them, there is a 1$ per pay period subscription fee – so not exactly fee free. And if you want to fast-track your payments, there is a $1.99 to $13.99 fee to get money.

This means payments can reach your bank account debit card in under an hour via direct deposit. Otherwise, the funds will be credited to your checking account balance in two to three business days.

Overall, Dave is a great cash advance app that offers a variety of features to help you manage your finances better. Despite no sign up bonus, whether you need a paycheck advance feature or want to repair your credit score, Dave has got you covered.

Dave App Advantages:

- No credit check. While many similar cash advance apps and other financial providers only claim to offer such banking services, this platform really doesn’t perform any credit pulls. Hence, it’s suitable for every borrower who needs money instantly.

- Accept any credit score. If you have issues with your credit rating and need an advance, using a cash advance app like Dave will help you get access to cash even with a less-than-stellar credit score.

- No interest rates. Yes, you’ve got it right. You can get an interest fee free advance. However, if you want to support this credit card cash advance app, you can send tips.

Dave App Disadvantages:

- No credit builder loans. Although there is no credit check and nobody asks about your credit score, you won’t have a chance to improve it even if you want to. This is because cash advances up to 250 with Dave only report to major credit bureaus.

- Borrowers will need to wait a few business days to get cash. This might be a bit frustrating, especially if you have temporary emergency costs and can’t wait to cover your needs.

- Extra fee. Those who want to obtain the paycheck advances within the same business day must pay a $1.99 to $13.99 membership fee.

#4 Earnin App

EarnIn is a mobile credit card cash advance app that connects to your bank account debit card and allows users to access a borrowing limit of up to $100 (per day- $750 per pay period) of your paycheck advances early. The app is subscription fee free to use, but it does ask for tips, which can range from $0 to $14 per transaction.

This app like earnin, also offers other features, such as credit monitoring and set up an automatic savings account feature. EarnIn can be a helpful tool if you need money in your checking account before your next paycheck. It’ll be a good choice for an emergency loan because the app is easy to use and navigate.

However, there are some downsides to consider. For one, the cash advance app relies on you having a steady paycheck, so if your income fluctuates or you’re self-employed, it might not be the best option for you. But they do accept social security as an income source. So keep your social security number safe. Additionally, the app has no sign up bonus and encourages tipping, which can add up over time and eat into your earnings.

As a lending platform, EarnIn is best for those who don’t want to pay for a membership, as there are no fees. In terms of how soon you can get your money, this lender offers Lightning Speed payments charged between $1.99 and $3.99. So instead of waiting between one and three days, you can get your money sent to your checking account straight away.

Earnin App Advantages:

- No interest rates. It’s an interest fee free option for consumers who want to pay nothing more than the cash advance amount they’ve borrowed. This cash advance app doesn’t have any hidden overdraft charges, no balance fees, or overdraft fees either.

- Money advance. Cash advances up to $100 are issued to people waiting to get paid. This is suitable only for full-time employees.

- Automatic withdrawal. The cash is issued and taken directly from your bank account on the next paycheck, provided that you have a steady source of income deposits.

Earnin App Disadvantages:

- Not suitable for the unemployed. If you don’t have stable employment, a valid work location, or a full-time job, you won’t be able to qualify for an Earnin paycheck advance.

- A small amount of cash. $100 may not be enough in many cases, especially when you have an emergency. In such a situation, it’s better to look for alternative personal loan options for cash advances.

- Tipping is encouraged. This lender’s tipping service means borrowers might spend more than they anticipate.

#5 Brigit App

Brigit is a personal finance app that focuses on helping users get cash advances up to 250, avoid overdraft fees or interest, improve their credit score (by reporting payments to the major credit bureaus), and gain financial protection and innovation. The app works by connecting to your bank account activity and analyzing your spending habits to provide personalized insights and recommendations.

Users can also set up alerts to notify them when their bank account debit card balance is low, so they can have overdraft protection. Lenders can direct deposit any money they owe to avoid costly overdraft fees.

Bridgit has standout features, including its paycheck advance option. If you’re in a pinch and need some extra cash back before your next paycheck, Brigit can provide you with a no-interest paycheck advance borrowing limit of up to $250 (like a Varo advance).

And there are no credit checks to worry about. The app will automatically deduct the advance amount from your next paycheck, so you don’t have to worry about paying it back on your own.

Overall, Brigit is a great option for those looking to improve their financial health. While there are some drawbacks, such as the $9.99 per pay period fee and no sign up bonus, the app’s benefits far outweigh the costs.

With its easy-to-use interface, paycheck advance option, and personalized insights, Brigit is definitely worth considering if you’re looking to take control of your personal finance situation.

Brigit App Advantages:

- Special notifications. One of the biggest highlights of this cash advance app is the ability to receive notifications each time you are going to experience an overdraft fee (you have real overdraft protection). This way, the app helps to keep track of your checking account spending.

- Due date extension. This is another advantage of the Brigit cash advance app. Borrowers have a chance to extend the per pay period two or three times if necessary.

Brigit App Disadvantages:

- Slow money deposit. You will have to wait for about three business days to get the cash back in your checking account. This might be too slow for emergencies that require money instantly.

- Monthly membership fee. You need to pay $9.99 each month for the membership if you want to utilize this cash advance app. A borrowing amounts fee is applied if you don’t withdraw funds each month.

- Customer support. This app has email only as a customer support option. It’s common for replies to take one to two business days, which might be too long for some.

#6 MoneyLion App

MoneyLion is a popular financial service that’s been making waves in the market. Simply put, it’s a financial service app that allows users to get a cash advance on their paycheck without paying for a credit check.

This means that even if you have bad credit or no credit history, you can still get access to the money you need in a pinch. Once you sign up for the service, you can request a paycheck advance borrowing limit on your paycheck of up to $250. The funds are then sent directly into your bank account via direct deposit.

The MoneyLion checking account charges a $0.49 to $5.99 express fee for delivery of funds – typically arriving in your checking account within a few minutes. If you don’t fancy the turbo fee, there is a maximum of five business days to wait for fee free funds to get to your checking account.

The downside to this lender is they don’t have a sign up bonus and don’t update your credit report, so it’s probably not the best choice for those wanting to improve their credit score. Having said that, there is a MoneyLion Plus membership fee, costing $19.99 per month. For this, users can qualify for a credit builder loan (5.99 – 29.99 annual percentage rate APR), a paycheck advance, as well as the chance to increase their borrowing limit.

MoneyLion App Advantages:

- No credit check. You don’t need to have an excellent credit score to get access to the money you need. MoneyLion will support you regardless.

- Accept any credit score. Even if you get rejected for other loans from traditional lenders, for example, you can still apply here. This cash advance app accepts any credit rating.

- No interest rates. You can get fee free access to paycheck advance funds.

MoneyLion App Disadvantages:

- MoneyLion Plus membership costs $28 a month. The monthly subscription fee is applied to customers with a MoneyLion checking account on a monthly basis, even if they don’t need to borrow money.

- Doesn’t improve your credit score. If you pay a regular membership fee, you can only get a small cash advance without the ability to take credit builder loans.

- Can’t be used in some states. This cash advance app can’t be used in Nevada, Iowa, Nebraska, Montana, Indiana, and Vermont.

How do Cash Advance Apps Work?

Instant cash advances have become increasingly popular in recent years, thanks to the rise of cash advance apps. These loan apps typically offer a quick and convenient way for people to access cash when they need it most. But how do cash advance apps work?

In a nutshell, cash advance apps allow users to borrow money against their upcoming paycheck, sometimes with no fees. The process is simple: users register with their email address, then link their bank account debit card to the app, and then request an instant cash advance to their typical spending account.

The app uses algorithms by checking your bank statements to determine how many cash advances the user is eligible to borrow based on their income deposits and spending habits.

Once the user is approved for a cash advance, the money moves into their bank account balance through direct deposit within a few hours. Then, when the user’s next paycheck arrives, the app automatically deducts the loan amount borrowed plus fees.

These loan apps typically have revolutionized the lending industry by providing access to quick cash at the click of a button. You can avoid the hassle of traditional lending methods like Sutton bank or a credit union and get the money you need in a matter of minutes. Most of the instant loan providers listed here have no cost or a small fee, nor do they add interest on the cash advances they offer.

How to Choose the Best Cash Advance App

In today’s digital age, instant cash advances have become a popular way for individuals to get cash back in times of emergency. With the rise of cash advance apps, the process of getting nice loan amounts has become even more streamlined and convenient.

However, with so many options available on the market, it can be challenging for borrowers to know which cash advance app is the best fit for them. With this in mind, we have selected the most important factors you need to consider when selecting instant cash advances.

By considering interest rates, ease of use, no fees, and reputation, you can make money decisions better to meet your financial needs and save money in the long run.

- Apps Fees: While some cash advance apps may seem like a great deal at first glance, they can end up costing you more in fees than you bargained for. Take a look at any additional fees that may be charged. Some loan apps may charge a fee for processing cash advances, while others may charge a fee for repayment extensions or a bank balance transfer fee. Be sure to read the fine print and understand exactly what fees you’ll be responsible for.

- Cash Advance Limits: These cash advance limits determine how much money you can borrow at any given time. You don’t want to be stuck with an app that only allows users to borrow a small loan amount, especially if you’re in dire need of funds. On the other hand, you don’t want to go for an app that allows users to borrow more cash advances than you can realistically pay back.

- Repayment Plan Requirements: Make sure to read the loan terms and conditions carefully and understand the repayment terms. Look for cash advance apps that offer flexible repayment extensions, such as weekly or per pay period installments received through direct deposit. It’s also worth checking whether there are no fees or any penalties for early repayment or missed payments.

- Employer eligibility Requirements: You would rather not waste your time and energy on an app that doesn’t work with your specific employer’s payroll system. So, before you download the app, make sure you do your research and find out what your employer’s eligibility requirements are. Some cash advance apps may require you to have certain minimum income deposits, while others may only work with a specific work location.

Should I use a Cash Advance App?

Like most things in life, whether or not you should get a cash advance app depends on your individual circumstances and spending habits. If you need cash back fast and don’t have time to go through the traditional loan process, a cash advance app may be a good option for you. With one, you’ll get a quick loan decision and can apply, often with just a few taps on your phone.

However, it’s important to understand the risks involved with cash advances. If you’re someone who’s constantly living paycheck to paycheck and struggling to make ends meet, a cash advance app might not be the best solution for you.

On the other hand, if you’re someone who’s financially stable and just needs a little extra cash back to cover expenses at gas stations and utility bills, for example, then a direct deposit cash advance app could be a good option for you.

This is because they’re designed to make the borrowing process quick and easy and are bank member FDIC approved. And they often have lower membership fees and interest compared to traditional payday loan and bank accounts options, or no fees at all.

Tips on Using Cash Advance Apps

It won’t hurt to keep up to date on how to use these apps responsibly to keep your debt under control. Here are some tips for using cash advance apps:

- Make a list of your expenses: Before using a cash advance app, make a list of your expenses by going through your bank statements and determining how much money you need.

- Use the app only for emergencies: Cash advance apps should only be used for emergencies, such as unexpected car repair. Avoid using them for expenses like shopping products and services or dining out, you’ll save money this way.

- Read the loan terms and conditions: Be sure to read the terms and conditions of the app before using it. Understand the membership fees and interest rates associated with borrowing money, and know when the loan amounts are due.

- Pay back the loan on time: To avoid accumulating additional fees and interest, remember to pay back cash advances on time through direct deposit. If you can’t pay it back in full, make at least the minimum payment to avoid damaging your credit score.

Cash Advance Apps Alternatives

Ultimately, the decision to use cash advance apps or explore an alternative is a personal one that depends on your financial products situation and needs. However, there are other options out there that may be better suited to your situation than a high-interest payday loan, for example.

Fortunately, there are many alternatives. Personal loans, small loans, credit unions, and secured credit cards stand out as the most reliable and affordable options. Take a look at our expertly reviewed top 5 personal small loans to help get you back on track.

With personal loans, borrowers can secure fixed interest rates and more manageable repayment terms, while secured credit cards offer a chance to build your credit score without the risk of falling into a debt cycle.

If you don’t want to rely on cash advance apps to make money, consider the following options.

Personal Loan

A personal loan is a type of loan facilitating cash advances that you can use for any purpose, such as overdraft protection, consolidating debt, paying for a wedding, or covering unexpected emergency expenses like overdraft fees. You borrow a fixed cash loan amount and pay it back over time, usually with interest – although not as high as a payday loan.

With personal loans, you can borrow a larger amount of cash advances at a lower interest rate than with a cash advance app. Plus, you’ll have the flexibility to repay the cash loan in installments through direct deposits over a longer period of time rather than having to pay it all back at once. And if you don’t want to go through the credit check process, there are many bad credit loan options on the market too.

Another advantage of a personal loan is that they don’t require any collateral, unlike some other types of cash advances. This means that you don’t have to risk losing your car or other valuable assets in order to get the money you need.

Overall, a personal loan is a much smarter financial decision and a good payday loan alternative. It’s way better than relying on a cash advance app. It provides a more affordable and flexible way to borrow money without the risk of high fees and interest rates.

Secured Credit Card

A secured credit card is a type of financial institution service provider that requires a security deposit as collateral. This deposit acts as a safety net for the issuer in case you default on your payments. The credit limit is usually equal to the deposit loan amount, and it works just like any other credit card to provide cash advances when you need them.

The advantage of a secured credit card is that it can help you get a better credit score. By making timely direct deposits and keeping your balance low, you can improve your creditworthiness and qualify for unsecured credit cards in the future.

A secured credit card allows users to build their credit score while also providing a safety net for unexpected expenses. With one of these, you put down direct deposits that act as your credit limit. This deposit is fully refundable and can even earn money from the interest rate in some cases.

Using a secured credit card responsibly can help you get a positive balance and credit history, which can lead to better interest rates, a lower transfer fee, and other options for cash advances in the future. Plus, it offers the convenience of a credit card without the temptation to overspend.

In the end, it’s important to carefully consider your options and choose the advance app option that makes the most sense for your situation. Whether you opt for personal loans, a secured credit card, or fancy using a cash advance app, make sure you read the terms and conditions carefully and understand all the fees and interest rates involved.

The Bottom Line

In today’s fast-paced world, we often find ourselves in need of some extra cash for our savings accounts to tide us over until we get paid. This is where cash advance apps can help. With just a few taps on your smartphone, you can access quick cash advances.

The best cash advance apps are designed to be fast and easy to use – you won’t need an investment advisor! This makes them perfect for people who are always on the go and need a little extra cash in their checking account balance and debit card in a hurry.

But, like any financial product, cash advances come with their own set of risks and drawbacks. They don’t offer much in terms of financial aid and aren’t great for keeping your debt under control – similar to the high interest fees that come with a payday loan.

And remember, there is always an alternative to payday advance and cash advance apps. Personal loans, installment loans, and credit builder loans are perfect for those who want to borrow money with no fees. All without risking a damaging credit check or a high interest rate that payday lenders offer, for example.

As with any loan, always be sure of bank member FDIC safety financial protection, and innovation by weighing the pros and cons of cash advance apps before deciding whether they’re right for you. You can do this by reading their table of contents.

If you need fast emergency cash and can pay it back in a timely manner, they can be a lifesaver. But if you’re not careful, they can also be a trap that’s hard to escape from. So, be sure to do your research and use them responsibly.